Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Energy Storage

Northvolt is building a future for greener batteries

Swedish firm aims to feed a booming electric vehicle market with more-sustainable lithium-ion batteries

by Mark Peplow, special to C&EN

December 13, 2019

| A version of this story appeared in

Volume 97, Issue 48

“Here?” my taxi driver asks. We’ve stopped at the edge of a drab industrial park in Sweden, and he’s skeptical that we’re in the right place. He has a point—it seems like an unlikely location for the billion-dollar battery start-up I’ve been telling him about.

But sure enough, a short walk through a thin cluster of trees on the outskirts of Västerås (pronounced “Vester-ross”) brings me to a low-rise building with a sheet of paper stuck to its front window: “Northvolt,” it reads.

The modest facade of the company’s research and development hub, Northvolt Labs, belies the firm’s huge ambitions. Northvolt aims to build Europe’s first home-grown “gigafactory” for lithium-ion batteries, most of them destined to power electric vehicles.

The plant, called Northvolt Ett, is under construction 700 km north of here, in Skellefteå (“Shell-EFF-tay-oh”), where large-scale manufacturing is slated to begin in 2021. It’s called a gigafactory because of the scale of production—by 2024, the firm expects it to make enough batteries every year to store at least 32 GW h of energy, sufficient for powering more than half a million fully electric sedans. But Northvolt’s ambitions don’t stop there. The company also promises that these will be the world’s greenest lithium-ion batteries.

Northvolt at a glance

▸ Founded: October 2016

▸ Headquarters: Stockholm

▸ R&D labs: Västerås, Sweden

▸ Manufacturing sites: Skellefteå, Sweden (battery cell manufacturing); Gdansk, Poland (module assembly)

▸ Employees: >500

▸ Cash raised: €1.45 billion ($1.6 billion) as of June 2019

▸ Selected industry partners: ABB, BMW, Epiroc, Scania, Siemens, Stena, Vattenfall, Vestas, Volkswagen

Source: Northvolt.

Exhaust gases from road transportation are responsible for about 16% of human-made carbon dioxide emissions, according to the Intergovernmental Panel on Climate Change. Although electric vehicles could help dramatically reduce that climate burden, the batteries that will power them also come with an environmental cost. Refining ores to produce essential battery materials generates sulfur dioxide and nitrogen oxides, causing problems like acid rain and smog. Energy-intensive manufacturing processes cause copious CO2 emissions. Spent batteries threaten to leach toxic chemicals if they are tossed into a landfill.

Northvolt aims to reduce these impacts at every step. The gigafactory will run on hydroelectricity, the firm says, and many of its raw materials will be refined close to where they are mined, rather than shipped halfway around the world, to limit the batteries’ carbon footprint. Strict environmental controls will minimize emissions, and chemical recycling processes will recover more raw materials from spent batteries.

To pull this off, Northvolt has adopted a different business model than that of other automakers and battery manufacturers. Tesla, for example, currently buys ready-made battery cells from its partner Panasonic, while battery makers buy components like cathode materials from suppliers such as Umicore or BASF.

In contrast, Northvolt is bringing most of this long and complex supply chain in-house. It will deal directly with mining companies and refiners to buy raw materials; it will prepare its own cathode materials, assemble its own cells and battery modules, and recover materials from spent cells through its own recycling program. This vertical integration should help the company make cells with 60–70% lower CO2 emissions than equivalent batteries made in China, says Emma Nehrenheim, Northvolt’s chief environmental officer. China is the world’s current leader in battery production.

The plan requires some innovative science and plenty of money. Northvolt raised about €900 million ($1 billion) in investment capital this year, more than any other tech company in Europe, according to the venture capital firm Atomico. Investors include automakers like Volkswagen and BMW and electrical engineering giants including Siemens and ABB. In May, the European Investment Bank agreed to loan the company an additional €350 million, its largest-ever commitment in energy storage.

Ett means “one” in Swedish, signaling that for Northvolt, this gigafactory is only the beginning. The company is already planning more gigafactories to feed an electric vehicle market that’s about to go stratospheric.

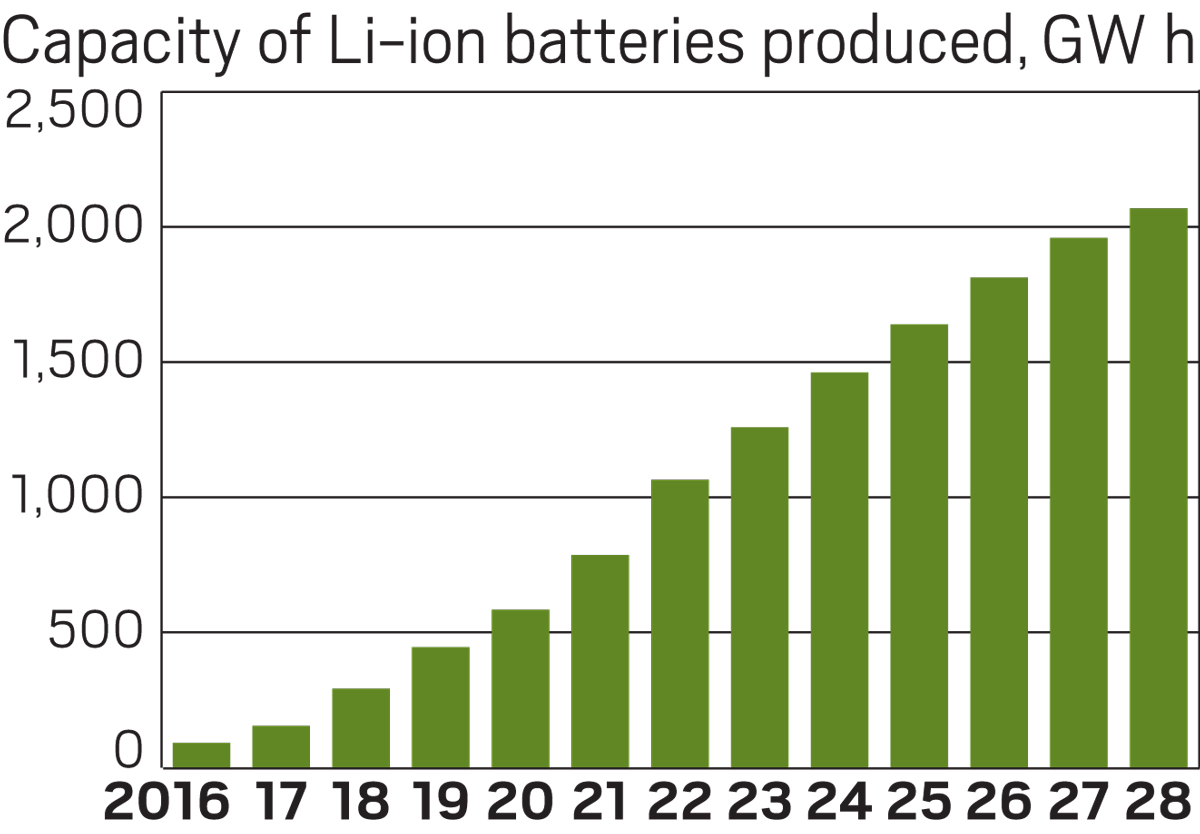

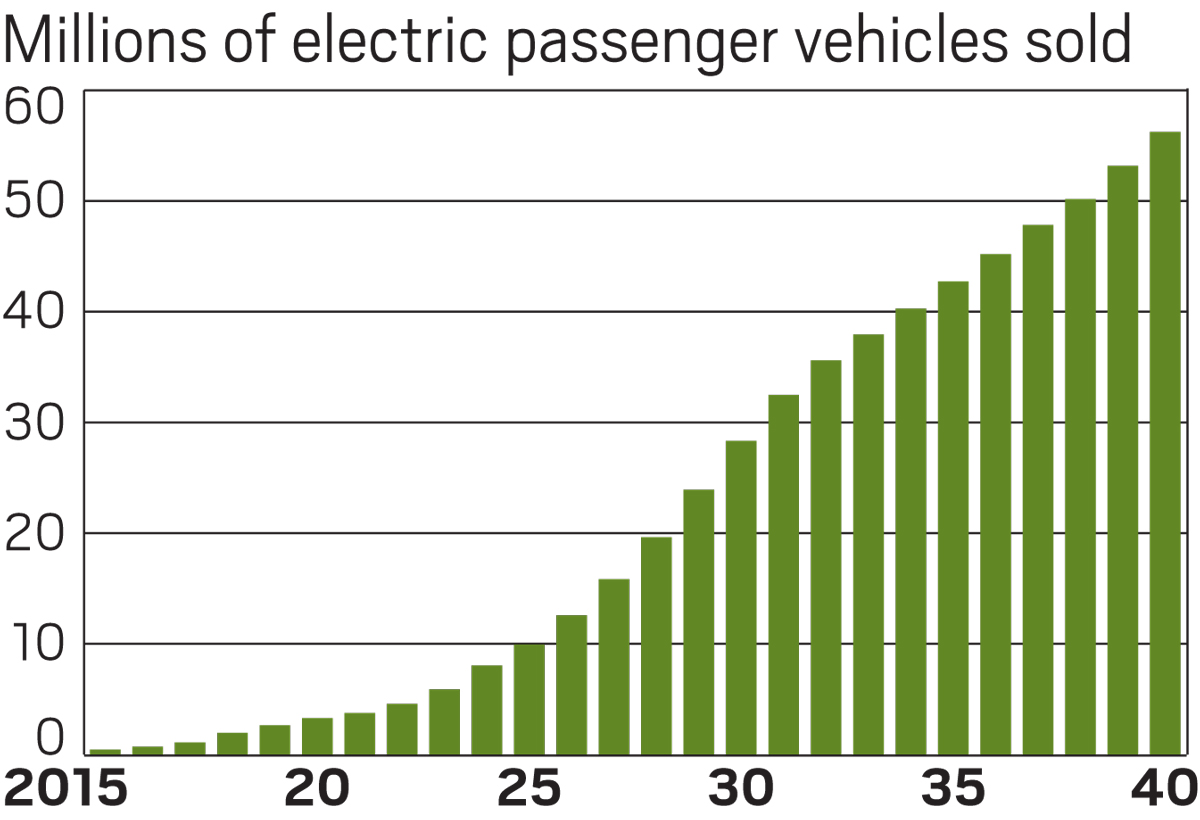

Roughly 1 million of the vehicles were sold worldwide in 2017, and Bloomberg New Energy Finance anticipates annual sales will soar to 28 million over the coming decade. In response to the predicted demand for electric vehicles, battery makers around the world are scrambling to boost their capacity. Global production of lithium-ion batteries stood at around 154 GW h in 2017 and could exceed 2,000 GW h by 2028, according to the price reporting agency Benchmark Mineral Intelligence. All of these new factories will face the same environmental challenges that Northvolt is trying to tackle.

Rewriting the rules of battery production at huge scale and high speed is a tall order. But Nehrenheim hopes that Northvolt can offer a model for sustainable production in the sector, thereby spurring its rivals to reduce their own environmental footprints. “We hope that other battery manufacturers globally take on this challenge of producing the greenest battery,” she says.

The parts make the whole

Västerås is an appropriate base for Northvolt Labs, given the city’s long industrial history built around electrification. The company that would eventually become ABB moved here in 1891, attracted by a small hydroelectric dam that had just been built on the Svartån River. Closing a neat historical circle, Northvolt’s temporary offices are now housed in one of ABB’s current buildings.

In a sparse office at Northvolt Labs, I watch as about 60 people work on laptops at temporary tables, giving the place the air of a Silicon Valley hackathon. Over in the clean room, researchers wield scissors and tape as they bustle around in head-to-toe “bunny suits” that prevent any contamination of the sample cells they’re building by hand.

Battery boom

The lithium-ion batteries in today’s electric vehicles use a range of materials to store and release energy, but they all rely on the same fundamental principles. The cell’s anode is typically made of graphite, which acts as a storage site for lithium ions. When the battery discharges, electrons flow through a circuit from anode to cathode. At the same time, lithium ions in the anode travel through a liquid electrolyte and into the cathode. During charging, the electrons and ions run in reverse.

Northvolt will be using a graphite anode, along with a conventional electrolyte of lithium hexafluorophosphate in an organic solvent. But the firm is embracing the latest in cathode chemistry, building on decades of research across academia and industry to optimize the capacity, stability, and cost of lithium-ion batteries.

Vroom, vroom

A growing number of automakers prefer batteries with lithium nickel manganese cobalt oxide (NMC) cathodes, which power the Nissan Leaf, Chevy Volt, and BMW i3. That preference is in part because nickel generally gives batteries higher energy capacity, says battery researcher Arumugam Manthiram of the University of Texas at Austin. “You get higher charge storage capacity, and that means longer usage times between charges for the same size and weight of battery,” he says.

On the flip side, nickel makes the cathode material less stable, which shortens the battery’s cycle life—the number of times it can be charged and discharged without losing energy capacity—and raises the risk of overheating. Cobalt counteracts this stability problem by preventing nickel and lithium ions from swapping places in the cathode material’s layered structure, although it also increases the cathode’s cost.

NMC cathodes once featured equal proportions of nickel, manganese, and cobalt, a blend called NMC 111. Over time, battery makers have increased nickel and reduced cobalt, using thermal management systems and electronics that regulate charging and discharging to reduce degradation of the cathode material. Northvolt’s batteries will be the latest generation of this formulation, with an 8:1:1 ratio of nickel to manganese to cobalt. “All the development around NMC 811 has been to keep the high energy density but maintain the stability and cycle life,” says Tim Grejtak, an energy storage analyst at Lux Research.

Earlier this year, the Chinese battery manufacturer Contemporary Amperex Technology (CATL) became the first company to begin mass-producing NMC 811 batteries. But the batteries come with significant manufacturing challenges, partly because the cathode’s reactive nickel ions are highly sensitive to moisture.

“These high-nickel-content cathodes are a lot harder to work with because they have to be mixed and coated in really dry conditions,” says Gregory B. Less, technical director at the University of Michigan Battery Lab. Factories must run part of their production lines in large, climate-controlled dry rooms, which increases the process’s overall energy consumption.

A life-cycle analysis suggests that all the steps involved in turning ore and other raw materials into typical NMC-based Li-ion batteries collectively emit about 42 kg of CO2 for every 1 kW h of capacity, and roughly 40% of those emissions are generated during cell manufacturing (Nat. Sustainability 2019, DOI: 10.1038/s41893-019-0222-5). Northvolt’s hydroelectricity-powered gigafactory should avoid almost all that CO2.

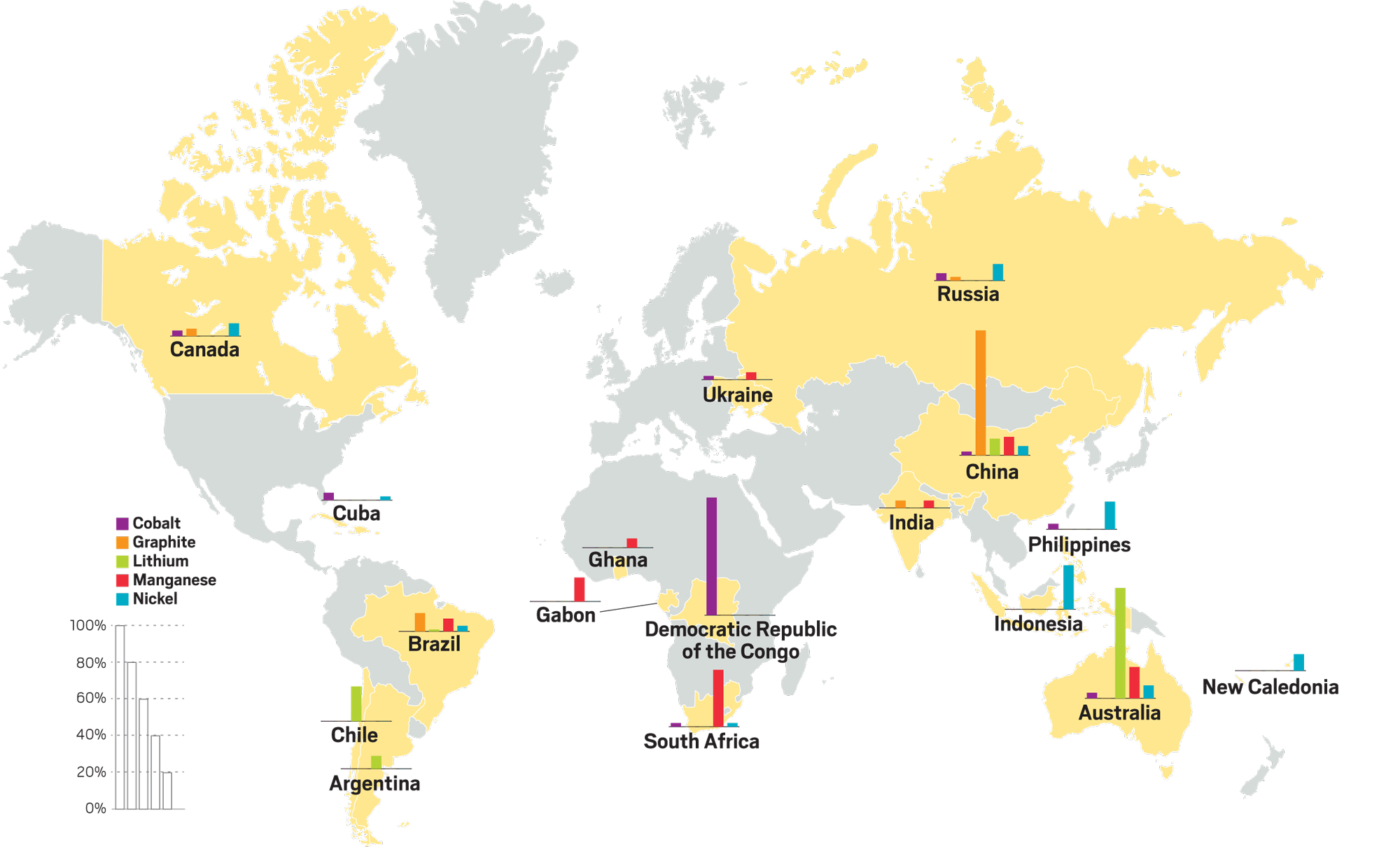

But another 30% of the battery’s greenhouse gas burden comes from the mining, refining, and transportation of the cathode materials. Northvolt’s decisions about its raw material supplies will therefore play a critical role in determining the greenness of its batteries. “The recipes of these batteries are very international,” says Jennifer B. Dunn, associate director of Northwestern University’s Center for Engineering Sustainability and Resilience. “And what drives the impact of the cathode materials is mostly which metals it contains,” especially cobalt and nickel.

Global sourcing

Secret source

Northvolt’s pilot line is across the road from its research labs in Västerås. The line is housed in a brand-new 19,000 m2 building that will start producing sample cells for customers early next year and ramp up to an annual output of 350 MW h. During my October visit, about 300 people are working on-site, and everything is noise and bustle. Trucks and diggers rumble over the muddy ground around the building, readying the surface for blacktop. The sky is leaden, and a chill fills the air. All this work needs to be finished before harsh weather arrives.

Large silos await the arrival of raw materials, including sulfates of the three crucial transition metals—nickel, manganese, and cobalt. “We have secured our sources of raw materials for our first 16 GW h,” says Chief Operating Officer Paolo Cerruti, who cofounded Northvolt with CEO Peter Carlsson. Both are former Tesla executives.

Northvolt’s lithium will come from spodumene ore mined in Australia and Canada, and it will be processed and refined into lithium hydroxide at plants located near these mines. Bringing lithium hydroxide from thousands of kilometers away will inevitably incur a carbon penalty. “But the distance between the mine and the refinery is actually more important,” Nehrenheim says.

Most of Australia’s spodumene is currently sent to China for refining, for example, but the ore contains just a few percent lithium by mass—so most of the associated transportation emissions come from shipping unwanted atoms. By colocating mining and refining operations, Northvolt can avoid transporting the vast majority of the ore’s mass, Nehrenheim explains, and make this stage of battery production much more energy efficient.

China’sTianqi Lithium will supply Northvolt with lithium hydroxide from a new refinery in Western Australia, using ore mined some 250 km away—a lot closer than China. Northvolt’s Canadian supplier is Nemaska Lithium in Quebec, which has developed a new approach to making lithium hydroxide that relies on electrolysis. By running on hydroelectric power, the process will shrink the material’s carbon footprint.

This sounds well and good, but Nemaska reported in November that it will idle its mining and refining operations until it can raise more capital. “They have a huge cost overrun,” says Martin Potts, mining research director at the investment bank finnCap.

Nehrenheim contends that Northvolt will still be able to source enough lithium hydroxide elsewhere, but Potts is not so sure. Nemaska had agreed to supply Northvolt Ett with up to 5,000 metric tons of lithium hydroxide per year, which Potts estimates is about one-quarter of the lithium the gigafactory needs. “They could find they’re trying to start up a factory without the required raw material,” Potts says.

Cobalt poses another problem. About two-thirds of the world’s supply is currently mined in the Democratic Republic of the Congo, where poorly regulated small-scale mining—often using child labor—accounts for up to 20% of output. Most battery makers rely on the DRC’s cobalt to some extent, but Northvolt has ruled it out for now: “It’s too difficult for us to do it in a responsible and sustainable way,” Nehrenheim says.

Instead, Cerruti says Northvolt’s cobalt and nickel will be mined and refined within about 1,000 km of the gigafactory. Northvolt won’t disclose which companies will supply these materials, but Potts believes one of the most likely sources is the mines of Norilsk Nickel (Nornickel) in the Russian Kola Peninsula.

Nornickel has a poor environmental record, though. “Russian smelting towns are staggeringly filthy,” Potts says. Nickel sulfide ores produce a lot of SO2 emissions during smelting, and Nornickel mine tailings have caused substantial metal pollution in the region, according to the Bellona Foundation, an environmental group based in Norway. In recent years, though, Nornickel has committed to mitigating its environmental impact.

Nehrenheim declines to comment on Northvolt’s relationship with Nornickel. However, she says Northvolt aims to work not only with companies that already have environmental sustainability built into their business models but also with those that are willing and able to make investments that support their transition to more-sustainable practices. She adds that Northvolt will set up monitoring processes to ensure suppliers meet sufficiently green standards.

Milestones and targets

▸ October 2016: Northvolt is founded.

▸ September 2017: Battery recycling research program begins.

▸ April 2018: Construction of Northvolt Labs, a pilot line and R&D center, begins in Västerås.

▸ March 2019: Northvolt’s research division produces its first cell.

▸ June 2019: Northvolt raises €900 million ($1 billion) in investment capital.

▸ October 2019: Construction work begins at Northvolt Ett, the first of the company’s gigafactories.

▸ 2021: Large-scale manufacturing (8 GW h per year) is set to begin at Northvolt Ett.

▸ 2024: Northvolt Zwei is set to supply Volkswagen with 16 GW h of batteries per year.

▸ 2028: Global lithium-ion battery production is projected to exceed 2,000 GW h.

A virtuous cycle

Inside the pilot plant at Northvolt Labs, the clang of metal on metal echoes through the cavernous building. Construction workers trundle around on telescopic platforms, their voices raised against the noisy chorus. Technicians ignore the din as they fiddle with workstations, setting up the complex machines that will soon churn out batteries.

Once the electrodes have been fabricated on a pair of long production lines, they’ll be pressed between enormous rollers, cut into narrow ribbons, and vacuum dried in a large oven for several hours. The electrodes are then put into cell casings, which are filled with electrolyte and sealed, given their first charge, and stacked in floor-to-ceiling storage racks, each individually monitored with fire sensors. Later, the cells will go through repeated charging and discharging cycles to ensure they are ready for use.

This pilot plant is a baby compared with Northvolt Ett, which will cover about 500,000 m2, more than 100 American football fields. Its vast size is not only about meeting soaring demand. Economies of scale reduce costs and help ensure batteries are less energy intensive to make. Northvolt has already taken orders for about half of Ett’s planned 32 GW h annual capacity.

Advertisement

Aside from its hydroelectric supply, Northvolt says, the gigafactory will use waste heat to warm the company’s offices, and it will recycle all the water used in its processes. The company’s chief development officer, Yasuo Anno, has 3 decades’ experience in battery engineering at Panasonic and Sony, and his research team is filled with people from Japanese and South Korean companies that already have experience with NMC 811.

“I was so motivated by the green batteries,” Anno says. “I don’t think anyone in Japan, Korea, or China makes green batteries.”

Improving the sustainability of battery manufacturing is only half the battle, though. Over the next 10 years, electric vehicles currently on the road will generate around 250,000 metric tons of waste battery packs globally (Nature 2019, DOI: 10.1038/s41586-019-1682-5). “By the end of the next decade, there could be millions of batteries coming through, and then we really need to have quick, efficient, and environmentally sustainable recycling schemes,” says Paul Anderson, a materials chemist at the University of Birmingham who leads the Reuse and Recycling of Lithium Ion Batteries (ReLiB) project, the UK’s flagship research effort in lithium-ion battery recycling.

Efforts to recycle this growing battery mountain are only just ramping up—globally, less than 5% of Li-ion batteries are currently recycled (Science 2019, DOI: 10.1126/science.aax0704). But Northvolt argues that using recycled metals in place of mined ores can slash the carbon emissions associated with preparing battery materials and almost entirely avoid the SO2 emissions of ore smelting. “Basically, all of our footprint currently comes from the supply chain, from the mining and refining, so [efficient recycling] would remove a very substantial part of that footprint,” Nehrenheim says.

Recycling also makes good business sense, Cerruti adds. The battery industry currently uses less than 5% of global nickel production, but by the mid-2020s, that could rise to 25%. “We think there is going to be a systemic shortage of material on the market, which will drive nickel prices higher,” he says.

Northvolt expects that its automaker customers will recall spent battery packs from consumers, perform diagnostics on the batteries, and then dismantle them to remove useful parts. What’s left of the battery modules or cells will be shipped to Northvolt, which is developing a highly automated cell-disassembly system. To assist in this process, every cell will be marked with a QR code during manufacturing that identifies the materials it contains and other useful information.

Commercial battery recyclers broadly use three approaches to extract useful metals from lithium-ion batteries (ACS Sustainable Chem. Eng. 2018, DOI: 10.1021/acssuschemeng.8b03545). Some crush the batteries and pick out just metals that are easy to recover, such as copper and aluminum. Others use pyrometallurgical recycling, a 3,000 °C process that smelts the batteries into a mixture similar to an ore. Cobalt, nickel, and copper can be extracted from this mess, but lithium and aluminum are typically lost. The third, lower-temperature option, hydrometallurgical recycling, also allows lithium to be recovered, in addition to other metals.

Northvolt has developed its own hydrometallurgical approach to process old cells and production scraps. “It can provide a very high purity of metals,” says Martina Petranikova at Chalmers University of Technology, who is collaborating with Northvolt on the process. An inorganic acid will leach metals from shredded cell materials, and a series of liquid-liquid extractions will separate the metals with the help of acidic extraction agents. Petranikova says that hydrometallurgical treatment is a lot less energy intensive than pyrometallurgy and that many of the recycling reagents can be reused.

Although one recent analysis concluded that pyrometallurgical and hydrometallurgical processes do not significantly reduce life-cycle greenhouse gas emissions (Nat. Sustainability 2019, DOI: 10.1038/s41893-019-0222-5), Nehrenheim points out that using hydroelectricity to run the process will make Northvolt’s recycling process much more sustainable than those estimates suggest.

Northvolt contends that recycling could supply half the raw materials it needs for its Ett gigafactory by 2030. That could be a tall order, Lux’s Grejtak suggests, not least because there may not be enough dead batteries with the right chemistry around. “I would say that’s pretty aggressive,” he says.

A growing market

In October, the first trusses and columns of Northvolt Ett began to rise from the snow-covered ground at the Skellefteå site. Even as that factory takes shape, the company has already committed to building Northvolt Zwei (“two”) in Germany, aiming to supply Volkswagen with 16 GW h of batteries per year by 2024. The automaker expects it will actually need 150 GW h of batteries per year by 2025 for its European sales alone, a sign of how rapidly the electric vehicle market is expanding on the continent. “It’s a wonderful, exploding market,” says George W. Crabtree, director of the US Department of Energy’s Joint Center for Energy Storage Research.

Other battery makers are responding to that demand with their own big plans. Last year, for example, Umicore raised more than $1 billion that will mostly fund new facilities to manufacture cathode materials in China and Europe. LG Chem says it is ramping up production from 10 GW h to 70 GW h over the next 2 years at a battery plant in Poland. China’s CATL and South Korea’s SK Innovation are both planning battery gigafactories in Europe. Thanks to this flurry of factories, Bloomberg New Energy Finance says Europe’s lithium-ion battery manufacturing capacity should edge past the US’s by 2023.

Advertisement

European legislation is putting battery makers under additional pressure. No diesel or gasoline cars can be sold in Norway after 2025, for example, and Germany says it will ban internal combustion engines by 2030. Meanwhile, the European Union’s ecodesign directive obliges manufacturers to reduce the energy consumption and environmental impacts of batteries and many other products.

Northvolt’s vertical integration strategy will make it easier to trace exactly where its materials come from and how they were prepared, Cerruti says, and cutting out the intermediaries in the materials supply chain will ensure the batteries are cost competitive.

The company plans to demonstrate its batteries’ green credentials through the Product Environmental Footprint system established by the European Commission, which uses life-cycle analysis to measure environmental performance. Ultimately, this is how Northvolt will prove it has created the world’s greenest lithium-ion battery. “I’m very supportive of Northvolt,” Anderson says. “But I think at the moment, their green credentials rely a lot on the fact they’re using hydroelectricity.”

Nevertheless, Crabtree thinks Northvolt could mark a major step forward for battery manufacturing in Europe, which, like the US, lags far behind China in electric vehicle and battery production. “It’s only going to get worse unless there’s some strong action taken,” he says. “And this looks like strong action.”

Back in Västerås, it’s obvious that Cerruti is driven by the urgency of this challenge. “We are fighting against the clock,” he says. “There’s clearly a time window when there is a need for more capacity on the market, and there is a scarcity of talents and technology. This has been an Asian game for 3 decades, and it’s only now becoming a European game.”

Mark Peplow is a freelance science writer based in the UK.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter