| Editorial lead: | Matt Blois |

| Project manager: | Michael Sheehan |

| Writers: | Craig Bettenhausen, Matt Blois, Britt E. Erickson, Bethany Halford, Laura Howes, Laurel Oldach, Mark Peplow, Alex Scott, Gina Vitale, and Vanessa Zainzinger |

| Editors: | Matt Blois and Michael McCoy |

| Creative director: | Robert Bryson |

| Art director: | William A. Ludwig |

| UI/UX director: | Kay Youn |

| Web producers: | Luis A. Carrillo, Ty A. Finocchiaro, Jennifer Muller, and Seamus Murphy |

| Production editors: | Allison Elliot, Jonathan Forney, David Padgham, Raadhia Patwary, and Sydney Smith |

| Copyeditors: | Michele Arboit and Sabrina J. Ashwell |

| Audience Engagement editor: | Liam Conlon |

Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

TThe standard career path for promising young chemists has long involved earning a PhD, honing skills further in a postdoctoral research position, and ultimately landing a job at a university, a national laboratory, or a multinational chemical firm. But there is an alternative route. Rather than trying to fill their curriculum vitae with as many peer-reviewed publications as possible, chemists from all over the world are using their skills to start new companies. Often, they’re motivated by the chance to slow climate change, combat pollution, or feed hungry people. Several of the founders in this year’s 10 Start-Ups to Watch fit this description.

For Samantha Anderson, it was impossible to stand on the sidelines watching plastic pollution get worse. So while finishing a PhD at the Swiss Federal Institute of Technology, Lausanne (EPFL), she cofounded DePoly, a company that’s developing a better way to recycle polyethylene terephthalate.

Similarly, after earning his PhD, Ryan Pearson went straight to Cyclotron Road, a fellowship program at Lawrence Berkeley National Laboratory that helps scientists turn their research into companies. That’s where Cypris Materials got off the ground. The company is developing new colorants that it hopes will reduce carbon emissions and pollution from coloring clothes, cars, and other products.

Lately, C&EN’s pages have been filled with stories about start-ups founded by young chemists. A piece in July dug into Pivot Bio, a company trying to replace carbon-intensive synthetic fertilizers with microbes. The firm, now valued at more than $1 billion, was founded in 2011 by a pair of PhD candidates. A cover story in March featured Twelve, which hopes to make jet fuel out of carbon dioxide. That company took shape during Etosha Cave’s 2015 Activate Fellowship, a 2-year program that gives scientists funding and technical resources to turn themselves into founders.

Not all companies in this year’s selection have stories like this. Some of them were founded by serial entrepreneurs with several companies under their belts. Others were catalyzed by government support or started by veterans from big companies who abandoned the security of incumbent firms to try something audacious.

We considered hundreds of star-ups before settling on our finalists. They came from reader submissions, the pages of C&EN, and our reporters, who talked to chemists and entrepreneurs. Keep an eye on them. We're excited to see what they do.

-

Belharra TherapeuticsOpen or Close

Probes scour protein surfaces to reveal binding sites for undruggable proteins

by Laura Howes

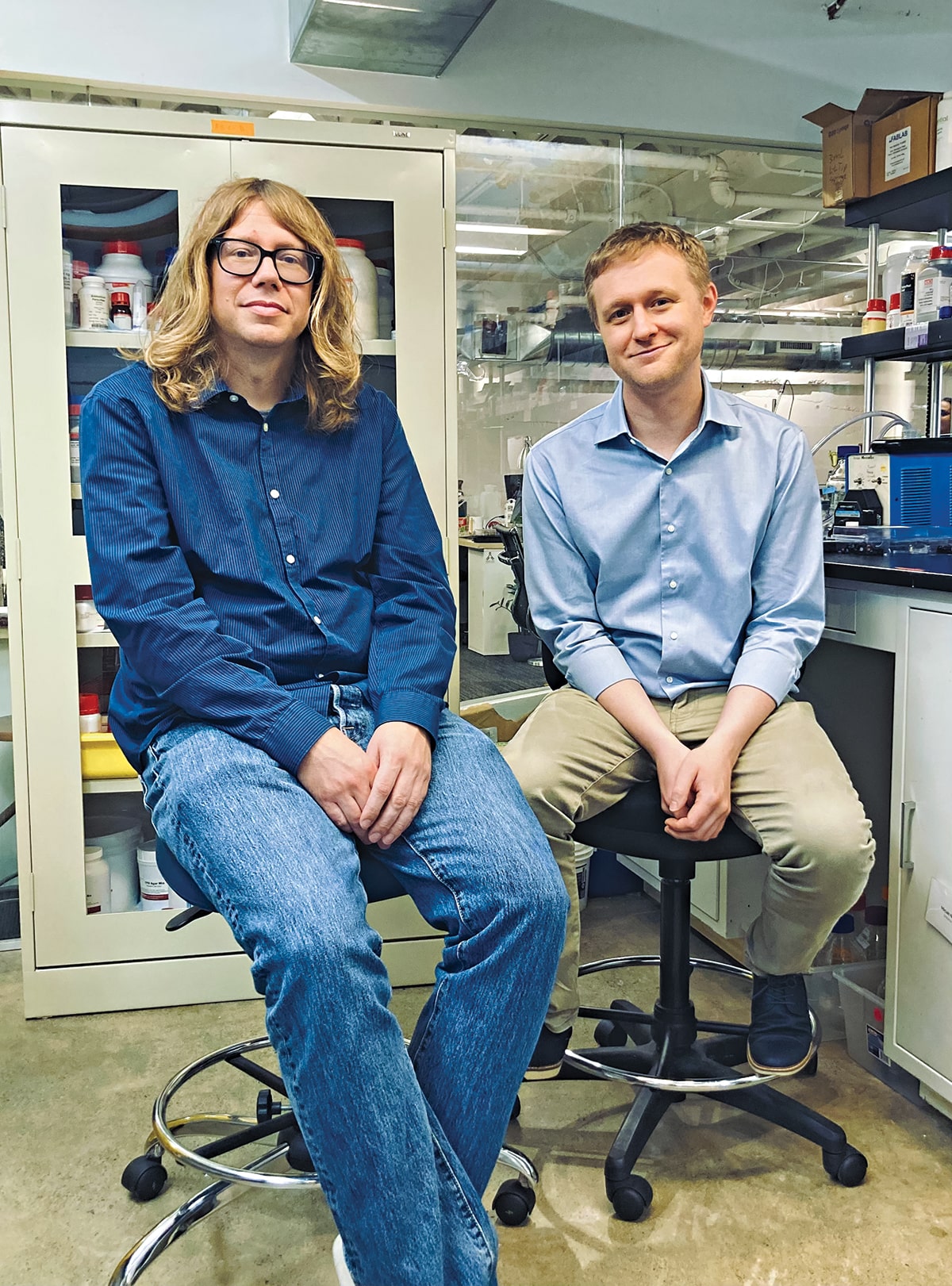

Belharra Therapeutics chief scientific officer Gary O'Neill (left) and CEO Jeff JonkerCredit: Belharra Therapeutics

Belharra Therapeutics chief scientific officer Gary O'Neill (left) and CEO Jeff JonkerCredit: Belharra Therapeutics

At a glance

Launched: 2023

Headquarters: San Diego and San Francisco

Focus: Drug target identification

Technology: Chemoproteomic profiling of the cellular proteome

Founders: Benjamin Cravatt, Christopher Parker, Stuart Schreiber, and John Teijaro

Funding or notable partners:

$130 million from Versant Ventures and GenentechTThere are many proteins involved in making people sick, but right now, small-molecule drugs target only a small fraction of them. The San Diego–based start-up Belharra Therapeutics wants to go after a wider swath, focusing on proteins that have never been targeted by a drug.

The story of Belharra, which came out of stealth at the beginning of this year, begins with Christopher Parker, a chemist at Scripps Research in California. As a postdoctoral scholar in Benjamin Cravatt’s lab at the same institute, Parker worked to build techniques for discovering pockets on proteins where drugs could bind. Parker continued that work when he started his own lab in 2018. He took the techniques he was working on to his Scripps colleague John Teijaro, an expert in immunology and persistent viral infections, and they had success binding Parker’s chemical probes to pockets on notoriously tricky immune proteins.

Parker and Teijaro went to Cravatt, who had founded several biotechnology companies, for assistance starting a company based on the technique. The trio then brought in Stuart Schreiber, a chemist at the Broad Institute of MIT and Harvard, to advise on how to use the platform for drug discovery.

The nascent company found support from the investment firm Versant Ventures. The first two employees were CEO Jeff Jonker, a biotech executive, and Chief Scientific Officer Gary O’Neill, who had been working at Abide Therapeutics, a start-up founded by Cravatt that was acquired by the Danish pharmaceutical company Lundbeck in 2019. O’Neill says he “jumped at the opportunity” to join the new company in 2021.

Belharra’s aim is to massively increase the identification of crevices on proteins where a ligand can bind. To do that, the team uses a library of probes to comb protein surfaces for undiscovered pockets, just like a rock climber might scour the surface of a cliff to find a handhold.

“We haven’t found anything we can’t ligand. Any pocket, any protein.”Jeff Jonker, CEO, Belharra TherapeuticsUnlike many other firms, Belharra runs its assays on proteins in cells rather than on purified proteins or static snapshots from structural studies. The complex environment of the cell provides better information about how the proteins look and interact in the real world, but only with the right technology to probe them.

When studying inside those cells, Belharra scientists use a library of noncovalent molecular probes to scan the surface of all the proteins they find. The library has enantiopairs of each probe since differences in chirality can change how well molecules bind with proteins.

Belharra Therapeutics’ probes can lightly scan protein surfaces looking for ways to grip on, just like Yvonne Schmidt, Belharra’s director of medicinal chemistry, looks for handholds on a rock wall.Credit: Belharra Therapeutics

Belharra Therapeutics’ probes can lightly scan protein surfaces looking for ways to grip on, just like Yvonne Schmidt, Belharra’s director of medicinal chemistry, looks for handholds on a rock wall.Credit: Belharra TherapeuticsJonker says the technique allows Belharra scientists to investigate handholds that aren’t identified by more typical covalent tagging methods, which have more precise requirements, like needing electrophilic residues to latch on to. The Belharra approach provides more hits, and those hits help researchers seek out, detect, and map all the ways that proteins could bind with a ligand, Jonker says.

These tests are already proving to be a big success. The team says it has found over 4,000 new handholds that could lead to new drugs, even on floppy, tricky proteins and proteins where the pocket is hidden. “We haven’t found anything we can’t ligand,” Jonker says. “Any pocket, any protein.”

In-house, the team is keeping its focus where it all began: developing drugs for immunology and oncology. But Belharra’s scientists can’t by themselves advance everything they find. When the company came out of stealth at the beginning of this year, it already had an $80 million partnership with Genentech. That deal gives the Roche-owned firm access to neurological, immunologic, and oncologic disease targets that Belharra identifies.

Like many firms, Belharra is also looking to machine learning to give it an edge, but only where it makes sense. For now, Jonker says, that area is in helping researchers parse the data pile they are generating. Machine learning may ultimately help scientists predict and prioritize ligand-protein interactions for previously undrugged targets. And that means the firm will continue to work from two locations, and it is exploring how to best tap into the talent in San Francisco’s Bay Area while lab work continues further south.

-

Cypris MaterialsOpen or Close

Self-assembling copolymers create a rainbow of structural colorants

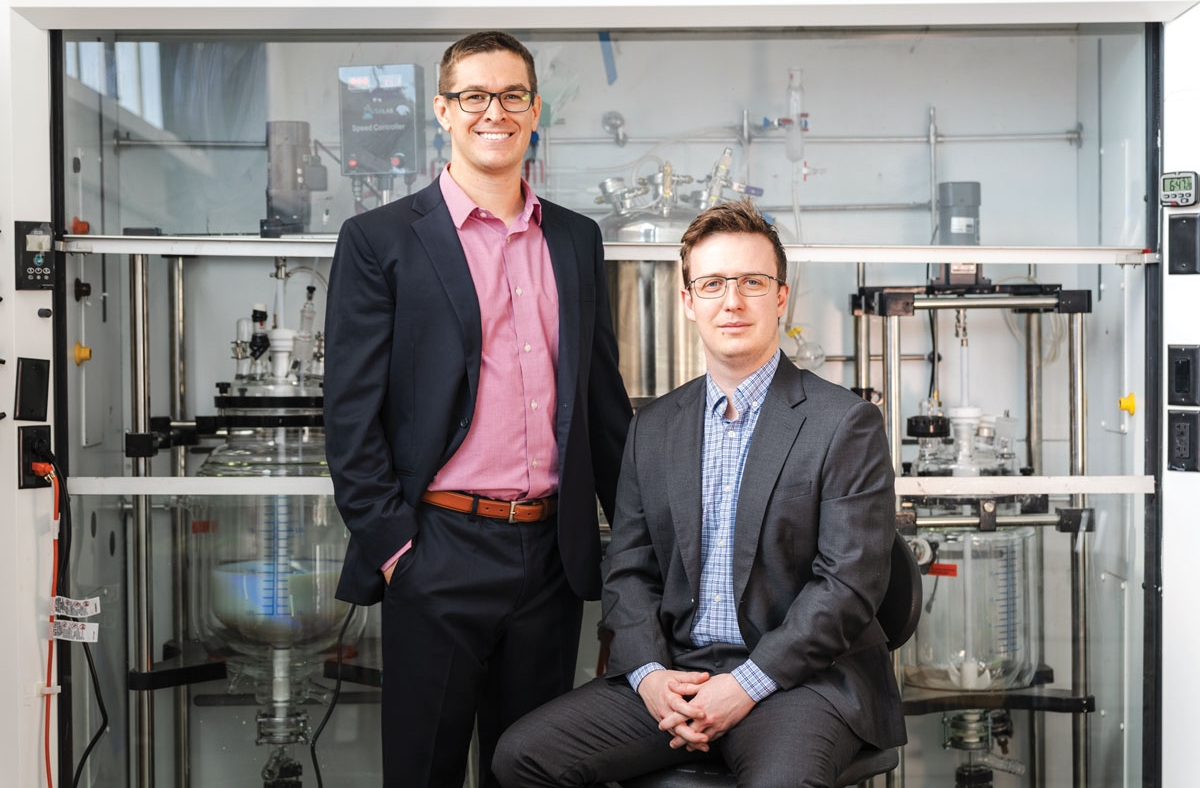

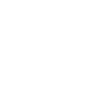

Cypris Materials cofounder and CEO Ryan Pearson (left) and cofounder and Chief Technology Officer Matthew Ryan at their lab in San Leandro, CaliforniaCredit: Cypris Materials

Cypris Materials cofounder and CEO Ryan Pearson (left) and cofounder and Chief Technology Officer Matthew Ryan at their lab in San Leandro, CaliforniaCredit: Cypris Materials

At a glance

Launched: 2019

Headquarters: San Leandro, California

Focus: Paints and coatings

Technology: Bioinspired structural color based on brush block copolymer technology

Founders: Ryan Pearson, Matthew Ryan, Raymond Weitekamp, Garret Miyake, and Robert H. Grubbs

Funding or notable partners:

$3.1 million in private capital and $3.2 million in nondilutive capital from Better Ventures, KdT Ventures, Activate Fellowship, the US National Science Foundation, and other investors and government supportTThe multicolored feathers of a peacock, the brilliant blue wings of a morpho butterfly, and the metallic golden shell of a Chrysina beetle have one thing in common: they get their stunning color from biological nanostructures that have exactly the right spacing to reflect certain wavelengths of light.

Scientists have long been interested in using this phenomenon to lend color to manufactured goods because traditional dyes and pigments require lots of water, energy, and harmful substances, such as heavy metals, aromatic amines, volatile organic compounds, and phthalates.

In 2016, Ryan Pearson, then a materials chemistry PhD student at the University of Colorado Boulder, heard the apparel giant Nike present its dye problem at an industry workshop he attended. “Color was this huge environmental footprint for them,” he says. “And that’s kind of when it all clicked for me.”

Structure-based colorants could offer an environmentally friendly option, but they have so far eluded commercialization because they tend to be costly and hard to manufacture reproducibly.

In 2019, Pearson cofounded Cypris Materials to solve those problems. The company reckons it has found a way to finally take structural color from the lab to the paint pot: it uses speedily self-assembling brush block copolymers.

When dissolved in a carrier fluid, such as an ultraviolet-curable monomer, brush block copolymers form neatly ordered layers that reflect light. The length of the copolymer chain determines the wavelength reflected. Short chains reflect shorter wavelengths of light, in the blue and green parts of the spectrum. Longer chains reflect longer wavelengths, such as reds.

Previous attempts to use these bottle-brush-shaped polymers to make colorants were hampered by a lack of density in their molecular structures—they were like a comb that lacks some of its teeth. This structure makes them less rigid and has kept scientists from making the polymers long enough to reflect all wavelengths of light.

Cypris is able to make particularly dense polymers with the help of a ruthenium catalyst system developed by one of its cofounders, the late Nobel Prize–winning chemist Robert H. Grubbs.

“It’s the next generation of coloring.”Ryan Pearson, CEO, Cypris MaterialsThe polymers’ rigidity allows the team to produce unusually large copolymers that can reflect anything from ultraviolet to near-infrared light. “A classic problem with structural color is people can’t make the polymers long enough to get all the colors of the spectrum,” Pearson says. “And that’s one problem that is addressed by this system.”

Coatings like paints and inks typically have four elements: binders, solvents, additives, and colorants. The coatings industry has already dealt with environmental issues associated with three of those elements, Pearson says. Most companies have moved from petrochemical to biobased binders, from organic chemicals to water as a solvent, and away from problematic additives like phthalates. But colorants have eluded replacement.

Cofounder and Chief Technology Officer Matthew Ryan (right) and Formulation Associate Scientist Gisella Esparza (left) review samples screen printed with Cypris Materials’ ultraviolet-curable structural color ink.Credit: Cypris Materials

Cofounder and Chief Technology Officer Matthew Ryan (right) and Formulation Associate Scientist Gisella Esparza (left) review samples screen printed with Cypris Materials’ ultraviolet-curable structural color ink.Credit: Cypris MaterialsBy removing the need for a traditional colorant, “we’re essentially eliminating the major contributor to the environmental footprint of a paint or ink,” Pearson says.

The company’s approach could reduce the need for traditional pigments and dyes across a number of industries, including cosmetics, printing, automotive, and apparel, says Jared Yarnall-Schane, director of innovation at the Biomimicry Institute, a nonprofit that named Cypris the runner-up to its 2020 Ray of Hope Prize. “Cypris Materials has a platform technology with wide market applications, meaning the environmental and business impact is quite large and attractive.”

In 2021, Cypris announced a partnership with BASF to develop coatings for the automotive industry. This collaboration is throwing the firm’s researchers in the deep end, Pearson acknowledges. “It’s one of the hardest markets—the color needs to stay on for long periods of time; it needs to be something that stays on even if you spill gasoline all over.” Meanwhile, the team is on track to start commercialization of other products in 2024.

“Colorants have been largely unchanged for hundreds of years,” Pearson says. “Cypris, along with other companies out there, is figuring out how to make color in a more sustainable and more exciting way. It’s the next generation of coloring.”

Correction: This story was updated on Nov. 20, 2023, to correct the carrier fluids that Cypris Materials uses. It uses solvents such as ultraviolet-curable monomers. It does not use aromatic solvents. -

DePolyOpen or Close

Recycling complex plastic waste for a circular economy

From left: DePoly cofounders Christopher Ireland, Samantha Anderson, and Bardiya ValizadehCredit: DePoly

From left: DePoly cofounders Christopher Ireland, Samantha Anderson, and Bardiya ValizadehCredit: DePoly

At a glance

Launched: 2020

Headquarters: Sion, Switzerland

Focus: Plastic waste recycling

Technology: Chemical depolymerization

Founders: Samantha Anderson, Bardiya Valizadeh, and Christopher Ireland

Funding or notable partners:

$18.1 million from investors, including BASF and BeiersdorfIIn 2018, reports in the mainstream media about plastic pollution reached a crescendo. Dead whales with bellies full of plastic trash appeared on the pages ofNational Geographic. Scientists voiced concerns about microplastics in our food, water, and air. Images of tropical bays choked with plastic debris offered visceral proof that our waste management systems were failing.

Samantha Anderson was a PhD student at the Swiss Federal Institute of Technology, Lausanne (EPFL), at the time, and she vividly remembers how these reports spurred her and her colleagues to take action. “We just decided that we were going to try and tackle it with chemistry and chemical engineering, because that’s what we knew,” she says.

With her EPFL lab mates Christopher Ireland and Bardiya Valizadeh, Anderson developed a process for recycling polyethylene terephthalate (PET) in complex waste streams that most recyclers reject. In 2020, the trio cofounded DePoly to commercialize the technology.

“We’re really trying to target all the really difficult stuff that nobody else would be dealing with,” says Anderson, who now serves as DePoly’s CEO.

PET is used to make plastic bottles, packaging, and polyester clothing, among other things. It’s also one of the few plastics that is already widely recycled. Clean bottles can be shredded, melted, and reprocessed. But this mechanical recycling process tends to produce lower-quality plastic, and it cannot deal with PET mixed with other plastics.

To save this mixed waste from incineration or landfill, DePoly uses chemical recycling to turn PET back into its starting monomers—terephthalic acid and ethylene glycol—which are the same quality as oil-derived monomers and can be used to make new PET products.

“We’re really trying to target all the really difficult stuff.”Samantha Anderson, CEO and cofounder, DePolyDePoly’s process is a form of alkaline hydrolysis. The company first takes unwashed, unsorted waste containing PET and shreds it. It then adds a basic aqueous solution along with a metal oxide such as titanium dioxide and illuminates the mixture with ultraviolet light. The team suspects that UV activates the metal oxide to generate radicals that help the reaction operate at room temperature and pressure—unlike previous hydrolysis-based depolymerization processes. The reaction can selectively turn PET into its monomers in as little as 10 min, leaving other plastics as solids that are easily removed.

As DePoly’s chief technology officer, Valizadeh has led its work to industrialize the laboratory-scale process that Anderson and Ireland initially put together. “The chemistry that they developed, the main beauty I saw in it, was the simplicity. That’s the dream for an engineer,” Valizadeh says.

DePoly recently raised $13.8 million in seed funding, and it currently has a 300 L reactor that can process about 50 metric tons (t) of waste per year. The funding will help the company scale that up 10-fold in a demonstration plant that should be commissioned in early 2025. BASF Venture Capital is a major investor in DePoly and has provided technical advice, Anderson says.

DePoly can recycle the polyethylene terephthalate in mixed plastic waste (shown here) into its monomers, terephthalic acid and ethylene glycol, which can be used to make fresh plastic.Credit: DePoly

DePoly can recycle the polyethylene terephthalate in mixed plastic waste (shown here) into its monomers, terephthalic acid and ethylene glycol, which can be used to make fresh plastic.Credit: DePolyThe process can handle mixed waste from the packaging, health-care, fashion, and chemical industries, as well as plastic waste collected from the ocean. “So far, we haven’t seen any limitations,” Valizadeh says.

DePoly hopes to make money at first by selling monomers to PET manufacturers rather than charging for waste processing, although its business model may change in the future. The firm has signed up one major customer and is in discussions with others.

The company will be able to sell the monomers at current market prices once it hits a production scale of 10,000 t per year, Anderson says. The products’ carbon dioxide footprint will be at least 65% lower than that of oil-derived materials, an improvement that should attract environmentally conscious customers. Anderson hopes that within 5 years, DePoly will have opened its first commercial plant at a 50,000 t scale.

DePoly is not alone in pursuing PET depolymerization. In France, Carbios is building an enzyme-based PET recycling plant; Canada’s Loop Industries and US-based Eastman Chemical are both applying methanolysis to break down PET; Revalyu Resources uses glycolysis to regenerate waste PET at a plant in India; and the Swiss firm Gr3n is developing microwave-assisted PET depolymerization.

Anderson says that these technologies have drawbacks. Some require much-higher- quality PET waste or depend on energy-intensive processes. Still, she emphasizes that a multitude of approaches can flourish in the burgeoning plastics recycling business. “There’s so much room in the market for all of us to grow,” she says.

-

Elicit PlantOpen or Close

Phytosterols could boost crop yields under drought conditions

Jean-François Déchant, CEO and cofounder of Elicit PlantCredit: Elicit Plant

Jean-François Déchant, CEO and cofounder of Elicit PlantCredit: Elicit Plant

At a glance

Launched: 2017

Headquarters: Moulins-sur-Tardoire, France

Focus: Biostimulants for row crops

Technology: Phytosterols that enhance crop resistance to water stress

Founders: Jean-François Déchant, Olivier Goulay, and Aymeric Molin

Funding or notable partners:

$27.5 million from Sofinnova Partners, ECBF, and othersWWater scarcity is a challenge for farmers in many regions, and climate change is making the problem worse. The French start-up Elicit Plant is tapping into the power of phytosterols to help boost yields for row crops like corn, soybeans, wheat, and sunflowers in the face of growing water shortages.

Phytosterols are lipids that form part of cell membranes in plants. They function as signaling molecules that trigger growth and other adaptive responses when plants are under stress. The chemicals have been used in cosmetic, health, and nutrition applications, but Elicit is the first to apply them to agriculture, according to CEO and cofounder Jean-François Déchant.

Elicit’s first commercial product, Best-a corn, contains a mixture of phytosterols extracted from plants. They’re designed specifically to increase corn yields under dry conditions. When taken up by the plants through their leaves, the phytosterols act as messengers, signaling to the plant to do what it does naturally when faced with water shortages: enhance root growth and close stomata on leaves to limit evapotranspiration. The key is to apply the product before conditions become dry to give the plant time to grow deeper roots.

The idea to use phytosterols in agriculture originated with a discovery by Elicit cofounder Olivier Goulay, who was working as a consultant for cosmetic laboratories about 7 years ago, Déchant says. “By serendipity they found that they had a candidate product for cosmetics that was working pretty good on plant health,” he says.

At the time, Déchant, an entrepreneur who had been working primarily in the cybersecurity space, was looking for a fresh start. Goulay was looking for a seasoned entrepreneur to help launch an agricultural biotechnology start-up and wanted to build a lab within a farm to test candidate products. The pair met in 2017 and partnered with farmer and agronomist Aymeric Molin to launch Elicit that year.

“We tested more than 100 product formulations on different crops under real farm conditions.”Jean-François Déchant, CEO and cofounder, Elicit PlantMolin’s farm covers over 1,000 ha in southwestern France, in the Nouvelle Aquitaine region, a destination popular for its vineyards, seaside resorts, and mild climate. Molin grows rapeseed, wheat, barley, sunflowers, millet, soybeans, and corn. Though the farm is in an idyllic setting, the soils are shallow, and water stress has a big impact on crop yields. About 5 years ago, Elicit tested its first candidate product on Molin’s crops, as well as on grapevines grown by a neighboring cognac producer.

“We tested more than 100 product formulations on different crops under real farm conditions,” Déchant says. One of the biggest challenges was getting the plants to take up the fatty phytosterols. “When you try to bring a droplet of oil into a hydrophilic environment, it doesn’t work very well,” he says. “So we figured out a specific composition to make it happen.”

Best-a corn needs to be applied only once and can be sprayed with the same equipment commonly used for pesticides. The product is currently available in some European countries, Brazil, and Ukraine. Elicit hopes to have the product available throughout Europe by the end of the year and is waiting for regulatory approval in the US.

A tractor sprays phytosterols on corn plants on an experimental farm in Charente, France.Credit: Elicit Plant

A tractor sprays phytosterols on corn plants on an experimental farm in Charente, France.Credit: Elicit PlantThe company is also optimizing phytosterols for row crops beyond corn. It recently announced plans to launch a phytosterol product for sunflowers grown in Europe and one for spring barley grown in France later this year. The company also has its eye on soybeans. Elicit opened an office in Brazil a few years ago because of the large soybean market there, Déchant says.

Results from field trials in France and around the world show that the formulations improve yields for many crops. Elicit claims Best-a can improve corn yields 10–12%.

Despite the promising results, the company faces skeptical farmers who aren’t convinced they need to fight climate change, Déchant says. Launching a product in Ukraine just weeks after the country went to war with Russia has also been challenging, he says. Rather than sell Best-a corn in Ukraine, Elicit decided to give it to farmers there in limited amounts for the first year to conduct some trials.

Getting regulators up to speed on using phytosterols as plant biostimulants is another challenge. Some countries are quicker than others, Déchant says. The key is that these products have no toxicity, he adds. “It helps us get through the regulators quite fast.”

-

H2ProOpen or Close

Making green hydrogen cheaper with a 2-step electrolyzer

by Alex Scott

H2Pro has a staff approaching 100, most of whom are scientists.Credit: H2Pro

H2Pro has a staff approaching 100, most of whom are scientists.Credit: H2Pro

At a glance

Launched: 2019

Headquarters: Caesarea, Israel

Focus: Efficient production of green hydrogen

Technology: Low-cost electrochemical process for generating hydrogen and subsequently oxygen in two steps

Founders: Hen Dotan, Gideon Grader, and Avner Rothschild

Funding or notable partners:

$107 million from Sumitomo, Yara, Breakthrough Energy, and other investorsMMost of the world’s hydrogen is made unsustainably from methane or coal, and today most of it is used to produce petroleum-based fuels and chemicals. But the start-up H2Pro says hydrogen could also be key to slowing climate change if it is made without fossil fuels. This can be done by taking hydrogen out of water using renewable electricity.

Scientists have long known how to extract hydrogen from water. But existing electrolyzers, the machines used to split water molecules, convert only about 70% of the electric energy they use into chemical energy, which is stored as hydrogen.

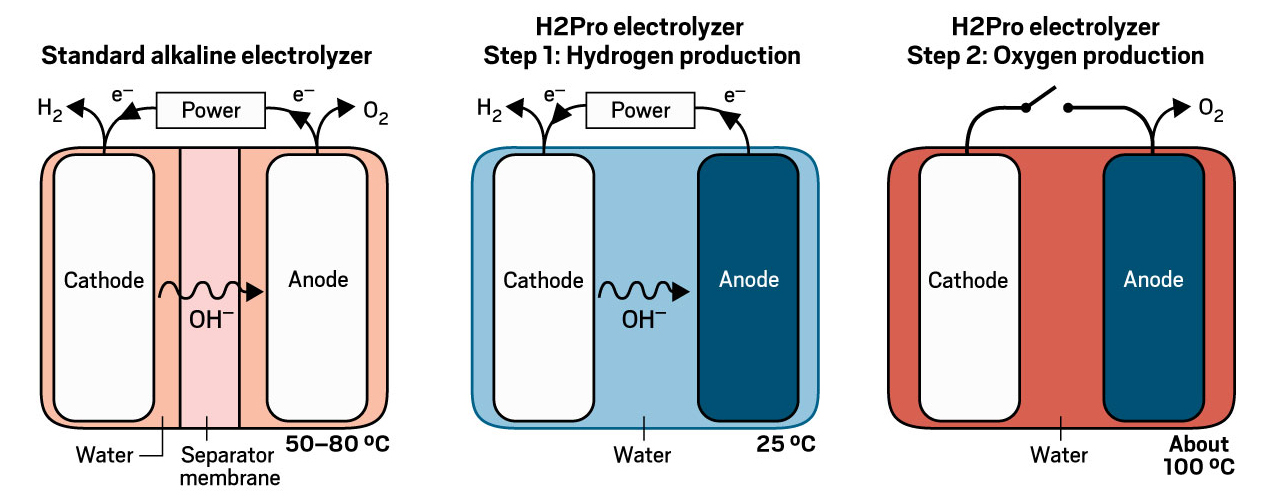

H2Pro has devised a two-step process that generates hydrogen and oxygen in separate steps, ensuring they don’t mix. Hen Dotan, H2Pro’s cofounder and chief technology officer, says his company’s technology converts about 95% of the electricity it uses into chemical energy, a rate that would yield substantial financial savings at commercial scale.

In H2Pro’s two-step process, hydrogen gas is released in an electrochemical reduction reaction at the cathode. Meanwhile, hydroxide ions (OH-) oxidize a nickel hydroxide (Ni(OH)2) anode into nickel oxyhydroxide (NiOOH), thereby closing the electrical circuit without generating oxygen. Subsequently, the electricity is turned off and the NiOOH anode reacts with water to release oxygen, transforming the anode back to Ni(OH)2, which is ready for the reaction to start over when electricity is reintroduced. Hydrogen production at the cathode takes place at ambient temperature, while the oxygen production at the anode is optimal at about 100 °C.

Since hydrogen and oxygen never mix in H2Pro’s process, the company doesn’t need to separate them with a membrane, the most expensive part of a standard electrolyzer. Dotan says that helps make the electrochemical thermally activated chemical (E-TAC) device, as H2Pro has named it, about 50% cheaper to build. Meanwhile, the second, thermal step requires almost no power and so leads to substantial savings in operating costs compared with standard electrolyzers.

“We started to think, ‘If we can get this process to scale up, then we can make a difference in the real world.’ ”Hen Dotan, chief technology officer and cofounder, H2ProDotan was part of a team that came up with the idea of a two-step electrolyzer while researching photoelectrolysis at Technion—Israel Institute of Technology. “The eureka moment happened in 2015 when we tried the process for the first time,” he says. “We started to think, ‘If we can get this process to scale up, then we can make a difference in the real world.’ ”

Dotan, along with Technion professors Gideon Grader and Avner Rothschild, brought in business experts and founded H2Pro in February 2019 after raising $1.5 million in seed funding. H2Pro has since raised over $100 million. Backers include venture capital firms as well as Yara, the Norwegian fertilizer company that aims to produce ammonia with low carbon emissions using green hydrogen as a starting material.

H2Pro is developing a membrane-free, highly efficient electrolyzer.Credit: Adapted from H2Pro

H2Pro is developing a membrane-free, highly efficient electrolyzer.Credit: Adapted from H2ProH2Pro’s latest iteration of its E-TAC device produces up to 10 kg of hydrogen per day. The company aims to start operating a pilot facility with a capacity of 200 kg per day from 400 kW of electricity in the next 2 years. A demonstration facility should follow a couple of years after that, says Rotem Arad, H2Pro’s director of business development.

In March, the company announced its first big collaboration: a partnership with Sumitomo, one of its investors. The Japanese firm, which aims to become a major producer of green hydrogen, will supply H2Pro with raw materials and manufacturing equipment for its demonstration plant. H2Pro is now in discussions with other potential partners, Arad says.

Existing electrolyzer technologies, which are based mostly on alkaline or proton-exchange membrane cells, have lower electrical efficiencies. Solid-oxide electrolysis cells, which are starting to emerge, have electrical efficiencies of about 90% but operate at an energy-sapping 600–900 °C. Anion-exchange membrane cells, with promising but unproven cell chemistry that allows for cheap electrode materials, are also starting to come to the market.

Meanwhile, H2Pro is looking to deepen its understanding of the basic chemistry involved in the E-TAC process. Grader and Rothschild continue to work as professors at Technion, providing H2Pro with a strong link to academic advances in the field. “I’m very excited by this because at my core I am a scientist much more than a manager,” Dotan says.

Energy levels at the company are high as it moves toward pilot production. “This is the most exciting thing I ever did in my life,” Arad says. “To make a difference in the world is the dream.”

-

Halda TherapeuticsOpen or Close

Using bifunctional small molecules to say RIP to cancer cells

by Gina Vitale

From left: founder Craig Crews, Chief Scientific Officer Kat Kayser-Bricker, and Executive Chair Tim Shannon of Halda TherapeuticsCredit: Halda Therapeutics

From left: founder Craig Crews, Chief Scientific Officer Kat Kayser-Bricker, and Executive Chair Tim Shannon of Halda TherapeuticsCredit: Halda Therapeutics

At a glance

Launched: 2023

Headquarters: New Haven, Connecticut

Focus: Small-molecule drug development

Technology: Bifunctional molecules that hold proteins together to kill cancer cells

Founder: Craig Crews

Funding or notable partners:

$76 million from Access Biotechnology, Canaan Partners, Connecticut Innovations, Elm Street Ventures, 6 Dimensions Capital, and other investorsCCraig Crews is no stranger to the challenge of devising a punchy name for a new class of drug. The chemical biologist was involved in both the discovery and the naming of proteolysis-targeting chimeras, or PROTACs, which are double-ended molecules that degrade proteins.

When Crews founded Halda Therapeutics to develop another new class of drug, he and the leadership team—including Executive Chair Tim Shannon and Chief Scientific Officer Kat Kayser-Bricker—wanted to give these molecules a moniker that’s a little graver.

“We wanted to kill cells,” Crews says. “We had to figure out a way to make sure that RIP found its way into the name.”

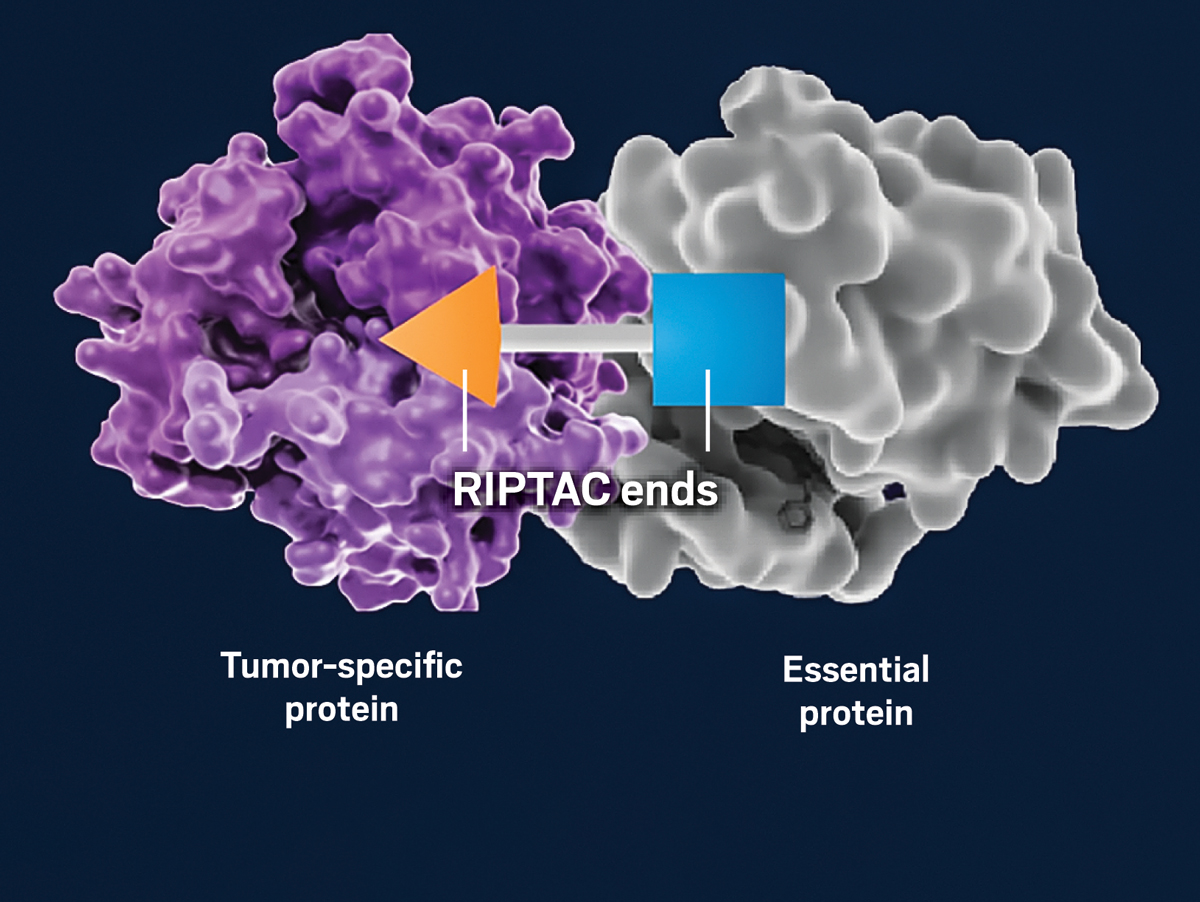

And so regulated induced proximity targeting chimeras, or RIPTACs, were christened. As the moniker suggests, a double-ended RIPTAC brings two proteins together. With one end, it binds a protein that is overexpressed in a tumor, which helps the RIPTAC get to, and stay inside, the cancer cell it needs to kill. With the other end, it binds a protein that the tumor cell needs to survive. The RIPTAC holds these two proteins together, preventing the essential one from functioning, until the tumor cell perishes. The team calls this mechanism “hold and kill.”

Many oncology drugs target cancer drivers, which are proteins or other biological entities that contribute to the growth of cancers. But cancer cells can become resistant to these drugs, whereas it’s harder for them to become resistant to a drug targeting an essential protein, according to Kayser-Bricker.

At the American Association for Cancer Research (AACR) annual meeting in April, Halda unveiled data comparing two RIPTACs with Pfizer’s enzalutamide, which inhibits the androgen receptor. The androgen receptor, a protein, is a significant driver of prostate cancer. But cancer cells can evolve to sidestep the drug in a few ways: for example, they can use signaling pathways that don’t involve the androgen receptor, or the androgen receptor can mutate so that the inhibitor can no longer bind to it enough to block its function.

“Right now, way too many patients unfortunately are succumbing to the disease when their current very powerful oncology drugs start to fail.”Craig Crews, founder, Halda TherapeuticsThe RIPTACs that Halda presented at the AACR meeting anchor themselves to a tumor cell using the androgen receptor. To kill the cell, they simultaneously bind a different protein that’s critical for its survival.

At the AACR meeting, Halda showed that one of the RIPTACs was able to bind both intended proteins even when the androgen receptor had mutated. And at a different conference earlier this year, Halda presented data showing that after cancer in mouse models became resistant to enzalutamide, it was susceptible to one of the RIPTACs.

Halda Therapeutics’ regulated induced proximity targeting chimeras (RIPTACs) are double-ended molecules. One end binds a tumor-specific protein, and the other end binds a protein that the cancer cell needs to survive. The RIPTAC holds these proteins together until the cancer cell dies.Credit: Adapted from Halda Therapeutics

Halda Therapeutics’ regulated induced proximity targeting chimeras (RIPTACs) are double-ended molecules. One end binds a tumor-specific protein, and the other end binds a protein that the cancer cell needs to survive. The RIPTAC holds these proteins together until the cancer cell dies.Credit: Adapted from Halda Therapeutics“What we’re trying to do is to give patients options,” Crews says. “Right now, way too many patients unfortunately are succumbing to the disease when their current very powerful oncology drugs start to fail.”

Notably, Halda also reported at the AACR meeting that both RIPTACs were effective when administered to mice orally. It can be a challenge for drugmakers to make bifunctional compounds—which have two functional ends—that are orally bioavailable. To be taken by mouth, they need to be small enough to be absorbed through parts of the digestive tract, like the intestinal wall, after which they enter the bloodstream.

Oral drugs come with several advantages. They’re more convenient for patients to take and less expensive to produce. They can also be small enough to slip through the cell membrane, getting at proteins inside the cell.

Kayser-Bricker notes that larger medicines, like antibody-drug conjugates and bispecific antibodies, depend on a limited lineup of extracellular proteins. Halda is targeting intracellular proteins, which “opens up a lot of uncharted territory for us” to use RIPTACs to go after proteins that may have never been targeted before because they aren’t cancer drivers, she says.

Halda joins an ever-growing roster of companies developing bifunctional small molecules that draw two proteins together. That includes Vicinitas Therapeutics, a spin-off of the University of California, Berkeley, and Novartis that uses deubiquitinase-targeting chimeras, or DUBTACs, to rescue proteins that are erroneously tagged for destruction. It also includes Arvinas, a start-up that Crews founded in 2013 that uses PROTACs to degrade proteins.

“We’ve now seen with Arvinas’s products in humans how big a difference that can make to people who need help,” Shannon says. “That’s what we live for.”

Both Halda and Arvinas are nestled in New Haven, Connecticut, a short walk from Crews’s office at Yale University. There’s no shortage of talent in that pocket of New England, according to the Halda team.

“I would put our 30 people up against anyone,” Shannon says. “Not all the smart people are in Boston or San Francisco.”

-

Mitra ChemOpen or Close

Machine learning helps speed the discovery and scale-up of low-cost battery materials

by Matt Blois

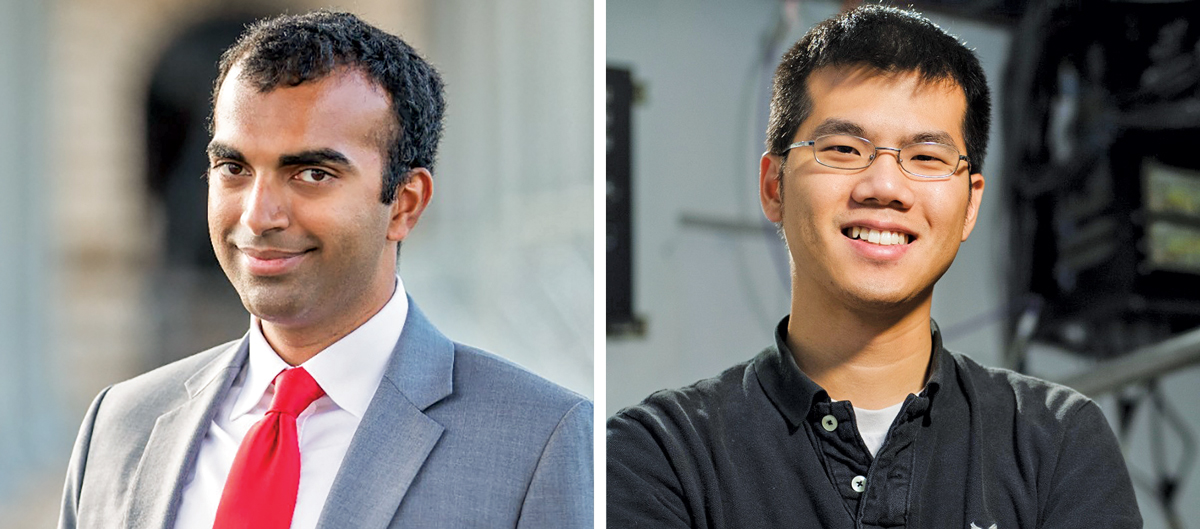

CEO and cofounder Vivas Kumar (left) and Chief Scientific Adviser and cofounder William Chueh of Mitra ChemCredit: Mitra Chem and Stanford University

CEO and cofounder Vivas Kumar (left) and Chief Scientific Adviser and cofounder William Chueh of Mitra ChemCredit: Mitra Chem and Stanford University

At a glance

Launched: 2021

Headquarters: Mountain View, California

Focus: Battery materials

Technology: Machine learning to speed the process of developing low-cost battery materials

Founders: William Chueh, Chirranjeevi Gopal, and Vivas Kumar

Funding or notable partners:

$60 million from General Motors, Social Capital, TechMet-Mercuria, and other investorsBBy the beginning of 2020, the range of new electric cars had surpassed 330 km, up from 130 km a decade earlier. But drivers in the US were still pushing for more.

“More range, more power, faster acceleration,” Vivas Kumar, then a principal with the battery material research firm Benchmark Mineral Intelligence, said in a talk at Stanford University that spring. “That’s the kind of attitude that drives Western automotive design decision-making.”

To boost the capacity of their batteries, carmakers were increasing the amount of nickel they contained. Kumar, who previously managed Tesla’s battery material supply chain, predicted that they would continue to do so. But he warned that future shortages of nickel and cobalt could prove a roadblock for the industry.

After the talk, a university administrator introduced Kumar to William Chueh, a materials scientist working on batteries at Stanford. Over the next several months, they brainstormed ways to produce the high-capacity batteries drivers wanted—without using nickel and cobalt.

Iron-based battery chemistries, such as lithium iron phosphate (LFP), offered a potential solution. They were less expensive and less likely to catch fire than batteries made with nickel. While LFP batteries were popular in China, US carmakers weren’t interested because they didn’t store as much energy.

In 2021, Kumar and Chueh, along with Chueh’s former postdoctoral researcher Chirranjeevi Gopal, cofounded Mitra Chem to develop new iron-based battery materials that would store more energy than LFP and help wean carmakers off nickel and cobalt.

“We could come up with a better solution and better meet the specifications that a mass-market customer wants,” Kumar says. “We need to go beyond it.”

To go beyond LFP, Mitra synthesizes thousands of new battery materials every month. The company uses machine learning to predict which ones are most likely to store significant amounts of energy—the key characteristic carmakers are looking for currently.

“There’s no one bottleneck in the R&D process. It’s a bottleneck at every level.”William Chueh, chief scientific adviser and cofounder, Mitra ChemMitra can also use machine learning techniques to predict which materials will be cheap, safe, and long lasting or how they will behave in a large-scale manufacturing process. This helps the company quickly narrow the list of materials it will keep testing and ensure that it spends its resources on the most-promising candidates.

Chueh says this approach should dramatically reduce the amount of time it takes to develop new battery materials.

“There’s no one bottleneck in the R&D process. It’s a bottleneck at every level,” he says. “It’s about ripping apart how material development is done today and reimagining how it can be done much faster.”

Last year, Mitra started shipping an enhanced LFP powder to battery makers for qualification. But LFP is just a starter product. The firm is working with General Motors to develop lithium manganese iron phosphate (LMFP) battery materials, which can store more energy than LFP. Kumar says Mitra is combining iron with other metals to develop new materials that will perform better than LMFP. In August, Mitra announced that it had raised $40 million in an investment round led by GM.

Mitra Chem scientists run experiments on battery cells made with a variety of materials to quickly determine which ones will be successful.Credit: Mitra Chem

Mitra Chem scientists run experiments on battery cells made with a variety of materials to quickly determine which ones will be successful.Credit: Mitra ChemChueh expects that all iron-based chemistries will use a similar manufacturing process, which means carmakers won’t have to retool their factories to switch to a more advanced iron formula. “We are future proofing our manufacturing capability,” he says.

One challenge for Mitra will be competing with Chinese manufacturers that have been working for years to improve iron-based battery materials. In May, China’s Gotion High-Tech announced that after a decade of research, it had produced an LMFP battery that could power a car for 1,000 km. And in August, Contemporary Amperex Technology Co. Limited, also based in China, unveiled an LFP battery that could last for 400 km after a 10 min charge.

Sam Adham, a battery material analyst with the research firm CRU Group, says Chinese battery material companies are leaders when it comes to both lab-scale innovation and industrial-scale manufacturing. But he notes that the Inflation Reduction Act, which offers financial incentives to make battery materials in the US, will provide US companies with a major boost.

Kumar agrees that Chinese companies are ahead of the curve, but he’s undaunted. He says Mitra’s advantage is the ability to move new battery materials from research labs to battery factories quickly—and then start the process all over again.

“If all we’re doing is making the best powder, somebody else will copy it,” he says. “By the time they get there, we want to make an even better powder.”

-

SepternaOpen or Close

Revitalizing G protein–coupled receptor drug discovery

Septerna’s founders are (clockwise from top left) Arthur Christopoulos, Jeffrey Finer, Patrick Sexton, and Robert J. Lefkowitz.Credit: Septerna

Septerna’s founders are (clockwise from top left) Arthur Christopoulos, Jeffrey Finer, Patrick Sexton, and Robert J. Lefkowitz.Credit: Septerna

At a glance

Launched: 2022

Headquarters: South San Francisco

Focus: Drug discovery for G protein–coupled receptors

Technology: Purification of receptor-signaling protein complexes and structure-based drug design

Founders: Arthur Christopoulos, Jeffrey Finer, Robert J. Lefkowitz, and Patrick Sexton

Funding or notable partners:

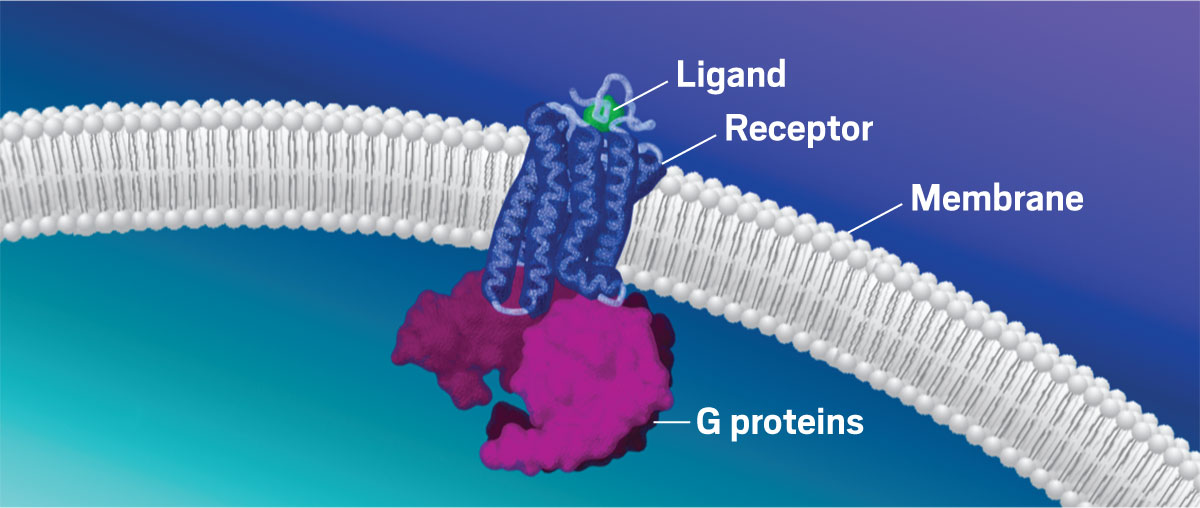

$225 million from Third Rock Ventures, RA Capital Management, and additional investorsTThere are hundreds of G protein–coupled receptors (GPCRs) in the human genome, regulating just about every physiological system. While roughly a third of marketed drugs target a GPCR, many of the receptors have remained out of reach for drug hunters, in part because of challenges involved in studying them. After the heyday of GPCR-targeting drugs in the 1990s and early 2000s, few medicines targeting these proteins have been introduced. But new technologies may be poised to change that. A few years ago, chemistry Nobel laureate Robert J. Lefkowitz was working with scientists in his lab at Duke University in North Carolina to develop a new way to isolate enzymatically active GPCRs.

Halfway around the world, at Monash University in Melbourne, Australia, the eminent pharmacology duo Patrick Sexton and Arthur Christopoulos was simultaneously developing techniques to modulate GPCR signaling using structure-based drug design. And in San Francisco, Jeffrey Finer, a biotechnology veteran and venture partner at Third Rock Ventures, was looking to invest.

Third Rock spent a year or more in conversation with these researchers and others in the field before bringing them together to start Septerna, a South San Francisco–based company focused on GPCR drug discovery. The company launched publicly in 2022 with Finer as CEO and $100 million in venture backing led by Third Rock.

Early in the pandemic, while the company was still in stealth mode, Septerna’s first few employees worked to determine whether they could scale up an approach to isolate GPCRs and reconstitute them in complex with other key signaling proteins. The complexes are critical because the proteins that bind with GPCRs can change the signals they send; the same receptor can produce different effects depending on which partner it is bound to. In addition, different ligands, including some that bind to alternative sites on the GPCR, can nudge the complex toward different signaling outcomes.

Techniques that stabilize GPCRs to determine their structures have historically compromised their function, Lefkowitz says. He compares those techniques to putting a protein in a straitjacket, whereas “the essence of a receptor is its flexibility.”

“The essence of a receptor is its flexibility.”Robert J. Lefkowitz, cofounder, SepternaHe says the new approach enables Septerna researchers to produce GPCR complexes that move as freely in a test tube as they would in a cell. This means Septerna can apply structure-based drug design techniques to GPCRs that were previously too difficult to study. Its employees use these techniques to determine the structures of GPCRs, identify potential secondary binding pockets that can influence receptor activity, test out molecule libraries in the laboratory, and run computational screens of billions of potential molecules. Finer emphasizes the iterative nature of these processes, which he says “allow our chemists to very quickly crank out drug-like lead candidates.”

Septerna’s most advanced molecules, which are in late preclinical development, went from undergoing initial chemistry lab work to being tested in animal models within a year, Finer says. These drug candidates are a small molecule that can activate the parathyroid hormone receptor and one that can block autoantibody binding to the thyroid-stimulating hormone receptor.

Septerna’s signature technology is its ability to reconstitute G protein–coupled receptors (GPCRs) in complex with their binding partners to study the GPCRs’ structures and activities and screen ligands.Credit: Adapted from Septerna

Septerna’s signature technology is its ability to reconstitute G protein–coupled receptors (GPCRs) in complex with their binding partners to study the GPCRs’ structures and activities and screen ligands.Credit: Adapted from SepternaSepterna is focusing on finding candidates for what Christopoulos calls the “right target, wrong approach” subset of the GPCR family: receptors with good clinical validation that have been difficult to drug until now. The firm aims to develop orally available small molecules that promote, block, or tweak GPCRs’ signaling.

Finer says that while the company expects to develop its thyroid-stimulating and parathyroid hormone receptor programs on its own, it plans to collaborate with deeper- pocketed companies for targets that could require enormous clinical trials. Septerna recently signed its first such deal, a $47.5 million development agreement with Vertex Pharmaceuticals for an undisclosed target. That deal came just months after Septerna closed a $150 million series B fundraising round.

“There are a lot of strong programs, and they’ve progressed . . . very rapidly, from my perspective,” Sexton says. But no drug discovery program is without risk. As Septerna’s first molecules move toward the clinic, he says, “it’s a bit of ‘watch this space’ and ‘fingers crossed.’”

-

Sublime SystemsOpen or Close

Electrochemistry enables cement production with fewer emissions

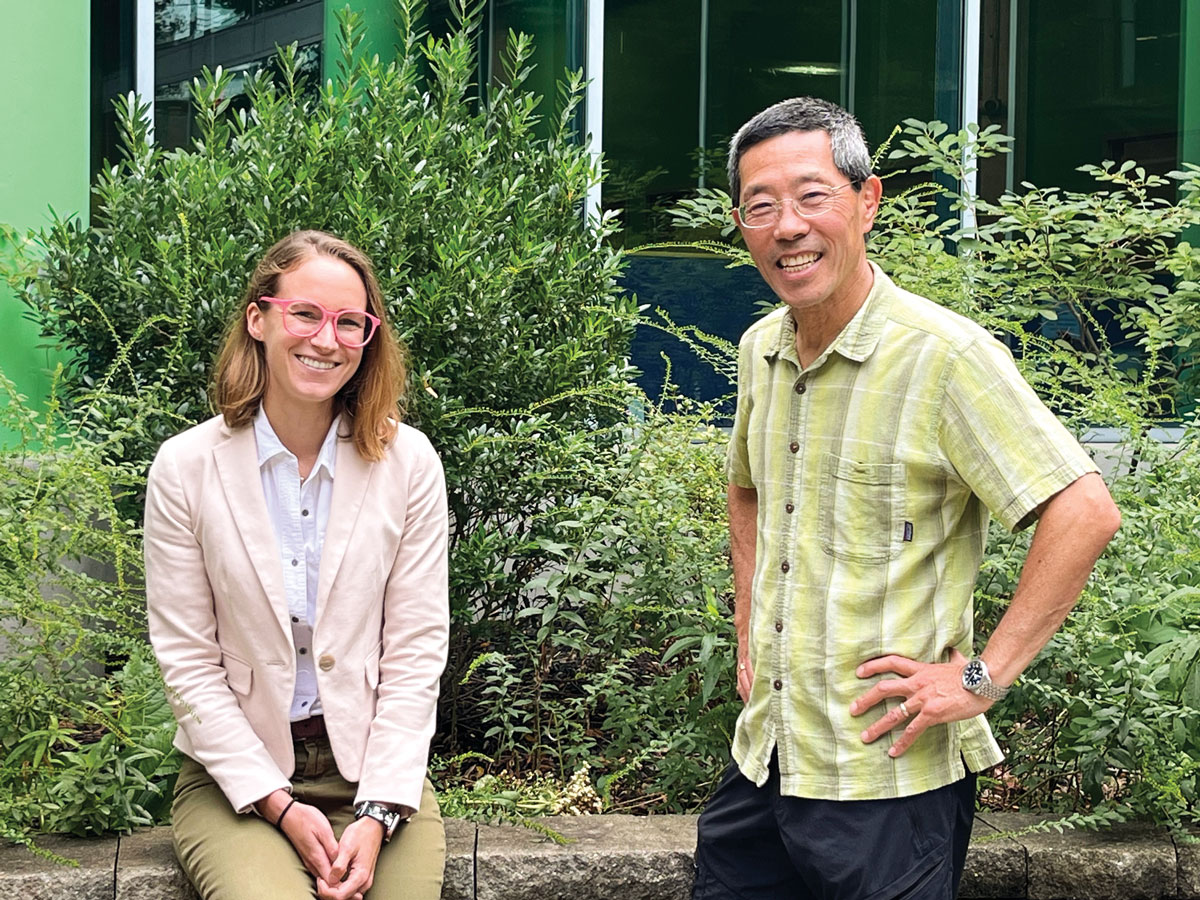

Sublime Systems CEO and cofounder Leah Ellis (left) and Chief Scientific Officer and cofounder Yet-Ming ChiangCredit: Bethany Halford/C&EN

Sublime Systems CEO and cofounder Leah Ellis (left) and Chief Scientific Officer and cofounder Yet-Ming ChiangCredit: Bethany Halford/C&EN

At a glance

Launched: 2020

Headquarters: Somerville, Massachusetts

Focus: Low-carbon cement

Technology: Electrochemical alternative to current carbon dioxide–intensive method

Founders: Leah Ellis and Yet-Ming Chiang

Funding or notable partners:

$50 million from an Advanced Research Projects Agency–Energy grant, Siam Cement Group, and other investorsCCement holds the modern world together, but it lacks the allure of high-tech materials. “The stuff is gray,” says Yet-Ming Chiang, a professor of ceramics and materials science at the Massachusetts Institute of Technology. “You would be forgiven for thinking it’s kind of dull and boring.”

But it’s not for Chiang and Leah Ellis, cofounders of Sublime Systems. They say finding a new way to make cement is necessary to solve one of the planet’s most pressing problems: the carbon dioxide emissions that are driving climate change.

Cement, or calcium silicate hydrate, binds rocks and sand together to form concrete. Worldwide, cement companies make roughly 4 billion metric tons (t) of the stuff annually, according to the US Geological Survey. By some estimates, cement production accounts for as much as 8% of global CO2 emissions.

About half that massive belch of CO2 is an unavoidable product of the chemical reaction used to make ordinary portland cement, in which calcium carbonate, CaCO3, is heated until it releases CO2 to form lime, CaO. The rest of cement’s emissions come from the high temperature—achieved by burning fossil fuels—required to break the CaCO3 bonds.

Sublime developed a way to make cement that sidesteps both problems. Instead of starting with CaCO3, the company makes its lime electrochemically from calcium silicates, which can be found in basaltic rocks, and from other aggregates that contain calcium and silicon, like mining waste. This prevents the inherent CO2 that occurs when CaCO3 is broken down.

Sublime uses an electrochemical reactor to generate acidic conditions at one electrode and basic conditions at the other. The acid solubilizes the calcium, which precipitates as lime when exposed to base. (This is where Sublime gets its name—it’s a nod to lime.) The silicates are transformed into insoluble silica. If the company uses renewable electricity, fossil fuels aren’t needed at all.

“Sublime exists to have a swift and massive impact on climate change”Leah Ellis, CEO and cofounder, Sublime SystemsLime and silica are dried as separate powders. Mixing them with water forms cement that has strength and durability akin to ordinary portland cement. It’s essentially an electrochemical version of the process the ancient Romans used.

Decarbonizing cement production was not an obvious problem for Chiang and Ellis to solve, as both are experts in cutting-edge battery technologies.

Sublime Systems’ pilot plant uses electrochemistry to make enough cement each year to fill 50 concrete trucks.Credit: Sublime Systems

Sublime Systems’ pilot plant uses electrochemistry to make enough cement each year to fill 50 concrete trucks.Credit: Sublime SystemsIn 2018, Ellis, who is now Sublime’s CEO, joined Chiang’s lab on a prestigious Banting postdoctoral fellowship. She had just finished her doctoral studies in battery chemistry at Dalhousie University and could use her fellowship funding to work with anyone she wanted. She chose Chiang, a serial entrepreneur known for cofounding innovative battery-focused companies, including A123 Systems, Form Energy, and 24M Technologies.

Although Ellis had written her fellowship proposal on a battery-related project, she and Chiang decided to go in a different direction. “We had this conversation where we said, ‘You know batteries. I know batteries. So, let’s do something other than batteries,’ ” Chiang recalls.

He had been thinking about what to do with excess electricity that might otherwise be wasted and wondered if it might be employed in energy-intensive industries like cement production. It was a broad problem statement—let’s use electricity to make cement in a completely new way—and he tasked Ellis with figuring out how to make it work.

There are other strategies for decarbonizing cement production. For example, Blue Planet Systems is using waste CO2 to make CaCO3 for overall carbon-negative cement. Companies like Fortera and Biomason are harnessing the power of biomineralization by using microbes to manufacture cement. Ellis and Chiang see cement made electrochemically as a solution that can be scaled quickly.

Sublime now has 60 employees and plans to do its first cement field test before the end of the year. It has a pilot plant that can make over 100 t of cement—enough to fill 50 concrete trucks—annually. Its first commercial-scale plant, which will be able to churn out 100 times as much cement, is planned for 2026.

It seems fast, but that’s part of the company’s mission. “Sublime exists to have a swift and massive impact on climate change,” Ellis says. Speed is also important for showing the cement industry, which tends to be skeptical of new technology, that rethinking production makes sense. The industry doesn’t like to hear about academics who have come up with a solution to long-standing problems, Ellis says, “so it’s a race to put that material in their hands.”

-

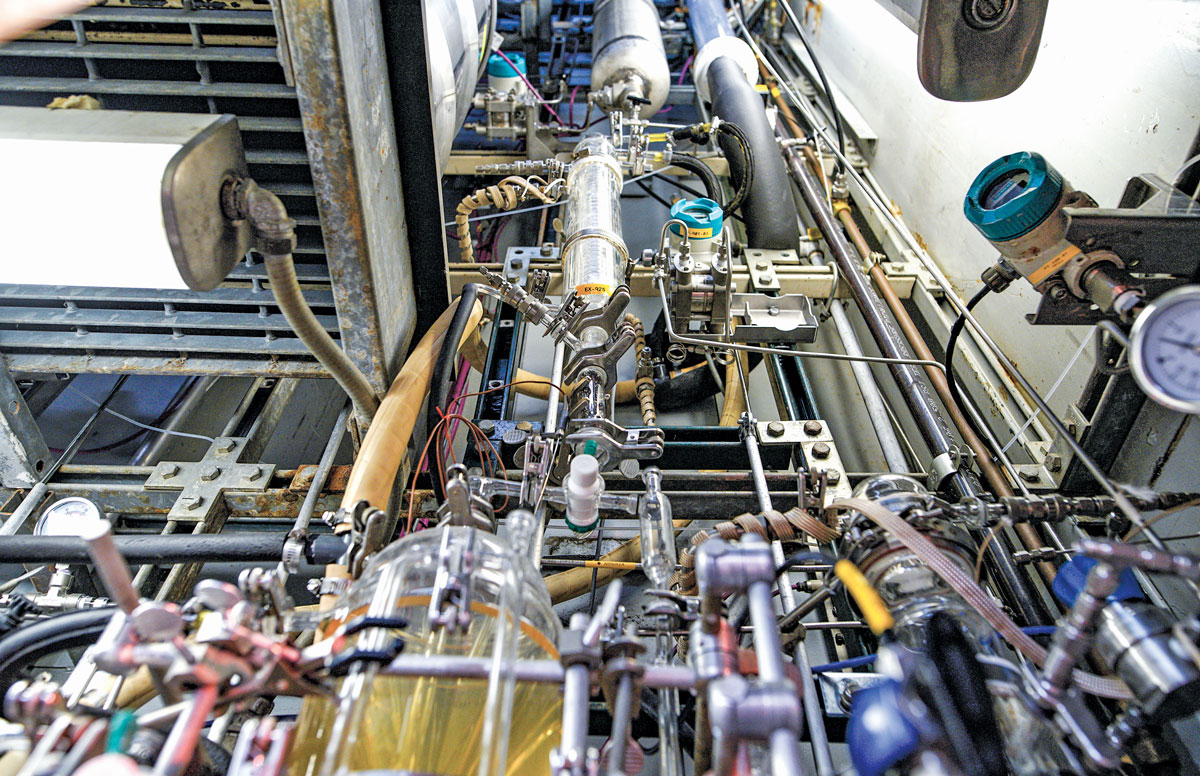

Trillium Renewable ChemicalsOpen or Close

Biobased acrylonitrile for greener carbon fiber and polymers

Trillium Renewable Chemicals cofounders Liesl Schindler (second from left) and Corey Tyree (fourth from left) with their team at the company’s West Virginia pilot plantCredit: Trillium Renewable Chemicals

Trillium Renewable Chemicals cofounders Liesl Schindler (second from left) and Corey Tyree (fourth from left) with their team at the company’s West Virginia pilot plantCredit: Trillium Renewable Chemicals

At a glance

Launched: 2021

Headquarters: Knoxville, Tennessee

Focus: Biobased acrylonitrile

Technology: Thermocatalytic dehydration of glycerin to acrolein followed by conversion to acrylonitrile and acetonitrile

Founders: Liesl Schindler and Corey Tyree

Funding or notable partners:

$16 million from investors including Capricorn Partners, Hyosung Advanced Materials, Helm, and Southern Research InstituteAAt a 2013 workshop held in a hotel at the Detroit airport, representatives from the Clean Energy Manufacturing Initiative of the US Department of Energy (DOE) asked a group of industry leaders how to reduce emissions from manufacturing carbon fiber—a strong and lightweight material used to replace steel and aluminum in airplanes, automobiles, and wind turbines. They all had the same response.

“We need sustainable acrylonitrile,” they said, according to Corey Tyree, CEO and cofounder of Trillium Renewable Chemicals.

Acrylonitrile is the raw material used to make carbon fiber. It’s also used as a feedstock for polymers such as nitrile rubber and acrylonitrile-butadiene-styrene, the plastic in Lego blocks. Conventional acrylonitrile is normally made from propylene, a petrochemical with a heavy carbon footprint.

After the workshop, the DOE funded a project at the nonprofit Southern Research Institute to make biobased acrylonitrile. The team found a way, and Southern Research spun out Trillium as a for-profit start-up to commercialize the technology with financial backing from the investment group Capricorn Partners. Capricorn asked Tyree, who was a senior research director at Southern Research, to lead business operations.

Trillium’s starting material is glycerin, a by-product of converting natural oils and fats into things like soaps, detergents, and biofuels. The process begins by catalytically dehydrating glycerin to acrolein, according to Liesl Schindler, Trillium’s other cofounder and its vice president of technology development. To get acrylonitrile, the firm reacts acrolein with oxygen and ammonia—the same basic ammoxidation reaction used to make acrylonitrile from propylene. Both routes yield the coproduct acetonitrile, itself a valuable solvent and synthetic building block.

“We’ve got a team of all former industry people. And that’s not just by happenstance; that’s the strategy.”Corey Tyree, CEO and cofounder, Trillium Renewable ChemicalsThe switch to glycerin may seem like a small change, but Trillium says using a biobased starting material instead of propylene results in a 70% drop in the carbon footprints of acrylonitrile and acetonitrile. Like most manufacturers, carbon fiber makers are facing consumer and investor pressure to reduce their greenhouse gas emissions. They’re willing to pay a “green premium” for biobased acrylonitrile because it’s one of the few levers they have to meet that goal. “They’ve got one raw material, and it’s pretty dirty,” Tyree says.

Trillium Renewable Chemicals’ pilot plant is one of several integrated into the contract piloting firm AVN’s chemical process development center in Charleston, West Virginia.Credit: Trillium Renewable Chemicals

Trillium Renewable Chemicals’ pilot plant is one of several integrated into the contract piloting firm AVN’s chemical process development center in Charleston, West Virginia.Credit: Trillium Renewable ChemicalsTrillium started up its pilot plant earlier this year and is now working with the engineering firm Zeton on a demonstration-scale plant slated to open in 2025. “The pilot we have now allows us to produce and purify product for testing,” Schindler says. “The next scale will be much more substantial volumes so that our potential customers can then take it into their pilot units and do whatever testing they need to prove it in their process.”

Both Tyree and Schindler spent the early part of their careers in the petrochemical industry. Tyree likes to say he’s a corporate dropout. Schindler, whom Capricorn recruited from Shell, prefers to think of herself as a corporate convert—from fossil fuels to sustainable chemicals.

“We were both coal and petroleum folks early in our career. Now here we are talking about plant-based feedstocks,” Tyree says. “We’ve got a team of all former industry people. And that’s not just by happenstance; that’s the strategy.”

Tyree says Trillium’s use of thermal, catalytic chemistry gives it an advantage over firms trying to commercialize biobased materials made via microbes or enzymes. “There is just a lot of knowledge out there in the industry about these kinds of technologies,” he says. “We’re not trying to put a man on the moon here, right? We’re trying to scale up reactors and columns. They’ve done this before.”

-

On our radarOpen or Close

These early-stage chemistry start-ups are on the rise

by Matt Blois by Alex Scott

by Alex Scott

Flo Materials makes endlessly recyclable plastics

SS

hoes, carpets, and packaging are each made from several types of plastic, which makes them hard to recycle. In addition, some types of plastic start to degrade after being repeatedly recycled.

The start-up Flo Materials, founded in 2021, is trying to commercialize a group of vitrimer plastics called enamine covalent adaptive networks (ECANs). These can be recycled endlessly, even if they are combined with other materials.

The company, which is located in Berkeley, California, says its recycling process, based on research from Lawrence Berkeley National Laboratory, breaks down the plastic to monomers that are just as good as virgin materials. It also removes colors, contaminants, and additives.

Flo CEO Kezi Cheng says that like high- performance thermosetting polymers, such as epoxy or polyurethane foam, her company’s materials are resistant to heat and chemical degradation. The bonds that make thermoset materials strong also make them hard to recycle, but Cheng says ECANs can be recycled both chemically and mechanically.

Flo’s first market is eyewear. To make glasses, companies cut a design out of a sheet of cellulose acetate and discard the rest. If eyewear manufacturers used ECANs, Cheng says, her firm would be able to transform discarded material back into brand-new plastic, regardless of the color or style of the original glasses.

Flo originally focused on making rigid plastic sheets for the eyewear industry, but Cheng says the company recently developed methods for making other forms of plastic, such as fibers or foams. She says going all the way back to monomers also means the company can potentially turn recycled plastics into different polymers.

“Maybe in the first life, those monomers were made into something like a foam,” she says. “But in the second life, those monomers could be made into something like a fiber.”

That flexibility makes the technology applicable to a wide range of products, Cheng says. She adds that the company is trying to develop plastic formulations that can drop into existing manufacturing processes, which will make it easier to replace multiple types of plastics.

Flo is in the process of raising seed funding. The company is setting up its first two pilot projects with eyewear brands for next year. The projects will process about 400 kg of material, enough for about 4,000 pairs of glasses. The company wants to expand its capacity to 10,000 kg within the next 2 years.

Flo Materials hopes to deploy its endlessly recyclable plastic material first with eyewear manufacturers, which typically cut glasses out of rigid sheets of plastic and discard the remainder.Credit: Flo Materials

Flo Materials hopes to deploy its endlessly recyclable plastic material first with eyewear manufacturers, which typically cut glasses out of rigid sheets of plastic and discard the remainder.Credit: Flo Materials

Jupiter Ionics synthesizes ammonia with fewer greenhouse gas emissions

MMaking ammonia for nitrogen fertilizers releases an enormous amount of carbon dioxide into the atmosphere. Jupiter Ionics, a start-up that spun out of Monash University in 2021, hopes to make the chemical without greenhouse gas emissions, using only air, water, and renewable energy.

Conventional ammonia is produced via the Haber-Bosch process, which uses high temperatures, pressure, and a catalyst to combine nitrogen from the air with hydrogen made from methane or coal.

Some companies are trying to make low-emission ammonia by switching to hydrogen made by electrolyzing water and by using renewable energy to combine hydrogen with nitrogen. Jupiter chief scientific officer and cofounder Douglas MacFarlane says there are several challenges to that approach.

The Haber-Bosch process typically runs continuously, but renewable sources of energy, such as wind and solar, are often available only intermittently. That means fossil fuel sources of energy may need to supplement systems that rely on a continuous process. In contrast, Jupiter’s small-scale electrolytic cell can rely solely on renewable energy because it can turn on only when solar or wind energy is available.

In the company’s cell, water is fed into the anode, while nitrogen is fed into the cathode. At the anode, hydrogen ions are catalytically stripped off of water molecules, releasing oxygen. At the cathode, nitrogen reacts with lithium in the cell’s electrolyte to form lithium nitride. When the electrolyte transports hydrogen ions from the anode to the cathode, the ions break the lithium nitride into lithium ions and ammonia.

MacFarlane says scientists have known about this route to synthesizing ammonia for decades, but his lab developed a component of the electrolyte that made the process much more efficient. “We can achieve 100% conversion of electrons, effectively, to ammonia,” he says.

Other companies are also exploring alternatives to the Haber-Bosch process. The start-up Nitricity is using a plasma reactor to produce ammonia using solar energy. Nium, another start-up, says it can produce ammonia at low temperatures and pressures with renewable energy by using a new type of catalyst.

The electrodes in Jupiter’s current device measure only about 100 cm2, but the company is scaling up. It hopes to eventually produce a metric ton of ammonia per day on large farms using shipping container–size plants.

The electrodes in Jupiter Ionics’ ammonia synthesis cell currently measure about 100 cm2, so the company has to scale up the device by a couple of orders of magnitude to reach a size that could serve a large farm.Credit: Jupiter Ionics

The electrodes in Jupiter Ionics’ ammonia synthesis cell currently measure about 100 cm2, so the company has to scale up the device by a couple of orders of magnitude to reach a size that could serve a large farm.Credit: Jupiter Ionics

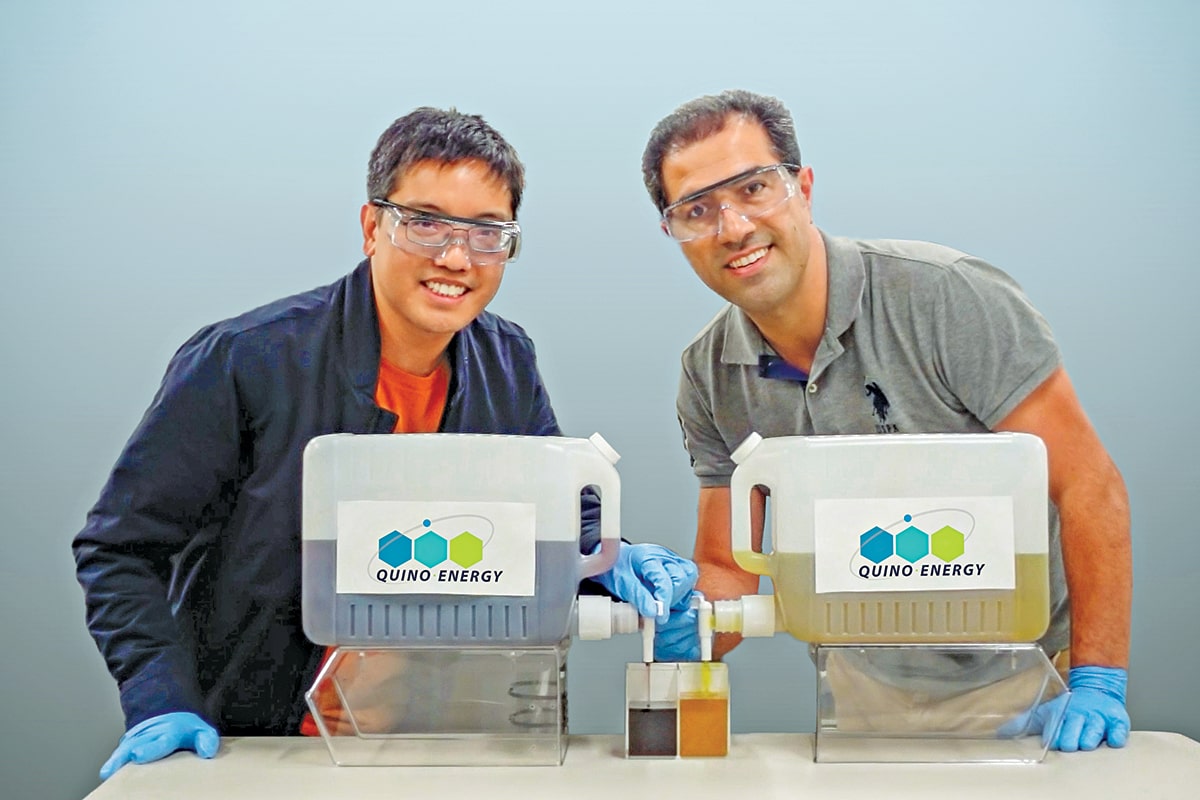

Quino Energy is making cheaper flow batteries

WWorking on the next generation of a novel technology that itself isn’t widely adopted yet could be disheartening for some entrepreneurs. Not so for Eugene Beh, CEO and cofounder of Quino Energy, a US start-up developing an organic electrolyte for flow batteries that promises to provide stationary energy storage for when the wind doesn’t blow and the sun isn’t shining.

Unlike lithium-ion batteries, which store energy in solid electrodes, flow batteries store their energy in liquid electrolytes located in two tanks. The electrolytes are circulated to enable ion exchange between them.

Standard flow batteries use vanadium salts—a relatively expensive material—as an electrolyte. Although vanadium flow batteries are already cheaper in some applications than lithium-ion batteries, they could be made cheaper still by replacing the vanadium with organic quinones, Beh says. Quinones are a family of molecules that can be easily switched between reduced and oxidized states so that they hold a charge and then discharge it. Quino proposes using organic quinones in a liquid solution as one electrolyte and a solution of ferrocyanide as the other.

Examples of organic quinones are vitamin K1, also called phylloquinone, and dyes such as 1,2-dihydroxyanthraquinone, also known as alizarin. Quino plans to source its organic quinones from a company that makes them from phthalic anhydride, a low-cost intermediate of unsaturated polyester resin.

Beh has demonstrated he is in it for the long haul. His involvement in the technology dates back to 2015, when he was a chemistry postdoctoral scholar at Harvard University. Since Beh and three Harvard researchers founded Quino in 2021, the firm has raised $5.25 million from investors and scooped up $4.6 million in US Department of Energy grants.

Quino’s business plan is to make and sell its electrolyte. The firm aims to close its series A funding round in the coming months so that it can build a 100-metric-ton-per-year quinone electrolyte plant that could be up and running as early as the end of 2024.

CEO and cofounder Eugene Beh (left) and Chief Technology Officer and cofounder Meisam Bahari of Quino Energy show samples of their organic quinone and ferrocyanide electrolytes.Credit: Quino Energy

CEO and cofounder Eugene Beh (left) and Chief Technology Officer and cofounder Meisam Bahari of Quino Energy show samples of their organic quinone and ferrocyanide electrolytes.Credit: Quino Energy

Sóliome blocks ultraviolet rays with a molecule found in human eyes

Sóliome chief scientific officer and cofounder Anthony Young (left) with CEO and cofounder Micah Nelp at their laboratories in San FranciscoCredit: Sóliome

Sóliome chief scientific officer and cofounder Anthony Young (left) with CEO and cofounder Micah Nelp at their laboratories in San FranciscoCredit: SóliomeIIt was the week after experiencing a terrible sunburn from a 2021 trip to Mexico that Sóliome’s CEO and cofounder, Micah Nelp, first thought of using the product of a human enzyme as sunscreen. At the time, Nelp was studying enzymes for his postdoctoral studies at Princeton University and knew that the tryptophan metabolite kynurenine, which is concentrated in the lens of the eye, was a fantastic ultraviolet absorber.

By virtue of occurring naturally in the human body, kynurenine does not require testing on animals to be used as a sunscreen. “We figured if we could get this amino acid in a larger molecule, we could give that protection that our eyes naturally already have to our skin as well,” Nelp says.

Sóliome is now making that larger molecule in its laboratories in San Francisco by attaching kynurenine to a peptide. “This allows us to adjust the size, hydrophobicity, acidity, and binding characteristics,” Nelp says.

Sóliome’s sunscreen provides broad-spectrum protection, is photostable, and is biodegradable. The company is working on a range of sunscreens with SPF ratings of between 15 and 30, as well as a compound that would make sunscreens water resistant.

The company is on track to become the first producer of sunscreen made with peptides. Typically, sunscreens contain one or more of eight compounds: avobenzone, homosalate, octinoxate, octisalate, octocrylene, oxybenzone, titanium dioxide, and zinc oxide.

“It is so different from the heavy, greasy feel of existing sunscreens. Our peptide spreads beautifully on the skin and feels like it isn’t there,” Nelp says. “We wanted to start with a daily-wear product that was incredibly light and wouldn’t interfere with other products, like makeup, which is a major issue with existing products.”

Sóliome claims that the ingredients in its sunscreen are so safe you can eat them. “My favorite one tastes slightly salty and has a hint of umami,” Nelp says.

Sóliome has raised $525,000 from the venture capital firm SOSV. The company has also been awarded $255,000 in funding from the US National Science Foundation (NSF). It is hoping to secure additional NSF funding in the coming weeks.

The company estimates that it is already able to make its sunscreen at the same cost of some existing products. Sóliome is now working with partners to develop its first commercial product and is contemplating seeking major funding.

Umaro Foods turns seaweed into bacon

Umaro Foods’ bacon is in 140 restaurants around the US, including more than a dozen bodegas in New York City.Credit: Umaro Foods

Umaro Foods’ bacon is in 140 restaurants around the US, including more than a dozen bodegas in New York City.Credit: Umaro FoodsTThere’s nothing quite like a crispy piece of bacon. But the pork industry releases more greenhouse gases than the entire country of Germany each year, according to the Food and Agriculture Organization of the United Nations. While some companies make plant-based bacon, the start-up Umaro Foods says existing products lack the key characteristic that makes bacon delicious: crispiness.

Umaro says it’s making a better bacon substitute out of seaweed. The company extracts a hydrocolloid gel and protein from red seaweed and recombines them to make its product. The hydrocolloid gel is infused into a dough of the protein mixed with sunflower and coconut oil. The gel traps the oil in tiny pockets, which allows the liquid vegetable oils to perform like solid fat found in meat. CEO and cofounder Beth Zotter says the result is crispy and very fatty. “The hydrocolloid gel is a sponge, and the fat is the water,” she says. “It’s mostly fat.”

Zotter started the company in 2019 after concluding that seaweed was the best way to sustainably provide protein for the world’s growing population. She says seaweed is incredibly productive, generating more than five times as much protein as soy per hectare. And she believes the size of the ocean means seaweed farming will be feasible to scale.

Companies like Dutch Weed Burger and Akua agree. They’re both making meat alternatives using seaweed as an ingredient.

“By moving our protein supply from land to sea, we can sequester vast amounts of carbon, simply by relieving the pressure on our land and allowing forests to regenerate,” Zotter says.

Other companies are making meatless bacon using other protein sources. In June, MyForest Foods raised $15 million to commercialize fungal bacon. La Vie, which also mimics animal fats by trapping vegetable oils between hydrocolloid gels, raised $28 million last year to produce bacon from soy protein.

Umaro has raised $4 million in funding, including a $1 million investment raised from Mark Cuban on the ABC business-pitch show Shark Tank. Umaro’s bacon is now in more than 140 restaurants, and the product will be in a burger chain starting next year. The company is hoping to use its technology in other meat substitutes but hasn’t decided which product to make next.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter