Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Start-ups

Editorial: Drugs versus chemicals in the start-up world

by Michael McCoy

November 10, 2023

| A version of this story appeared in

Volume 101, Issue 37

For most of the 9 years that C&EN has published its 10 Start-Ups to Watch feature—which appears this week on page 16—we’ve assessed drug and materials companies by separate financial standards.

Start-ups focused on drugs typically raise much more money than materials firms in series A or other early funding rounds. For example, Alltrna, one of the three drug discovery firms we profiled last year, had $50 million in investor funding when it launched in 2021. The other two each raked in $100 million or more in their early investment rounds.

By contrast, the chemical, agricultural, and clean technology start-ups we profiled were lucky to hit $30 million in their series A investment rounds, the stage in which companies typically transition from a promising concept to a full-fledged business.

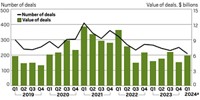

Sure, 10 companies are a small sample. But figures from the venture capital data firm PitchBook point to the same dichotomy. From 2020 through 2022, the median series A for pharmaceutical start-ups tracked by PitchBook was about $15 million. For companies focused on chemicals, batteries, or other materials, the median series A was $9 million.

Pharmaceutical deals are also way more plentiful: PitchBook found 1,200 series A investment rounds during those 3 years, compared with about 100 deals in chemicals.

A big reason for these discrepancies is that drugs are protected by patents. In the US, firms that win the Food and Drug Administration’s approval for a new pharmaceutical enjoy 20 years of patent protection, starting on the date a patent was filed. The drug approval process eats up several of those years, but companies that successfully navigate it and reach the market generally have more than 10 years free of worries about direct competition.

This period of exclusivity is built into the venture capital industry’s valuation of drug start-ups. Investors know that companies lucky enough to win FDA approval have hit the jackpot and will either be racking up huge profits or getting takeover offers from established drug firms.

It has long been thus. But climate change—and the government money being spent to try to stave it off—may be rebalancing where investors put their money.

The news section of today’s magazine has a story about the biobased chemical start-up Solugen (page 9). Solugen boasts a quirky technology for coproducing hydrogen peroxide and organic acids—a process that it says is carbon negative. When Solugen was one of C&EN’s 10 Start-Ups to Watch in 2018, it had raised a mere $18 million in funding. Since then, the Houston-based firm has brought in a whopping $600 million from investors.

Companies developing materials for lithium-ion batteries are also vacuuming up investment. My colleague Matt Blois, who was the editorial lead for 10 Start-Ups to Watch this year, points out that just three such firms—Ascend Elements, Group14 Technologies, and Redwood Materials—have raised more than $5 billion combined through equity investments, grants, and favorable government loans since the beginning of 2022. The US Inflation Reduction Act and similar legislation provides funding and other incentives to these firms, reducing financial risk for private investors.

Growth in investor enthusiasm for chemical start-ups is also apparent in the 10 companies profiled in this issue. As usual, aspiring drug companies with good technology had no problem raising money, but some of the chemical and materials firms were also quite successful. The low-carbon cement firm Sublime Systems, for example, has raised $50 million. Mitra Chem, a battery material developer, has $60 million and counting in its coffers. H2Pro, a developer of electrolyzers for making green hydrogen, has raised more than $100 million.

Like in the drug market, the government had a hand in these lofty numbers. Like in the drug market, the chances of long-term financial success are slim. And like in the drug market, materials firms are tackling real problems that need solutions.

Views expressed on this page are those of the author and not necessarily those of ACS.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter