Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Mergers & Acquisitions

Lilly strengthens autoimmune pipeline with purchase of Dice

The deal contrasts with the firm’s concerns for the future of small molecules

by Shi En Kim

June 22, 2023

Eli Lilly and Company has announced that it will acquire Dice Therapeutics, a San Francisco-based biotech that develops oral drugs for chronic autoimmune and inflammatory diseases. Under the terms of the deal, Lilly will pay approximately $2.4 billion in cash for the smaller company.

The Lilly deal is the latest in the multibillion-dollar strategic purchases by big pharma companies in the last few months. Earlier this year, Pfizer shelled out $43 billion for Seagen, followed by Merck and Co.’s $11-billion buy of Prometheus Biosciences and Novartis’s $3.2-billion deal to purchase Chinook Therapeutics. In all these deals, the newly acquired company had at least one mid- to late-stage drug candidate in the works that complemented the acquirer’s pipeline.

In this new case, the complementarity relates to the field of interleukin-17 (IL-17) taming treatments. Dice is developing two inhibitors of the pro-inflammatory signaling molecule while Lilly has an anti-IL-17 monoclonal antibody called ixekizumab approved for plaque psoriasis.

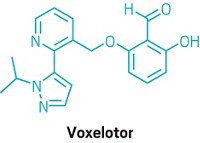

There’s an argument to be made for why Lilly would want yet another IL-17-targeting drug candidate. Dice’s portfolio exclusively consists of small molecules, and this class of drugs is generally more convenient to administer and cheaper to manufacture than biologics. But last December Lilly expressed a negative opinion on the investment future of small-molecule therapeutics when it issued a statement excoriating the Inflation Reduction Act for its drug pricing provisions. The new stipulations allow the government to negotiate drug prices with the companies that develop them, thereby tanking future profit margins. Small molecule drugs are up for pricing negotiations 9 years after their launch, compared with the 13-year free-pricing period for biologics. “Small molecule medicines are unfairly disadvantaged by the law,” Lilly sayss in the statement.

It seems like an about face that the company is now buying a small-molecule focused company, says Cody Powers, a principal at the management consulting firm ZS Associates. “I personally was surprised, this acquisition being around small molecules.” Powers speculates that perhaps Lilly’s executives are banking on the DC-806 to be a bestseller, making them enough to justify Dice’s price tag in the shortened 9-year window.

The rate of big pharma acquisitions has been ticking up in the last 6 months after an industry-wide slowdown in late 2021. An atmosphere of low investor confidence has made it difficult for development-stage start-ups to raise capital, according to Powers, so they’ve become more receptive to acquisition offers from fully-fledged firms sitting on cash. Going public is still many start-ups’ dream, Powers says. “A lot of them still have the aspiration where they want to become the next Vertex.” But getting bought up is still a respectable exit and no small consolation prize.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter