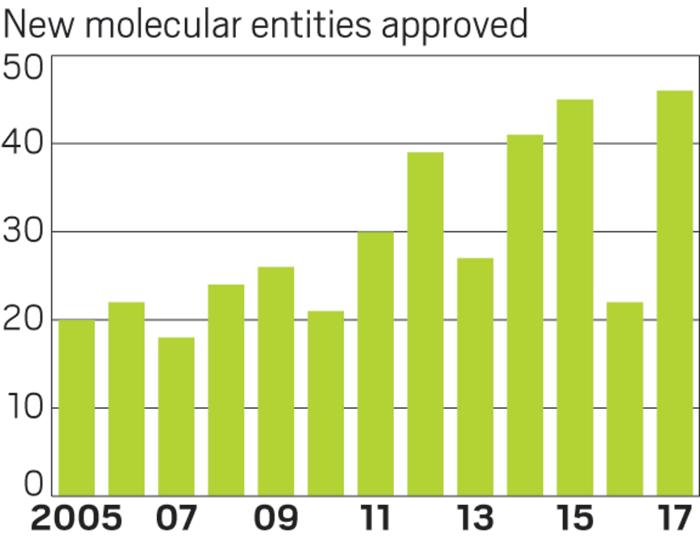

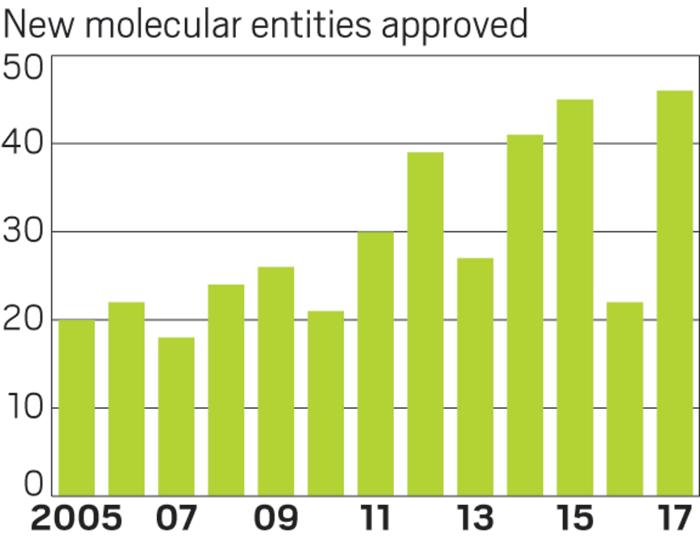

Early on in 2017, it was clear the year would bring a bountiful crop of new medicines. By mid-June, FDA had given its nod to as many new molecules as were approved in all of 2016.

The prior year’s meager output meant many big companies were in need of a rebound in productivity. And indeed, for some, 2017 was a salve. AstraZeneca, for example, had no approvals in 2016. It now has three new products in its portfolio: two cancer treatments and an asthma drug.

Bountiful year

Cancer and rare-disease drugs scored the most approvals in 2017, and small molecules continued to be an important drug modality.

Download a PDF table of the new drugs shown in the slideshow below.

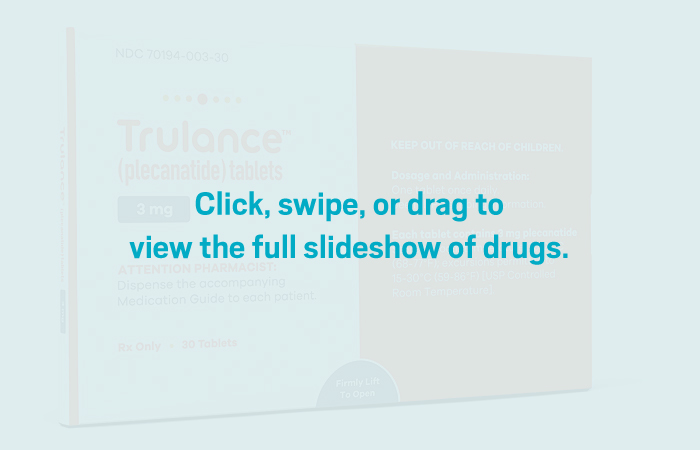

Trulance (Peptide)

Credit: Synergy Pharmaceuticals

Active ingredient: Plecanatide

Applicant: Synergy Pharmaceuticals

Indication: Chronic idiopathic constipation

Mechanism of action Guanylate cyclase-C agonist

Wholesale acquisition cost*: $353/month

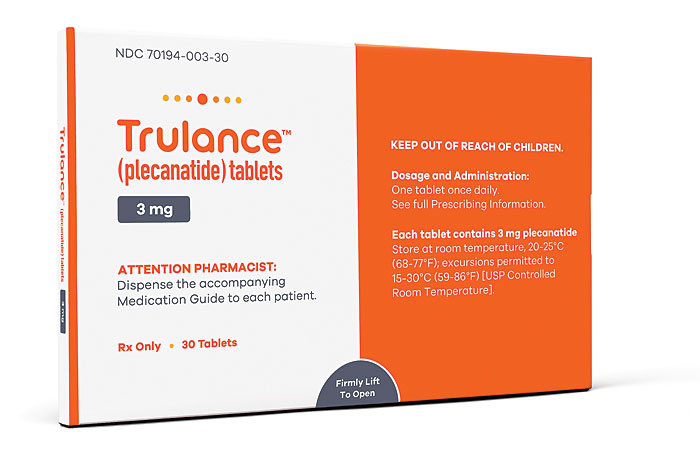

Parsabiv (Peptide)

Credit: Amgen

Active ingredient: Etelcalcetide

Applicant: Amgen

Indication: Secondary hyperparathyroidism in chronic kidney disease

Mechanism of action Calcium-sensing receptor modulator

Wholesale acquisition cost*: N/A

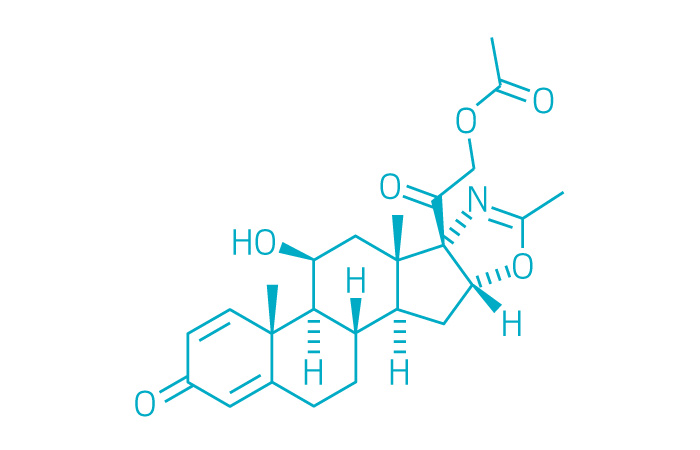

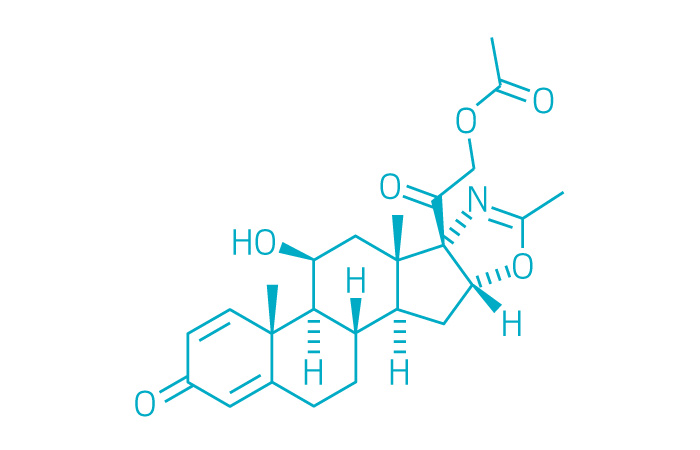

Emflaza (Small Molecule)

Active ingredient: Deflazacort

Applicant: Marathon Pharmaceuticals

Indication: Duchenne muscular dystrophy

Mechanism of action Corticosteroid prodrug

Wholesale acquisition cost*: $35,000/year (lowered from $89,000)

Incentive: Rare pediatric priority review voucher

Siliq (Antibody)

Credit: Valeant Pharmaceuticals

Active ingredient: Brodalumab

Applicant: Valeant Pharmaceuticals

Indication: Psoriasis

Mechanism of action IL-17RA antagonist

Wholesale acquisition cost*: $3,500/month

Xermelo (Small Molecule)

Active ingredient: Telotristat ethyl

Applicant: Lexicon Pharmaceuticals

Indication: Carcinoid syndrome diarrhea

Mechanism of action Tryptophan hydroxylase inhibitor

Wholesale acquisition cost*: $5,164/month

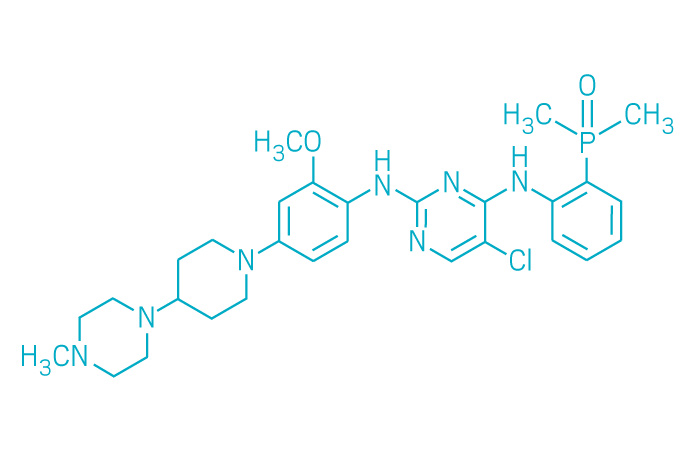

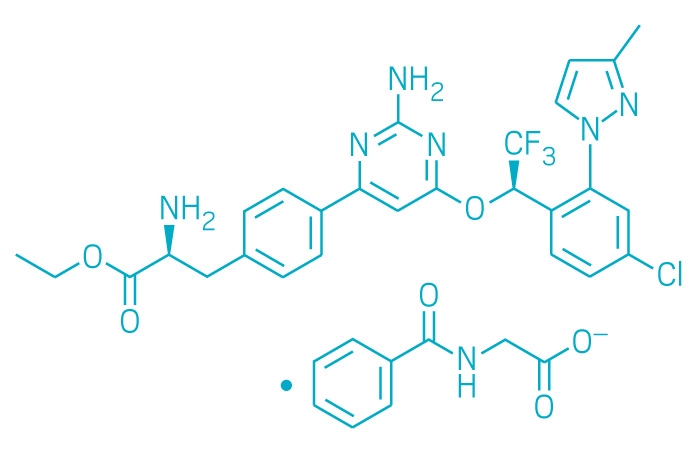

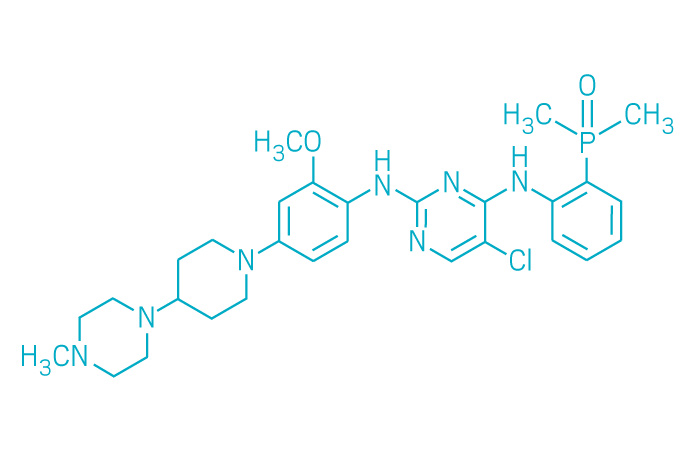

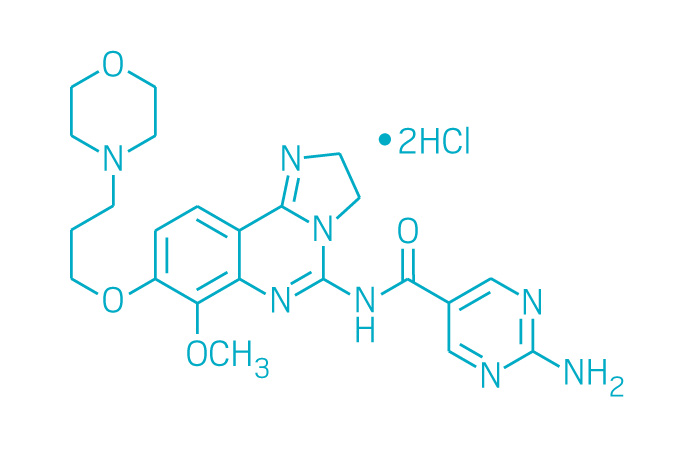

Kisqali (Small Molecule)

Active ingredient: Ribociclib

Applicant: Novartis

Indication: HR-positive/HER2-negative advanced or metastatic breast cancer

Mechanism of action CDK4/6 inhibitor

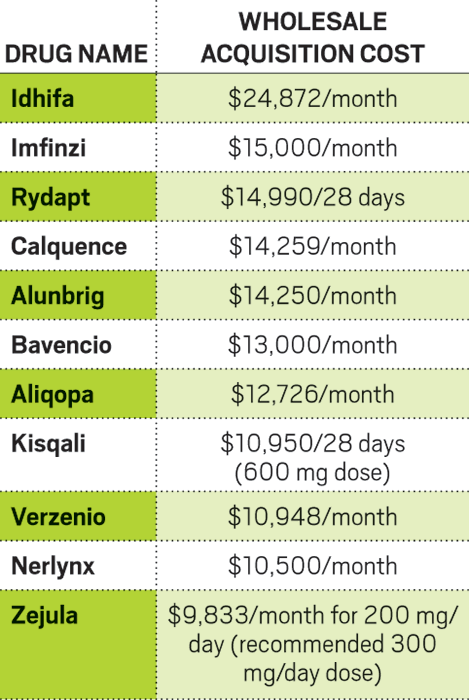

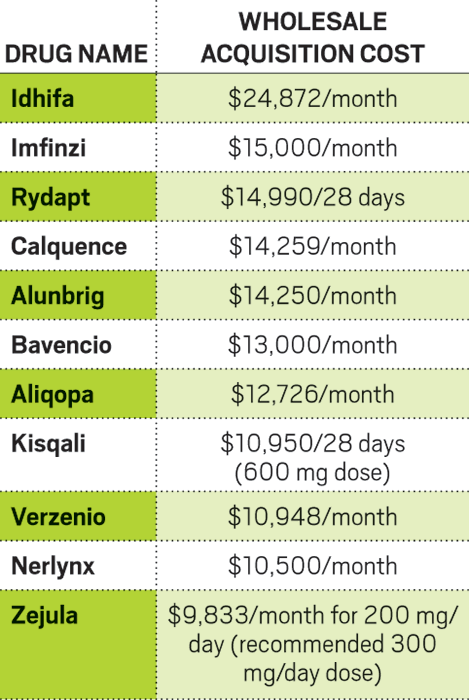

Wholesale acquisition cost*: 28-day supply of 600 mg pills is $10,950; 400 mg is $8,760; and 200 mg is $4,380

FDA special status: Breakthrough

Xadago (Small Molecule)

Active ingredient: Safinamide

Applicant: Newron Pharmaceuticals

Indication: Parkinson's disease

Mechanism of action Monoamine oxidase B inhibitor

Wholesale acquisition cost*: $670/month

Bavencio (Antibody)

Credit: Merck KGaA/Pfizer

Active ingredient: Avelumab

Applicant: Merck KGaA

Indication: Merkel cell carcinoma

Mechanism of action PD-L1 inhibitor

Wholesale acquisition cost*: $13,000/month

FDA special status: Breakthrough| Accelerated approval

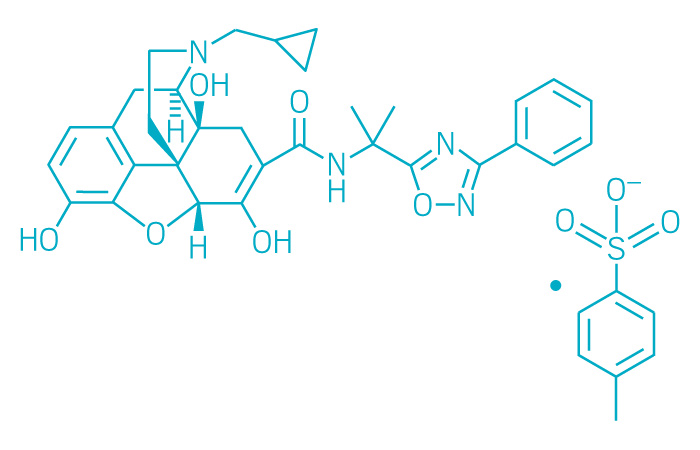

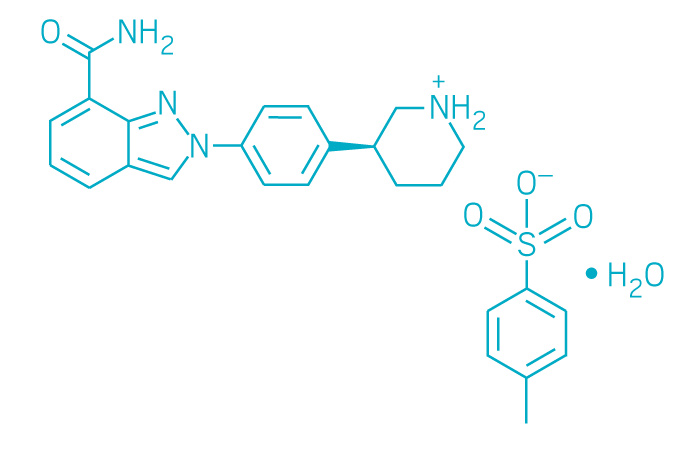

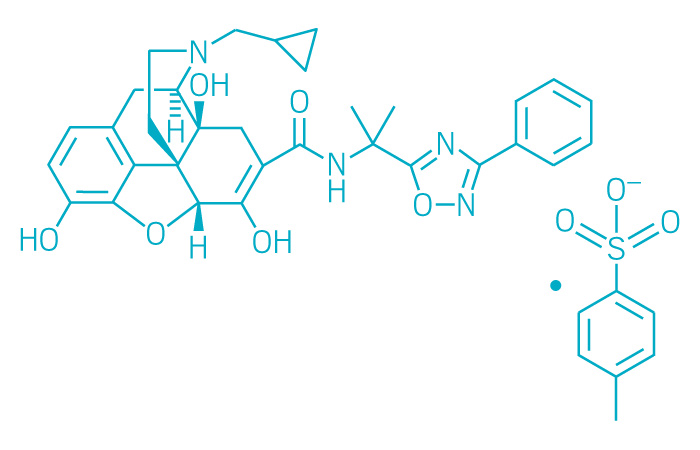

Symproic (Small Molecule)

Active ingredient: Naldemedine

Applicant: Purdue Pharma

Indication: Opioid-induced constipation

Mechanism of action Mu opioid receptor antagonist

Wholesale acquisition cost*: N/A

Zejula (Small Molecule)

Active ingredient: Niraparib

Applicant: Tesaro

Indication: Recurrent epithelial ovarian, fallopian tube, or primary peritoneal cancer

Mechanism of action PARP inhibitor

Wholesale acquisition cost*: $9,833/month for 200 mg/day (recommended 300 mg/day dose)

FDA special status: Breakthrough

Dupixent (Antibody)

Credit: Sanofi/Regeneron Pharmaceuticals

Active ingredient: Dupilumab

Applicant: Sanofi/Regeneron Pharmaceuticals

Indication: Eczema

Mechanism of action IL-4 and IL-13 inhibitor

Wholesale acquisition cost*: $37,000/year

FDA special status: Breakthrough

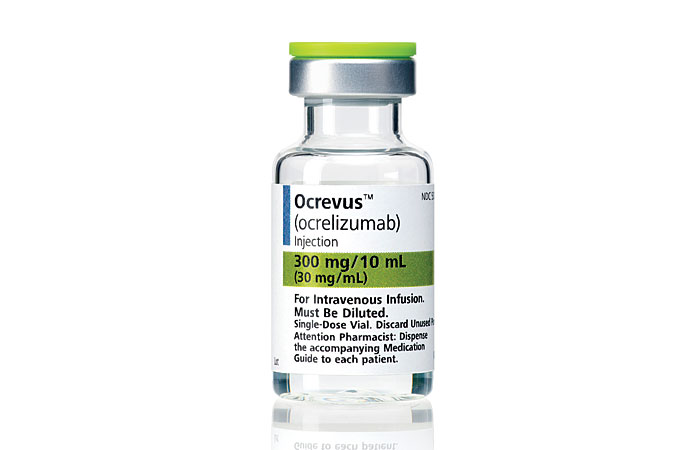

Ocrevus (Antibody)

Credit: Roche

Active ingredient: Ocrelizumab

Applicant: Roche

Indication: Multiple sclerosis

Mechanism of action CD20 binder

Wholesale acquisition cost*: $65,000/year

FDA special status: Breakthrough

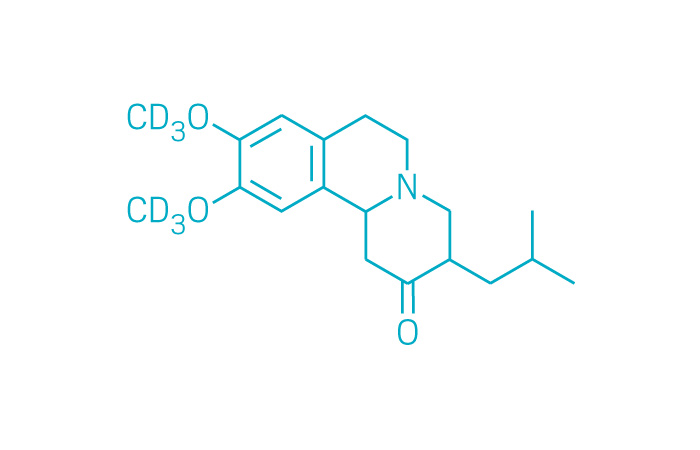

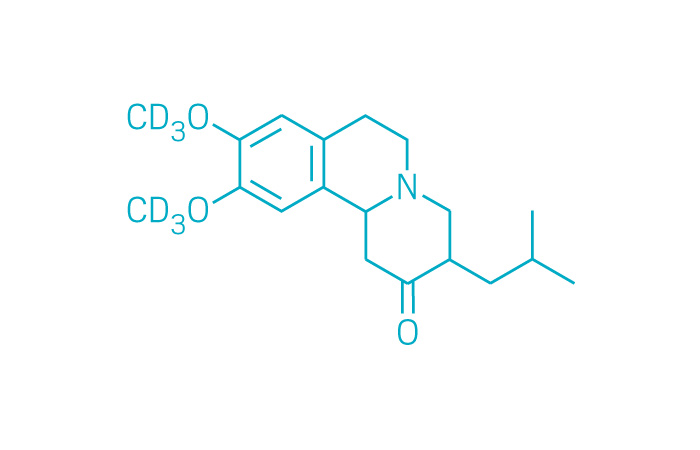

Austedo (Small Molecule)

Active ingredient: Deutetrabenazine

Applicant: Teva Pharmaceutical

Indication: Huntington's disease-associated chorea

Mechanism of action Vesicular monoamine transporter 2 inhibitor

Wholesale acquisition cost*: $60,000/year

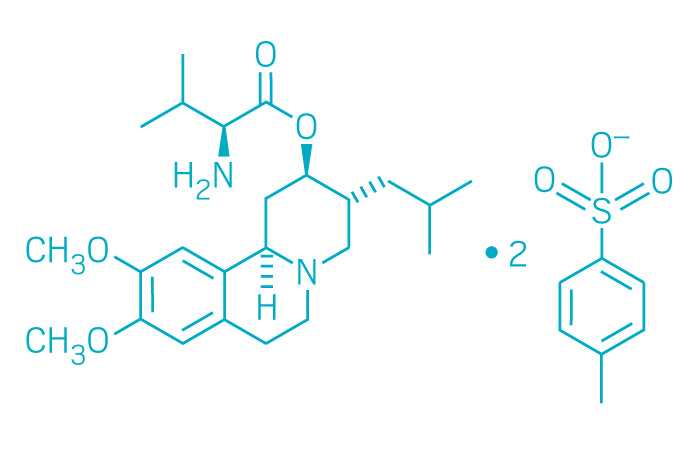

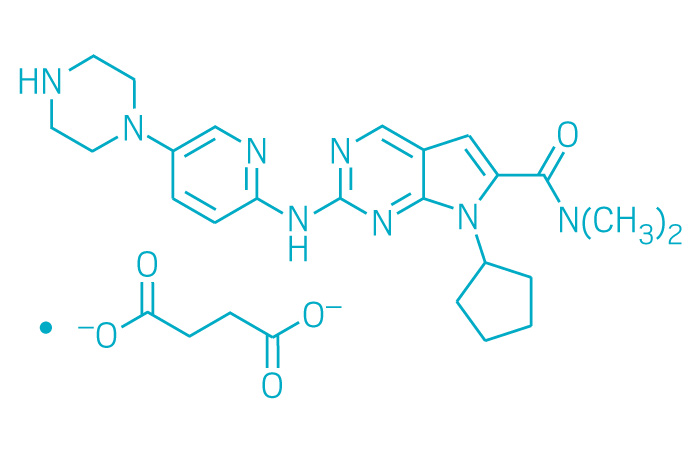

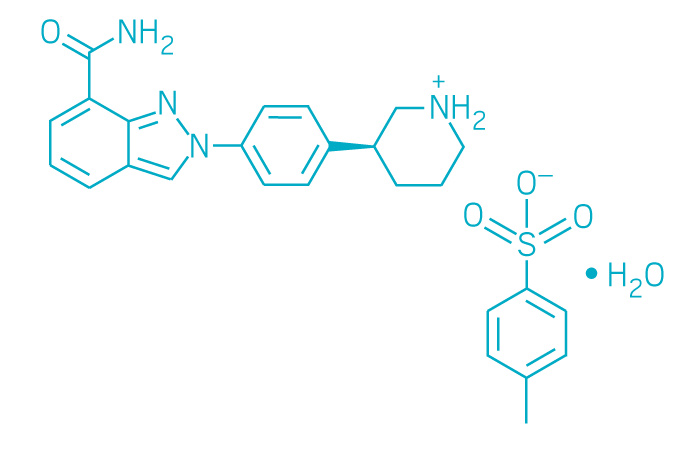

Ingrezza (Small Molecule)

Active ingredient: Valbenazine

Applicant: Neurocrine Biosciences

Indication: Tardive dyskinesia

Mechanism of action Vesicular monoamine transporter 2 inhibitor

Wholesale acquisition cost*: $5,275/month

FDA special status: Breakthrough

Brineura (Enzyme)

Credit: BioMarin Pharmaceutical

Active ingredient: Cerliponase alfa

Applicant: Biomarin Pharmaceutical

Indication: Batten disease

Mechanism of action Enzyme replacement therapy

Wholesale acquisition cost*: $702,000/year

FDA special status: Breakthrough

Incentive: Rare pediatric priority review voucher, sold for $125 million

Alunbrig (Small Molecule)

Active ingredient: Brigatinib

Applicant: Takeda Pharmaceutical

Indication: ALK-positive non-small cell lung cancer

Mechanism of action ALK inhibitor

Wholesale acquisition cost*: $14,250/month

FDA special status: Breakthrough | Accelerated approval

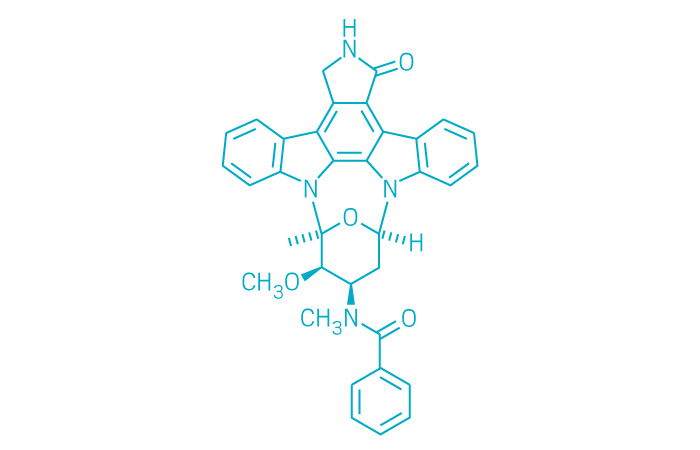

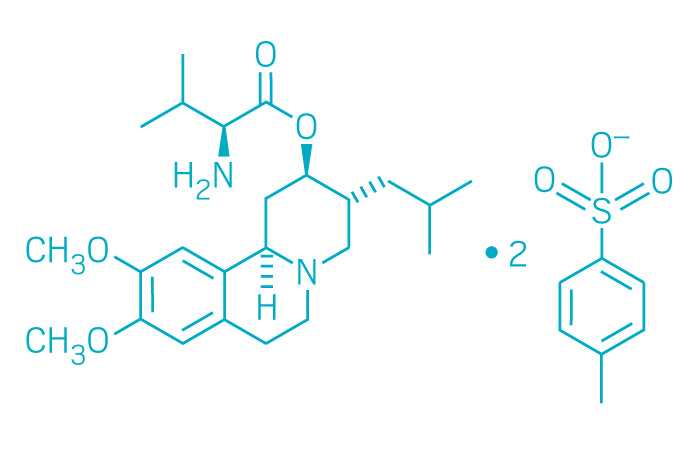

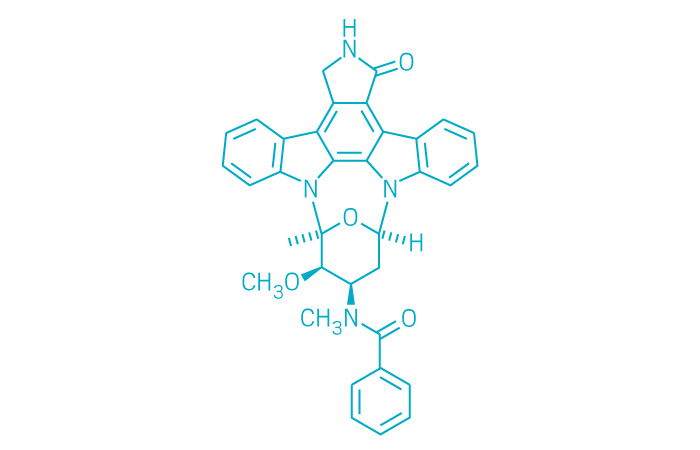

Rydapt (Small Molecule)

Active ingredient: Midostaurin

Applicant: Novartis

Indication: FLT3-positive acute myeloid leukemia

Mechanism of action Multikinase inhibitor, including FLT3 and KIT

Wholesale acquisition cost*: $14,990/28 days

FDA special status: Breakthrough

Tymlos (Peptide)

Credit: Radius Health

Active ingredient: Abaloparatide

Applicant: Radius Health

Indication: Osteoporosis

Mechanism of action Parathyroid hormone-related protein

Wholesale acquisition cost*: $19,500/year

Imfinzi (Antibody)

Credit: AstraZeneca

Active ingredient: Durvalumab

Applicant: AstraZeneca

Indication: Urothelial carcinoma

Mechanism of action PD-L1 inhibitor

Wholesale acquisition cost*: $180,000/year

FDA special status: Breakthrough | Accelerated approval

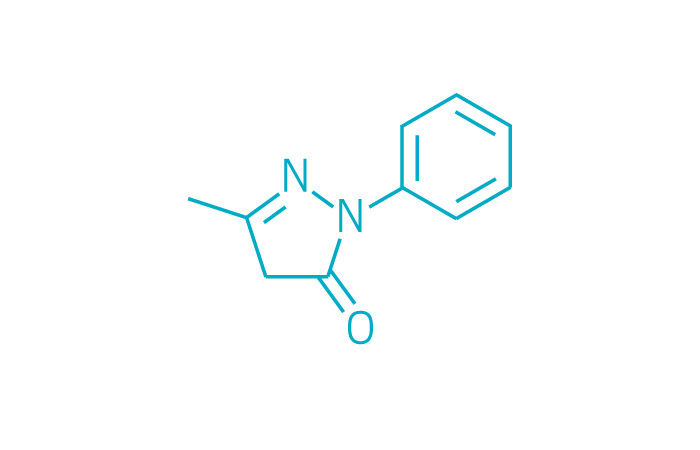

Radicava (Small Molecule)

Active ingredient: Edaravone

Applicant: Mitsubishi Tanabe

Indication: Amyotrophic lateral sclerosis

Mechanism of action Unknown

Wholesale acquisition cost*: $145,524/year

Kevzara (Antibody)

Credit: Sanofi/Regeneron Pharmaceuticals

Active ingredient: Sarilumab

Applicant: Sanofi/Regeneron Pharmaceuticals

Indication: Rheumatoid arthritis

Mechanism of action IL-6R inhibitor

Wholesale acquisition cost*: $39,000/year

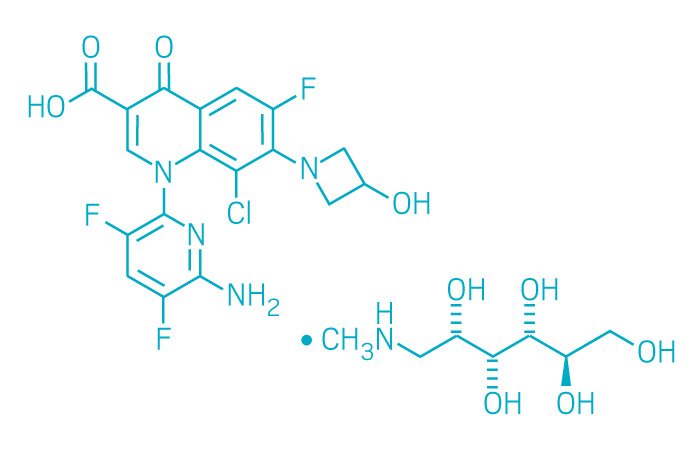

Baxdela (Small Molecule)

Active ingredient: Delafloxacin

Applicant: Melinta Therapeutics

Indication: Skin infections

Mechanism of action Fluoroquinolone

Wholesale acquisition cost*: N/A

Bevyxxa (Small Molecule)

Active ingredient: Betrixaban

Applicant: Portola Pharmaceuticals

Indication: Venous thromboembolism

Mechanism of action Factor Xa inhibitor

Wholesale acquisition cost*: N/A

Tremfya (Antibody)

Credit: Johnson & Johnson

Active ingredient: Guselkumab

Applicant: Johnson & Johnson

Indication: Psoriasis

Mechanism of action IL-23 inhibitor

Wholesale acquisition cost*: $58,100/year

Incentive: Priority review voucher filed with application

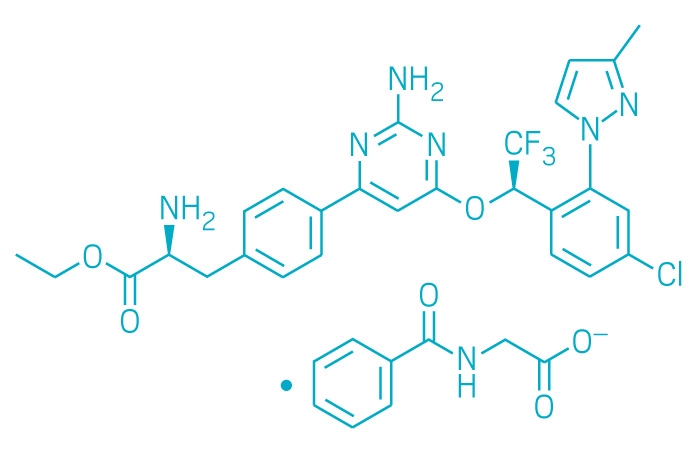

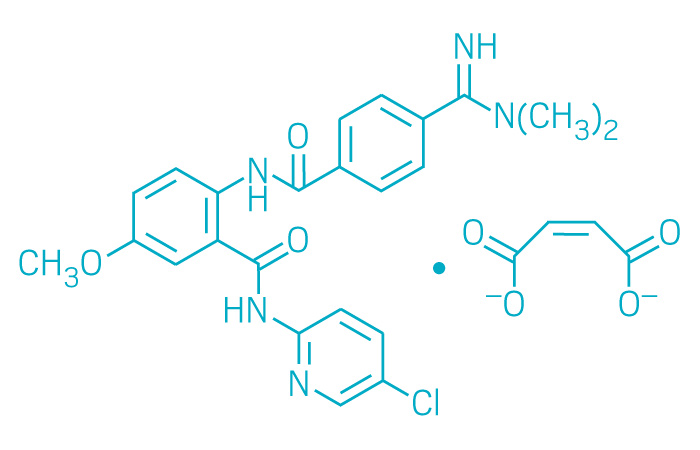

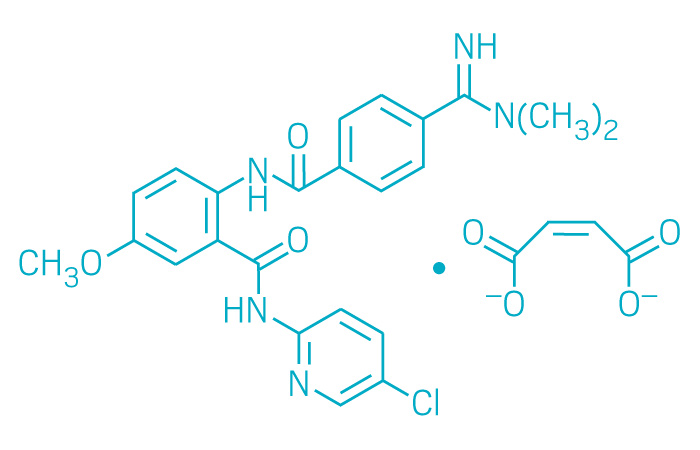

Nerlynx (Small Molecule)

Active ingredient: Neratinib maleate

Applicant: Puma Biotechnology

Indication: HER2-positive breast cancer

Mechanism of action EGFR, HER2, and HER4 inhibitor

Wholesale acquisition cost*: $10,500/month

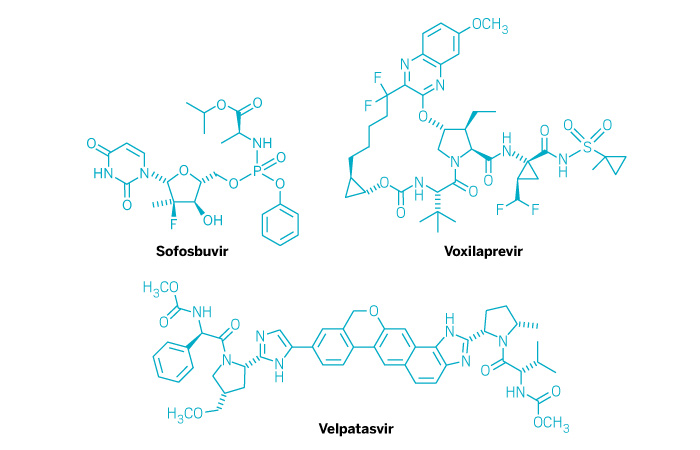

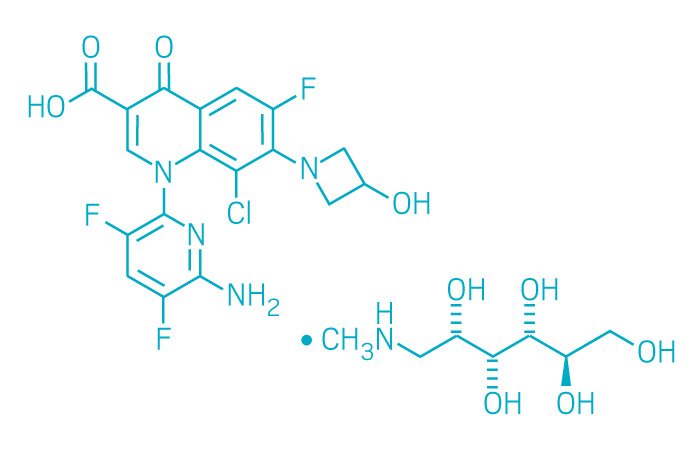

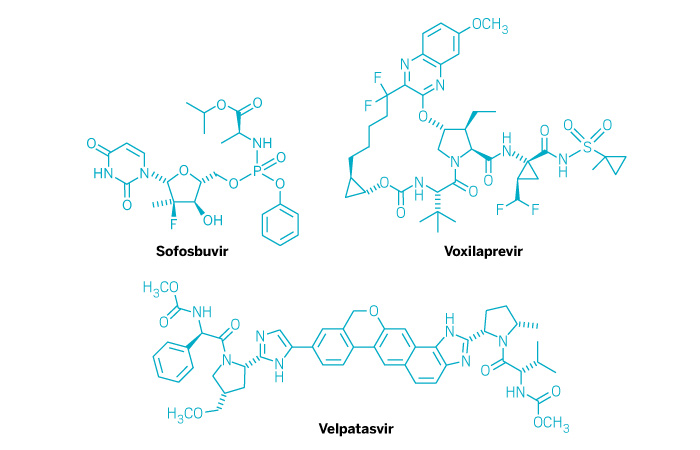

Vosevi (Small Molecule)

Active ingredient: Sofosbuvir, velpatasvir, and voxilaprevir

Applicant: Gilead Sciences

Indication: Hepatitis C

Mechanism of action NS5B polymerase, NS5B, and NS3/4A protease inhibitors

Wholesale acquisition cost*: $74,760/12-week course

FDA special status: Breakthrough

Idhifa (Small Molecule)

Active ingredient: Enasidenib

Applicant: Celgene

Indication: IDH2-positive acute myeloid leukemia

Mechanism of action IDH2 inhibitor

Wholesale acquisition cost*: $24,872/month

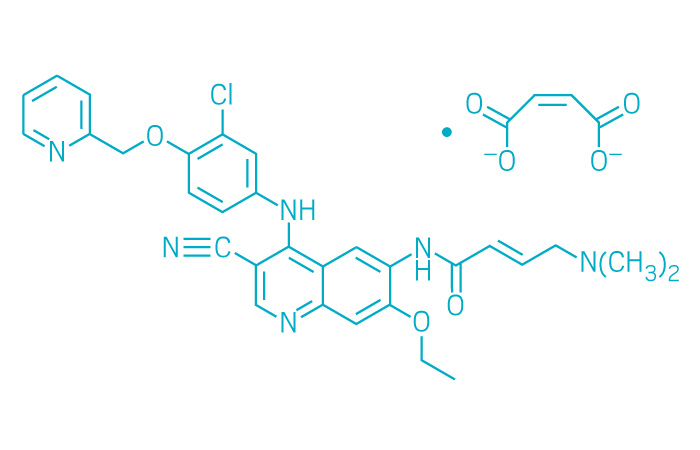

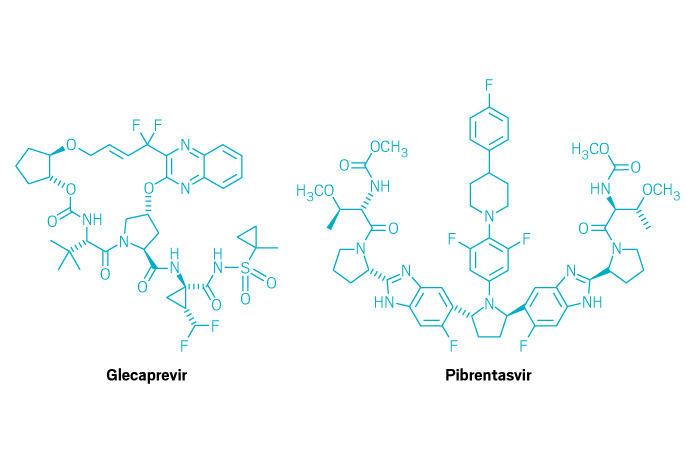

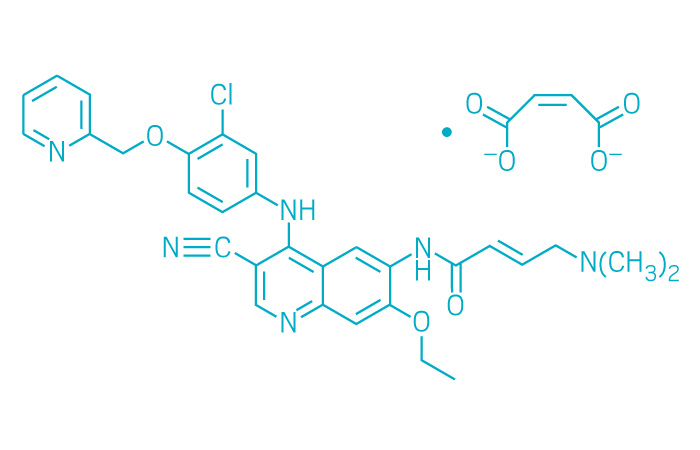

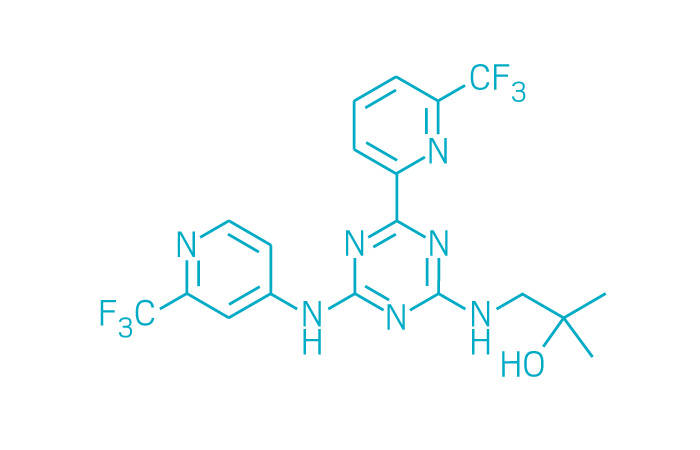

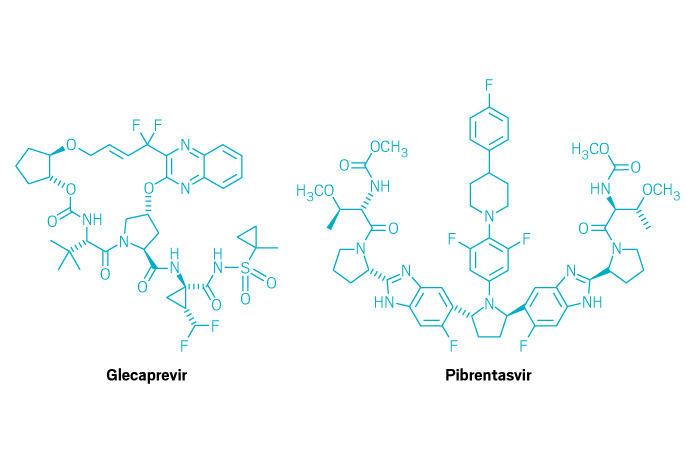

Mavyret (Small Molecule)

Active ingredient: Glecaprevir and pibrentasvir

Applicant: AbbVie

Indication: Hepatitis C

Mechanism of action NS3/4A protease and NS5A inhibitors

Wholesale acquisition cost*: $26,400/8-week course

FDA special status: Breakthrough

Besponsa (Antibody-Drug Conjugate)

Credit: Pfizer

Active ingredient: Inotuzumab ozogamicin

Applicant: Pfizer

Indication: Acute lymphoblastic leukemia

Mechanism of action CD22-binding antibody and cytotoxic antibiotic

Wholesale acquisition cost*: N/A

FDA special status: Breakthrough

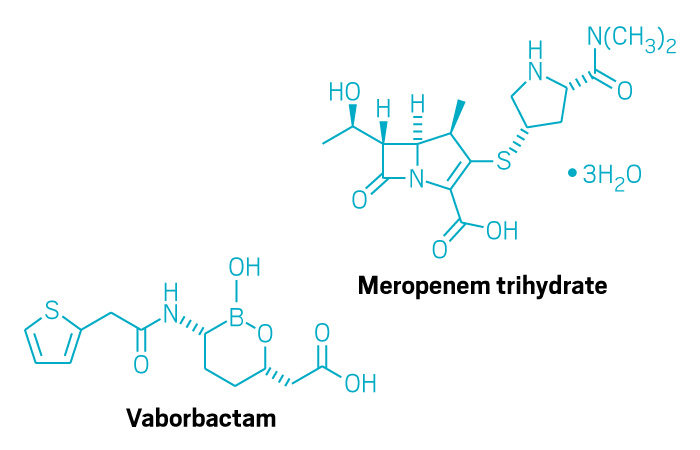

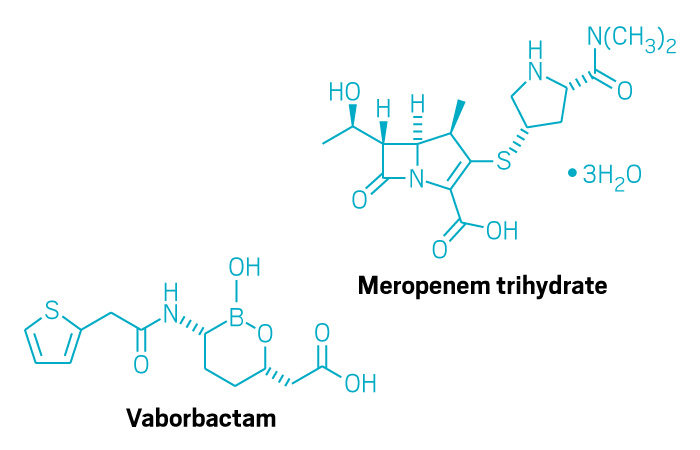

Vabomere (Small Molecule)

Active ingredient: Meropenem and vaborbactam

Applicant: The Medicines Co.

Indication: Complicated urinary tract infections

Mechanism of action Carbapenem antibacterial and non-β-lactam β-lactamase inhibitor

Wholesale acquisition cost*: N/A

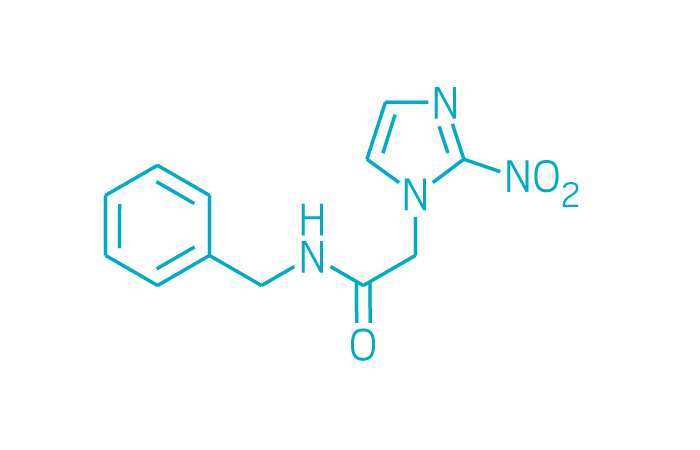

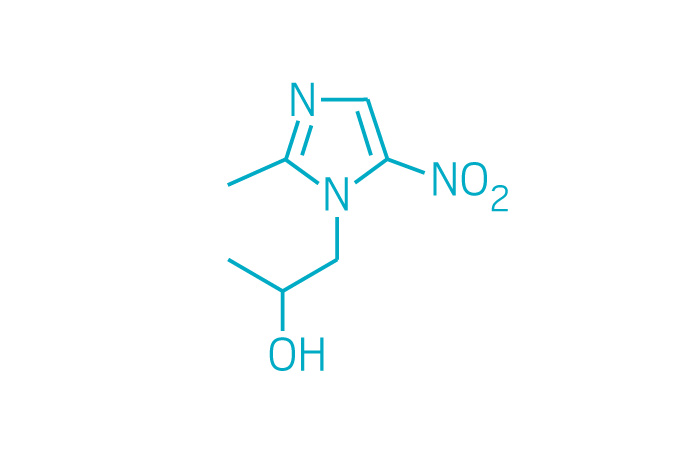

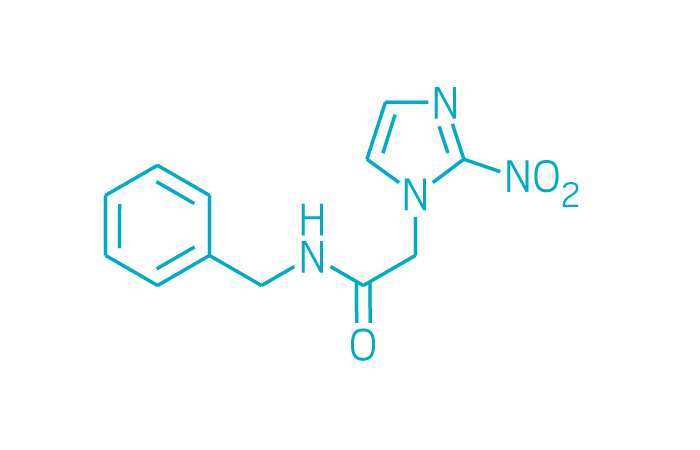

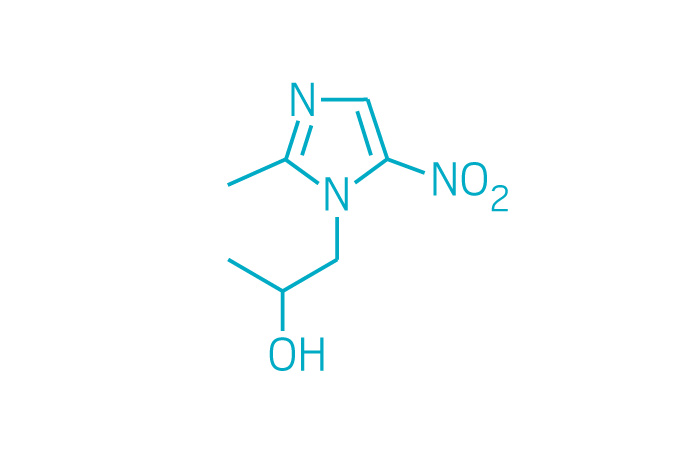

Benznidazole (Small Molecule)

Active ingredient: Benznidazole

Applicant: Chemo Research

Indication: Chagas disease

Mechanism of action Nitroimidazole antimicrobial

Wholesale acquisition cost*: N/A

FDA special status: Accelerated approval

Incentive: Tropical disease priority review voucher

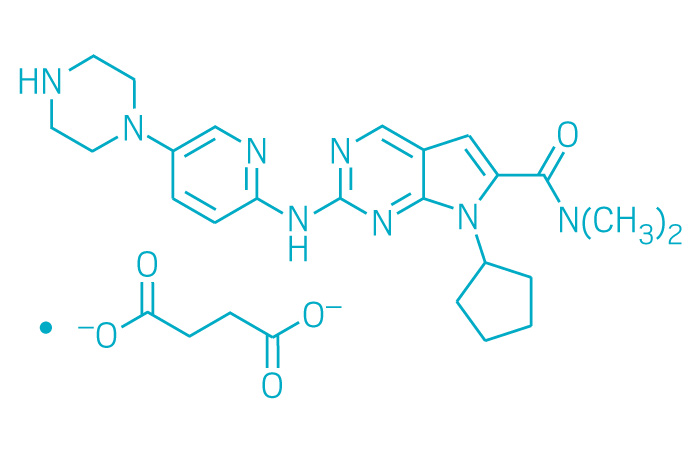

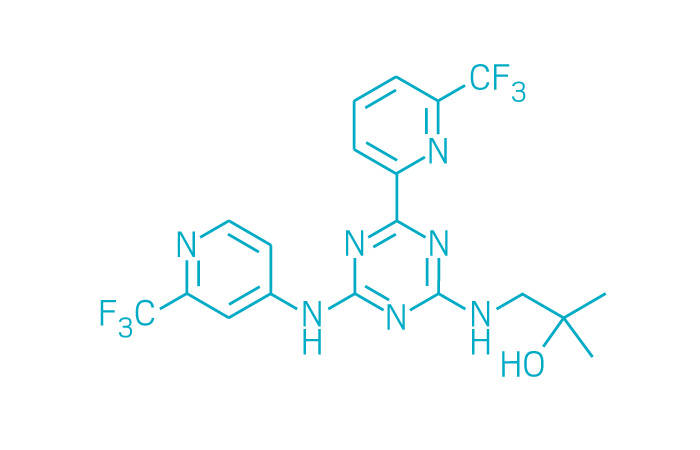

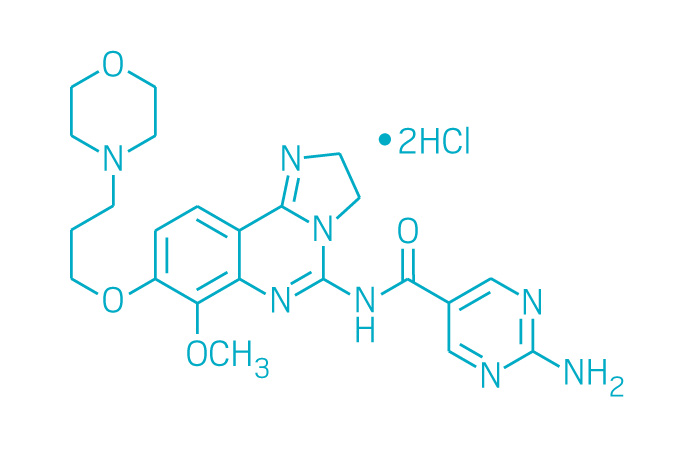

Aliqopa (Small Molecule)

Active ingredient: Copanlisib

Applicant: Bayer

Indication: Follicular lymphoma

Mechanism of action Pan-PI3K inhibitor

Wholesale acquisition cost*: $12,726/month

FDA special status: Accelerated approval

Solosec (Small Molecule)

Active ingredient: Secnidazole

Applicant: Symbiomix Therapeutics

Indication: Bacterial vaginosis

Mechanism of action Nitroimidazole antimicrobial

Wholesale acquisition cost*: N/A

Verzenio (Small Molecule)

Active ingredient: Abemaciclib

Applicant: Eli Lilly & Co.

Indication: Breast cancer

Mechanism of action CDK4/6 inhibitor

Wholesale acquisition cost*: $10,948/month

FDA special status: Breakthrough

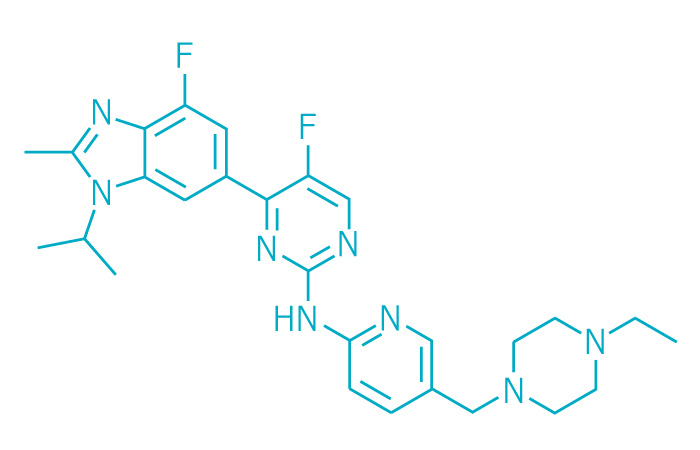

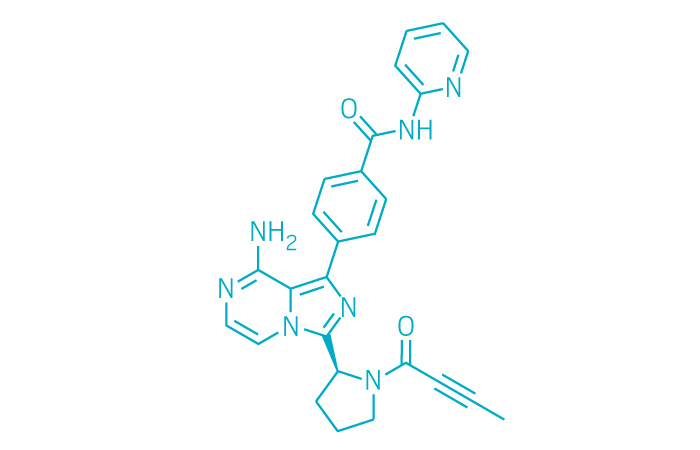

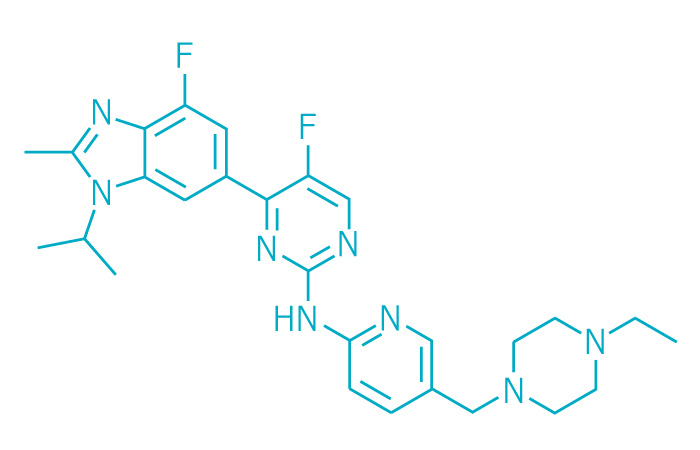

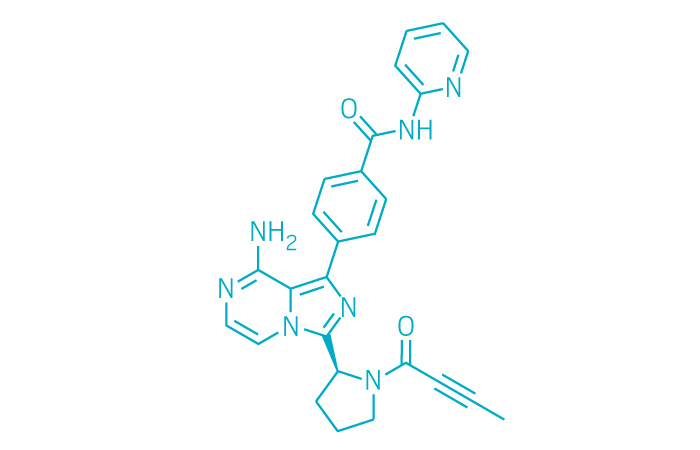

Calquence (Small Molecule)

Active ingredient: Acalabrutinib

Applicant: AstraZeneca

Indication: Mantle cell lymphoma

Mechanism of action BTK inhibitor

Wholesale acquisition cost*: $14,259/month

FDA special status: Breakthrough | Accelerated approval

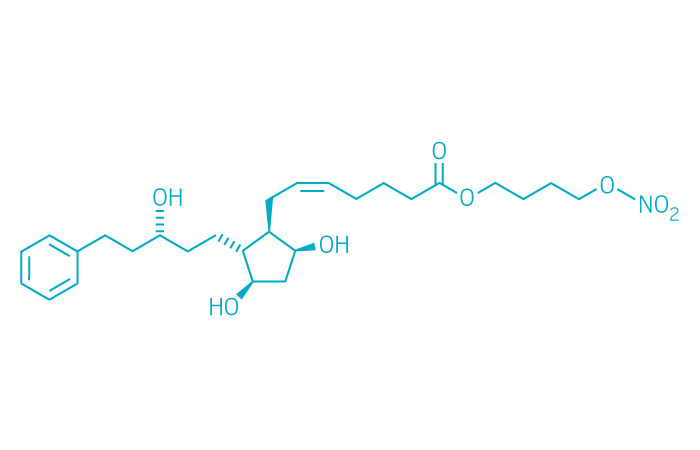

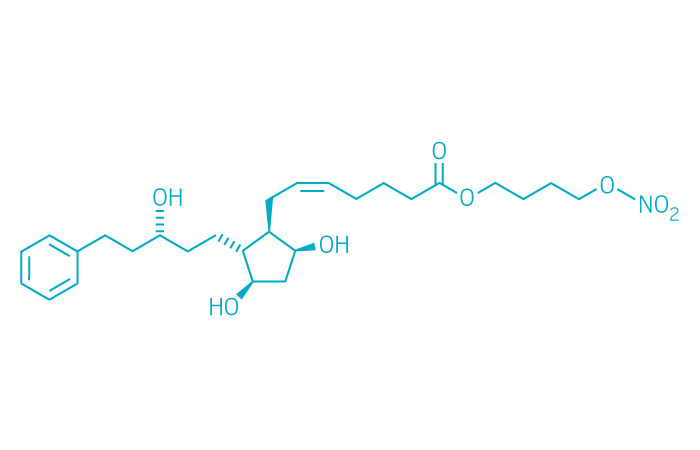

Vyzulta (Small Molecule)

Active ingredient: Latanoprostene bunod ophthalmic solution

Applicant: Valeant Pharmaceuticals

Indication: Glaucoma/ocular hypertension

Mechanism of action Metabolizes into two pressure-lowering moieties

Wholesale acquisition cost*: N/A

Prevymis (Small Molecule)

Active ingredient: Letermovir

Applicant: Merck & Co.

Indication: Infection prevention after bone marrow transplant

Mechanism of action Cytomegalovirus DNA terminase complex inhibitor

Wholesale acquisition cost*: $195/day for tablets or $270/injection

FDA special status: Breakthrough

Fasenra (Antibody)

Credit: AstraZeneca

Active ingredient: Benralizumab

Applicant: AstraZeneca

Indication: Severe asthma

Mechanism of action IL-5R α receptor binder

Wholesale acquisition cost*: $38,000/first year

Mepsevii (Enzyme)

Credit: Ultragenyx Pharmaceutical

Active ingredient: Vestronidase alfa

Applicant: Ultragenyx Pharmaceutical

Indication: MPS VII (Sly syndrome)

Mechanism of action Enzyme replacement therapy

Wholesale acquisition cost*: $375,000/year

Incentive: Rare disease priority review voucher, sold to Novartis for $130 million

Hemlibra (Bispecific Antibody)

Credit: Roche

Active ingredient: Emicizumab

Applicant: Roche

Indication: Hemophilia A

Mechanism of action Factor IX and X binder

Wholesale acquisition cost*: $482,000/first year

FDA special status: Breakthrough

Ozempic (Peptide)

Credit: Novo Nordisk

Active ingredient: Semaglutide

Applicant: Novo Nordisk

Indication: Type 2 diabetes

Mechanism of action GLP-1 receptor agonist

Wholesale acquisition cost*: $676/4–6 week supply

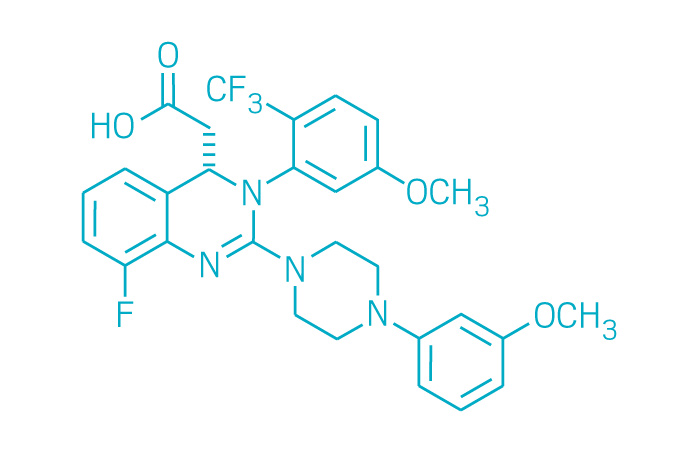

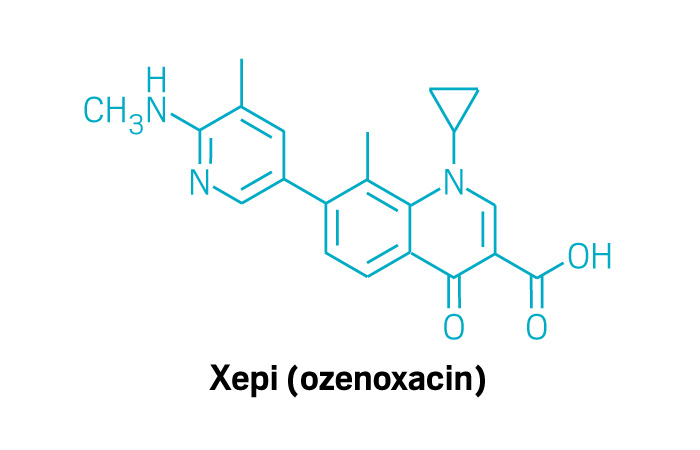

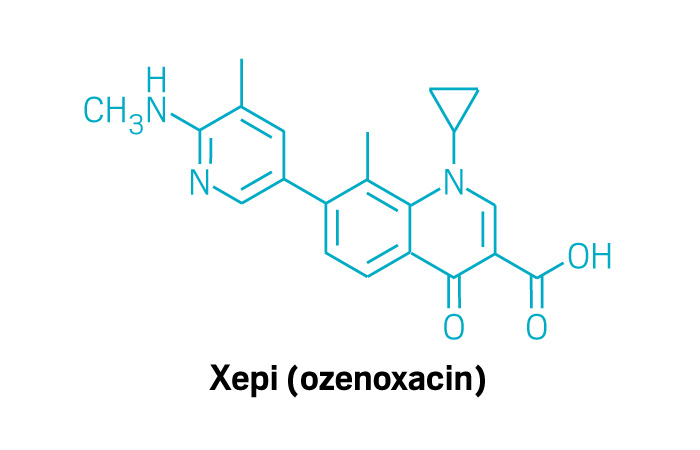

Xepi (Small Molecule)

Active ingredient: Ozenoxacin

Applicant: Medimetriks Pharmaceuticals

Indication: Impetigo

Mechanism of action Nonfluorinated quinolone antibiotic

Wholesale acquisition cost*: N/A

Rhopressa (Small Molecule)

Active ingredient: Netarsudil ophthalmic solution

Applicant: Aerie Pharmaceuticals

Indication: Glaucoma/ocular hypertension

Mechanism of action ρ-Kinase inhibitor

Wholesale acquisition cost*: N/A

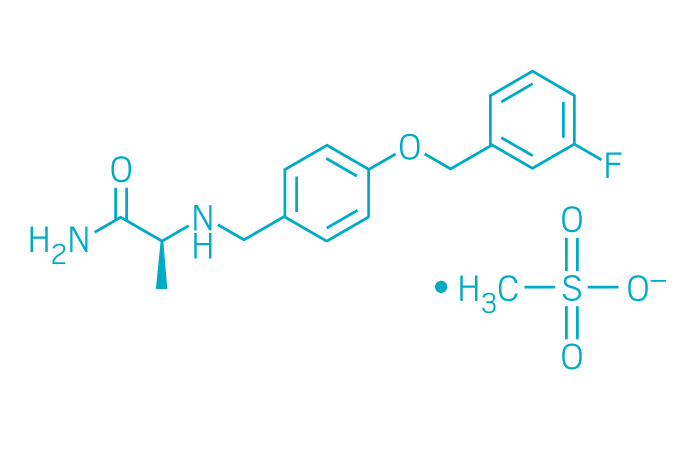

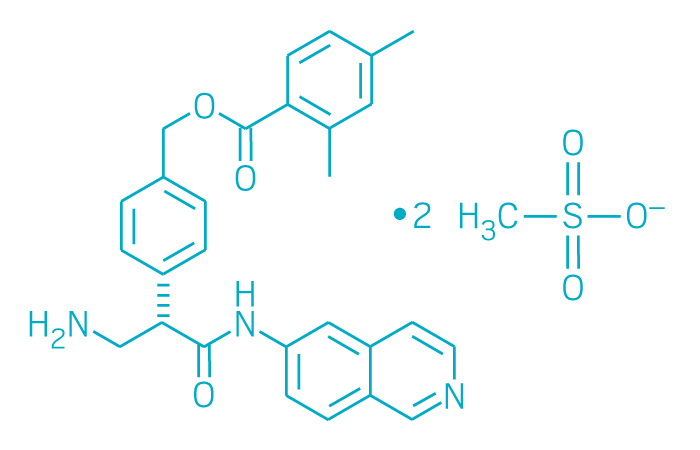

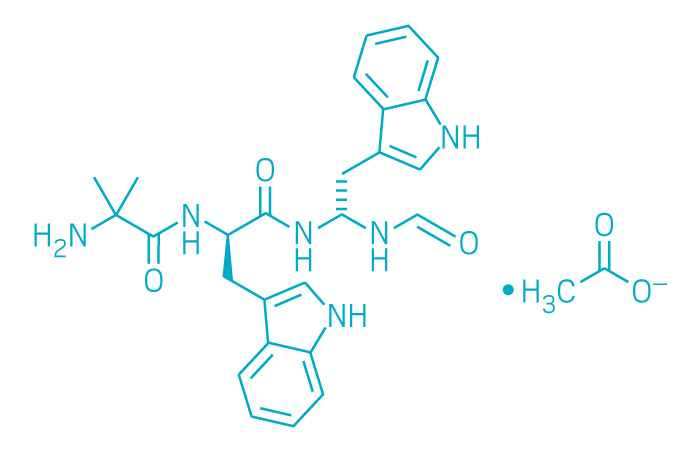

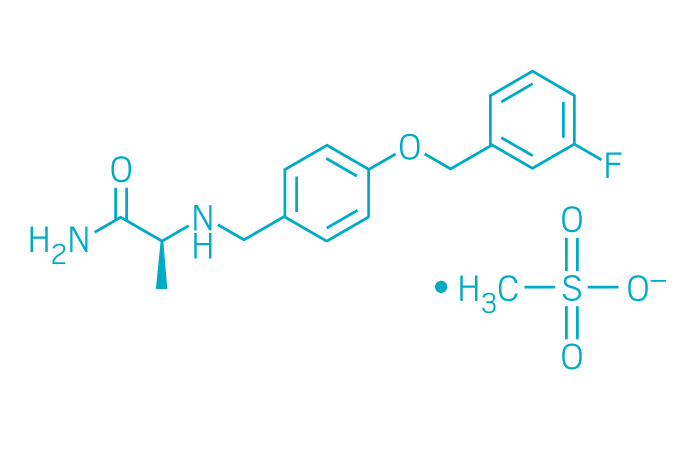

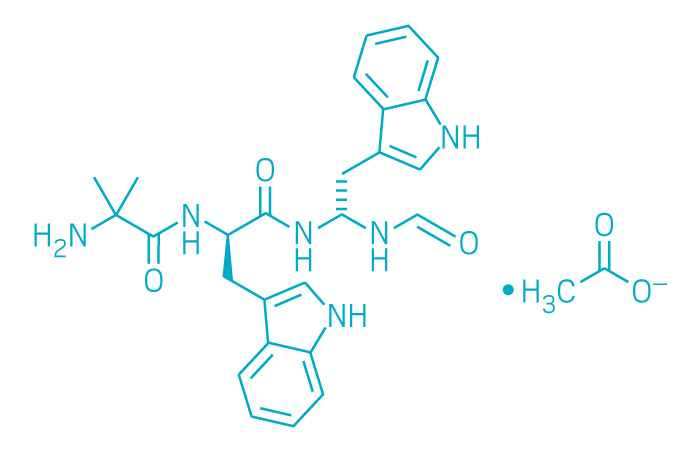

Macrilen (Small Molecule)

Active ingredient: Macimorelin acetate

Applicant: Aeterna Zentaris

Indication: Adult growth hormone deficiency

Mechanism of action Ghrelin mimetic

Wholesale acquisition cost*: N/A

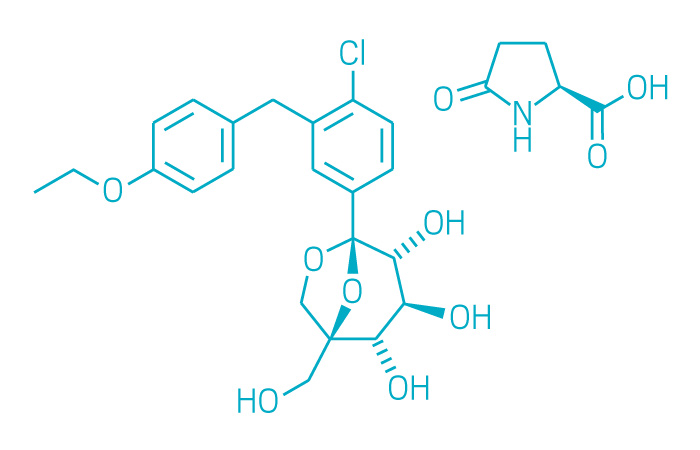

Steglatro (Small Molecule)

Active ingredient: Ertugliflozin

Applicant: Merck & Co./Pfizer

Indication: Type 2 diabetes

Mechanism of action SGLT2 inhibitor

Wholesale acquisition cost*: N/A

Giapreza (Peptide)

Credit: La Jolla Pharmaceutical

Active ingredient: Angiotensin II

Applicant: La Jolla Pharmaceutical

Indication: Hypotension in sepsis or critical illness

Mechanism of action Synthetic human angiotensin II

Wholesale acquisition cost*: N/A

Pfizer, which in 2016 had a lone approval that came only through a midyear acquisition, also scored three new products last year. However, it must share rights to two of them: the cancer immunotherapy Bavencio, which came to Pfizer in 2014 through a multi-billion-dollar deal with Germany’s Merck KGaA, and the diabetes treatment Steglatro, an internally developed drug that in 2013 Pfizer chose to codevelop with U.S.-based Merck & Co.

For others, the drought persisted. Although Bristol-Myers Squibb continued to expand the types of cancer that are treated with its existing immuno-oncology drugs, 2017 was the company’s second year in a row without a new product approval.

The drug industry’s record-breaking productivity does come with caveats. Although FDA said 33% of the products it approved belonged to new classes of compounds, most drug industry watchers would consider several of them to be older drugs.

For example, FDA’s list of first-in-class drugs includes Emflaza, a decades-old corticosteroid approved for the first time in the U.S. to treat Duchenne muscular dystrophy. A handful of other treatments either are similarly old drugs just now reaching the U.S. market or work against older protein targets now associated with new diseases.

Cancer treatments continued to dominate the list, representing over a quarter of all new molecules approved last year. However, many of the new oncology drugs are not especially unique and work by the same mechanism of action as already marketed drugs. The approval list included two more CDK4/6 inhibitors, two more PD-L1 inhibitors, and more compounds that block the proteins PARP, BTK, and ALK.

The new cancer treatments were the primary beneficiaries of FDA’s effort to speed development of potentially important new drugs. Of the 12 oncology products approved, nine had breakthrough therapy designation (BTD), a status introduced in 2012. FDA has previously described BTD as triggering an all-hands-on-deck approach at the agency to ensure efficient and well-designed clinical programs for drugs that are novel or address an underserved disease.

The program has been growing quickly. Overall, 17 drugs approved in 2017 had BTD status. In 2015, which previously held the recent record for new drug approvals, just 10 products had the special status.

Beyond cancer, anti-infectives and drugs for rare diseases were the other beneficiaries of breakthrough status. According to the Tufts Center for the Study of Drug Development, BTD is significantly shortening drug development timelines. The average time from Investigational New Drug Application—asking FDA to begin clinical trials—to approval letter was 65 months for the 17 BTD drugs approved in 2015 and 2016, compared with 110 months for drugs approved without the status.

“I would say that’s pretty good confirmation that this is another FDA program that seems to be working,” says Christopher-Paul Milne, director of research at the Tufts center. “What has to come next is expansion into other therapeutic areas of need.”

That shortened development time, which in theory should mean lower R&D costs for companies focused on oncology, is not translating into lower prices. All 12 oncology drugs approved last year featured six-figure annual wholesale acquisition costs, the company’s list price before any rebates or discounts.

Although the biotech industry has been energized by the potential for new technologies and therapeutic modalities to tackle difficult-to-treat diseases, small molecules continue to dominate FDA’s docket. Conventional, chemically synthesized drugs represented almost two-thirds of the new molecular entities approved last year.

Still, compared with a decade ago, the new drug list last year featured a wider range of modalities, including peptides, enzyme replacement therapies for rare diseases, and an antibody-drug conjugate.

Industry insiders will notice that the tally of 46 does not include the two new therapeutic modalities that garnered the biggest headlines in 2017. Missing are Novartis’s in pharma Kymriah and Gilead Sciences’ Yescarta, both chimeric antigen receptor (CAR) T-cell therapies, a new class of drugs made by reengineering a person’s own T cells to seek and destroy cancer cells. Also absent is Spark Therapeutics’ Luxturna, the first-ever approved gene therapy for a genetic condition. Luxturna treats a rare form of blindness.

C&EN has long tracked FDA’s actions on new molecular entities, and these cellular treatments—the approval of which the agency called “historic”—fall outside that category. Overall, FDA gave the green light to a combined 56 new molecular entities and biologic therapies.

Similarly, the list does not capture another groundbreaking approval that arrived in 2017. In May, FDA green-lighted Merck & Co.’s cancer immunotherapy Keytruda for use in anyone harboring a specific genetic profile.

Keytruda had already been on the market for three years for a variety of cancer types. But last year the agency gave the drug its first “tissue agnostic” approval, meaning that a genetic mutation rather than the location of the cancer—lung or colon, for example—guides use of the treatment.

Soon after coming on as FDA commissioner on May 9, Scott Gottlieb signaled his intention to ease the path for other tissue-agnostic drugs, and he quickly acted: In December, the agency released draft guidance to clarify the clinical development for such treatments.

“When drugs successfully target these molecular mistakes to reverse the effects of different diseases, we need a development pathway that allows the new drug to pursue approval in each of these novel settings on the basis of the molecular marker that the drug targets,” Gottlieb said when the draft guidance was released.

Even as the breadth of modalities and clinical pathways expands, the agency said that every drug in 2017 was approved within the review time frame required by law; many applications actually got the nod before the deadline.

Looking ahead, the agency appears determined to continue partnering with companies to make the development process for innovative drugs even more efficient.