Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Ethane supplier to the world

Chemical makers on three continents are set to tap into cheap feedstock from the U.S.

by Alexander H. Tullo

November 7, 2016

| A version of this story appeared in

Volume 94, Issue 44

In 2016, chemical companies built navies.

Where are they? You can track the ethane carriers Ineos Intrepid and Navigator Aurora—orany other vessel in the world that has its transponder on—at marinetraffic.com.

European chemical makers Ineos and Borealis have already christened ships that will carry ethane from the U.S. to their ethylene crackers in Europe. India’s Reliance Industries is taking delivery on a fleet of six so-called very large ethane carriers, which will be the biggest ships of their kind in the world, each with nearly 90,000 m3 of storage capacity.

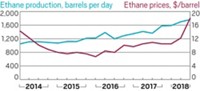

The shale revolution has driven down U.S. natural gas prices. Today, on an energy content basis, natural gas is only one-third the price of oil. And a lot more ethane is being produced than the current stable of U.S. ethylene crackers can consume. Most of the excess is being left in natural gas and burned as fuel.

The U.S. chemical industry has about a dozen ethylene projects in the works to gobble up a good chunk of the excess ethane. Foreign chemical makers want the rest.

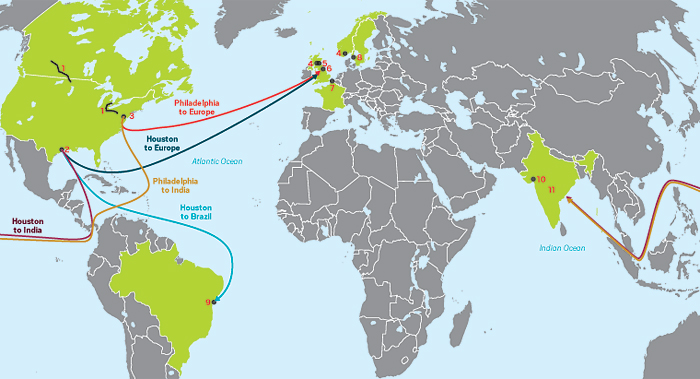

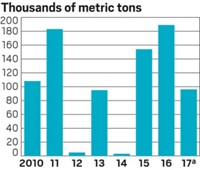

Keefer Douglas, director of natural gas liquids research at IHS Markit, says U.S. crackers currently consume 21 million metric tons of ethane per year. By 2022, that number is projected to be 37 million metric tons. Another 8 million metric tons will be exported, much of it along the shipping routes and pipelines shown here.

By then, the market will be balanced. “Given our outlook for U.S. oil and gas production, there’s enough ethane to meet the current slate of planned crackers plus the current slate of export contracts, but not much beyond that,” Douglas says.

PIPELINE EXPORTS TO CANADA

1: Joffre, Alberta; and Sarnia, Ontario

Nova Chemicals has been importing ethane from the U.S. for three years. The Vantage pipeline has the capacity to bring up more than 900,000 metric tons per year from North Dakota to a Nova facility in Alberta. Sunoco Logistics’ Mariner West pipeline will eventually deliver about 300,000 metric tons of Marcellus Shale ethane from Pennsylvania to Ontario.

EXPORT TERMINALS

2: Morgan’s Point, Texas, near Houston

Enterprise Products Partners said bon voyage in September to the first ship leaving its new export terminal for customer Ineos. The Houston Ship Channel facility has the capacity to load 11,000 metric tons of ethane per day.

3: Marcus Hook, Pa., near Philadelphia

Sunoco Logistics’ terminal near Philadelphia made its first delivery in March. It has the capacity to load about 2,000 metric tons per day of ethane originating from shale gas in western Pennsylvania.

ETHANE IMPORTERS

4: Grangemouth, Scotland; and Rafnes, Norway

Ineos’s ambitious plan is to import about 800,000 metric tons per year of ethane from Houston and Philadelphia for two of its European crackers. The company has already taken delivery on four of eight 180-meter-long Dragon-class carriers. Together, they will form what the firm calls a virtual pipeline across the Atlantic, making eight deliveries per month by 2020.

5: Mossmorran, Scotland

ExxonMobil has agreed to purchase imported ethane from Ineos for use at the Fife Ethylene Plant it shares with Shell. Deliveries are set to commence next year.

6: Teesside, England

Saudi Basic Industries Corp. (SABIC) will soon begin receiving deliveries of U.S. ethane at its English cracker, which has been upgraded to accept the new feedstock. The shipments will reportedly originate from Enterprise in Texas.

7: Dunkirk, France

Versalis began work to allow its French ethylene cracker to consume U.S. ethane. However, citing low oil prices, the company has put the program on hold.

8: Stenungsund, Sweden

Borealis has chartered the Navigator Aurora, a 180-meter ethane carrier built at the Jiangnan Shipyard in Shanghai. The European chemical maker plans on receiving 240,000 metric tons of ethane annually from the Philadelphia terminal.

9: Camaçari, Brazil

Braskem is spending $120 million to convert some of the feedstock of its largest Brazilian cracker from naphtha to ethane. Enterprise, in Houston, will supply roughly 200,000 metric tons of ethane annually starting next year.

10: Dahej, India

Reliance Industries may have the most ambitious ethane plan. It intends to import, beginning later this year, 1.5 million metric tons annually from the U.S. for consumption at three ethylene crackers near its Dahej terminal.

11: India

Gail and Hindustan Petroleum plan to build an ethylene cracker in India that will consume 1.3 million metric tons per year of U.S. ethane. Gail solicited ethane contracts earlier this year.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter