Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Specialty Chemicals

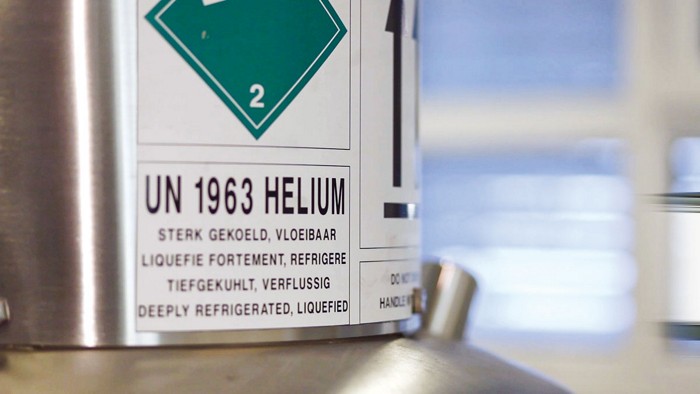

Podcast: How helium shortages have changed science

Stereo Chemistry looks at how chemists are adapting to a wobbly helium market

by Craig Bettenhausen

October 21, 2020

Helium shortage 3.0 is winding down. But 2021 is likely to bring more changes to the global market for this critical, nonrenewable gas. And even if there isn’t another crunch, scientists who use helium are tired of unstable supply of a material they need to keep their instruments running. This episode of Stereo Chemistry will look at what’s behind the wobbly helium market and what scientists and instrument makers are doing to lift the heavy burden of helium use.

Find all C&EN’s COVID-19 coverage at cenm.ag/coronavirus.

Make a donation to support C&EN’s nonprofit science journalism at cenm.ag/donate.

Subscribe to Stereo Chemistry now on Apple Podcasts, Google Podcasts, or Spotify.

The following is the script for the podcast. We have edited the interviews within for length and clarity.

Kerri Jansen: In the summer of 2012, scientists at the University of Maryland Institute for Bioscience and Biotechnology Research were facing a big problem. They rely on regular deliveries of liquid helium to cool their nuclear magnetic resonance instruments. These NMRs can reveal all kinds of useful structural information about a wide range of molecules, but they have to stay very cold in order to keep the instruments’ delicate superconducting magnets operating. But the university’s helium supplier was only able to deliver about half of what they needed to refill one of their magnets. And during the transfer, gaseous helium in the supply tank caused a rapid boil-off of remaining liquid helium in the magnet. Without adequate cooling, the 600 MHz magnet began to drift—lose its magnetic field strength—threatening to upend operations and cause permanent damage to the $700,000 magnet, known as a quench.

Robert Brinson, a NIST [National Institute of Science and Technology] research chemist at Maryland, remembers the experience.

Robert Brinson: So I just want to emphasize that this is not like running out of gas in your car where you can just kind of go get a gas can. This is literally, it is a very involved and expensive process requiring hundreds of liters of liquid helium in order to get the magnet back up. And that’s assuming that nothing broke internally.

Kerri: The scientists were ultimately able to restore the magnet’s function with help from its manufacturer, but escaping the quench was costly, and they were spooked by the close call. And the NIST scientists are not alone in this. In the last couple of decades, shortages in helium supplies have become a recurring nightmare for scientists who rely on the noble gas to keep their NMRs and other critical instruments running. In this episode of Stereo Chemistry, we’re going to look at how helium has become so scarce and how the wobbly helium market is driving permanent changes in science. I’m your host, Kerri Jansen.

To help me tell this story, I’d like to introduce you all to Craig Bettenhausen, who is C&EN’s reporter covering scientific instrumentation and industrial gases, including helium. Welcome to Stereo Chemistry, Craig.

Craig Bettenhausen: [takes a deep breath] Hi, Kerri. Really excited to be here.

Kerri: I see you’re really leaning into our helium theme! I’ve got a balloon here, too. Let’s give this a try. [takes a deep breath] So Craig, what can you tell us about helium shortages?

Craig: Well, like you said, helium shortages have been a concern on and off for a couple of decades now. We’re getting to the end of one right now that started in 2018, maybe the end of 2017. Before that, there were shortages in 2012–2013 and 2005–2007. Helium people are calling this one “helium shortage 3.0.” Each of these shortages has had its own instigating factors, but there are also a lot of underlying conditions that have contributed to overall market instability. And we’re going to discuss some of those factors in this episode. Some analysts think that shortage 3.0 might actually be the last one in the foreseeable future, and we’ll hear why they think that as well.

Kerri: And can you give us sort of an overview of why helium is important to the world and to chemistry? Who’s affected if there’s a shortage of it?

Craig: It’s actually a really important material. And balloons are a big thing. I mean, lifting accounts for about 15% of the global helium use—both party balloons, but also things like weather balloons and blimps. Another big chunk goes to manufacturing. It’s used a lot in welding and in other areas where you need to create an oxygen-free environment for something that you’re doing. But the real reason it’s important to a lot of chemists and scientists is because it’s a cryogenic fluid. And what that means is when you compress it down into a liquid, that liquid is very, very cold—around 4.2 K, which is around –269 °C. It’s the coldest we can get with a cryogenic fluid. The other choices, such as liquid nitrogen or liquid argon, are cold, but they’re not that cold. They’re at 77 K for liquid nitrogen and 83 K for liquid argon. So liquid helium is the coldest. And that’s especially important when it comes to superconducting materials.

Down near 4 K, superconductors can pass electric current with zero resistance, an effect that lets you create very strong electromagnets. That enables technologies like nuclear magnetic resonance, NMR, magnetic resonance imaging, MRI, along with cryostats, quantum computing, and other sorts of scientific endeavors. That magnet is sitting in a bath of liquid helium, and it needs to stay cold or you can have a real crisis on your hands for the instrument.

Kerri: And so how is it possible then that we wouldn’t have enough helium for these applications? Where does helium actually come from?

Craig: Helium is extracted from underground deposits. Helium-4—that’s the kind used in industrial and scientific instruments—comes from the decay of uranium and thorium. I spoke with John Kutsch of the Thorium Energy Alliance, and he had a colorful way of putting it.

John Kutsch: So all the helium is a gift from the decay of naturally occurring radioactive substances in the Earth’s nether regions.

Craig: John works on developing supply chains for thorium and other critical materials like helium. And as he told me, the thing that makes helium really tricky is that unlike just about every other material, once you vent helium—once your helium balloon pops—that helium goes up, up, up, it keeps going, it goes to space, it is gone. Like almost no other material on Earth it is gone. It’s really, really not coming back. And so it’s important to conserve it for that reason.

Kerri: But the helium supply has always been finite. Why the recent pressures?

Craig: Well, there are a few reasons. Over the last several years, helium extraction has taken a hit—there’s just less of it being pulled up out of the ground. John Raquet, editor-in-chief of the industry journal Gasworld, told me that commercial helium is extracted from natural gas wells, where it makes up a small portion of the gas. But the energy industry—especially in North America—has moved away from using conventional natural gas wells and toward fracking, which is used to extract gas and oil from shale formations.

John Raquet: You don’t find helium associated with shale gas. And as a result, they have been able to extract less and less helium because there’s less and less natural gas.

Craig: Another factor in the US is the shutdown of the Federal Helium Reserve, which is kind of a big pillow of helium that softens the blow of market disruptions. The US federal government built up a massive stock of helium starting during the Cold War and stored it in a giant geological formation near Amarillo, Texas, that as far as we know is unique in the world. It turns out, they didn’t end up needing all that helium. So in 1996, the government instructed the Bureau of Land Management, which oversees the Reserve, to sell off the helium, which they did at significantly cheaper than market prices, with some stops and starts along the way. Those auctions are all done now and the reserve is scheduled to mostly be shut down in 2021. John Kutsch says the flood of cheap helium really damaged private industry.

John Kutsch: And they made it worse by saying, “Immediately sell this off.” Well, they sold it off in a fire sale and what private industry there was got shredded.

Craig: In response, John says, Congress overhauled the program in 2013 and directed the BLM to raise prices dramatically in an attempt to stimulate the industry. He says that in the 1990s, you could get a cubic meter of helium for about $1.75. And now, the price is around $7 per cubic meter.

John Kutsch: And that’s where we find ourselves today, this whipsawing.

Craig: So the US has less helium being produced. It just finished a 24-year program of dumping a huge amount of helium onto the market at low prices, and it’s about to remove a central cog in its helium infrastructure. It’s a big disruption that’s causing a lot of uncertainty, instability, and most recently, an actual shortage where some people weren’t getting all the helium that they needed. And everyone is paying prices they do not like.

Kerri: So these factors that you’ve just described are affecting helium supplies in the US. What’s the state of the global helium market? The US isn’t the only global source of helium, right?

Craig: Right. So for some time, the US has been supplying about 30% of the global helium. But there are other sources. Algeria and Qatar are producing helium. They’re part of the existing supply chain. There’s also resources being developed in Tanzania, Canada, and Russia. But those supplies aren’t online yet.

So we’re coming from this regime where the global supply was really buffered by this US Federal Helium Reserve into a regime where there’ll be these different geopolitical powers that are controlling the helium supply. And that could lead to artificial shortages. For example, the most recent shortage was caused in part by a Saudi Arabian blockade of Qatar; Qatar is a major helium producer. So that makes people nervous.

Kerri: And when there’s a pinch on helium, globally, what does that look like besides maybe sad kids at birthday parties who can’t have balloons?

Craig: Yeah, I mean, you do lose the balloons. But that’s not as big of a deal, really. One thing that you see in the most recent shortage—which once again is from like 2018, to the beginning of this year—is it mostly took the form of price increases, and quotas or allocations, by which I mean people not getting as much helium as they would like. They didn’t have a free hand with their helium.

I spoke with Martha Morton, who manages a handful of helium-drinking instruments as director of research instrumentation in the chemistry department at the University of Nebraska–Lincoln. Here’s how she describes the experience.

Martha Morton: Most people were reporting spikes in prices and that they were receiving dewars that were 80% full. My vendor actually looks after me, and if I say I’m going to need helium in a week, they try to bend over backwards to get it to me. So in 2018 when all the shortage went through, they sent out an email saying, “We need 20 days lead time.” So I’ve gone to giving them 60–90 days lead time, because I have 4 NMR magnets and a Bruker FTMS. I go through about 1,700 L a year.

Craig: Most people were able to get the helium they needed. But it was stressful, it was uncertain. And it was expensive. And as we mentioned, helium shortages can threaten important equipment. The NIST folks barely dodged a quench. Sophia Hayes, a chemistry professor at the Washington University in St. Louis, says others have had to beg for helium from nearby institutions, and others still have lost instruments. And that’s not what you want to be doing with your time as a scientist, you want to be doing the experiments, not barely keeping your instruments alive.

Advertisement

The shortages have also caused instrument installations to be delayed, putting funded, long-planned investigations on hold. See, even if people could get their regular supply of helium to keep their existing instruments going, they couldn’t get this big delivery that they needed to cool the magnet down in the first place.

A really interesting effect was that these shortages, this instability, has led a lot of users to look critically at how they use their helium, often leading them to invest in technology that reduces their helium use or, in some cases, eliminates it entirely. Folks are sick of not being sure how they’re going to keep their million dollar and multimillion dollar instruments alive and how they’ll run their critical analyses.

Kerri: OK so we’ve gone over the causes and impacts of helium shortages. Let’s take a short break, and when we come back, we’ll look at how scientists are adapting to the disruptions.

Gina Vitale: Hey everyone, Gina Vitale here. I’m an assistant editor at C&EN.

The last 10 months have seen a flood of new information about the coronavirus responsible for COVID-19, and our understanding of the virus is constantly evolving. The C&EN team is working hard to keep you up to date on news related to the COVID-19 pandemic. And we’ve collected all of those stories in one place at cenm.ag/coronavirus. There, you’ll find our coverage of vaccine developments and the latest research on how the virus spreads, along with stories about the pandemic’s impact on the chemistry community.

Again, you can find those stories and more at cenm.ag/coronavirus. All of that coverage is available for free. If you’d like to support our nonprofit journalism with a donation, you can do so at cenm.ag/donate. We’ll post both those links in this episode’s description. And now, back to the show.

Kerri: So Craig, you were saying that many scientists are looking for ways to escape the uncertainty and anxiety around helium supplies.

Craig: Yeah, and we’ve seen a lot of labs using new equipment to help reduce their helium needs.

Kerri: Right, let’s talk about some of those technology innovations. Because in most cases, those weren’t temporary changes. Right?

Craig: Right. And a good example of that is what’s going on with gas chromatography. So in gas chromatography, which chemists use to separate the components of a mixture, you have an analyte of some sort being pushed through a column by a gas. And helium has been the dominant gas in that for a long time. That’s because the technology matured while helium was cheap and readily available. So a lot of these gas chromatography methods were developed based on using helium as the carrier gas. Now, however, helium is not all that cheap, it’s not all that reliable. It’s gotten to the point where things like hydrogen gas and argon are competitive on cost.

It’s raised some new questions for scientists about whether helium is actually the best gas for the job. Ed Connor from Peak Scientific, which makes nitrogen and hydrogen generators, told me he’s seen a surge of interest from labs looking to switch their GCs to hydrogen. Not only is hydrogen easier to come by, but Ed says labs may be able to get a performance boost as well. And he says that once customers switch over to hydrogen, there’s not much benefit to switching back.

These hydrogen generators, they cost between $5,000 and $20,000, depending on exactly what you need. And that’s not chump change. But if you can get out of a troubled supply chain, and potentially double your throughput, that can really be worth it.

Kerri: So in the case of GC, people sidestepped potential supply issues by doing away with helium entirely. And it sounds like they’re unlikely to go back. What about other instruments, like the ones that use helium to cool a magnet?

Craig: Yeah, so, superconducting magnets are important for both NMR instruments and for MRI, the medical imaging technique. For both of those, the focus has been on reducing the amount of fresh helium they need to operate. And there have been some pretty significant strides in that area. John Raquet shared some interesting numbers with me about how MRI magnet tech has changed.

John Raquet: Typically, it used to take 5,000 L of liquid helium to cool down an MRI magnet, each one. And then every year you had to top up the magnet with some more helium, right, to keep it cold. And typically you could use up to 2,000 L a year—these are the older magnets—a year for topping up the MRI units. OK. So, you can see quite a bit of helium is involved just in manufacturing and servicing the MRI units. Today, they can cool down an MRI unit with only 50 L, five-zero liters, of helium compared with 5,000. Those magnets then only use—MRI units only use—between 300 and 400 L every 3 years. They used to use 2,000 a year, right? So that’s an example of technology shift in application that has reduced the amount of helium per magnet and for maintaining that magnet.

Craig: Some instruments now require no new helium after the initial installation, thanks to improved insulation and integrated cold heads to recondense the helium. And you can get smaller MRIs for medical samples that are cryogen-free, cooled with heat exchangers. It’s only recently that there’s been a demand for these adaptations, but instrument makers are starting to deliver on that technical front.

For NMR, it’s a little trickier. If you look at MRI versus NMR, the NMR is a lot more detailed in the chemical information that it’s giving you; you’re looking a lot closer. MRI, in a lot of respects, is looking for the presence or absence of a signal, whereas NMR is looking in very intricate detail about that signal. With NMR, you’re able to tell things like, you know, how close is this hydrogen to this nitrogen four carbons down the chain, at that level of detail. It can’t tolerate a compressor turning on and off nearby. So instead, these places are looking at helium recycle and recovery systems. And that’s kind of an exciting thing. Rainer Kuemmerle, head of NMR operations for Bruker BioSpin, says helium woes have been on the company’s radar for a while.

Rainer Kuemmerle: We were starting to look into solutions to address the dependence on helium already in the early 2000s. That was actually one of my first projects.

Craig: Rainer was part of a team that developed what the company calls Aeon magnets. They have a closed-loop system that recondenses evaporated helium using a two-stage process.

Rainer Kuemmerle: So that was one solution, and it took about 10 years of development before we brought this system out to the market, and that was actually April 2013.

Craig: Rainer says that currently those systems make up only about 1% of the company’s NMR sales. Although cutting way back on helium use is an advantage where regular liquid helium delivery is impractical or undesirable, right now the systems are expensive to buy and to maintain.

Rainer Kuemmerle: So it’s really a carefree solution, but it’s a relatively expensive solution.

Craig: But Bruker’s direct recondensing system is just one way to recover helium. The most common system uses basically a big balloon. You’re going to fill a big helium balloon from the helium that boils off of your system either as it operates or as you’re filling it. That’s a large, room-size balloon that you’re filling. And then you have a liquefier system that’s going to pull out of that balloon, reliquefy that down into liquid helium, and then that can then be recycled back into a dewar and reloaded back into the instruments. There are also some systems where you can capture it and pump it down into a medium pressure cylinder. But that isn’t quite as good because then you have to find a gas supplier who’s willing to buy that back from you, and reliquefy it themselves. And a lot of gas suppliers aren’t interested in doing that.

Kerri: And so how widespread are these recycling/recovery systems, now?

Craig: They’re catching on, for sure. A small system might cost $150,000, and that would go up to $2–3 million for one that can support a larger array of instruments all at the same time. NIST is asking all its helium users to get recycling systems. The NMR facility there we heard about earlier is in the last stages of procurement for that. In some cases you can even get financing from the Bureau of Land Management.

Advertisement

Now, some of the bigger universities have had these systems for a little bit longer. I got to tour the helium recycling system in the basement of the Johns Hopkins Physics and Astronomy building in Baltimore in September. Their system, which they installed in 2012 in response to the earlier shortage, collects helium from several instruments throughout the building. Here’s what it sounds like liquefying helium. [A rythmic clanking and hissing sound plays] They’re growing in popularity in academia as deans, department heads, and funding agencies cotton to the idea. There were several different systems I found when I was reporting this that were installed recently. A handful of systems were inspired by the 2012–2013 shortage, and had it ready to go by the time this one hit. Others are working on it now. If you are careful, and if you’re doing it right, you can actually serve many, many instruments with one helium recovery system. And that’s really where it starts to pay itself off in a fast way.

Multiple scientists told me, I should emphasize, that saving money on helium fills is not always the primary driver for the investment. Yale’s chemistry department got a recovery system in 2013, and NMR facility manager Eric Paulson told me about the case they made to the university.

Eric Paulson: It’s really the right thing to do. Because helium is the most nonrenewable resource we really have here on Earth, as far as I’m concerned. So when we run out of helium, we’re going to be in serious trouble. I mean, that may not happen too soon. But I think that it’s good to conserve it if we can. And then the other, probably more practical justification is that we look at our recovery system as sort of an insurance policy against disruptions of the helium supply, and instability. Because with our recovery system, we can easily go on the order of a year without having to buy any liquid helium. Whereas without the recovery system, you know, if we couldn’t get helium for a month or two, we’d be in serious trouble, because there’d likely be a magnet that we need to fill or would have to be energized. In terms of the cost justification, you can easily say, well, if there’s a disruption that causes us to either shut down, or damages a magnet, and we have to, like, replace it or re-energize it, you know, just a single case of that could easily equal the cost of installing the recovery system.

So I feel much less anxiety when the disruptions come about now than I did before we had the recovery system. It’s not like it could never affect us, but it would take a very serious disruption to have an impact on us.

Craig: The experts I talked to predict that incorporating helium recovery systems is increasingly going to be just the way these facilities are built. And once they’re in, the users aren’t going to go back for all these same reasons as GC. The people who are actually managing the facilities love not having to worry about whether or not they’re going to be able to get their helium.

Kerri: So it sounds like the threatened helium supply prompted some changes that will actually benefit science in the long run.

Craig: The recycling systems make life better for scientists. Victoria University of Wellington, in New Zealand, for example, has a hard time getting helium on a reliable basis even in normal circumstances. Shortages—and pandemics—make it worse. The facility manager there, Ian Vorster, said they would have had at least one quench during the lockdown, except that they turned on a new recycling system at the beginning of this year. The whole facility is lower-stress now.

And the push to develop instruments that don’t need as much, or any, helium is also going to push new technologies ahead. High-temperature superconductors, for example. We can’t yet make a high-temperature superconducting wire long enough to be the main magnet for an NMR. But taking the coil lengths we can make and putting that in liquid helium inside rings of conventional superconducting magnets, well, that’s how Bruker delivered two record-high-field strength magnets this year, 1.2 GHz. We’re going to see new technologies, new capabilities, new analyses spin off from the helium conservation efforts.

Kerri: So that’s definitely a silver lining.

Craig: Yeah. And look, the scientific and medical users of helium that we’ve discussed here represent only part of the world’s helium consumption. Changes to the helium supply chain can have far-reaching effects on many industries. But what we’re seeing now is that across the board, consumers of helium—NIST, university labs, and others—are seeing the market tension start to ease.

Kerri: Yeah, you said earlier in the episode that experts are predicting that the current helium shortage will be the last one. Why is that, when all of these issues—at least in the US—still remain?

Craig: Yeah, I mean, we’re in a better place. The current shortage wasn’t as bad as a lot of people thought it would be. I mean, it was real doomsday predictions happening. It wasn’t as bad and it looks like it’s over. That’s partially due to a dip in demand related to the pandemic. But the larger factor is that a bunch of new helium sources are now coming online or ramping up in Russia, Tanzania, and Qatar. Gasworld’s John Raquet told me Russia has plans to supply a third of the world’s helium by 2025.

John Raquet: Well first of all they have shed loads—shed, shed, shed loads—of natural gas in Siberia. And they have decided to extract that natural gas. And they have a readily available customer in China.

Craig: And as the US ramps down, the hope is that these other supplies will come online and the overall global market will be adequate for what we need, both in the scientific community and in these other uses, including aerospace.

John Raquet: Here we are today, 2020. And the rumors you’re hearing is that the shortage has gone away. Well, yes, that’s true. There isn’t a glut of helium as we speak. But the impact is that additional helium has come on stream over the last 6 months, but added to which the pandemic—the global pandemic—has reduced the demand of helium in industrial uses, applications, because of the general downturn in the economies around the world. So with a decline in the use of helium and the slightly increased availability of helium, the pinch point, the tightness in the market, is gone.

Craig: But some of the lasting changes in the helium market, I think, are making it more susceptible to disruptions. And you see that in the pricing. Here’s Martha Morton again.

Martha Morton: There is a helium oversupply, actually, at the moment. But the prices aren’t elastic. The prices have not come down.

Craig: So taking the new supplies with the adoption of these recycle and reduce technologies lowering demand, we might not have this kind of helium shortage again for the foreseeable future. But as we’ve said a few times now, helium is the ultimate nonrenewable resource. And a lot of people in the scientific community are taking its conservation seriously.

Fortunately, Martha’s university was able to afford one of those helium recovery systems, which promises to alleviate some of her helium concerns. When we spoke, they were expecting a system to be installed soon.

Craig (in interview): So how does it feel that this system is on its way finally after some years and some pretty dramatic incidents?

Martha Morton: It feels good. It will feel better when I know that my helium supply is secure.

Kerri: Thanks, Craig, for sharing this story with us. It sounds like this will be an interesting area to watch in the next few years as the global helium market tries to reach a new normal.

You can find Craig’s future coverage of this topic at C&EN’s website, cen.acs.org.

This episode was written by Craig Bettenhausen and produced by me, Kerri Jansen. It was edited by Michael McCoy and Amanda Yarnell. Our copyeditor was Heather Holt. The music in this episode was “Chasing the Sun - Instrumental Version” by Narrow Skies and “Universal Donor” by Stanley Gurvich. Thanks to Waldi Bauer for the magnet quench sound effect.

Stereo Chemistry will be back next month with a new episode. Be sure to subscribe so you don’t miss it. Stereo Chemistry is the official podcast of Chemical & Engineering News, which is published by the American Chemical Society.

Craig: [in helium voice] Thanks for listening.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter