Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Drug Development

The Future Is Now

This year saw the shaky rollout of a revamped, post-patent-cliff pharmaceutical industry that may need time to gain traction

by Rick Mullin

December 9, 2013

| A version of this story appeared in

Volume 91, Issue 49

Talk of transformation in the drug industry is getting old. Big changes have been in the works for years, a majority of them undertaken to prepare for the loss of patent exclusivity on blockbuster drugs that major pharmaceutical companies can no longer reliably replace with newly minted billion-dollar sellers.

In particular, the changes girded the industry for 2012, the year of the so-called patent cliff, when a large number of top-selling drugs lost exclusivity. This year, industry watchers agree, the Rubicon has been crossed. The period of significant transformation has ended, and the dreaded cliff is in the rearview mirror. The remade industry is coming into focus.

As the year closes, the U.S. health care system may be an apt metaphor for the sector’s post-patent-cliff performance. Just as the Affordable Care Act’s debut fell disastrously flat, the pharmaceutical industry seems to have flopped in 2013. Any hope that the painful downsizing and strategy overhauls at major drug companies would launch the sector into a brighter era was dashed by slow market growth, a downturn in drug approvals, poor flow from the new drug pipeline, and the announcement of yet another round of job cuts by a major drug firm, Merck & Co., late in the year.

A cynical observer might not be surprised at the downturn in key indicators this year, arguing that drug companies were simply set up for failure after 2012. But many industry watchers are interested in the long game, pointing to current and coming changes in the regulatory and reimbursement landscapes that will chart new paths for growth in pharmaceuticals.

There is no denying that the numbers for 2013 look dismal. Global drug sales will grow a mere 1.3%, to $854 billion, compared with 3.5% growth last year, according to IMS Institute for Healthcare Informatics.

“That’s extremely low on a global basis,” says Michael Kleinrock, director of research development at IMS. “The five-year consolidated annual growth rate up to the present totals about 4.5%.” North American drug sales are on course to repeat last year’s performance of shrinking by 1%, Kleinrock says. However, the U.S. market may resume positive growth into 2014 on the strength of protected brands as the threat of patent expiries recedes, he notes.

As of Dec. 3, the Food & Drug Administration has approved 25 drugs this year, compared with 39 for all of 2012. The number of projects in drugmakers’ pipelines also dipped after a spike in 2012, according to IMS.

New drugs are still entering the pipeline. However, many are coming from smaller companies and biopharmaceutical makers. Some of the largest and most significant mergers and acquisitions (M&A) also involved small firms and biotechs, while big pharma stayed on the deal-making sidelines in 2013.

Some observers point to the shift in M&A away from big pharma as an indication of a general evolution in the pharmaceuticals power base. Innovation from smaller companies, they say, is reflected in the emergence of significant new drugs to treat intractable and rare diseases.

Meanwhile, risk and payment criteria have transformed health care systems in ways that are directly impacting research. Drug companies accustomed to being rewarded by the market for any and all scientific innovations are now challenged to prove the health benefits of new medicines and provide evidence that they will lower the cost of care. A scientific breakthrough means little, now, unless the firm bringing it forward can prove advantages over other drugs on the market, including low-cost generic alternatives.

“This repositioning in the way the industry is spreading risk and thinking about its financial return is a key element of a world going forward in which innovation is under question,” Kleinrock says. “Evidence is the new black, as it were.”

Drug companies are adjusting their pipelines and their research organizations in accordance, with many firms pursuing science through partnership or acquiring drug candidates discovered elsewhere. “The pipelines work differently now,” Kleinrock says. “Companies are having to think very carefully about their business, whether they want to carry direct risk on R&D investment or whether they want to share that risk with partners.”

The life sciences leader at the consulting firm Ernst & Young, Glen Giovannetti, agrees that drug firms are adjusting research in light of regulatory and market changes. “Pipelines are shifting to drugs with a better chance of being differentiated or addressing a clear unmet need,” he says. Companies are no longer likely to spend time developing the next new statin drug in a market where “payers are looking for ‘good enough’ and are certainly looking to generics in the first instance.”

Karla Anderson, pharmaceuticals and life sciences principal at PricewaterhouseCoopers, acknowledges that real change is under way in the health care world. But she also sees hesitancy on the part of large firms to respond robustly to these changes.

“The market is not changing in a smooth fashion,” Anderson says. “There is movement toward starting to change models but also a cautiousness.” But regardless of whether firms are ready or not, she says, the fast-evolving environment for both business and research will force a response.

The Year In Pharmaceuticals

The big firms are not moving in lockstep, analysts point out. Not all of the major companies are pursuing research in the same way, for example, and some were still getting their labs in order in 2013. In January, AstraZeneca announced the ouster of its head of R&D, Martin Mackay, who came to the firm only three years earlier from Pfizer. The company cited a weak research pipeline and big hits from patent expirations.

Then in March, Merck announced that it was replacing its head of research, Peter S. Kim, with Roger M. Perlmutter, late of Amgen and a onetime research executive at Merck. Perlmutter promptly dismissed the company’s therapeutic area research heads. Instead, the company set up a network of cross-area managers. The move was described by one commentator on a prominent pharma blog as a management-level bloodbath.

Staff cuts elsewhere followed over the summer, with AstraZeneca announcing another layoff round and Sanofi cutting research, both in June. In July, Bristol-Myers Squibb replaced Elliott Sigal as chief scientific officer with Francis Cuss.

Eli Lilly & Co., on the other hand, has so far maintained its investment in research. In an interview with C&EN in February, Chief Executive Officer John C. Lechleiter said the company will stay the course despite the loss of patent exclusivity for Zyprexa, a schizophrenia drug; the imminent loss of patent protection for the antidepressant Cymbalta; and a series of failures in Phase III clinical trials.

“The challenge that we face, the biggest challenge of our company in its 137-year history, has forced us to come to terms with who we are, what we do best, and how we’re going to write our future,” Lechleiter said. He dismissed the cutbacks encouraged by Wall Street as quick fixes.

Pfizer was also thinking about its “innovation core” when CEO Ian C. Read announced that the company would start 2014 with three new divisions, separating its patented drugs; vaccine, oncology, and consumer health care products; and mature and off-patent products into their own business units. Meanwhile, Abbott Laboratories launched its research-based pharmaceutical business, formed in a 2012 corporate split, as AbbVie this year.

The major drug firms shied away from mergers in 2013, according to figures from Ernst & Young. Whereas big pharma deals accounted for 70% of the total value of M&A in 2011, two years later deals by the top companies are on track for only a 12% stake. Although the total value of M&A this year is expected to be one-third less than the 2011 value, deals involving specialty pharma and generics companies, small players two years ago, each account for about one-third of the action so far in 2013.

IMS’s Kleinrock dispels the notion that 2013 has been an off year in M&A as a whole. Big pharma deals, he says, often cluster in a kind of herding event. “Sometimes it’s like the county fair in big pharma: We all do mergers now.” It’s been an off year for those companies, but not so for biotech firms.

“I don’t call Amgen buying Onyx a slowdown,” he says. “It reflects the fact that over five years the big companies have put portfolios and strategies in place. Now they are polishing the edges and sliding in little things.”

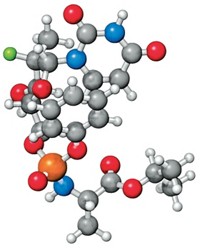

Amgen’s acquisition of Onyx Pharmaceuticals, valued at $10.4 billion, was certainly not small. Nor is Amgen a small biotech company. The deal is interesting in that it gives Amgen a pipeline of small-molecule drugs, particularly kinase and proteasome inhibitors for cancer, at a time when its biologics face potential competition from biosimilars.

Meanwhile, the $4.2 billion acquisition of ViroPharma last month by the Irish drugmaker Shire is significant not only for the high price but for the reason the deal came in at that price. ViroPharma is a rare disease specialist whose marketed drug Cinryze, a treatment for a potentially life-threatening hereditary skin disorder, is one of the most expensive drugs on the market, with an annual price tag approaching $400,000.

Ireland also figures in one of the more dramatic M&A sagas of 2013: Perrigo’s $8.6 billion acquisition of Elan. Dublin-based Elan, which in recent years divested its entire portfolio and pipeline, maintaining only royalty rights, had been pursued all year by Royalty Pharma, a firm built on acquiring drug royalties. Although Royalty’s $7.3 billion offer would have led to a novel deal, Perrigo prevailed with a more traditional strategy of buying Elan and moving itself to tax-friendly Ireland.

Rather than M&A, the major drug companies focused on partnerships in 2013, including ones with each other. Merck and Pfizer, for example, announced a research venture in diabetes in April. Pfizer also entered a collaboration with CytomX Therapeutics to develop antibody-drug conjugates (ADCs), therapies attaching cytotoxins or other drug payloads to antibodies with an affinity for tumor sites or other targets.

To date, regulators have approved two ADCs: Seattle Genetics’ Adcetris for lymphoma and Roche’s Kadcyla for breast cancer, introduced in 2011 and 2012, respectively. Technologies to improve the accuracy of ADC drug delivery are advancing, as are partnerships for those technologies. Celgene, for example, entered a collaboration last December with Sutro Biopharma, a biotech company in California working on a cell-free approach to making ADCs.

Other interesting partnerships announced this year include Astellas Pharma’s agreement to develop a drug for nocturia, a sleep disorder, with Drais Pharmaceuticals. Astellas will license the compound to Tacurion Pharma, a virtual company operated by Drais. The collaboration is Astellas’s third with virtual firms established by Drais.

Emerging economies are another place major drug companies turned for growth in 2013. Asia and Latin America are each on track for drug industry expansion in excess of 13% this year, according to IMS. China and India, long the locus of low-cost manufacturing, are developing robust contract research sectors as well.

But the dynamics in these countries are shifting, as evidenced in some of the news in 2013. A heightened effort to bring China’s manufacturing infrastructure up to Western quality standards is cutting into the cost advantage of outsourcing, IMS’s Kleinrock observes.

Ernst & Young’s Giovannetti also sees elements of drag in fast-growth regions this year associated with the introduction of higher standards of science and safety. “Companies are seeing not as rapid growth as they had seen a few years ago,” he says. “There is a significant cost associated with operating safely in those markets.”

China announced it will invest $7 billion over the next five years in academic research projects that might yield new drugs. “China is about to become the world’s second-largest health care market because of rising affluence and longer life expectancy,” Xiaodong Wang, director of the National Institute of Biological Sciences in Beijing, told C&EN in March. “Drugs need to be developed here.”

In an effort to boost confidence in the safety of drugs coming from China, the country elevated its Food & Drug Administration to the ministry level. It had operated as a division of the Ministry of Health.

But confidence was shaken in June when a major Western drugmaker, GlaxoSmithKline, announced the firing of the manager of its Shanghai research center for misrepresenting data in a paper published in Nature Medicine. And the news from GSK in China only got worse. In June, it emerged that the firm’s sales and marketing divisions in the country were under investigation for bribing doctors to prescribe GSK medicines.

Some industry watchers point to the prosecution of GSK as an example of China arbitrarily targeting a Western firm in the guise of executing an anticorruption campaign. Others are skeptical of this view, however, given that domestic firms have also come under investigation.

“The bigger point is that if you are a multinational company, you have to be in China,” Giovannetti says. “So far, the growth there is better than it would be in the West, but not as high as companies would have expected. And it’s coming at a higher level of cost to operate safely and within the developing compliance regimes being put in place.”

The cost of not being in compliance was all too clear this year to India’s Ranbaxy Laboratories, which agreed to pay $500 million to the U.S. Department of Justice to settle criminal and civil claims that it knowingly manufactured substandard drugs. FDA banned imports of all pharmaceuticals made by a Ranbaxy facility in Mohali, India, where the company had recently initiated a new quality system.

Industry watchers agree that the drug industry’s performance this year must be judged in the context of an overall shift in the regulatory climate toward value-based health care. This shift is already reflected in the drug approval and reimbursement process as regulators and insurance companies redirect their focus from medical procedures to health care outcomes—from the cost of treatment to the value delivered by therapy regimens.

Heightened price constraints, greater patient involvement in health care decision making, and the influx of nontraditional health care technologies impacted drugmakers in 2013. And the force behind much of the change is the massive deluge of data.

The main front in data, however, continues to be “big data” in the laboratory. Information technology firms responded in 2013 with a new generation of electronic lab notebooks and other software for collecting, storing, and analyzing data in drug discovery and development. Drug firms are seeking statistical analysis skills in the lab. Some even claim that research positions once filled by scientists who are taught statistics on the job are now filled with mathematicians who learn the science in the lab.

Employment in the lab continues to be a touchy subject. Merck’s announcement in October that it would eliminate 8,500 positions made clear that the passing of the patent cliff didn’t mean the end of job cuts. This was reinforced by Forest Laboratories’ announcement this month that it will also make cuts to R&D. Lilly also said it will likely have to make unspecified spending cuts going into 2014. Lilly, which has made steep cuts in its sales force in recent years, has not indicated how further cuts will affect its research budget, and the company continues to dismiss calls from analysts to pursue the next big pharma megamerger.

Such a deal would be coming rather late in the game. “In the mid-2000s, most pharma companies had a strategic rethinking phase,” Kleinrock says. “We are not in that phase anymore.” Most companies have presented new business plans, and investors are comfortable with them, he says. “So now you are not going to see as much wholesale rejigging.”

Advertisement

So if the big changes have been made, the question is whether the drug industry will start posting real improvements. Again, the Affordable Care Act may be a useful analogy. Was the health care initiative’s poor performance in the first weeks of enrollment largely an information technology glitch, or does the system house fundamental flaws that a quick technical tune-up can’t fix?

CNN released a poll just before Thanksgiving indicating that 54% of the American public is optimistic that the problems will be solved—that the plan is fundamentally sound. It will just take longer than expected for it to generate the desired benefits. Drug company managers are hoping that their industry will follow a similar path.

To download a PDF of this article, including the time line, visit http://cenm.ag/pharma2013.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter