Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Energy Storage

Flow batteries, the forgotten energy storage device

They may soon emerge from the shadow of lithium ion to store renewable energy

by Alex Scott

July 30, 2023

| A version of this story appeared in

Volume 101, Issue 25

Redox flow batteries have a reputation of being second best. Less energy intensive and slower to charge and discharge than their lithium-ion cousins, they fail to meet the performance requirements of snazzy, mainstream applications, such as cars and cell phones. There’s no such thing as a flow-battery Tesla.

But the companies at the International Flow Battery Forum in Prague in late June were adamant that flow batteries are now cheaper, more reliable, and safer than lithium ion in a growing number of real-world stationary energy applications. Flow-battery makers say their technology—and not lithium ion—should be the first choice for capturing excess renewable energy and returning it when the sun is not out and the wind is not blowing.

The flow-battery sector has met with a number of false dawns before. This time, developers and producers say, the technology is ready.

“Slowly but steadily, flow batteries are gaining their place in the energy storage space. It’s not about will it happen but how fast it will happen,” said Kees van de Kerk at the start of the Prague forum. Van de Kerk is president of the industry group Flow Batteries Europe and managing director of the flow-battery firm Volterion.

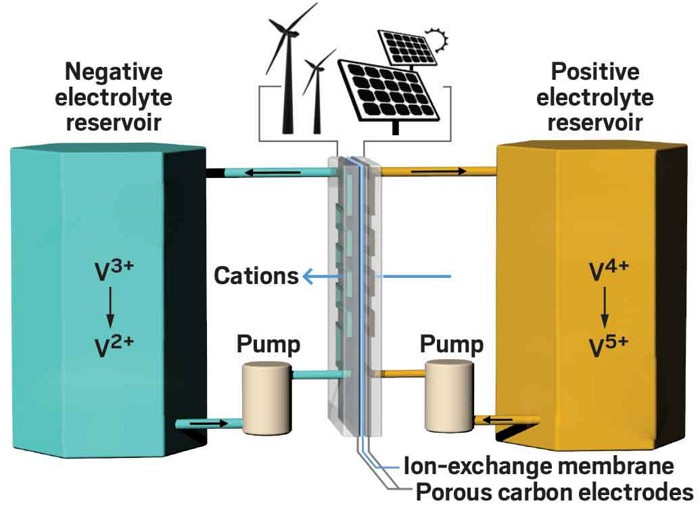

In standard flow batteries, two liquid electrolytes—typically containing metals such as vanadium or iron—undergo electrochemical reductions and oxidations as they are charged and then discharged. Held in tanks that can be as big as shipping containers, the electrolytes release electricity when they are pumped over electrodes separated by an ion-exchange membrane. On charging, ions from one electrolyte move through the battery’s membrane to the second electrolyte.

Comparing the cost

Hundreds of flow batteries are already in commercial use. Almost all have a vanadium-saturated electrolyte—often a mix of vanadium sulfate and sulfuric acid—since vanadium enables the highest known energy density while maintaining long battery life. Vanadium in the anolyte, the electrolyte solution at the cell’s anode, switches between the +3 and +2 states of oxidation. In the catholyte, the electrolyte at the cell’s cathode side, vanadium switches between states +4 and +5.

The Anglo-American firm Invinity Energy Systems claims to be the world’s biggest vanadium flow-battery supplier; it has more than 275 in operation and a growing number of projects planned. The company builds its batteries inside 6 m long shipping containers, making them easy to transport and ready to plug in once on site.

The sweet spot for flow batteries is providing between 10 and 36 h of energy—a range known as interday—when power grids don’t have enough electricity to meet demand, Invinity’s CEO, Larry Zulch, said at the conference. This interday matchup of flow batteries with energy demand means “the killer app for flow batteries is wind,” Zulch said. When paired with wind power, Invinity’s batteries can deliver power at 25–30% less cost than lithium-ion systems, he claimed.

By 2030, flow batteries could be storing about 61 MW h of electricity each year and generating annual sales for producers of more than $22 billion, Zulch said. “We have a big opportunity here. The numbers are staggering.” Energy companies are obvious customers. Utilities such as wastewater treatment plants are also seeking energy security and want to avoid peak-time electricity tariffs.

Despite such projections, the flow-battery sector remains largely unknown. “We need to mainstream flow batteries,” Zulch said. “People say, ‘Invinity, what do you do?’ I say we make vanadium flow batteries. And they say, ‘What are those?’ ”

Several firms, including Enerox and Sumitomo Electric Industries, are also selling vanadium flow batteries in greater numbers worldwide, but the market is still small compared with lithium ion.

An inherent shortcoming of vanadium flow batteries is that they have an energy density of about 30 W h/L, about 10% of that of lithium-ion batteries. But big lithium-ion batteries need to be spaced far apart in case they catch fire, so they still take up a lot of room, said Thomas Lüth, vice president of flow batteries at Voith Group, a provider of renewable energy services.

In contrast, flow batteries pose a minimal fire risk on account of the high water content in their electrolyte. As a result, they can be stacked on top of each other or even positioned safely inside a building, said Ellen Loxley-Slåttsveen, head of business development at Bryte Batteries, a Norwegian flow-battery producer.

Vanadium flow battery

Flow batteries aren’t price competitive at small scale, but their per-unit cost of electricity drops as they increase in size. This is because flow batteries can be made larger simply by adding bigger electrolyte tanks and increasing the volume of the electrolyte, which is relatively cheap. Lithium-ion batteries do not scale this way. They become steadily pricier as they get bigger because they need more cathode material, which is expensive.

Similarly, flow batteries don’t measure up for applications with short discharge times. Makers of vanadium flow batteries typically expect their products to compete with lithium-ion batteries once they are delivering electricity over more than 4 h. The longer the discharge, the more cost competitive flow batteries are, Toshikazu Shibata, manager of Sumitomo Electric’s energy system division, said during a panel discussion at the forum.

A positive attribute of flow batteries is their stability. Vanadium flow batteries “have by far the longest lifetimes” of all batteries and are able to perform over 20,000 charge-and-discharge cycles—equivalent to operating for 15–25 years—with minimal performance decline, said Hope Wikoff, an analyst with the US National Renewable Energy Laboratory.

Lithium-ion batteries’ energy storage capacity can drop by 20% over several years, and they have a realistic life span in stationary applications of about 10,000 cycles, or 15 years. Lead-acid batteries last 1,000 cycles, or 5–15 years, Wikoff said.

But scaling up the production of vanadium flow batteries can be challenging. Flow-battery makers have yet to adopt industry-wide standards, installation contractors have little experience with flow batteries, and the sector has potential supply chain problems ahead, speakers at the forum said.

Of those issues, supply chain security may present the biggest obstacle. The global production of vanadium is currently about 110,000 metric tons (t) per year, but the market is already tight, and demand could grow to about 400,000 t per year by 2030, said Jana Plananska, an independent consultant working with the Anglo-Norwegian company Norge Mining. Flow batteries could account for up to half of that demand.

An additional concern for companies outside China and Russia is that 62% of the world’s vanadium is produced in China, and about 20% comes from Russia, Plananska said. Most of this material is generated as a by-product of iron refining. Between 10 and 15% of vanadium comes from secondary sources, such as petroleum refining.

Europe currently has no vanadium production. Norge Mining plans to begin mining vanadium-containing phosphate rock deposits in Norway by 2028.

The specter of rising vanadium prices worries flow-battery producers because the metal represents about half the cost of a flow battery, according to Sumitomo Electric’s Shibata. Alternative electrolytes that avoid potential supply bottlenecks are in development.

Cyprus-based Redox One wants to begin large-scale production of a flow battery featuring a chromium 2+-3+ anolyte and an iron 2+-3+ catholyte. The company is looking to raise $45 million to implement the plan, CEO Thomas Gebauer said.

Other companies attempted but failed to commercialize chromium-iron flow batteries about a decade ago. This time around, the technology is more efficient, and the market need is stronger, Gebauer said.

Formed around technology from the Cypriot mining firm Tharisa, Redox One will source iron-chromium ore from Tharisa’s mine in South Africa. By taking this route, the company will easily be able to make an electrolyte that is 10% the cost of a vanadium electrolyte, Gebauer said.

The drawback of iron-chromium flow batteries is that their energy density is even lower than that of their vanadium counterparts. Gebauer countered that this is not necessarily a problem, since Redox One will be selective in the projects it pursues: it will target sites with ample space for large volumes of electrolyte.

The oil and gas giant Saudi Aramco is taking a different route. It is spending an undisclosed—but substantial—share of its $1 billion investment in alternative energy technologies to develop a hybrid iron-vanadium flow battery that is both cheap and reliable in hot desert conditions, said Ahmad Hammad, head of energy storage at the company. The battery features an iron catholyte in one tank and a vanadium anolyte in the other.

Aramco recently tested a 50 kW h version of its battery that can deliver electricity for up to 16 h. The firm now plans to increase testing to megawatt scale and is aiming for commercial production in 2025, Hammad said.

More exotic electrolytes, including those made with organic compounds, are also in development. California-based Quino Energy, founded to commercialize Harvard University research, is developing an organic electrolyte based on quinones, which are commonly used as dyes. Earlier this year the firm raised $4.55 million in seed funding to demonstrate its flow battery at scale.

Making progress in another direction, Michael Marshak, a professor at the University of Colorado Boulder, worked with RTX Technology Research Center to develop a chromium-chelate electrolyte that promises to be lower cost than vanadium electrolytes.

Marshak has also tailored chelates suited to other electrolyte chemistries. For example, a ligand-modified iron-chromium chelate is stable and features an energy density comparable to that of lithium iron phosphate batteries, he said.

Using yet another chelating agent, “we can also do the same trick with vanadium,” Marshak said. He plans to commercialize the technology via a new company called Otoro Energy. “I’m leaving the university in the next couple of months to go work full-time with my company,” he said.

A wave of more experimental flow-battery chemistries designed to reduce cost and increase energy density is also coming. For example, Lukas Siefert and colleagues at the University of Duisburg-Essen have been working on a zinc-polyiodide battery with a theoretical energy density of about 350 W h/L, or about 10 times that of a vanadium battery. For now, performance stability is a problem.

But “even if it only reaches 200 W h/L, it’s a great advantage,” Siefert said.

The good news for the flow-battery sector is that there appears to be plenty of opportunity to enhance efficiency beyond the electrolyte. Numerous academic and commercial laboratories are demonstrating improved membranes, electrodes, and more.

The fly in the ointment is that lithium-ion batteries are entrenched, and they continue to improve as well. Nevertheless, speakers at the Prague forum were confident that flow batteries are about to take off. “It’s a real situation,” said Alexander Schönfeldt, CEO of Enerox. “We have arrived—I think—at the commercialization of flow batteries.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter