Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Economy

Petrochemical prices spike after Saudi bombings

Concerns are raised about the supply of ethylene glycol and polyethylene

by Alex Scott

September 18, 2019

| A version of this story appeared in

Volume 97, Issue 37

The bombings of Saudi Aramco’s oil-refining complexes in Khurais and Abqaiq, Saudi Arabia, on Saturday, Sept. 14, caused a spike in prices for oil and some petrochemicals due to concerns about a tightening global supply.

The attacks, which US officials are linking to Iran, forced Saudi Aramco to suspend production of 5.7 million barrels of crude oil per day. That’s half of Saudi Arabia’s oil production and 5% of global output. According to news reports, the attackers launched at least 20 drones along with other missiles and hit 14 storage tanks and three processing trains.

Production at the Khurais complex resumed 24 h after the attack, Saudi Aramco CEO Amin H. Nasser said at a press conference. Production at the Abqaiq refinery is back up to 2 million barrels per day—around 50% of full production—and will return to full production by the end of September, Nasser said.

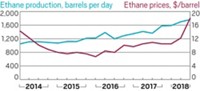

Chemical plants at the complexes don’t seem to have been hit. Still, following news of the attacks, prices for ethylene glycol and polyethylene, the region’s two main chemical exports, rose in Asia. Spot prices in China for ethylene glycol, known as MEG, surged almost 10% compared with the week earlier, says Salmon Lee, head of polyesters for the market research and consulting firm Wood Mackenzie. “MEG market participants are concerned about the disruption in feedstock supplies to assets producing MEG in Saudi Arabia, which is the world’s biggest exporter of the polyester intermediate,” Lee says.

The price of crude oil spiked by about 20% to almost $72 per barrel after the attacks. It later eased after reassurances from Saudi officials about security of supply.

Despite Saudi Aramco’s assertion that production will be back to 100% by the end of September, analysts at IHS Markit say the most likely scenario is that the return to normalcy will take between 30 and 120 days.

Follow-up attacks are a concern. “What was a risk scenario has become a reality,” says Daniel Yergin, vice chairman of IHS Markit. “Two things will jangle the oil market in coming days—how long the recovery and what comes next.”

CORRECTION

This story was updated on Sept. 19, 2019, to correct the date of the bombings of two Saudi Aramco oil refineries. The bombings occurred Saturday, Sept. 14, not Sunday, Sept. 15.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter