Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Energy

Tension arises as clean hydrogen projects spread

Saudi Arabia to build world’s largest plant for green hydrogen as the UK plans a big blue hydrogen project

by Alex Scott

July 9, 2020

| A version of this story appeared in

Volume 98, Issue 27

Companies have announced two major projects to produce clean hydrogen for fuel and chemical use as debate grows over just what clean hydrogen is.

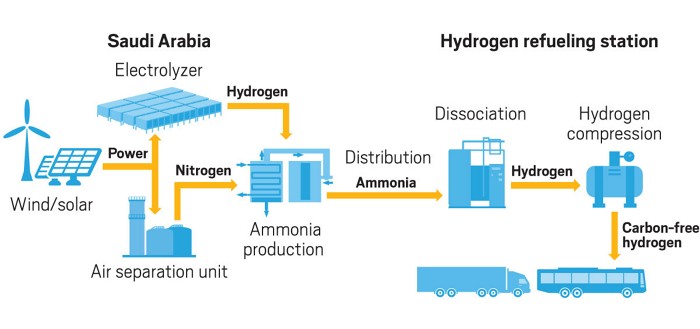

Air Products is partnering with the Saudi energy firm ACWA Power and the Saudi development agency Neom to build in northwest Saudi Arabia what will be the world’s largest facility for green hydrogen—hydrogen made by electrolyzing water with renewable energy.

The partners will use alkaline water electrolyzers produced by the German engineering firm Thyssenkrupp to convert water into oxygen and about 650 metric tons (t) per day of hydrogen. They plan to build 4 GW of solar and wind energy facilities—the world’s largest renewable energy project—to power the electrolyzers.

The hydrogen project, due to start up in 2025, will cost $5 billion and be equally owned by the three partners. Infrastructure to distribute hydrogen for use in fuel-cell buses and trucks worldwide will cost $2 billion and be owned and paid for 100% by Air Products.

To transport the hydrogen, the partners plan to convert it into ammonia, which is easier and safer to ship. To make the ammonia, Air Products will extract nitrogen from air and then combine it with the hydrogen in a process provided by Haldor Topsoe. The plant will have capacity to make 1.2 million t per year of ammonia. One t of ammonia contains 177 kg of hydrogen.

Once at its market location, the ammonia will be dissociated back into hydrogen and nitrogen. Air Products is not disclosing the efficiency of the full process.

“Is this feasible? No one really knows,” says Ben Gallagher, senior analyst with the consulting firm Wood Mackenzie. He points to layers of uncertainty associated with the project: its massive size, the processing of hydrogen to ammonia and back again, and that some major renewable energy projects in Saudi Arabia have not materialized as announced.

Air Products estimates the project will save more than 3 million t per year of CO2 emissions compared to hydrogen produced via standard steam methane reforming of natural gas—equivalent to the annual emissions of more than 700,000 cars.

Meanwhile, a group of firms has announced plans for a large facility in the UK to produce blue hydrogen—hydrogen made from natural gas but with the separation and storing of by-product CO2.

Led by the Norwegian oil and gas company Equinor, that project is to be built at Saltend Chemicals Park near Hull, England, for start-up in 2026. The resulting hydrogen will be supplied to chemical companies at the site and be blended with natural gas at a 30% concentration to feed a power plant at the park.

The project is to include the world’s largest auto thermal reformer, a variation on the steam methane reformer. Equinor claims that it will save 900,000 t per year of CO2. “We plan to transform the UK’s largest industrial cluster into its greenest cluster,” Al Cook, Equinor’s UK manager, says in a statement.

About 100 large-scale hydrogen projects are being planned globally, mostly in Europe, the Asia-Pacific region, and Australia, Gallagher says.

The European Commission has set a target for hydrogen to meet 14% of Europe’s energy needs by 2050. To help reach this goal, the EC is gearing up to spend billions of dollars in a post-COVID-19 economic stimulus package that it hopes will attract private investment to create a combined fund of $200 billion.

The EC proposes cofunding any blue hydrogen project in which roughly 90% of the CO2 is captured and stored. But such a policy would be a “huge mistake” because it would divert resources from green hydrogen, according to the European Environmental Bureau, which represents more than 140 environmental organizations across Europe.

“Investing in fossil-based hydrogen, whose production is already available at industrial scale, risks making truly clean and fossil-free hydrogen uncompetitive for the EU market,” Barbara Mariani, the bureau’s senior policy officer, says in a statement.

Hydrogen from fossil fuel currently costs about $1.65–$1.90/kg. Blue hydrogen is expected to cost $2.20/kg and green hydrogen $2.80–$6.15/kg, according to the EC.

The EC is unapologetic for backing blue hydrogen projects, some of which are proposed by large oil companies. “I’ve no shame in saying this: we need industry on board,” EC executive vice president Frans Timmermans told journalists at a recent press briefing.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter