Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

A reckoning for Japan’s petrochemical industry

Mitsubishi Chemical’s change of direction shows new willingness for drastic reorganization

by Katsumori Matsuoka, special to C&EN

January 12, 2024

In Japan, there is an expression from a Chinese legend, “A tiger at the front gate, a wolf at the rear gate.” It refers to a situation in which one is caught between powerful threats and forced to make difficult choices. Japan’s petrochemical industry is in such a situation, and it seems there is only one escape: massive restructuring.

In December, Mitsubishi Chemical Group, the country’s largest chemical company, announced that Jean-Marc Gilson, its CEO of less than 3 years, will step down in March. Gilson, a Belgian chemical industry executive with experience at Dow Corning and Roquette, was hired with much fanfare in 2021 as Mitsubishi’s first non-Japanese CEO.

His replacement will be Manabu Chikumoto, a 35-year Mitsubishi veteran who is now head of Mitsubishi’s petrochemical division. Gilson’s signature plan since joining Mitsubishi had been to carve out the petrochemical division as a new company. Now, that plan is on hold as the company seeks instead to reorganize the petrochemical business under Chikumoto’s leadership.

At a press conference, Takayuki Hashimoto, chair of Mitsubishi’s presidential nominating committee, said poor profitability in the petrochemical business is one of the key issues facing the company and that Chikumoto was chosen as someone who can reorganize the business in a “hands-on” way.

The health of the petrochemical industry across Japan has deteriorated since 2021, when Gilson announced the carve-out. Japan’s ethylene-based petrochemical production centers face stiff competition from a flood of new, large-scale facilities in China. Japanese petrochemical businesses are losing money or barely breaking even.

Masanori Kawakami, who was a petrochemical manager for a Japanese trading company and currently consults for several chemical-related companies, expects what he calls “unprecedented shuffling” in Japan. The prospect of regional cooperation among multiple companies—as well as more extensive and complex countrywide reorganization—is increasing, he says. But consolidating production means that several ethylene crackers are likely to close.

“My biggest mission is to participate in the reorganization of the petrochemical industry,” Chikumoto said at the press conference. “The momentum for reorganization in the industry is stronger than ever. We cannot survive unless we undergo a major transformation.”

The Japanese chemical industry’s goal of being carbon neutral by 2050 only adds to the challenge, Chikumoto noted. “In order to solve the problems of research and development, limited resources, and time, we need to show the best performance as an industry, involving the government rather than fighting on an individual-company basis. It is important to have many companies participate,” he said.

Talk of reorganization has already begun at other firms. Mitsui Chemicals is “considering optimal production of ethylene and polyolefins through collaboration with other companies,” CEO Osamu Hashimoto said at a press conference late last fall.

In Chiba, on Japan’s east coast, where Mitsui, Idemitsu Kosan, Sumitomo Chemical, and Maruzen Petrochemical operate petrochemical plants, “we will implement what we can, including rationalization and streamlining of facilities,” Hashimoto said. The firm will seek similar collaborations in western Japan, including at its Osaka site, he added.

Koshiro Kudo, president of Asahi Kasei, which is believed to be one of Mitsui’s partners in western Japan, made similar comments at a year-end press conference about the firm’s materials business. “We have begun to consider collaboration with other companies in western Japan with regard to optimization of naphtha cracker capacity,” Kudo said.

And Keiichi Iwata, Sumitomo’s president, said at a meeting with analysts last fall that the company is “studying rationalization through joint operations by multiple companies” in the Chiba region.

It won’t be the first time the Japanese petrochemical industry has restructured itself. In the mid-2010s, Mitsubishi shut one of the crackers in Kashima. Sumitomo closed its cracker in Chiba and instead obtained the product it needed from Keiyo Ethylene, a joint venture in which it had a minority stake. Similarly, Asahi Kasei shut its ethylene cracker in Mizushima and became a 50-50 partner in Mitsubishi’s nearby facility, now called Asahi Kasei Mitsubishi Chemical Ethylene.

As a result of these closures, Japan’s ethylene production capacity fell from 7.6 million metric tons (t) per year in 2014 to 6.4 million t per year in 2016. And the performance of the country’s petrochemical business significantly improved: Mitsubishi and Sumitomo doubled their profits between the 2016 and 2017 fiscal years in large part because of improved petrochemical profitability.

But the essential structure of the industry, which still operates 12 ethylene crackers, is unchanged. And the industry continues to depend on exports from old, small, and uncompetitive facilities. According to the Japan Petrochemical Industry Association, the country exported about $10 billion worth of petrochemicals in 2021, while imports were worth only $2.4 billion.

Since that earlier restructuring, new challenges have emerged, including a rise in crude oil prices and rapid expansion of overseas capacity. In China, a traditional export destination for Japanese petrochemicals, the industry will be adding 32 million t of ethylene capacity in the next 5 years, Kawakami says. Propylene capacity in China is expected to increase by 43 million t in the same period. “The supply-demand gap will not be resolved for several years,” he says.

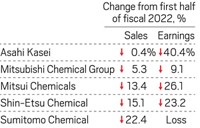

These structural and external factors, combined with sluggish domestic demand due to a population that is both decreasing and aging, have led to profit declines in the petrochemical businesses of major Japanese firms in the past 2 years.

Companies have taken some new restructuring steps on their own. Mitsui closed a polypropylene plant at its Chiba facility last March. Asahi Kasei is undergoing a restructuring that includes exiting some commodity chemical and other businesses with total annual sales of about $700 million. Sumitomo is restructuring 30 business units, including its polyolefin operation in Japan.

But the managers of Japanese petrochemical businesses understand that individual company responses alone will not be enough to weather today’s competitive environment.

Some in the industry are calling for the creation of ethylene production cooperatives in eastern and western Japan, although the specifics of the plan are not clear. “I expect that a trend will emerge to build one large, competitive, carbon-neutral ethylene supply base each in the east and west,” Kawakami says. “It will take a certain amount of time to realize, but Japan has the technology to do so.”

At the same time, firms will need to get customers to pay more for carbon-neutral petrochemicals and polymers. Kawakami says public-facing customers may be willing to do so. “It is necessary to understand from the perspective of economic security that environmental values are widely spread not only in the packaging and cosmetics industries but also in the automotive industry,” he says.

The restructuring of Japan’s petrochemical industry is still in its early stages. Meanwhile, China, which had the world’s largest ethylene production capacity last year, has been launching multimillion-metric-ton plants one after another. Kawakami says the key to a successful restructuring is “the speed at which a bold consensus can be formed.”

Katsumori Matsuoka is a freelance writer based in Japan.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter