Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Inorganic Chemicals

Sodium comes to the battery world

Sodium-ion technology is ready, cheap, and safe, but can it oust lithium ion?

by Alex Scott

May 24, 2022

| A version of this story appeared in

Volume 100, Issue 19

“What a time it is to be a battery chemist—on paper, some are even multimillionaires,” says Jerry Barker, chief scientist and founder of the battery firm Faradion and a chemist who has been discovering battery materials for decades.

Breakthroughs in lithium-ion battery technology are being registered almost daily. “I can’t keep up with it all,” Barker says. Gigafactories for making lithium-ion batteries are appearing with increasing frequency. It would take something extraordinary to knock Li-ion battery technology off its perch.

And yet lithium has a fundamental problem. Demand for the element is so great for applications including electric vehicles, portable electronic devices, and stationary energy units that lithium mining companies are struggling to keep up. “The price of lithium will stay high,” says Michael Sanders, senior adviser at the consulting firm Avicenne Energy, speaking at the International Battery Seminar & Exhibit in March. In addition, about 90% of the world’s supply of lithium is controlled by Chinese companies.

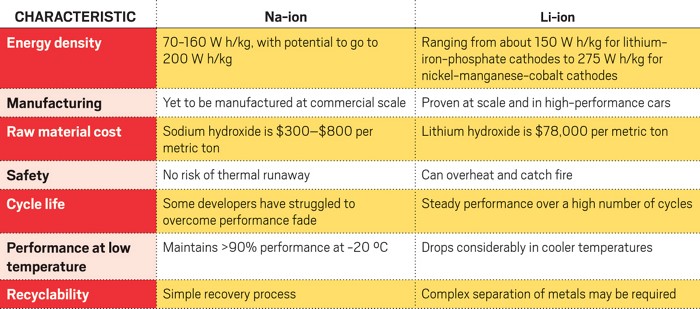

As a result, batteries based on sodium are gaining attention, especially from Western companies seeking a secure supply chain for battery materials. The Achilles’ heel of sodium-ion batteries is that they can store only about two-thirds of the energy of Li-ion batteries of equivalent size. Developers of Na-ion batteries say they are steadily increasing the energy density of their prototypes. None are commercial yet, but serious competition for lithium could soon be on the way.

“Price of lithium has gone to insane levels!” Tesla CEO Elon Musk tweeted April 8. “Tesla might actually have to get into the mining & refining directly at scale, unless costs improve. There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.” Musk pointed to data from the information service World of Statistics showing that the price of lithium hydroxide had risen to $78,032 per metric ton (t) from $6,800 in 2019.

Meanwhile, the price of sodium hydroxide, a common sodium-ion battery precursor, is below $800 per metric ton. While lithium must be extracted from rocks or brine, battery-grade sodium hydroxide is readily produced during the electrolytic conversion of salt into chlorine.

Cost is indeed a key differentiator between lithium and sodium ion, according to Chris Wright, executive chairman of Faradion, which is developing sodium-ion batteries.

Sodium or lithium?

“The bill of materials for a sodium-ion cell is about one-third cheaper than for an equivalent one made from lithium ion,” Wright says. Na-ion batteries also perform well at as low as –20 °C and are not at risk of thermal runaway, “unlike some Li-ion batteries, which have been known to catch fire,” he adds.

Rechargeable sodium-ion batteries are similar in construction to lithium-ion ones. During charging, Na ions move from a sodium- and iron-containing cathode through a liquid electrolyte and across a polymer barrier to a hard carbon anode. On discharge, the sodium ions return from the anode to the cathode.

Faradion’s batteries have an energy density of about 160 W h/kg, similar to that of older Li-ion batteries featuring a lithium iron phosphate (LFP) cathode. At least for now, sodium ion’s relatively poor energy density precludes its use in fast electric vehicles and limits its applications largely to stationary energy markets.

Still, the consulting firm Wood Mackenzie forecast in a 2021 report that Na-ion batteries have the potential to mitigate some of the supply chain pressure on LFP and newer Li-ion batteries containing nickel, manganese, and cobalt. The firm forecast that production of Na-ion batteries will reach 20 GW h by 2030, up from pilot-scale production quantities today. Total battery production capacity in 2030 will be about 2,800 GW h, according to Avicenne’s Sanders.

Sodium ion’s lower energy density, which previously held back its use in batteries, may not be such an issue after all, Wright says. “People have realized that for many applications, a slightly lower energy density is not as commercially significant as was once thought,” he says.

LFP-based batteries, which were almost written off 8 or 9 years ago, are taking an increasingly large share of the market, Wright says. One reason is that newer, more energy-dense Li-ion cells have high heat output, which means they require more space for cooling, he says.

Through improvements in cell architecture and component engineering, Faradion and other developers of Na-ion batteries expect to improve the energy density of their batteries in the next few years. Faradion is targeting 190 W h/kg. “Our latest understanding shows sodium-ion’s performance in batteries could become better than we thought,” Barker says.

Executives at India’s Reliance Industries certainly think sodium-ion technology is well positioned to carve out a niche in the battery market. The industrial giant acquired Faradion in January for $135 million and has pledged to invest $35 million in the British firm to commercialize its technology. Reliance plans to build a Na-ion battery factory in Jamnagar, India, for applications such as slower electric vehicles, like rickshaws, and stationary power storage.

Faradion is not the only Na-ion company with near-term plans for commercial production. The California-based start-up Natron Energy unveiled plans earlier this month to open a facility in 2023 to produce 0.6 GW h of Na-ion batteries annually. Rather than build a plant from scratch, Natron has partnered with Clarios to convert a portion of that firm’s Li-ion battery plant in Michigan to sodium-ion technology.

Natron uses a sodium material based on the pigment Prussian blue for both its anode and cathode. The cathode is rich in iron, while the anode is rich in manganese. “The materials and the chemistry are where Natron innovates; the manufacturing techniques are all standard,” says Rob Rogan, Natron’s chief business officer.

The company has outsourced production of its Prussian blue compound to Arxada, Lonza’s former specialty chemical business. Arxada will make the material, including the precursor hydrogen cyanide, in Visp, Switzerland.

Natron batteries have an energy density of about 70 W h/kg—similar to that of lead-acid batteries and too low for most electric vehicles. “We have relatively low energy density but extremely high power density,” Rogan says. “What we’re finding is that as the world’s energy transitions, there are different battery technologies that are suited for certain applications. Our batteries are designed to deliver huge amounts of power over short durations.”

As a result, Rogan says, the batteries are suitable as auxiliary power for industrial applications such as data centers, a market that could be worth $30 billion annually by 2027.

Natron’s transition from lab to mass production has been a long time coming. The company was founded in 2012 on technology developed by CEO and cofounder Colin Wessells while earning his PhD at Stanford University. The company has raised about $120 million in funding and received $25 million in grants and support from Advanced Research Projects Agency–Energy, a US government agency.

Altris Energy also recently announced plans to build its first commercial Na-ion battery plant. The Swedish start-up secured $10.5 million in February, bringing its total funding to about $12 million.

Uppsala University postdoc Ronnie Mogensen and associate professors William Brant and Reza Younesi founded Altris in 2017. Their interest in sodium-ion technology was sparked by a study by Nobel laureate John B. Goodenough and colleagues about Prussian white’s potential as a cathode material in Na-ion batteries (J. Am. Chem. Soc. 2015, DOI: 10.1021/ja510347s).

Altris’s Prussian white compound, an analog of Prussian blue that the firm has named Fennac, is composed primarily of iron and sodium. The company’s anode is made from hard carbon sourced from biomass, its electrolyte is fluorine-free, and its separator is derived from cellulose fiber. “Beyond the Fennac-based cathode, each and every one of the cell’s components are drastically improved compared to rival lithium-ion cells with regards to the sustainability of the materials used,” Altris says.

Before founding the firm, Mogensen and Younesi had selected Prussian white as a cathode material to suit a polymer electrolyte they had been developing. At the time, the only way to make Prussian white was in a pressurized boiler via a process that involved the formation of cyanide. “It was a potential cyanide bomb, so the university would not allow them to make it in any volume,” says Altris chief technology officer Tim Nordh. The two eventually developed a safer process that became the basis of the company, he says.

Altris’s battery cell has an energy density of about 150 W h/kg. “With this we are already in the LFP space.” With tweaks such as reducing the volume of electrolyte, increasing its energy density to 200 W h/kg “is not unreasonable,” Nordh says. Altris’s Fennac could still be years away from powering electric vehicles, Nordh says, as the qualifying tests for automotive batteries are extensive. The company is therefore initially seeking to market Fennac for use in stationary batteries.

In addition to using inexpensive starting materials, Altris expects to save money on solvent costs. Lithium-ion cathode production typically requires use of the solvent N-methyl-2-pyrrolidone, which the European Chemicals Agency classifies as a substance of very high concern. As a result, Li-ion cathode plants need sophisticated and costly drying rooms to recover solvents. Altris uses a water-based solvent to make its sodium-ion cathodes, Nordh says.Nordh is also happy to see that the energy density of a sodium-ion battery being developed by China’s Contemporary Amperex Technology, the world’s largest lithium-ion battery producer, “is about the same,” he says.

CATL declined to provide C&EN with information about its Na-ion battery technology, although the company disclosed last year that it expected to begin making commercial volumes in 2023. It reported previously that it had developed a Prussian white cathode with a porous hard-carbon anode.

The case for sodium would be even stronger if chemists could create a battery featuring a sodium metal anode. It would have an energy density beyond 230 W h/kg—enough to compete with today’s higher-performing Li-ion batteries.

One of the challenges of making such a battery is preventing the formation of the dendritic structures that can cause short circuits. Lithium metal battery developers such as QuantumScape and Factorial Energy say they have dendrites under control, but Nordh says the structures that can form in sodium metal batteries are bigger.

R&D for sodium metal batteries is in general far behind that for lithium metal batteries, but there is speculation that CATL is close to producing one. Success would constitute a major step forward in battery technology.

Meanwhile, sodium-ion battery developers are poised to begin moving from pilot- to commercial-scale production. Supply chain issues with lithium are the opening they have been waiting for. If sodium ion is going to steal market share from lithium ion, now is the time.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter