Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Middle East Continues To Produce

New projects in the Middle East will expand supply of value-added products

by Alexander H. Tullo

January 12, 2012

| A version of this story appeared in

Volume 90, Issue 2

The Middle Eastern petrochemical indus- try is growing up. It started in the 1980s as a way to convert the ethane by-product of oil production into exportable com- modities such as ethylene glycol and polyethylene. Today, local com- panies want to do more than make simple chemicals and are spending billions of dollars to diversify into more specialized chemistry.

COVER STORY

MIDDLE EAST Chemical producers aim to maximize value from resources

A spate of recently completed plants shows the trend. Saudi Kayan Petrochemical, an affiliate of Saudi Basic Industries Corp. (SABIC), opened Saudi Arabia’s first polycarbonate plant in 2011. A few months earlier, Borouge, a joint venture between Borealis and Abu Dhabi National Oil, started up a polypropylene unit in the United Arab Emirates that derives its propylene feedstock from ethane in a route that uses olefin metathesis.

Recent announcements are focused even more intensely on value-added products. SABIC and ExxonMobil are moving forward with plans to build plants for butyl, butadiene, styrene-butadiene, and ethylene-propylene-diene rubber in Saudi Arabia.

Sadara Chemical, a $20 billion joint venture between Dow Chemical and Saudi Aramco planned for Saudi Arabia, will produce sophisticated chemicals such as polyurethane raw materials and amines. It will also host an industrial park where Dow will make reverse-osmosis membranes and other high-tech products.

At last month’s Gulf Petrochemicals & Chemicals Association forum in Dubai, SABIC CEO Mohamed H. Al-Mady stressed the need for the technology push. “Comparative advantage is not static but is dynamic, and industries must maintain continuous improvement,” he said.

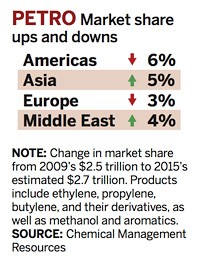

Leslie McCune, managing director of the Middle East-focused consulting group Chemical Management Resources Ltd., offers several reasons why officials see value-added chemicals as imperative. “It is an attempt to capture value that is currently being added elsewhere in the world, principally in China and Asia,” he says.

Moreover, ethane feedstock isn’t quite as abundant for new projects as it once was, and producers now are increasingly resorting to other feedstocks, such as naphtha. Saudi officials are looking to lower unemployment among the kingdom’s young population, McCune adds.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter