Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Economy

C&EN’s Global Top 50 chemical companies of 2014

Falling oil prices led to lower chemical sales but higher profits at the top chemical makers

by Alexander H. Tullo

July 26, 2015

| A version of this story appeared in

Volume 93, Issue 30

To read the current Global Top 50 Chemical Companies article, please click here.

The economic winds shifted for chemical producers in 2014.

The collapse in the price of oil during the second half of the year was good news for European and Asian chemical companies, which enjoyed a reprieve from high raw material costs. But it was bad news for the Middle Eastern and U.S. firms that saw their usual advantage from using gas as a feedstock erode after their oil-based competitors cut chemical prices.

The decline in oil prices shows up as a trend in this edition of C&EN’s Global Top 50, which measures the performance of the world’s largest chemical companies using their financial results for 2014.

Combined sales for the Global Top 50 were $961.3 billion, a less than 1% decline from the $965.1 billion the group posted a year earlier. That’s consistent with declining selling prices for chemicals, although nothing like the 40 to 50% plunge in oil prices.

Profits, on the other hand, rose. The 44 companies in the ranking that publicly report profits combined for $82.7 billion in operating income, a gain of 3.8% from the previous year. Profit margins increased to 9.6% from 9.3% a year ago.

Although the overall changes were modest, this year’s Global Top 50 survey uncovered a lot of company-level volatility. By and large, petrochemical companies, which are closer to the oil barrel, lost ground to downstream specialty chemical makers.

Five firms—Alpek, Eni, PotashCorp, Styrolution, and Total—dropped from the list altogether. Alpek, Eni, and Styrolution make petrochemicals and polymers. Total does too, but it is gone because it no longer reports its petrochemical results. PotashCorp suffered from a decline in potash prices.

Newcomers to the survey this year are Hanwha Chemical, Siam Cement, BP, Ecolab, and Johnson Matthey. BP joined because it is now breaking out its chemical sales in a timely fashion. Siam Cement and Hanwha are benefiting from rising economic fortunes in Asia. Ecolab and Johnson Matthey are both specialty materials suppliers that are seeing strong growth.

Regular readers of the Global Top 50 survey will notice a new presentation this year.

For the first time, C&EN is providing short profiles of each of the top chemical companies. The numbers in the survey don’t lie, but they also don’t tell the whole story. The new profiles complement the data by adding quick strategy reviews of the world’s top chemical makers.

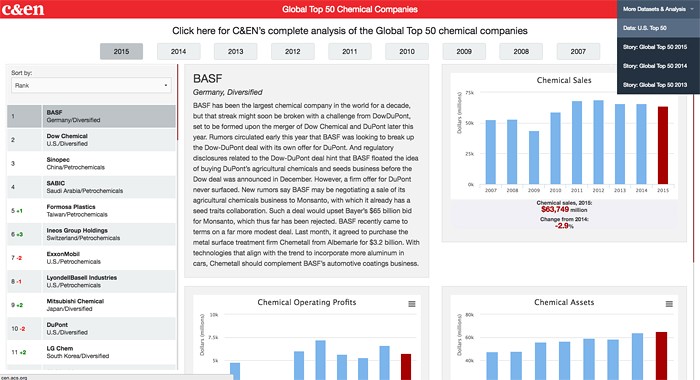

1 BASF

For the ninth year in a row, BASF is the largest chemical company in the world. This year also happens to be the company’s 150th anniversary, so in April it threw itself a party. Attendees were treated to a musical composition, “Symphony No. 8: Water Dances,” written by British composer Michael Nyman for the occasion and performed by London’s Royal Philharmonic Orchestra. The work was inspired by 1,500 recordings made at BASF offices and plants. German Chancellor Angela Merkel was on hand, and in addition to praising the company, she did remind the audience about BASF’s role in supplying chemical weapons during World War I and gas used in the Holocaust. BASF’s strategic initiatives were modest during its birthday year. The company inked a deal last October to sell its textile chemicals business to Archroma, the former Clariant textile chemicals business now owned by SK Capital. In May, it agreed to sell its fine chemicals unit to Siegfried, continuing a trend by major chemical firms to beat a retreat out of custom synthesis.

2 Dow Chemical

Andrew N. Liveris, CEO of Dow Chemical, spent much of the past year on the defensive. His company was beset by activist investor Daniel S. Loeb, whose hedge fund Third Point owns 1.9% of Dow. Loeb maintained that Dow’s strategy of integrating petrochemicals with downstream specialty chemicals was counterproductive and that the company, the largest U.S. chemical firm, should be earning $2.5 billion more per year. This marked a stark difference of opinion with Liveris, who once told reporters that a company focused solely on commodity chemicals has “no control of its destiny except the whims of the markets.” But before resorting to a contentious proxy fight, Liveris and Loeb made peace, and Dow allowed two Third Point directors on its board. Dow has since agreed to sell its chlorine and derivatives business to U.S. chlor-alkali specialist Olin.

3 Sinopec

Being the largest supplier of petrochemicals in the country that for a decade now has been the linchpin of global industrial growth has done wonders for Sinopec’s chemical revenues. China’s Sinopec is the world’s third-largest chemical company. A decade ago it was merely the ninth largest with $16.7 billion in revenues. However, Sinopec’s strong position hasn’t guaranteed high profits. Owing to a lack of competitive raw materials, China is one of the most expensive places in the world to make petrochemicals, which shows in Sinopec’s operating loss for 2014.

4 SABIC

Mohamed H. Al-Mady, who led Saudi Basic Industries Corp. since 1998, stepped down from the firm in February to accept a post in Saudi Arabia’s defense industry. Al-Mady presided over dynamic growth as SABIC used cheap Saudi ethane to fuel high profits and capital expansions. Knowing its feedstock advantage couldn’t last forever, SABIC has rolled many of those profits into international acquisitions such as its 2007 purchase of General Electric Plastics. Recently, the company has been focusing on technology. It is considering an oil-to-chemicals complex for the kingdom. It is forming a polyethylene joint venture with South Korea’s SK Innovation, and it even has a nanotube venture, Black Diamond Structures, with U.S.-based Molecular Rebar.

5 ExxonMobil

Unlike major oil companies such as Shell and BP, ExxonMobil never made major divestitures in petrochemicals. “We see the value of the chemical businesses,” former ExxonMobil Chemical president Stephen D. Pryor told C&EN shortly after retiring on Jan. 1. “The prospective value of chemicals has only grown over time, and you will see chemicals an ever-larger part of the company.” Indeed, ExxonMobil recently doubled petrochemical capacity at its refining and petrochemical complex in Singapore. It is also building an ethylene cracker in Texas and working on a massive elastomers joint venture in Saudi Arabia with Saudi Basic Industries.

6 Formosa Plastics

After a string of seven serious industrial accidents in 2011, Formosa Plastics made a strategic imperative of upgrading its flagship complex in Mailiao, Taiwan. The company spent $400 million to improve the facility to make it less susceptible to corrosion and easier to inspect. Meanwhile, Formosa is also exploiting shale gas riches in the U.S. At its Point Comfort, Texas, complex, the company is building an ethylene cracker, a propane dehydrogenation unit, and polyethylene and polypropylene plants.

7 LyondellBasell Industries

Bhavesh V. (Bob) Patel, LyondellBasell’s new CEO, has some big shoes to fill. His predecessor, James L. Gallogly, led the company out of bankruptcy and made it one of the most respected names in petrochemicals by the time he retired early this year. Conservatism seems to be the company’s mantra. While more than a dozen firms are building multi-billion-dollar U.S. ethylene crackers to take advantage of cheap shale gas, Lyondell is focusing on incremental expansions of existing plants as a way to boost output more quickly and cheaply.

8 DuPont

To activist investor Nelson Peltz and his firm Trian Partners, DuPont CEO Ellen J. Kullman and her management team can’t do anything right. The 2.7% stakeholder in DuPont says the firm’s high overhead hurts profitability and that its R&D spending yields disappointing results. Most other shareholders, it turns out, took Kullman’s side. At DuPont’s annual meeting in May, they voted down the four directors Peltz nominated to the board. Nevertheless, DuPont is making major changes. It just spun off its performance chemicals unit as Chemours, a company which on its own should rank among the world’s Top 50 chemical companies in 2016.

9 Ineos

Ineos is one of the world’s 10-largest chemical companies despite only having been founded only in 1998. Acquisitions, such as the 2005 purchase of BP’s Innovene olefins unit, made Ineos grow up fast. And Ineos hasn’t relented from this strategy. Last year it took over BASF’s share of the firms’ Styrolution styrenics joint venture, and this year it formed a polyvinyl chloride venture with Solvay that it will ultimately take over. Additionally, Ineos seeks to revolutionize the European chemical industry—now struggling with high-cost raw materials—by importing low-cost ethane from the shale-gas-rich U.S.

10 Bayer

The German giant is one of the last major companies to play in both pharmaceuticals and chemicals. But later this year, Bayer’s MaterialScience business will go by a new name, Covestro. The business, which makes polyurethanes and polycarbonate, had $15.5 billion in sales in 2014, a figure that would make Covestro, on its own, the 23rd-largest chemical company in the world. The business hasn’t been earning the same returns as Bayer’s agrochemical and pharmaceutical units. Even without Covestro, Bayer should remain in the Global Top 50 on the strength of its agrochemicals business, which had sales last year of $12.6 billion.

11 Mitsubishi Chemical

With high costs for feedstocks, labor, and just about everything else, Japan isn’t a cheap place to make chemicals. Japanese chemical makers, resistant to the ax-wielding that U.S. and European managers use to cut costs, have avoided consolidation. Until recently, that is, and Mitsubishi, Japan’s largest chemical maker, is helping lead the way. The company recently formed a joint venture with Asahi Kasei to operate a cracker in Mizushima, Japan, so Asahi can close an old cracker there.

12 Shell

Shell’s sales dropped by 42% in 2014, and its place in the Global Top 50 fell from fifth to 12th. Shell officials blame the decline on an extended outage at its facility in Moerdijk, the Netherlands. The company’s most ambitious current initiative is its planned ethylene cracker complex in Monaca, Pa. Unlike similar projects on the U.S. Gulf Coast, the project has advanced little since being announced in 2012, but it is still active. Shell recently purchased the land and has secured air permits from the State of Pennsylvania. Elsewhere during the past year, Shell completed expansions at its complexes in Singapore and Wesseling, Germany.

13 LG Chem

The South Korean chemical firm has been aggressively growing in materials for electronics. Earlier this year, LG unveiled a $100 million investment in liquid-crystal display polarizers in China. It also has been advancing organic light-emitting diodes for lighting. Its Holland, Mich., lithium-ion battery cell plant started up in 2013. But it isn’t all about electronics at LG. The company recently plunked down $200 million to buy the reverse-osmosis-membrane developer Nanoh3O.

14 Braskem

Braskem’s second-largest shareholder is the Brazilian state oil company Petrobras, which is enmeshed in a corruption probe. Allegations that Braskem may have improperly benefited from naphtha contracts with Petrobras back in 2009 may rope the petrochemical maker into the scandal. This year, the renewal of an all-important naphtha contract with Petrobras went down to the wire. Additionally, Petrobras may be forced to sell its Braskem stake. But given that Braskem is set to open a multi-billion-dollar petrochemical complex in Mexico, the company may still turn 2015 into a positive year.

15 Air Liquide

The past year has been one of big accomplishments for the French industrial gases firm. In February, the company was tapped to build the world’s largest air separation unit for South Africa’s Sasol. It also won its biggest hydrogen contract ever, in Saudi Arabia. Late last year, Air Liquide announced it is teaming up with Toyota Motor to build a chain of hydrogen filling stations in the northeastern U.S. for fuel-cell vehicles.

Advertisement

16 AkzoNobel

The Dutch paint and specialty chemicals maker has been relatively quiet on the strategic front since 2008, when it purchased ICI for $16 billion. Akzo has, however, been active on the technology frontier, especially in clean technologies. Over the past year, the company has unveiled initiatives to make chemicals from sugar beets, municipal solid waste, and even carbon dioxide.

17 Linde

Linde sees the combination of an aging population and rising life expectancy as a key to growth. That’s why in 2012 the German industrial gases maker bought Lincare and Air Products & Chemicals’ European home care business, both of which supply oxygen and other medical gases to patients. New CEO Wolfgang Büchele, who came to Linde last year after heading Kemira, endorses this strategy. “Our medical gases and services for respiratory therapy not only meet this growing demand, but also—even more importantly—support these patients by significantly improving their quality of life,” Büchele says in the company’s annual report.

18 Sumitomo Chemical

Like other Japanese chemical firms, Sumitomo has participated in consolidation in its home country, earmarking an ethylene cracker and a caprolactam plant for closure. Meanwhile, a weakening yen and lower oil prices lifted its earnings in 2014. A big focus for Sumitomo has been on its agricultural chemicals and electronic materials businesses. For example, it is doubling capacity for lithium-ion battery separators.

19 Mitsui Chemicals

Mitsui is trying to do its part to improve the competitiveness of the Japanese chemical sector through consolidation. After the formation of a polyurethanes joint venture this year with South Korea’s SKC, Mitsui will close a toluene diisocyanate plant in Japan. It is also shuttering a Japanese phenol plant it operates with Idemitsu Kosan.

20 Evonik Industries

Over the past year, Evonik has pursued as aggressive a capital expansion strategy as a specialty chemical maker can. The firm is planning a more-than-$100 million precipitated silica plant in the southeastern U.S. It will plunk down more than $100 million on specialty silicones in Germany and China. And with AkzoNobel, Evonik is building a potassium hydroxide and chlorine plant in Germany. The company also has been pushing new technology. Late last year it launched a silica-based replacement for plastic microbeads in personal care products and invested in Wiivv Wearables, a Canadian company that plans to use three-dimensional printing to produce biomechanically optimized shoe insoles.

21 Toray Industries

Among Japanese chemical firms, Toray has arguably the most aggressive growth strategy. The company bought industrial carbon fiber maker Zoltek last year. Months later, it won a new contract to supply carbon fiber to Boeing, a deal that brings its business with Boeing to $8.5 billion over 10 years. Toray likely isn’t finished investing. The firm plans to invest $1 billion in the U.S. and recently bought a 400-acre tract in Spartanburg County, S.C., where it will build a plant making carbon fiber and its precursors.

22 Reliance Industries

Reliance has long wanted to crack the U.S. petrochemical market. In 2009, the Indian firm tried but failed to buy LyondellBasell Industries out of bankruptcy. Reliance then bought into U.S. shale gas production and transportation, fueling speculation that it was contemplating a U.S. ethylene cracker. Instead, the company has decided to import 1.5 million metric tons of U.S. ethane per year to feed its ethylene crackers in India. It already has secured a contract with Mitsui O.S.K. Lines for six ethane-carrying vessels.

23 Yara

Formerly the fertilizer arm of Norsk Hydro, Yara was spun off in 2004 and has ridden the wave of the international fertilizer boom ever since. The company talked merger with U.S. rival CF Industries last year, but a deal didn’t materialize. Perhaps as a consolation, CF is acquiring Yara’s 50% stake in GrowHow, a U.K. fertilizer firm. Yara also will tap cheap U.S. shale gas through an ammonia plant it plans to build in Freeport, Texas, with BASF.

24 PPG Industries

PPG took a big step away from chemicals in 2013 when it merged its chlorine operations with Georgia Gulf to form Axiall. Now PPG is mostly a paint firm, though it retains a sizable silicas business. In cooperation with Goodyear, the company is rolling out high-performance silica for tires. And seeking to secure white pigment for paint, the company licensed its 40-year-old chloride-process titanium dioxide technology to Henan Billions Chemicals, which used the process to build a plant in Jiaozuo, China.

25 Solvay

The Belgian firm has been one of Europe’s most active chemical deal-makers. Solvay sold its pharmaceutical business to Abbott Laboratories for $6.2 billion in 2010 and used the proceeds to fund its purchase of Rhodia the following year. Jean-Pierre Clamadieu, who had led a turnaround at Rhodia, was tapped as Solvay’s new CEO. He has continued Solvay’s restructuring, recently sending its chloro-vinyl assets to a joint venture with Ineos and buying the oil-field chemicals firm Chemlogics.

26 Lotte Chemical

Lotte was known as Honam Petrochemical until a series of acquisitions that culminated in a name change in 2012. By any name, the South Korean firm was rather obscure in the U.S. until last year when it announced that it would partner with Axiall on an ethylene cracker in Louisiana. Lotte also plans an ethylene glycol plant downstream from the unit. However, the ethylene project has been delayed because of low oil prices.

27 Chevron Phillips Chemical

In 2011, Chevron Phillips was the first company in more than a decade to announce a new U.S. ethylene cracker. Since then, about a dozen firms have followed suit, and a few plants are already under construction, including Chevron Phillips’s. Big projects may be a core competency for the company. Chevron Phillips participated in the Middle Eastern petrochemical building boom a decade ago with the establishment of joint ventures in Saudi Arabia and Qatar.

28 DSM

Quick quiz: Name a chemical company being targeted by activist investor Daniel S. Loeb. If you guessed Dow Chemical, you would be correct. And if you said DSM, you would also be correct. Loeb’s firm has been prodding the Dutch chemical maker to focus on nutritional ingredients. In that direction, DSM is putting its polymer intermediates and composite resins businesses into a joint venture run by the investment firm CVC Capital Partners. However, DSM hasn’t charted as bold a course as Loeb might like. It continues to hold onto its engineering polymers business.

29 Praxair

Fractioning the atmosphere has its advantages. The strong margins of the industrial gas business have been the envy of others in the chemical industry for more than a decade. And among industrial gas makers, Praxair is a standout. At 31.8%, its operating profit margin is nearly double that of its closest rival, number 38 Air Products & Chemicals. It also exceeds those of Air Liquide, 15th, and Linde, 17th.

30 SK Innovation

One of South Korea’s leading chemical makers, the company boasts metallocene polymer technology that is the focus of a joint venture it is forming with Saudi Basic Industries Corp. The partnership will include a polyethylene plant already running in Ulsan, South Korea, and possibly another plant to be built in Saudi Arabia.

31 Shin-Etsu Chemical

The Japanese chemical maker has unveiled many capital projects over the past year. Its U.S. polyvinyl chloride subsidiary, Shintech, is moving ahead with plans to build a $1.4 billion ethylene cracker in Louisiana by 2018. The company also has been expanding capacity for vinyl chloride and polyvinyl chloride at its plant in Plaquemine, La. Closer to home, Shin-Etsu is plunking down more than $100 million apiece on projects to expand photoresists in Taiwan and silicones in Thailand.

32 Huntsman Corp.

Huntsman shareholders were so worried about the drop in oil prices late last year that CEO Peter R. Huntsman felt compelled to issue a statement promising that the development is a good thing. The company, he said, would benefit from lower feedstock costs and higher consumer spending. And, indeed, it managed to post solid gains in 2014, with profits climbing more than 17%. Last year, Huntsman bought Rockwood Holdings’ titanium dioxide unit. Now it is combining Rockwood with its own pigments business in preparation for a spin-off.

33 Syngenta

Advertisement

Syngenta has rejected, twice, a $45 billion takeover offer from rival Monsanto. Monsanto is doing everything it can to capture the Swiss crop protection and seeds firm. It is offering to relocate to the U.K. and to sweeten the deal with a $2 billion breakup fee, which Syngenta could pocket should regulators nix the transaction. Monsanto hasn’t raised the offer, though, and Syngenta claims the price doesn’t reflect the potential of its agrochemical pipeline.

34 Borealis

Like Ineos, Borealis plans to use ethane extracted from U.S. shale to resuscitate a European petrochemical plant. Next year, its site in Stenungsund, Sweden, will begin receiving ethane deliveries. In preparation, Borealis is installing an import terminal and performing other upgrades at the plant. The company, known mostly as a polyolefins maker, also has been growing its fertilizer business. For example, along with Agrifos Partners, the company is studying a U.S. fertilizer project.

35 Lanxess

Lanxess recorded a modest increase in operating profits and a small decline in sales in 2014, but the 2005 spin-off from Bayer believes it can do better. Early last year, the firm parted with its longtime CEO, Axel C. Heitmann. Then late in the year, it launched a restructuring program that will cut 1,000 of its 16,000 employees. The program could eventually entail finding partners for its rubber business.

36 Asahi Kasei

The Japanese chemical maker is taking a big plunge into battery materials with its $2.2 billion purchase of Polypore’s business of making microporous membranes used in lithium-ion batteries. However, one stock analyst, Jefferies’ Yoshihiro Azuma, complained that Asahi is overpaying by $600 million and that the prospects for electric cars is underwhelming. Separately, the company is rolling out a nonphosgene route to polycarbonate that makes the intermediate dialkyl carbonate from carbon dioxide and an alcohol. The company says it wants to expand the use of the greenhouse gas as an industrial feedstock.

37 Sasol

Sasol broke ground on an $8.1 billion ethylene cracker and derivatives complex in Westlake, La., earlier this year. The price came in nearly $4 billion more than originally envisaged. Executives at the South African firm blamed the “heated labor market.” Many big petrochemical projects, after all, are going up simultaneously on the Gulf Coast. Significantly, Sasol has delayed the go-ahead on a $14 billion gas-to-liquids facility it had been mulling. Lower oil prices make turning natural gas into liquid fuels less profitable.

38 Air Products & Chemicals

Like DuPont, Dow Chemical, and DSM, Air Products has been targeted by an activist investor, in its case Pershing Square Capital Management, which is led by William A. Ackman. Air Products responded last year by ousting longtime CEO John E. McGlade and replacing him with Seifi Ghasemi, former head of Rockwood Specialties. Ghasemi has moved quickly. He is cutting 500 jobs at the company. He also hinted that he may divest chemical businesses should they underperform industrial gases. In April, Ghasemi unveiled a project to create what he called the world’s largest industrial gas facility: a $2.1 billion plant in Saudi Arabia.

39 Eastman Chemical

The Kingsport, Tenn., chemical maker added a new leg to its chemistry stool last year with the purchase of Taminco for $2.8 billion. The purchase added capability in alkylamines and their derivatives to Eastman’s competencies in acetyl, polyester, and oxo chemistry. Taminco will also bring Eastman more sales in food, feed, and agriculture. In those markets, Taminco has about $700 million in annual sales to Eastman’s $300 million. It hasn’t been long since Eastman’s last major acquisition: The firm bought specialty chemical maker Solutia for $4.8 billion in 2012.

40 PTT Global Chemical

The Thai chemical maker is planning a project in a most American of places: Belmont, Ohio, where it wants to build a 1 million-ton-per-year shale-gas-based ethylene cracker with Japan’s Marubeni. Although far from the chemical hustle and bustle of the U.S. Gulf Coast, the region could get three ethylene projects if Braskem’s plant in West Virginia and Shell’s in Pennsylvania also get off the ground. PPT’s other strategic initiative, building a biobased chemical empire, stands in sharp contrast to a big U.S. petrochemical plant. Among its U.S. holdings are a 50% stake in NatureWorks and a majority interest in Myriant.

41 Mosaic

Last year, Mosaic closed on its $1.4 billion purchase of CF Industries’ phosphate mining operations. The mine in Hardee County, Fla., will allow Mosaic to forgo some $1.4 billion in expansions that it had been contemplating. Sales at Mosaic fell by about 9% last year because of slumping potash prices. The slump drove rival PotashCorp off of C&EN’s Global Top 50 ranking entirely.

42 DIC

In 2013, the Japanese company, formerly known as Dainippon Ink & Chemicals, launched a program, dubbed DIC 105, meant to restructure its printing inks business in North America and Europe and expand its “next generation” businesses, such as gas-barrier materials and cellulose nanofibers. The company, which runs U.S. pigments maker Sun Chemical, is seeing strong gains. Its sales improved by 17% in 2014, and profits rose by 7%.

43 Arkema

Only half over, 2015 has been an enormous year for Arkema. The French specialty chemical maker closed its $2.2 billion purchase of the adhesive maker Bostik from its former parent Total. The company also has been investing heavily in organic growth. It recently opened a $225 million thiochemicals plant in Malaysia. It unveiled plans to make the engineering plastic polyether ketone ketone in Mobile, Ala. And earlier this month, it announced it would invest almost $70 million to double its capacity for making molecular sieves in Honfleur, France.

44 Tosoh

The Japanese chemical maker saw a huge spike in profits, 24%, in its last fiscal year. CEO Kenichi Udagawa credited external factors, such as a decline in oil prices and the weakening yen, for the increase. Looking ahead, Udagawa hopes to improve the efficiency of Tosoh’s petrochemical operations while leveling financial volatility by expanding in specialty chemicals.

45 Hanwha Chemical

The growing South Korean diversified chemical firm was rocked by tragedy earlier this month when six contract workers died in an explosion at its polyvinyl chloride plant in Ulsan, South Korea. The explosion remains under investigation. In the meantime, the plant will remain idle. The company also has operations outside of chemicals, such as biopharmaceuticals.

46 Siam Cement

It is probably appropriate that Siam Cement joined the Global Top 50 in 2015: The Thai firm is celebrating its 100th anniversary this year. It attributes its 18% increase in chemical sales last year to the global economic recovery, which has brought steady growth in its home turf of Asia.

47 Indorama

The Thai company was a rather obscure regional polyester maker until a string of audacious acquisitions and capital projects turned it into a global giant. For instance, the company entered the U.S. market in 2003 when it purchased a polyethylene terephthalate (PET) plant in Asheboro, N.C. It grew by building a plant in Decatur, Ala., in 2009 and by buying Invista’s North American PET business in 2011. In March, it agreed to purchase a Cepsa plant in Montreal that makes the PET raw material purified terephthalic acid.

48 BP

BP was a much larger chemical company before it sold its Innovene olefins and derivatives business to Ineos a decade ago. But the company retained one of the world’s largest acetic acid businesses as well as its purified terephthalic acid (PTA) franchise. BP bought out its partners in an Indonesian PTA joint venture last year.

49 Ecolab

Once known as an institutional and industrial cleaning firm, the St. Paul company became a bigger player in chemicals in 2011 with its purchase of Nalco. To that acquisition the company bolted on Champion Technologies in 2013 in a $2.2 billion deal. A shale gas play, Champion bolstered Ecolab’s business in services for the oil and gas industry.

50 Johnson Matthey

The final entry in this year’s Global Top 50 is involved in a deal with direct consequence for many C&EN readers. It is selling its Alfa Aesar laboratory chemicals business to Thermo Fisher Scientific. The sale is part of an effort by Johnson Matthey to place more emphasis on its catalyst business. For instance, the British company sold its gold and silver refining operation to Asahi Holdings.

Advertisement

To see how the Global Top 50 data have changed over the years, visit http://cenm.ag/2015top50a.

For a full text PDF of the Global Top 50, click here.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter