Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Tough times for Japan’s chemical makers

Across the country, chemical companies had a difficult first half

by Katsumori Matsuoka, special to C&EN

November 22, 2023

| A version of this story appeared in

Volume 101, Issue 39

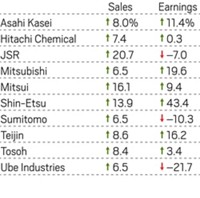

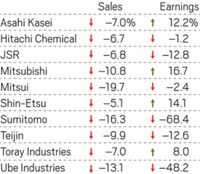

First-half results

Japan’s three biggest chemical companies are seeing their earnings suffer from a slump in basic chemicals. All three experienced a sharp drop in profits in the first half of fiscal 2023, which ended Sept. 30, and one of them, Sumitomo Chemical, is forecasting a loss of $655 million for the full fiscal year.

For all three firms, petrochemical demand has declined due to the slow recovery of the Chinese economy and other factors. Sale prices have been slumping.

Sumitomo, the only Japanese chemical company with global petrochemical operations, posted a $306 million loss in its petrochemical division in the first half of the fiscal year due to poor performance at facilities in Japan, Singapore, and Saudi Arabia. In addition, the company’s pharmaceutical segment had a $451 million loss due to patent expiration for the antipsychotic drug Latuda. Its overall loss for the period was $666 million.

“The substantial deficit in the first half and full-year forecast for 2023 is the most critical situation since the company’s founding,” Sumitomo President Keiichi Iwata said in a meeting with financial analysts. He announced plans for short-term savings actions and even more drastic structural reforms. The short-term measures are aimed at “achieving a V-shaped recovery in 2024 and strengthening the company’s financial position for future fundamental structural reforms,” Iwata said.

Specifically, Sumitomo aims to generate approximately $3.4 billion in cash and $344 million in profit by restructuring businesses, reducing inventories, more carefully selecting investments, selling assets, and utilizing surplus funds. The company “has focused on loss-making and unprofitable businesses in the past, but in addition, it is now proceeding with a restructuring project involving about 30 business units with total sales of close to $2 billion, based on the viewpoint of whether the company is the best owner—even if the business is currently profitable,” Iwata said.

Mitsubishi Chemical Group experienced strong US sales of industrial gases and Radicava, an amyotrophic lateral sclerosis (ALS) treatment, that offset weakness in the petrochemical and carbon businesses and helped keep earnings to a single-digit drop.

At a press conference, CEO Jean-Marc Gilson said Mitsubishi will step up cost-cutting, “The initial cost reduction target of 100 billion yen [$690 million] for the period 2021–2025 has been steadily progressing, so we have increased the target to 135 billion yen [$930 million],” he said.

Mitsubishi suspended production at its methyl methacrylate plant in Billingham, England, in 2022 and shut down a Canadian biotech subsidiary, Medicago, in February of this year. Gilson indicated that the company plans further business rationalization. “We will review every business from the angle of profitability and take the most appropriate measures,” he said.

Mitsui Chemicals also posted lower sales and profits in the first half of the fiscal year due to poor performance in its basic chemical division. The company’s mobility solutions division, which includes polypropylene compounds and lubricants, and life and healthcare solutions division, which includes eyeglass lens monomers and agrochemicals, performed well. Its materials and semiconductor products divisions did not.

Mitsui’s chief financial officer, Hajime Nakajima, said the firm plans to take action in its basic chemical division, including at its major site in Chiba, Japan. Mitsui sold its phenol business in Singapore to Ineos in March and plans to downsize its toluene diisocyanate facilities in Japan in 2025.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter