Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Mergers & Acquisitions

Merck KGaA wants to break up Versum-Entegris merger

German firm steps in with what it says is a better offer for Versum

by Michael McCoy

February 28, 2019

| A version of this story appeared in

Volume 97, Issue 9

Germany’s Merck KGaA is seeking to break up the merger of the electronic materials suppliers Versum Materials and Entegris with an offer to acquire Versum for $48 per share in cash, or about $6 billion including Versum’s debt.

Announcedin late January, the deal between Versum and Entegris is an all-stock “merger of equals” intended to create a $3 billion-a-year supplier of materials and equipment to the electronics industry. Merck says it is making a superior proposal that will provide Versum shareholders a 52% premium over Versum’s stock price before the Entegris deal was announced and a 16% premium over its more recent stock price.

Versum responds that it continues to believe in the “strategic and financial rationale of the proposed merger of equals with Entegris.” Versum says its board will review Merck’s proposal, but it also adopted an anti-takeover plan.

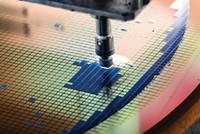

Versum is a maker of deposition materials, specialty gases, and chemical mechanical planarization (CMP) slurries with sales last year of about $1.4 billion. Both deals would make it part of a larger supplier of materials for semiconductor fabrication, but the product mixes would be different.

Entegris’s product line is mostly filtration, purification, and fluid-management equipment, although it also offers materials. Merck, in contrast, is mostly a materials supplier, with products such as CMP slurries, wafer cleaning and etching chemicals, and lithography materials. Buying Versum, it says, would more than double the size of its semiconductor materials business.

Merck says it is confident it can close the deal in the second half of the year, “assuming expedient engagement by the Versum Board of Directors.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter