Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Outsourcing

A U.K. option for a controlled substance

TPI Enterprises, an Australian poppy processor, enters the restrictive British codeine market via a contract with Sterling Pharma Solutions

by Rick Mullin

June 24, 2018

| A version of this story appeared in

Volume 96, Issue 26

Having developed a low-cost extraction and purification process for poppy-based drug raw materials, Australia’s TPI Enterprises pushed into the bulk controlled-substance market last year with the purchase of the narcotic pharmaceutical business of Vistin Pharma in Norway. The move, managing director Jarrod Ritchie said at the time, would advance the firm toward its goal of becoming “a fully integrated opiate pharmaceuticals business of global scale.”

COVER STORY

A U.K. option for a controlled substance

One European country cannot be served effectively from a plant in Norway, however. The U.K., one of the world’s largest codeine markets, has some of the most restrictive laws governing the import of narcotics, allowing only a short list of codeine-based products to cross the border. But TPI already had a plan in place for manufacturing and selling bulk opioids inside the U.K.

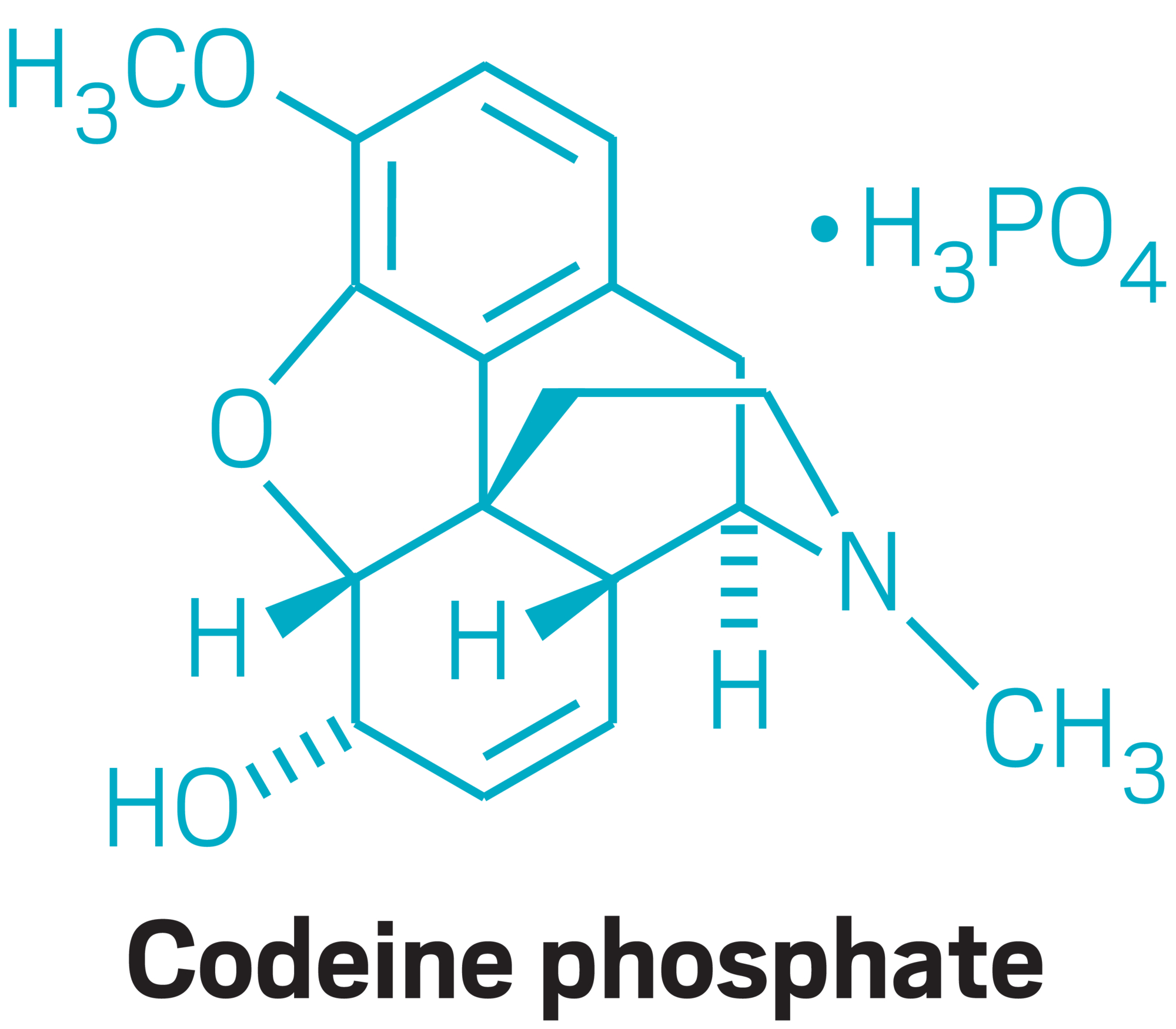

Sterling Pharma Solutions, a Cramlington, England-based manufacturer of active pharmaceutical ingredients (APIs), has begun producing registration batches of codeine phosphate for TPI. Under an agreement signed in 2016, TPI ships raw material to Sterling for the production of APIs that TPI, in turn, will sell to U.K. generic drug makers. Sterling is on track to begin producing at commercial scale by the end of the year.

The deal will set TPI up as solid competition for Johnson Matthey’s Macfarlan Smith division, which currently dominates the U.K. market for controlled-substance APIs. It will also significantly boost Sterling’s controlled-substance contract manufacturing business, which now accounts for less than 10% of revenues but is a fast-growing part of the firm, according to Andrew Henderson, marketing director.

TPI is one of three licensed poppy processors in Australia and one of eight worldwide to legally produce narcotic raw materials. TPI is now pushing into API manufacturing after a breakthrough in poppy processing that eliminates the use of highly volatile solvents. The company was started in 2004 by Ritchie, a chemist who headed R&D for GlaxoSmithKline’s poppy processing venture in Tasmania. In order to avoid infringing on GSK’s patented know-how, TPI developed a water-based process for extracting potent alkaloids from poppy plant matter.

Water-based processing, combined with a harvesting technology that culls the poppy head without stems, leaves, and other parts of the flower, results in a steep decrease in processing costs that TPI hopes to convert into a price advantage and profitable margin, according to Richard Scullion, TPI’s commercial director.

Codeine phosphate

U.K. market: $30 million to $40 million

Volume consumed in the U.K.: 60 metric tons per year

TPI’s supply target: More than 50% of the market

TPI’s main U.K. competitor: Macfarlan Smith

That scheme accelerated when the factory in Norway became available. TPI had initially planned to set up API manufacture at a warehouse it acquired in 2015 in Portugal, where it would have had to build and license a plant from scratch. The Vistin plant, on the other hand, was already manufacturing codeine phosphate. TPI acquired it and sold the warehouse in Portugal.

As for the U.K., TPI had two options, according to Scullion: Sell final dosage forms of allowable drugs—tablets for the most part—or make the API in the U.K. and sell it to formulators.

“Some tablets can be imported,” Scullion says. “Generally, the most common forms of codeine distributed to pharmacies and retailers in the U.K. market contain 8 mg and 30 mg. Those are all right to import.” But TPI wanted to be able to cover a broader range of the narcotics market—drugs based on not only codeine but also morphine, oripavine, and thebaine. The Sterling contract will eventually cover that range.

Selling raw material to an established API maker in the U.K. was out of the question, Scullion says. “If you manufacture codeine phosphate, 80% of the cost is narcotic raw material,” he says. The contract manufacturing arrangement with Sterling allows TPI to unlock the value of its lower cost of making that raw material. “If we supply it to somebody else to make API, then we are just giving away margin.”

Henderson says Sterling has been working in controlled substances for almost five years—both processing plant extracts and synthesizing compounds—and that it has the assets in place to produce commercial-scale APIs for TPI. Doing so required licenses for both firms from the Home Office, the U.K. government branch that performs functions similar to the U.S. Drug Enforcement Administration in regard to controlled substances.

While Sterling may eventually export APIs to TPI, the plan currently is to work within the border, according to Henderson. Once API manufacture is complete, he says, TPI will transmit orders to Sterling for shipping to generic drug makers. “We provide storage and shipping service, in effect,” he says.

Advertisement

Scullion, who worked as financial director at Macfarlan Smith before joining TPI in 2013, says his team selected Sterling largely on the basis of its well-established and licensed manufacturing assets. Sterling is a former Sterling Drug facility that went through a few owners before becoming a stand-alone firm in 2016.

TPI’s launch of API production in Europe is occurring in the wake of changes in the global controlled-substance business, spurred by the opioid abuse problem in the U.S., currently the controlled-substance market with the strictest import controls.

Industry consultant James Bruno says the contract manufacturing approach used by TPI is a popular option in closed markets like the U.K. and U.S. “I worked with a U.S.-based company as well as one in Europe which used this approach to circumvent the import restrictions,” he says, noting that the European market seems primed for growth.

“The controlled-substance market in Europe is not as well defined and big as in the U.S.,” Bruno says. “However, some people think that it’s underutilized and that palliative care will spur growth, even with all the controversies.”

TPI is currently concentrating on Europe and markets other than the U.S. “The principal reason,” Scullion says, “is that we have focused our energies on morphine-based products, for which the U.S. market is very restrictive.” He adds that the company is now “at a point in our evolution where we will increase attention given to the U.S. market and to developing sales of products other than morphine.”

TPI has had opportunities to sign U.S. manufacturing contracts similar to the arrangement with Sterling, Scullion adds. “Although we have not taken them, we would not rule out a move to do so in the future.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter