Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Water

Water treatment firm Xylem to acquire Evoqua

by Matt Blois

January 29, 2023

| A version of this story appeared in

Volume 101, Issue 4

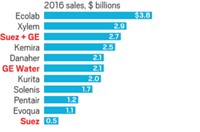

Xylem, which produces pumps, analytical instruments, and other water treatment equipment, plans to acquire Evoqua Water Technologies in a $7.5 billion all-stock transaction. The purchase will give Xylem advanced water treatment capabilities and access to customers in the life sciences, electronics, energy, and food industries. Evoqua also offers remediation for per- and polyfluoroalkyl substances. In addition, the acquisition will make industrial customers a much bigger part of Xylem’s business, which mostly serves the utility, commercial, and residential sectors. The deal is expected to close by midyear; it will give Evoqua shareholders a 25% stake in the combined company and represents a roughly 30% premium on Evoqua’s recent share price. Together, the firms are expected to have $7 billion in annual revenue. Xylem CEO Patrick Decker will continue to lead the company, and two representatives from Evoqua will join Xylem’s board. Evoqua shares jumped about 14% and Xylem shares fell about 8% after the announcement.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter