Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Asia-Pacific

Although region is still going strong, outlook darkens

by Jean-François Tremblay

January 14, 2008

| A version of this story appeared in

Volume 86, Issue 2

THE REST OF THE WORLD may be concerned about an impending economic slowdown, but it's business as usual in most of Asia. In China, where the Olympics will take place next summer, mountains are being blasted away to supply the dirt and iron needed to build roads and buildings throughout the country. The Shanghai World Financial Center, one of the world's tallest buildings at more than 1,600 feet above the city, is nearing completion.

In India, the red hot economy is a magnet for businesspeople from around the world. Travelers are hard- pressed to find a clean room with an Internet connection in any of India's major cities for less than $400 a night. The Sensex, the benchmark index of India's National Stock Exchange, reached a record high on Dec. 21, 2007.

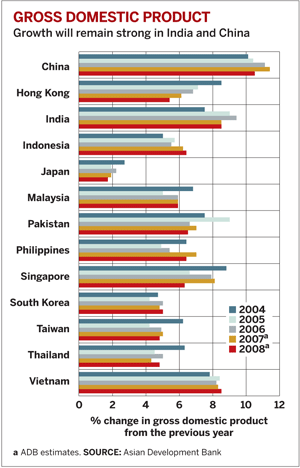

"Economic growth in emerging East Asia in the second half of 2007 likely sustained the momentum of the brisk first half," the Asian Development Bank (ADB) stated in its latest Asia Economic Monitor. The organization, owned by its 67 member countries, has been revising its estimate of 2007 economic growth upward throughout the year. Early in 2007, it expected annual growth in East Asia, less Japan, to average 7.6%. By the end of 2007, it said the region's emerging economies would grow by 8.5%.

This year, ADB expects that economic growth in Asia minus Japan will cool down to a still-rapid 8% tempo. The bank stresses, however, that this optimistic scenario is fraught with uncertainties. It warns that "the region's economic outlook is subject to greater downside risks now than just a few months ago—including the possibility of a U.S. hard landing, further tightening of global credit, an abrupt adjustment in exchange rates, and a continued rise in oil and commodity prices."

Despite all the focus on China and India, Japan remains the largest economy in Asia and the second largest in the world. What happens there matters for the whole region, and many in Japan fear that an economic downturn is just around the corner. Since reaching a five-year high last summer, the Nikkei stock market index has retreated by almost 20%. Housing starts plunged last year to their lowest level in at least 15 years. And Japanese car production stayed flat in 2007 after strong growth from 2002 to 2006.

Every three months, the Bank of Japan runs an influential survey, the Tankan, to assess the mood of the nation's manufacturers. The latest such survey, released on Dec. 14, 2007, shows that business confidence is at a two-year low. Survey respondents' key concerns were rising oil prices, falling housing starts, and a strengthening yen, which has appreciated almost 15% since the summer.

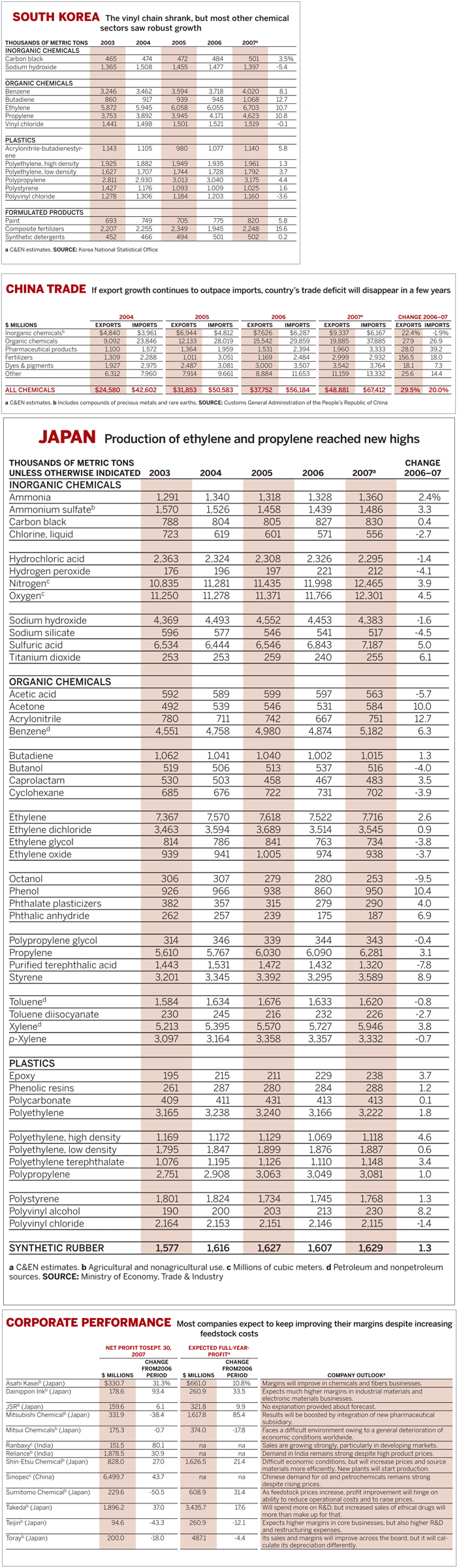

Despite negative sentiment about the Japanese economy as a whole, the country's large chemical producers are generally optimistic about their performance in the next few months. Asahi Kasei, a diversified chemical producer that also builds residential homes, expects that its net earnings in the fiscal year ending March 31 will be about 11% higher than in the previous year.

Asahi Kasei does expect its sales of homes, which represent about 25% of total sales, to decline nearly 11% in the current fiscal year. But it foresees margins in its chemicals business, which accounts for one-third of total sales, increasing by more than 12%. The firm has been enjoying strong foreign demand for its acrylonitrile, styrene, polymers, ion-exchange membranes, chlor-alkali systems, and separator membranes for rechargeable lithium-ion batteries.

Shin-Etsu Chemical, the world's leading producer of polyvinyl chloride and silicon wafers, expects to achieve record profits for the 13th year in a row. According to Shin-Etsu, worldwide demand for polyvinyl chloride is expanding. The firm notes that demand for its 12-inch silicon wafers is robust but that market conditions could change. To prepare for such an eventuality, the company says it has accelerated the pace at which it accounts for the depreciation of its facilities.

NOT ALL FIRMS are optimistic. For instance, Mitsui Chemicals, which depends on selling petrochemicals in Japan for most of its business, expects its net earnings to shrink 18% in the current fiscal year. The deterioration will be mostly due to special losses from the disposal of subsidiaries and to environmental liabilities. The company expects its petrochemical profits to be nearly the same as in the previous fiscal year.

Mitsubishi Chemical, another company that has a substantial petrochemical business in Japan, expects its current-year profits to surge by 85%, mostly due to its acquisition of the pharmaceutical company Tanabe Seiyaku. Mitsubishi had expected flat results in its petrochemical business, but that estimate will likely be lowered following a fire that took place at its main production site in Kashima on Dec. 21, 2007.

With its insatiable demand for materials, vehicles, and machinery, China accounts for much of the revival that corporate Japan has been enjoying in recent years. The Chinese economy continues to perform strongly. ADB estimates that the country's economy expanded 11.4% last year, and it expects that the torrid pace will moderate only slightly to 10.5% this year. This high growth is the result of "a widening trade surplus, galloping investment across the board, and buoyant private consumption," ADB says.

But not all is well in China. Consumer inflation has risen from a low of 1.0% per year in July 2006 to a 12-year high of 6.5% in October 2007. Food prices are surging, ADB says, because there is too much money in circulation. The causes of this excess liquidity are the country's monetary policy and its persistent trade surpluses. To control inflation, China's central bank last month raised its lending rate for the sixth time in 2007.

SO FAR, the worries of the People's Bank of China do not affect China's corporate sector. Sinopec, the country's largest petrochemical company, is having a bumper year. Its earnings in the first nine months of 2007 were 44% higher than a year earlier, thanks mostly to plants that operated smoothly at a time of strong economic conditions. Confident about short-term conditions, Sinopec is spending billions on capacity expansions at its petrochemical sites in Tianjin, Fujian, and Zhejiang.

Other parts of China's chemical industry are also enjoying vigorous growth. Simcere Pharmaceutical, a Nanjing-based producer of generic pharmaceuticals that is listed on the New York Stock Exchange, says its sales increased 45% in the first nine months of 2007. Net earnings grew by 73% in the same period. Simcere acquired two drug manufacturers last year in China and plans to buy more companies in the future.

In India, Asia's third largest economy, conditions are buoyant as well. ADB estimates that the economy grew 8.5% last year and expects that the pace of growth will remain the same in 2008. India is "among the world's fastest growing and most vibrant economies," the bank says.

Growth in India is mostly fueled by domestic demand, not by exports as in the rest of Asia. This local demand is due to rising corporate profits, available bank financing, growing business confidence, and healthy capital expenditures. According to ADB, market-oriented reforms adopted in recent years have enabled prosperity, but "a large section of the population has experienced little direct benefit from this high growth."

As a result, the bank says, the challenge for those in power will be to continue economic reform. One of India's main uncertainties, ADB says, is the unrest that could occur if the government stops subsidizing prices for the fuels that the country's poor need for cooking and heating.

FOR THE TIME BEING, Reliance Industries, an oil refiner and petrochemical producer that is also India's largest company, is enjoying strong results. Its net earnings in the fiscal half-year that ended Sept. 30, 2007, rose by 31% compared with the year-earlier period, while its sales increased 9%. Half of the sales increase was the result of price increases, and half was because the firm increased production. The company's profitability was further boosted by the appreciation of the rupee, which lowered the cost of servicing debt denominated in foreign currencies.

India's pharmaceutical industry is also healthy. In the first nine months of 2007, Ranbaxy Laboratories, a producer of generic drugs and active pharmaceutical ingredients, boosted its net earnings by 80% compared with a year ago, while sales grew by 21%. Sales growth was 12% in developed countries and 35% in developing countries.

At Nicholas Piramal India Ltd., net profit grew by 58% in the first half of the fiscal year that will end March 31. Sales of Indian branded drugs, which account for half of total sales, increased by 13%. The other half of the company, its custom manufacturing business, grew by 22%. NPIL says the sales increase was largely the result of opening new facilities in India. For the full year, NPIL expects its sales to grow about 20%.

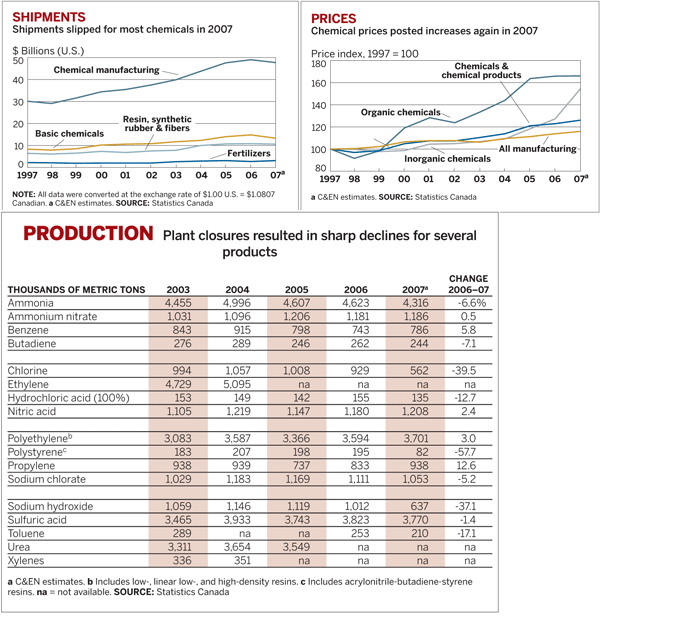

Compared with India, China, and Japan, Singapore is an economic midget. The 4.5 million people who live in Singapore do not form enough of a market to significantly affect the operating rate of the world-scale production units operating in the city-state. But with its open borders and strong links to the other economies in the region, the city-state serves as a regional barometer. For the past few months, the performance of Singapore's chemical and pharmaceutical industries has been surprisingly unexciting.

The Singapore Economic Development Board (EDB) estimates that the city-state's biomedical sector-made up of pharmaceutical and medical device companies-grew by nearly 9% in the first 10 months of 2007. However, growth in October was 15% lower than a year earlier because of a "different composition mix of active pharmaceutical ingredients," EDB says.

Singapore's chemical industry, which in official statistics also includes oil refining, is growing moderately. In the first 10 months of 2007, growth was only 3.3% higher than a year earlier, partly because some facilities underwent maintenance shutdowns.

In 2007, many Asian chemical and pharmaceutical companies attributed their high profits to strong economic conditions. The picture is positive for these industries in 2008 as long as economic growth rates stay high.

But economic growth could easily get off track in Asia if it does so in other parts of the world. In its most recent economic forecast, ADB ponders whether the economies of Asia would be able to weather a global financial storm. Its conclusion: only with great difficulty. According to the bank, the region's weak financial systems will "leave doors open to potential spillovers if conditions in global financial markets worsen or investor sentiments shift."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter