Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Oncology

BMS to buy Celgene in deal worth $74 billion

The mega-merger will create a leading oncology drug company

by Lisa M. Jarvis

January 3, 2019

| A version of this story appeared in

Volume 97, Issue 1

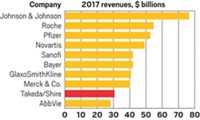

Seeking to create a leading oncology company, Bristol-Myers Squibb will acquire Celgene in a deal worth about $74 billion. The mega-merger, which according to the market intelligence firm Evaluate Pharma is the fourth-largest in drug industry history, is expected to close in the third quarter of this year.

The deal could become more lucrative for Celgene shareholders with near-term pipeline success. For each of their shares, Celgene investors will get $50 in cash, one share of BMS stock, and a “contingent value right” worth $9 per share if three Celgene drug candidates are approved in a timely fashion. The three products are the immunomodulatory pill ozanimod and the cellular therapies JCAR017 and bb2121.

The companies have similar yet complementary portfolios in oncology and immunology. In oncology, for example, BMS is a leader in solid tumors, whereas Celgene’s expertise is in blood cancers.

That overlap was a driving factor behind the deal, BMS’s CEO, Giovanni Caforio, told analysts this morning on a call to discuss the deal. “We’ve been discussing the potential for this combination for quite some time,” he said.

Caforio pointed to four main motivations for the acquisition: the scale of the combined companies’ product portfolio, which includes nine drugs with over $1 billion in annual sales; six drug candidates expected to launch in the next two years; the potential to extract $2.5 billion in cost savings from the combination; and a broad early- to mid-stage drug pipeline.

“When you look at it all together, it’s a very unique combination that brings together complementarities,” he added.

The deal makes sense in an evolving and uncertain drug pricing environment, Caforio noted. “Critical mass is important in highly managed markets,” he said. “And as the leading oncology company, which is what we are creating today, our competitive position with respect to payers improves no matter” how policy evolves.

But on the call, many analysts questioned the wisdom of the deal. The companies are both big R&D spenders—combined, they shelled out nearly $8 billion in 2017, according to Evaluate Pharma. But in the past decade they together have won just nine drug approvals, says Bernard Munos, senior fellow at FasterCures, a think tank at the Milken Institute.

“I think their R&D productivity sucks, frankly, individually, and we know what’s going to happen when you put together mega-mergers like this—it’s always bad,” Munos says. The mega-mergers in the first decade of this millennium caused firms to lose, rather than create, value, he says. “You can count me among the skeptics.”

The other pressing concern for industry watchers is the timing of generic competition for Celgene’s blood cancer treatment Revlimid, which in 2017 generated $8.2 billion in sales. BMS says it has a more conservative view of the situation than most industry observers. It’s assuming limited generic sales in 2022, with full patent loss coming in 2026.

And Celgene has had a series of drug-pipeline setbacks, including the failure of the Crohn’s disease treatment mongersen and a delay in the development of ozanimod. The big biotech company’s stock price has suffered as a result, causing many to push for new leadership.

Advertisement

Given those challenges, analysts say the deal is a win for Celgene. The acquisition “is a best-case scenario that should be immediately utilized” by the firm’s shareholders, Leerink stock analyst Geoffrey Porges said in a note to investors this morning. The urgency is because the price tag is linked to BMS’s share price, which could drop, prompting BMS investors to reject the deal.

“The deal generates tremendous immediate-term value that we believe would have taken years for Celgene to achieve,” Porges said. “It also distances Celgene investors from the management of Celgene, which has made multiple errors” over the past two years, and puts its portfolio and pipeline “in more capable hands.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter