Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Syngenta Rejects Bid By Monsanto

Agriculture: $45 billion deemed not enough to create world’s largest seeds and pesticides producer

by Alex Scott

May 14, 2015

| A version of this story appeared in

Volume 93, Issue 20

Syngenta, the world’s largest producer of agricultural chemicals, has rejected a $45 billion unsolicited takeover offer from Monsanto, the world’s largest seeds firm.

Monsanto offered 449.00 Swiss francs per Syngenta share, a roughly 33% premium to the Swiss firm’s share price in early May. Syngenta rejected the bid on May 8, calling it too low.

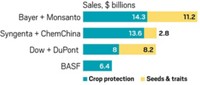

Both firms have a little more than $15 billion in annual sales. But about two-thirds of Monsanto’s sales are from seeds and the remainder from pesticides, whereas three-quarters of Syngenta’s sales are from pesticides and the rest mostly from seeds.

Although Monsanto had not disclosed as of late last week whether it would increase its offer, stock analysts from the investment firm Piper Jaffray calculate that even an offer as high as $50 billion would make sense for the firm. The acquisition would allow it to cut combined operating costs by up to $2 billion per year, they say. Monsanto could save an additional $500 million annually in taxes if it relocated to Switzerland.

Analysts at the investment firm Jefferies peg the chance of a deal at greater than 60%. “A merger would create a step-change in competitive position and create, if not the ‘Google of ag,’ at least the ‘Ecolab of ag productivity,’ ” Jefferies stated, referring to the big water, energy, and hygiene services firm.

For its part, Monsanto says the combined firm would accelerate the introduction of innovative solutions for growers and help increase the world’s food supply in a sustainable fashion.

But Syngenta argues that Monsanto hasn’t fully taken into account its rapid sales growth in 2015 so far or its “strong pipeline” of pesticides.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter