Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Latin American Growth Slowing Down

After significant growth in 2011, countries experience see slower growth this year

by Alexander H. Tullo

January 12, 2012

| A version of this story appeared in

Volume 90, Issue 2

The past few years have been boom times for Latin America. Countries such as Brazil, Argentina, and Chile have been raking in profits by exporting agricultural and mineral commodities. At the same time, people have been lifted out of poverty, and with their newfound dis- cretionary income, they have been nurturing local markets and homegrown economic development.

COVER STORY

LATIN AMERICA High growth is set to mellow in 2012

In fact, the International Monetary Fund is concerned that Latin American economies are showing signs of overheating. Among the indicators are high inflation, strong local currencies, and high prices for real estate and other assets. Governments are likely to respond by reining in the monetary supply and tightening controls on the flows of credit and capital. “The outlook is still strong, although downside risks have come to the fore and commodity prices will provide less momentum in the future,” IMF reports.

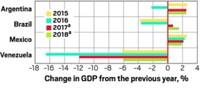

Already there are signs of a slowdown. According to IMF, Brazil’s economic growth fell from a heady 7.5% in 2010 to 3.8% in 2011, and it will likely continue at the lower level in 2012. Argentina, which experienced growth rates above 8% in 2010 and 2011, will likely see 4.6% growth this year, IMF predicts.

During a recent conference call, Carlos Fadigas, CEO of the Brazilian chemical producer Braskem, said he expects Brazilian demand for thermoplastics in 2011 to remain even with 2010 at about 4.8 million metric tons. He blamed the results on imports of finished goods that have displaced locally made products. “Our customers are losing share to the imported goods,” he said.

The lack of growth for plastics was unprecedented, and for 2012 growth should return to levels of 1.5 to 2.0 times GDP growth, Fadigas predicted.

Rina Quijada, CEO of consulting firm IntelliChem, notes several reasons the competitiveness of the Brazilian chemical industry has dulled and fallen prey to imports. Brazil’s currency, the real, is strong, making imports cheaper. High taxes and import duties have been raising the cost of producing goods in the country. And most petrochemical production in Brazil is based on naphtha, which has become a relatively costly feedstock since the advent of natural gas from shale in the U.S.

The bottom line, Quijada says, is that costs are escalating across the board. “Everything is very expensive,” she says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter