Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

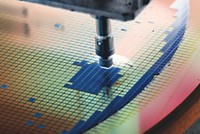

EFC to invest $210 million in semiconductor chemicals

Texas project is another tied to a government-backed chipmaking boom

by Craig Bettenhausen

August 8, 2024

EFC Gases and Advanced Materials is the latest company to invest in production of chemicals for the US semiconductor industry. The Massachusetts-based firm has secured 79 hectares of land in McGregor, Texas, where it will build a $210 million plant for specialty gases and chemicals needed to make computer chips.

Construction will start in early 2025. When completed, the facility will create about 120 permanent jobs, the firm says.

It’s a big move in scale and scope for EFC, which is now mainly a distributor and processor of chemicals made by third parties. “A large amount of our products now we buy in a crude format and purify,” says Robert Keller, the firm’s director of strategic marketing and global partnerships. “The Texas plant is definitely our first inroad into synthesis.”

Mark Thirsk, a partner at the electronic chemical research firm Linx Consulting, says the North American market for semiconductor fabrication gases is worth about $350 million this year and will grow to $570 million by 2028. EFC is privately held and does not disclose sales numbers, but Thirsk estimates the firm controls about 10% of the market.

The Texas plant is a huge investment for a firm the size of EFC, Thirsk says, but a smart one. “They have recognition with significant semiconductor customers in the US,” he says. “I think they are on track to become a major player in the electronic gases space.”

The plant in McGregor will synthesize fluorochemicals used in semiconductor etching and deposition chamber cleaning, Keller says. It will fill cylinders with rare gases including krypton, xenon, and neon, all of which are used to fabricate computer chips. EFC is also expanding its offering of wet chemicals used in the semiconductor supply chain, he says.

McGregor is about 1½ h north of Austin, Texas, an area that is expecting a $45 billion chip-making investment from Samsung. Chip firms such as Micron Technology and Texas Instruments also have facilities in the region. Keller says the site has its own rail spur and is near truck shipping routes, so the plant will be able to supply developing semiconductor hubs in Arizona, Ohio, and Indiana.

The $210 million is coming from private capital and conventional borrowing, Keller says. EFC is also optimistic about getting federal funding through the 2022 Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, which authorized $280 billion in US government support for domestic semiconductor capacity.

The US Department of Commerce announced on Aug. 6 that it will give $450 million in CHIPS money to the memory chip maker SK Hynix for an expansion in West Lafayette, Indiana. In signing a CHIPS deal, SK Hynix joins Intel, Micron, Samsung, and Taiwan Semiconductor Manufacturing, a group that the Biden administration says includes the only companies capable of producing leading-edge chips at scale.

The act has also supported suppliers of materials like EFC. In May, the Department of Commerce committed $75 million in CHIPS funds to the materials firm Absolics for a plant in Georgia that will make glass substrates for chips. And in June, the specialty chemical maker Entegris secured $75 million in funds for a plant in Colorado Springs. Chemical companies such as Merck KGaA and Sunlit Chemical are also investing in US facilities, even without CHIPS funds.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter