Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Employment

Opinion

Reevaluating the concentration of chemistry jobs

Chemjobber examines the geography of chemical industry and government positions advertised in C&EN

by Chemjobber, special to C&EN

June 3, 2022

| A version of this story appeared in

Volume 100, Issue 20

Top 3 industries and locations for chemistry jobs

1991 C&EN job ads

28%: Pharmaceutical

▸ New Jersey, California, Pennsylvania

19%: Chemical manufacturing

▸ Ohio, New Jersey, California

13%: Environmental or analytical laboratory

▸ California, Missouri, Texas

2011 C&EN job ads

25%: Chemical manufacturing

▸ California, Connecticut, Ohio

22%: Pharmaceutical

▸ China, New Jersey, North Carolina

16%: Government

▸ California, Maryland, New Mexico

2021 C&EN job ads

35%: Government

▸ New Mexico, Tennessee, Maryland

20%: Chemical manufacturing

▸ Massachusetts, Missouri, California

12%: Pharmaceutical

▸ California, Massachusetts, Washington

Where we choose to live determines so much about our lives, including career trajectories and family and friend groups. And many of us choose where we live by where we find work. I’ve always said, “You don’t choose the job; the job chooses you.” But where are industrial and government chemistry jobs in the US? I’ve always thought these jobs were primarily in the Northeast or in the San Francisco Bay Area, and I wanted to find out if that has always been the case.

There is very little granular historical data about chemistry jobs, but one of the best sources is the actual advertisements from employers seeking chemists in real time. To help understand the changes in industrial chemistry over the past 30 years, I collected all volumes of C&EN from 1991 and 2011 (I requested the 2001 issues from my local university library. Unfortunately, they never arrived). ACS Sales and Marketing also shared with me all the electronic C&ENjobs listings for the year 2021. After sifting through 1,866 listed industrial and government positions for 1991, 171 for 2011, and 366 for 2021, I can confirm that the geography of chemistry jobs has changed significantly over the past 30 years.

In 1991, the top 30% of the listed positions were found in three US states: California, New Jersey, and Pennsylvania. I was surprised to see Massachusetts ranking fifth and most of the biotech positions in California located in San Diego, which does not match modern perceptions of Boston and San Francisco as the nation’s biotech hubs.

Many of the companies with full-page ads in 1991 (Schering-Plough, DuPont Merck, Upjohn, Sandoz, and SmithKline Beecham) have since been subsumed into larger companies. I was surprised to see many of these companies regularly advertising postdoctoral fellowships, as those types of positions are rarely advertised these days (none appeared in 2021).

Top 15 US locations for industrial and government jobs advertised in C&EN in 1991

In 2011, the top two US states were still California and New Jersey. Maryland came in third, and Pennsylvania dropped to eighth. The lingering effects of the Great Recession were evident, as the number of listed positions was a mere 9% of 1991’s total. Part of that could also have been due to changes in companies’ advertising habits from more print focused to online.

Most strikingly, China tied with California for the top number of job listings in 2011. This was the only year of the ones I looked at in which a non-US country appeared in the top 10 locations. China’s appearance in the top advertisers points to the rise of Chinese contract research organizations (CROs) and the seemingly related job losses for US-based medicinal chemistry around that time. In particular, Pfizer’s closure of its Ann Arbor, Michigan, campus in 2007 likely affected pharma job creation in Michigan, which was home to 27 positions advertised in 1991 and 0 in 2021. Job opportunities in other sectors of the industrial economy, such as oil and gas, were also depressed in 2011.

Top 15 US locations for industrial and government jobs advertised in C&EN in 2011

Note: 14.8% of jobs advertised in 2011 were located in China. The country did not appear in the top 15 locations in other years.

Just as the Great Recession affected 2011 data, the COVID-19 pandemic may have decreased the overall number of 2021 listings. At just 43, the number of pharmaceutical positions was relatively low, especially for a year when the pharma market was considered quite hot. The small number likely reflects the ascendance of job websites other than C&ENjobs and other recruiting techniques, like seeking out individual scientists. Only one major pharma company, Genentech, listed more than 1 position, with 6.

Overall in 2021, California and Massachusetts were the first and fifth most common job locations, which reflects current perceptions of the US pharma centers of gravity. In an irony that shows trends can be cyclical, one of the larger individual employers hiring in the US was a subsidiary of an Indian CRO, TCG GreenChem, which opened a facility in Ewing, New Jersey, in 2021 and listed 10 positions there. Tennessee was a new entrant to the top states, debuting at number 2. Interestingly, most of the openings in that state were not industrial positions but both permanent and temporary positions with Oak Ridge National Laboratory. New Jersey dropped out of the top two positions, landing at number 9.

Top 15 US locations for industrial and government jobs advertised in C&EN in 2021

Source: C&EN Jobs. Data for 1991 and 2011 are based on print-issue ads collated by Chemjobber. Data for 2021 are based on online ads provided by ACS Sales and Marketing.

Note: Data from 2001 were not available

For each year I studied, half or more of government and industrial positions were located on the East or West Coast. Understanding the continuing bicoastal nature of chemistry jobs is important for everyone in the community.

For students and job seekers, understanding your school’s connections to employers on the coasts will be ever more important, I predict.

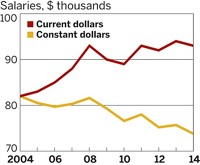

For the rest of us, we should discuss if this geographic concentration of chemistry jobs is really what we want. Must employers and employees continue to pile into cities like Boston and San Francisco? The benefits are definitely there: high concentrations of talented scientists, innovative universities, and a financial ecosystem that can support new job growth. But there are costs as well. For example, housing in these cities eats up an increasing share of salaries. Encouraging new clusters of innovation in less expensive regions of the country would offer more opportunities to different groups of chemists.

Chemjobber works in the chemical manufacturing industry and blogs about the chemistry job market at chemjobber.blogspot.com. He’ll be exploring data about chemistry and the people in chemistry several times a year in C&EN’s Opinion section.

Do you have a story you want to share with the chemistry community? Send a submission of about 800 words to cenopinion@acs.org.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter