Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceutical Chemicals

Novo Nordisk announces a $6 billion peptide expansion

Project will boost API production for two blockbuster drugs

by Rick Mullin

November 15, 2023

| A version of this story appeared in

Volume 101, Issue 38

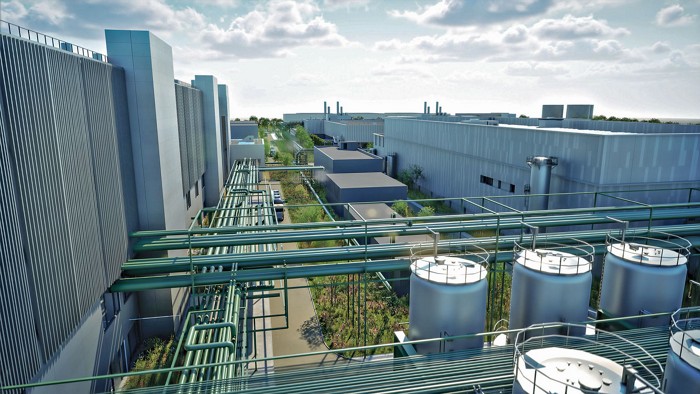

The Danish drug maker Novo Nordisk says it will invest about $6 billion to expand output at its facility in Kalundborg, Denmark. The focus of the project will be active pharmaceutical ingredients (APIs), including semaglutide, the API in the weight loss drug Wegovy and the type 2 diabetes therapy Ozempic.

The investment will include a 170,000 m2 API facility, described in a press release as a flexible, multiproduct installation designed to “future-proof” the company’s supply. Novo Nordisk estimates that the project will create 800 jobs by its completion in 2029.

Novo Nordisk is struggling to keep up with the supply of semaglutide, a glucagon-like peptide-1 (GLP-1) agonist, despite capacity expansions at sites in Denmark and North Carolina. The market for Wegovy and Ozempic has outpaced expectations, according to industry observers.

Meanwhile, Eli Lilly and Company is experiencing growing demand for tirzepatide, the peptide active ingredient in the diabetes drug Mounjaro and the recently approved weight loss drug Zepbound.

Novo Nordisk reported third-quarter Ozempic and Wegovy sales of $4.5 billion, a 37% increase over the same period in 2022. Lilly reported third-quarter Mounjaro sales of $1.4 billion, over six times sales in the third quarter of 2022.

Skyrocketing sales this year have prompted the UK and Belgian governments to ban the use of Ozempic for weight loss in order to ensure availability of the drug for type 2 diabetes patients.

“It’s fair to say that Novo and the market in general have been surprised by the demand for those drugs,” says Bernard Munos, a senior fellow at the Milken Institute and a former strategic advisor to Lilly. And he sees indications from tests of the drugs underway that the market will continue to grow rapidly.

“I am referring specifically to the signals I am reading about the potential of GLP-1 agonists to curb not just craving in food, but craving in general,” he says. “Now you are talking about tobacco, alcohol, and illicit drugs.” Munos notes that GLP-1 agonists are also being tested as a therapy for osteoarthritis.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter