Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Regulation

Regulators And Retailers Raise Pressure On Phthalates

Toxicity concerns prompt efforts to phase out widely used plasticizers

by Britt E. Erickson

June 22, 2015

| A version of this story appeared in

Volume 93, Issue 25

In a world without plasticizers, all objects made of polyvinyl chloride (PVC) would be as hard and rigid as sewer pipes. But thanks to a class of compounds called phthalates, PVC can be soft, flexible, and durable, making it attractive for use in endless applications—artificial leather, electrical wire insulation, and garden hoses, to name a few.

COVER STORY

Pressure On Plasticizers

Phthalates provide flexibility to vinyl products, but they are also controversial. Concerns—justified or not—have been bubbling up for more than a decade over their potential to disrupt hormones and cause reproductive and developmental effects. As a result, the plasticizer industry is in a state of flux, scrambling to adapt to ever-changing demands from regulators and the marketplace.

And it’s a big marketplace. The global plasticizer market was about 8 million metric tons last year, according to IHS Chemical, a market research firm. Phthalates make up about 70% of that volume, IHS says.

The plasticizers are widely used in building and construction materials to make vinyl surfaces longer-lasting and easier to maintain. Items in which they’re used most often include floor and wall coverings, roofing membranes, and cable and wire insulation. Phthalates are also used as plasticizers in automotive parts, medical goods, and synthetic leather. In rubber, inks, paints, adhesives, perfumes, hair spray, and nail polish, they act as a solvent.

The chemicals have been manufactured since the 1930s by reacting an alcohol with an acid, such as phthalic anhydride. The properties of the resulting esters depend on the specific alcohol and acid. The number of alcohol-acid combinations that are possible and their resulting properties are as endless as the number of applications.

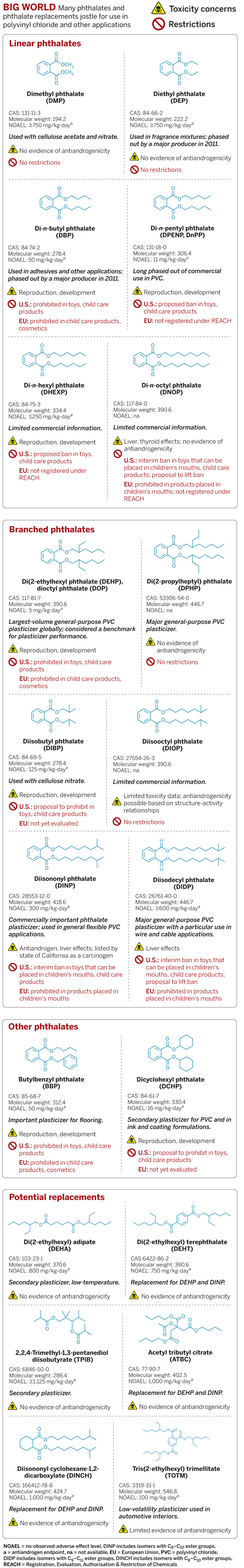

Most phthalates, however, never make it into commercial products because of concerns about performance, cost, availability, or toxicity. The alcohols used in making phthalates typically range from one or two carbons up to 13, forming either a straight or branched alkyl chain. Phthalates that end up with three to eight carbons in their alkyl side chain have received the most scrutiny because they have been associated with reproductive and developmental effects in lab animals.

Such studies have prompted regulators around the world to impose restrictions on a handful of phthalates in toys and other children’s products, as well as in cosmetics and, more recently, electronics equipment in the European Union. But regulators are not in agreement over which phthalates and applications should be restricted.

Public health and consumer advocacy groups, meanwhile, are pushing for broader restrictions, saying phthalates should be removed from all consumer products, including the construction materials and other durable goods that make up the bulk of plasticizer use.

Major retailers in the U.S. are bowing to pressure from such advocacy groups and voluntarily removing products containing phthalates from their store shelves. Home Depot, for example, announced in April that it would stop selling vinyl flooring containing phthalates by the end of this year.

“As the world’s largest home improvement retailer, Home Depot’s new policy sends a strong signal to the marketplace that retailers want healthier building materials free of harmful chemicals like phthalates,” says Andy Igrejas, director of Safer Chemicals, Healthy Families, a coalition of public health advocacy groups. The coalition launched a campaign two years ago called Mind the Store, which aims to encourage retailers to stop selling products that contain harmful chemicals.

Other major home improvement retailers in the U.S., including Lowe’s and Lumber Liquidators, quickly followed Home Depot’s lead, also pledging to stop selling flooring that contains phthalates.

The American Chemistry Council (ACC), which represents chemical manufacturers, claims that “the science does not support the removal of phthalates from vinyl flooring.” Retailers and customers should “closely examine misleading claims about phthalates used in vinyl flooring, rather than allowing scare tactics to distort the facts,” the group’s phthalates panel tells C&EN.

Health advocacy groups previously put pressure on retailers to stop selling food packaging, shower curtains, rubber ducks, and children’s toys that contain phthalates. Mike Schade recalls working on those campaigns several years ago for the Center for Health, Environment & Justice, an advocacy group. Today, as director of the Mind the Store campaign, Schade is focusing his efforts on getting retailers to stop selling phthalate-containing building materials and household products beyond vinyl flooring. His targets include adhesives, caulks and sealants, vinyl-backed carpeting and area rugs, garden hoses, mini blinds, roofing membranes, and wall coverings.

The campaign is also concerned about phthalates in “children’s back-to-school supplies, apparel—especially for children and women of child-bearing age—beauty and personal care products, and cleaning products,” Schade tells C&EN.

Consumers can avoid exposure to phthalates by not purchasing PVC products, Schade advises. “Approximately 90% of all phthalates are used to soften vinyl plastic products,” he says. Those products, he adds, are often labeled with the word “vinyl” or a plastic recycling sign with the number 3 in the center.

Regulators are taking their own steps toward removing phthalates from the marketplace, albeit at a much slower pace than retailers. Officials in the U.S. and Europe agree on the fate of three phthalates—di(2-ethylhexyl) phthalate (DEHP), benzyl butyl phthalate (BBP), and dibutyl phthalate (DBP)—in children’s toys but are at odds about many other phthalates in myriad applications.

Over the past decade, production and use of DEHP in the U.S. and EU have decreased as a result of regulatory pressure and are likely to decline more in anticipation of new European rules. DEHP, also known as dioctyl phthalate, is currently banned at levels greater than 0.1% in toys and child care products in the U.S. and EU, as well as in cosmetics in the EU. It is still the largest-volume general-purpose PVC plasticizer globally, however, because of its widespread use around the world in other products. BBP and DBP are also banned in toys and child care products in the U.S. and EU, as well as in cosmetics in the EU.

Production and use of diisononyl phthalate (DINP), diisodecyl phthalate (DIDP), and di(2-propylheptyl) phthalate, on the other hand, are on the rise in the U.S. and EU.

In the U.S., the Consumer Product Safety Commission (CPSC) is proposing to expand the number of phthalates subject to restrictions in toys and child care products. In addition to the three phthalates already banned, DINP, diisobutyl phthalate (DIBP), di-n-pentyl phthalate (DPENP), di-n-hexyl phthalate (DHEXP), and dicyclohexyl phthalate (DCHP) would be prohibited. The proposal would, however, lift interim bans on DIDP and di-n-octyl phthalate (DNOP).

DINP, DIDP, and DNOP are currently prohibited in toys and child care products sold in the EU that can be placed in the mouth by children.

CPSC’s proposal to permanently ban DINP in children’s products has generated a lot of debate because DINP is number two on the list of most-used phthalates by volume. Many health advocacy groups support the ban, claiming DINP can disrupt androgen hormone pathways in lab animals. Chemical manufacturers, however, say the proposal is based on an unproven process and outdated exposure data.

“Exposures to DINP are many times below the concentrations that induce adverse effects in rats,” the ACC’s phthalates panel says. But CPSC’s proposed rule relies on a cumulative risk assessment for all phthalates that have antiandrogenic effects. So even if exposure to a particular phthalate is below the level of concern, it contributes to the overall risk from all antiandrogenic phthalates. ACC, however, argues that this cumulative risk assessment is unproven.

Exposures to DIBP, DPENP, DHEXP, and DCHP are also expected to be below levels of concern, but they too contribute to the cumulative risk from antiandrogenic phthalates.

ACC points out that CPSC’s proposed rule relies on biomonitoring data from 2005–2006. More recent data from 2009–2010 and 2011–2012 show a marked decrease in overall phthalate exposure compared with that older data, the industry group contends.

In a letter sent to CPSC earlier this year, the EU also raises concerns about the proposed restrictions on DINP, DIBP, DPENP, DHEXP, and DCHP, saying they “would be substantially different from the current rules applicable in the EU.” The biggest difference is that in the EU, each phthalate is assessed individually. In the U.S., the proposed rule is based on the combined risk of all phthalates.

The European Chemicals Agency (ECHA) evaluated the risks of DINP, DIDP, and DNOP in 2010 and concluded that, unless people put a product containing the substances in their mouth, the chemicals do not present a health risk. CPSC, however, reached a different conclusion for DINP because it considered cumulative risk from all antiandrogenic phthalates. ECHA did not assess combined exposure to DINP with other phthalates.

The U.S. and EU agree on restrictions on DEHP, BBP, and DBP in children’s toys. But EU officials are planning to completely phase out the three phthalates, along with DIBP, in all but a few authorized applications.

Earlier this month, the EU announced a ban on these four phthalates in electrical equipment, effective 2019. ECHA is currently seeking information to identify what other products contain the four phthalates, what the levels are, and how much migrates out of the products. Nine other phthalates are widely expected to be phased out in the EU.

It will likely be several more years before regulators completely remove these phthalates from the market and evaluate the safety of alternatives. In the meantime, retailers will face continued pressure from advocacy groups to pull phthalate-laden products off the market. And chemical manufacturers, even as they defend phthalates, are racing to develop the next best plasticizer.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter