Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Investment

BASF, partner spar over future of oil and gas unit

BASF wants to divest Wintershall Dea in a public offering; LetterOne prefers to wait

by Alexander H. Tullo

February 2, 2022

| A version of this story appeared in

Volume 100, Issue 5

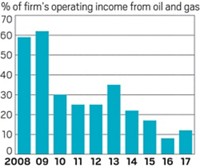

BASF is in a public row with the investment company LetterOne Holdings over the direction of their oil and gas joint venture, Wintershall Dea. BASF wants to divest its 73% stake in the firm with an initial public offering (IPO) of stock. LetterOne maintains that the timing for such a move is poor.

The two companies formed Wintershall Dea in 2019 through the merger of BASF’s Wintershall unit and LetterOne’s Dea business. The firm produces more than 600,000 barrels of hydrocarbons per day and posted sales of $4.4 billion in 2020.

Wintershall Dea operates mostly in northern Europe and Russia. It owns a 16% stake in the Nord Stream natural gas pipeline, which runs under the Baltic Sea from Russia to Germany. It is also helping to finance the controversial Nord Stream 2 pipeline currently under construction.

An IPO would continue BASF’s trimming of unwanted businesses. It sold its construction chemical unit to the private equity firm Lone Star in 2020 for $3.6 billion. It sold its pigment business last year to Japan’s DIC. And Platinum Equity purchased the water treatment chemical firm Solenis from BASF and Clayton, Dubilier & Rice in November for $5.3 billion.

LetterOne says the time is not right for a Wintershall Dea IPO. “Market sentiment remains a challenge, including towards Russian-exposed assets,” the investment company says in a statement.

Russia faces potential economic sanctions should it invade Ukraine.

Moreover, LetterOne says Wintershall Dea should focus on long-term investments. Becoming a public company would create pressure to focus on short-term cash flow and dividends.

“We remain fully committed to divest our share in Wintershall Dea and we continue to consider an IPO as the best way to market our share,” a BASF spokesperson says in an email.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter