Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

At BIO International Convention, whispers of an M&A return

Pharma executives say they’re looking to buy early-stage candidates

by Rowan Walrath

June 7, 2024

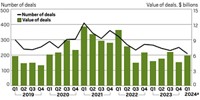

For the past 2–3 years, biotechnology investors and large pharmaceutical companies alike have been keen to buy late-stage assets—drug candidates that have already been tested in humans, which minimizes the amount of risk a buyer would take on.

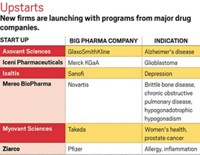

If decision-makers at the 2024 BIO International Convention in San Diego are to be believed, that’s about to change. Business development heads at pharmaceutical giants including Bayer, Johnson & Johnson, and Novo Nordisk are publicly discussing their willingness to acquire, or at least partner on, preclinical and Phase 1 drug candidates.

“Oftentimes, you will actually have more value-creating opportunities with early-to-midstage deals,” Nauman Shah, global head of business development for Johnson & Johnson’s Janssen division, said on stage on Monday. “For us, it’s not necessarily about struggling with finding the capital to fund a large deal.”

Indeed, Big Pharma is collectively sitting on a veritable ton of cash: more than $1 trillion at the end of March, according to EY’s latest Beyond Borders report. Arda Ural, EY’s Americas industry market leader for health sciences and wellness, estimated during a webinar at the end of May that pharma firms had $1.4 trillion sitting in balance sheets, “ready to be deployed.” That number goes up several fold if securities are taken into account, Ural said.

Last year closed out with $179 billion in biopharma M&A, according to the EY report, mostly driven by a handful of multibillion-dollar megadeals. By and large, the acquired companies—Seagen, Karuna Therapeutics, and Prometheus Biosciences, among others—had drug candidates in mid-to-late-stage clinical studies.

“Because of the activity last year . . . you’ve evaporated a lot of the large late-stage opportunities that were out there,” Shah said this week. “Many companies have deployed a lot of capital last year, and they are simply taking a little bit of a breather to recoup.”

According to Shah, Johnson & Johnson had most of its global business development team on-site at BIO. The team is on the hunt for drug candidates in several therapeutic areas: oncology, neurodegenerative and neuropsychiatric diseases, and possibly weight loss, although it will be difficult to find the right asset given the dominance of GLP-1 agonists.

Novo Nordisk, meanwhile, is looking to license potential treatments for diabetes, weight loss, cardiovascular diseases, and rare diseases, particularly those that affect the blood. The opportunities for dealmaking are near boundless for Novo Nordisk, thanks to the wild commercial success of semaglutide medications Ozempic and Wegovy.

The Danish pharma company started planning early, according to Novo Nordisk’s global head of business development and M&A, John McDonald. Speaking on stage on Tuesday, McDonald said he joined the company in 2018 because it predicted that semaglutide had blockbuster potential, which would have two major consequences: it would give the company a large war chest, and it would create a need to replenish the rest of Novo Nordisk’s pipeline. McDonald was tasked with finding the right candidates to take advantage of that opportunity to replenish the pipeline with that cash.

“[We’re] not at a place where our back is to the wall and we’ve got to buy something that’s big,” he said. Instead, the company is eyeing early-stage assets, which McDonald said could yield a better return for investors than late-stage ones.

Bayer is taking a similar approach. Juergen Eckhardt leads both the company’s investment arm, Leaps by Bayer, and its pharmaceutical business development and licensing team. The two often work hand in hand—Bayer sometimes wholly acquires Leaps-backed companies, as it did with BlueRock Therapeutics in 2019.

“We’re constantly active in the market. Whether it’s a license or a partnership or an acquisition needs to be seen,” Eckhardt said in an interview with C&EN. “Acquisition is just one of the tools that you have in your toolbox, right? . . . We’ll see whatever the right partnering approach is. We will be looking forward to more partnerships.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter