Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Electronic Materials

Entegris will sell bulk electronic chemicals unit to Fujifilm

$700 million purchase continues consolidation among suppliers to the semiconductor industry

by Craig Bettenhausen

May 12, 2023

The specialty chemical firm Entegris has agreed to sell its bulk high-purity acids and solvents business to Fujifilm for $700 million. Entegris says the transaction, which is scheduled to close before the end of this year, will let the firm focus on its core businesses and help pay down debt.

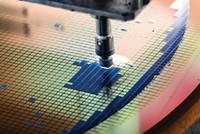

The unit moving to Fujifilm, called Electronic Chemicals, came as part of Entegris’s 2021 acquisition of CMC Materials for $6.5 billion. CMC, in turn, bought it as part of a $1.6 billion acquisition of KMG Chemicals in 2018. Before that, it had been owned by Air Products and Ashland. The business had sales last year of about $360 million and supplies chemicals used to clean, etch, and dry silicon wafers during the chip fabrication process.

Entegris bought CMC primarily to expand in the field of chemical mechanical planarization (CMP), a form of precision polishing that happens several times during chipmaking. Since 2021, Entegris has also sold pipeline materials, optics polishing, and biocides units that came with CMC. Along with CMP, Entegris considers its core businesses going forward to include specialty gases and chemical deposition formulations, inert tubing and other materials handling equipment, and precision filtration.

Mike Corbett, a managing partner at the electronic materials consultancy Linx Consulting, says the business has finally found a good fit. “Fujifilm does a lot of bulk solvents and developers for lithography applications in the semiconductor industry,” he says, and the semiconductor makers that need those chemicals are eager for supplier stability as they execute a historic scale-up in the US and other locations.

The sale comes amid a weak quarter for electronic materials overall, despite good long-term prospects driven by increasing demand for computer chips and pushes in several regions for robust, domestic semiconductor supply chains. Marcus Kuhnert, chief financial officer of Merck KGaA, says in a first-quarter summary that he expects slow sales at least through the summer for semiconductor supplies. Sales at Merck’s Electronics unit, which also includes materials for displays, were down 7.9% compared to the first quarter of 2022.

Entegris is also bracing for a slow year. The Boston Globe recently reported that the firm is eliminating 144 positions, or about 1% of its workforce. “Sales were down sequentially in the quarter, but we believe we outperformed the market,” CEO Bertrand Loy says in a statement. “2023 continues to be an uncertain year for the semiconductor industry.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter