Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Canada

Profitability continued in 2005, but long-term outlook for new petrochemical investment isn't good

by Alexander H. Tullo

January 9, 2006

| A version of this story appeared in

Volume 84, Issue 2

Canadian chemical producers say that despite a few blemishes, such as high energy prices and lower volumes, the industry performed well in 2005. These same experts are looking forward to some improvement in 2006.

But for the longer term, the Canadian industry is in a more difficult position. The high cost of natural gas is undermining the global competitiveness of the Canadian chemical industry, just as it has been in the U.S., leading to a lack of new investment.

Canadian production volumes of major chemicals dipped somewhat in 2005. According to C&EN projections based on data available from Statistics Canada, out of 16 products for which year-over-year comparisons are possible, only one product, ammonium nitrate, posted an increase in 2005. The key products ethylene and propylene are posting 24.3% and 17.3% declines, respectively, versus 2004.

Other measures, however, portray a situation more favorable to Canadian chemical producers. According to C&EN estimates, prices for chemicals and chemical products increased by 4.9% in 2005, while the prices for all manufactured goods in Canada increased only by 1.5%. Canadian prices for organic chemicals jumped 10.7%, while inorganic prices rose 7.0%.

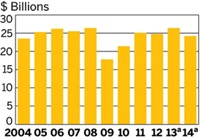

Higher prices pushed up Canadian chemical shipments in 2005. Shipments for all chemicals increased 5.3% in 2005 versus 2004, hitting $39.6 billion. Basic chemical shipments over the same period rose 2.6%, to $11.6 billion. Resin, synthetic rubber, and fiber sales increased 9.7%, to $7.9 billion.

The trade picture also improved for Canadian chemical manufacturers. For the second year straight, Canada's chemical trade deficit decreased. For 2005, it was $7.9 billion; it was $9.2 billion in 2004.

The Canadian Chemical Producers' Association (CCPA), which makes its own projections based on Statistics Canada data, albeit focusing only on basic chemicals and resins, squares well with the C&EN estimates.

According to CCPA, sales volumes of basic chemicals and resins dropped by 2% while prices increased by 8% during 2005. The value of the sales, meanwhile, increased by 5%, hitting $18.9 billion.

According to a CCPA survey of member companies, profitability of Canadian chemical producers held up well in 2005. After nearly quadrupling in 2004, operating profits decreased a slight 3%, slipping to $1.7 billion. Exports in these products jumped 17% to $14 billion.

"Supply-and-demand balances have remained pretty tight, which allowed producers in Canada to pass on higher costs of natural gas and feedstocks in higher product selling prices," says David J. Shearing, senior manager of business and economics at CCPA.

Company results for the first nine months of 2005 show that Canadian producers are holding on to profits. Imperial Oil, the Canadian affiliate of ExxonMobil, posted a net income in chemicals of $73.3 million on sales of $1 billion over this period. For the first three quarters of 2004, the company racked up a $64.3 million profit on $918 million in sales.

"It was nice to have a very profitable year, but it was a little ugly how we got there," says J. S. (Steve) Griffiths, vice president and general manager of petrochemicals at Imperial. "Overall, the volumes were a little weaker than in 2004. But the margins were good, despite the higher costs."

Nova Chemicals' olefins and polyolefins business, which is based in Alberta and Ontario, also posted strong profits through the first three quarters of 2005. The unit reported $196 million in net profits on $2.7 billion in sales, an improvement even over the $167 million in profits in 2004.

"It wasn't a bad year at all," comments Val Mirosh, president of olefins and feedstocks at Nova Chemicals. He notes that the selling prices for chemical products drove industry profitability even though natural gas prices in North America were driven well above $10 per million Btu in the months following Hurricanes Rita and Katrina. The natural gas price is a major determinant of ethane feedstock pricing in North America, particularly Alberta. "The prices of the commodities that we sell certainly more than reflected the increase in the feedstock price," he adds.

Nova also had production setbacks throughout the year. A maintenance turnaround related to a modernization at the company's Corunna, Ontario, ethylene cracker suffered mechanical difficulties, leading to a force majeure at that facility toward the end of the year. The company says the plant will soon resume production with as much as 180,000 metric tons of additional ethylene capacity.

In Alberta, Nova's facilities in Joffre were down because a tornado, not expected that far north, hit a supplier's ethane extraction plant.

The Alberta outage cost the company $24 million. The company says the delay related to the problematic maintenance turnaround could cost up to $70 million.

Canadian chemical producers are optimistic about 2006. CCPA forecasts that volumes in 2006 will increase by 5%, whereas prices are expected to increase by 6%, driving up sales by 12%. Operating profits are forecast to surge by 33%. "Everything seems to be looking pretty rosy for 2006, except for capital expenditures, and that is down because we don't have any new projects," Shearing says.

Nova's Mirosh says his company has been preparing for an excellent year in 2006. "We are really seeing 2006 and 2007 being the years that we should be looking forward to. This is why we scheduled a lot of our turnarounds for 2005," he says.

Imperial's Griffiths is also confident. "I'm looking for another strong year-there will be some recovery in volumes. I think the margins will be fairly robust," he says.

The Canadian industry faces the same long-term problems that the U.S. chemical industry faces: high raw-material costs undermining competitiveness, leading to little prospect for major new investments. "Natural gas prices in North America are the highest in the world," CCPA's Shearing says.

In remarks earlier this year at the Canadian Energy Research Institute (CERI) petrochemical conference in Kananaskis, Alberta, Ramesh Ramachandran, president of Dow Canada, said chemical companies are looking elsewhere to invest. "The risks of investing in petrochemical plants here in Canada are much higher than they were 30 years ago," he said. "There are currently 120 chemical plants in the billion-dollar-plus range under construction around the world. Only one of them is in North America."

And since Ramachandran's remarks in June, the one project he referred to, a new ethylene cracker in Mexico, has been shelved in favor of a project likely to cost less than $1 billion (see page 18).

There may eventually be potential for new investment in Alberta, Mirosh says. "Right now, when we look forward to investments and new expansions, the place we will be looking to is Alberta," he says. "We see increased opportunities for competitive feedstocks here."

The conventional thinking for expansion in Alberta is that a major new ethylene and derivatives project, like the one Nova and Union Carbide completed in 2000, would have to wait for new ethane feedstock to come from the north: the Mackenzie Delta in Canada's Northwest Territories or Alaska. But there are potentially other sources of ethane in the province, Mirosh says.

One source is the off-gas from the tar sands in northern Alberta being developed as a source of liquid fuels. The source, Mirosh says, could provide 80,000 barrels per day of ethane and ethylene. The gas is currently being burned as fuel and would need to be replaced by another fuel, such as gas from the north or coal-bed methane.

Mirosh says an additional 20,000 to 25,000 bbl of ethane per day could be obtained by extracting deeper cuts of ethane from existing streams of natural gas. Also, by extracting the ethane from the Alliance Pipeline that runs from Alberta to Chicago, another 45,000 bbl per day could become available. And another source in Alberta is depleted oil wells from which ethane could be pumped. The ethane was previously injected into the wells to further oil recovery.

"Any one of these can support an expansion," Mirosh says. And by 2012, a combination of these sources might be able to support a new world-scale ethylene cracker with about 3 billion lb per year of capacity.

The potential may be there, Griffiths agrees, but he is skeptical that such a project would be attractive when some large companies have other places to invest in, particularly the Middle East. "You could cobble together enough molecules to come up with a world-scale plant," he says. "Whether it will ever become an economic reality is another question."

Producers say they would like to see an energy policy in Alberta that encourages, for example, upgrading ethane to ethylene in Alberta rather than exporting it as fuel to the U.S. Some producers are happy that the government of Alberta views the petrochemical industry as a vital part of an integrated energy development approach. "We're constantly encouraging the Alberta government to move on these issues, and we believe they're listening to us," Ramachandran said at CERI.

A change in policy can help chemical investment. A 10-year tax holiday and incentives on capital expansions announced earlier this year by Saskatchewan's government led to more than 5.5 billion lb of new potash capacity from major fertilizer makers Potash Corp. of Saskatchewan, Agrium, and Mosaic. These companies are exploring other expansion opportunities as well.

MORE ON THIS STORY

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter