Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

United States

Economic woes may impact chemical industry growth, but a major downturn is unlikely

by Alexander H. Tullo

January 14, 2008

| A version of this story appeared in

Volume 86, Issue 2

THE U.S. ECONOMY took a couple big punches in 2007. The housing market collapsed and will take years to recover, and energy prices rose so spectacularly that they may finally dampen economic growth.

The fortunes of chemical makers in 2008 will depend largely on whether a relatively strong global economy and a weak dollar will encourage enough U.S. exports to soften these blows. Leading economists and industry observers are optimistic about such a scenario, though they acknowledge that a U.S. recession is still a possibility.

Overall, 2007 wasn't such a bad year for U.S. chemical makers. Profits at the 25 chemical companies C&EN tracks climbed 14.6% in the third quarter versus the same period the year before, reaching $3.58 billion. Sales for the quarter increased 9.4% to $48.0 billion. During the first nine months of the year, sales increased 7.7% and earnings improved 10.2% versus 2006, reaching $143.0 billion and $11.5 billion, respectively.

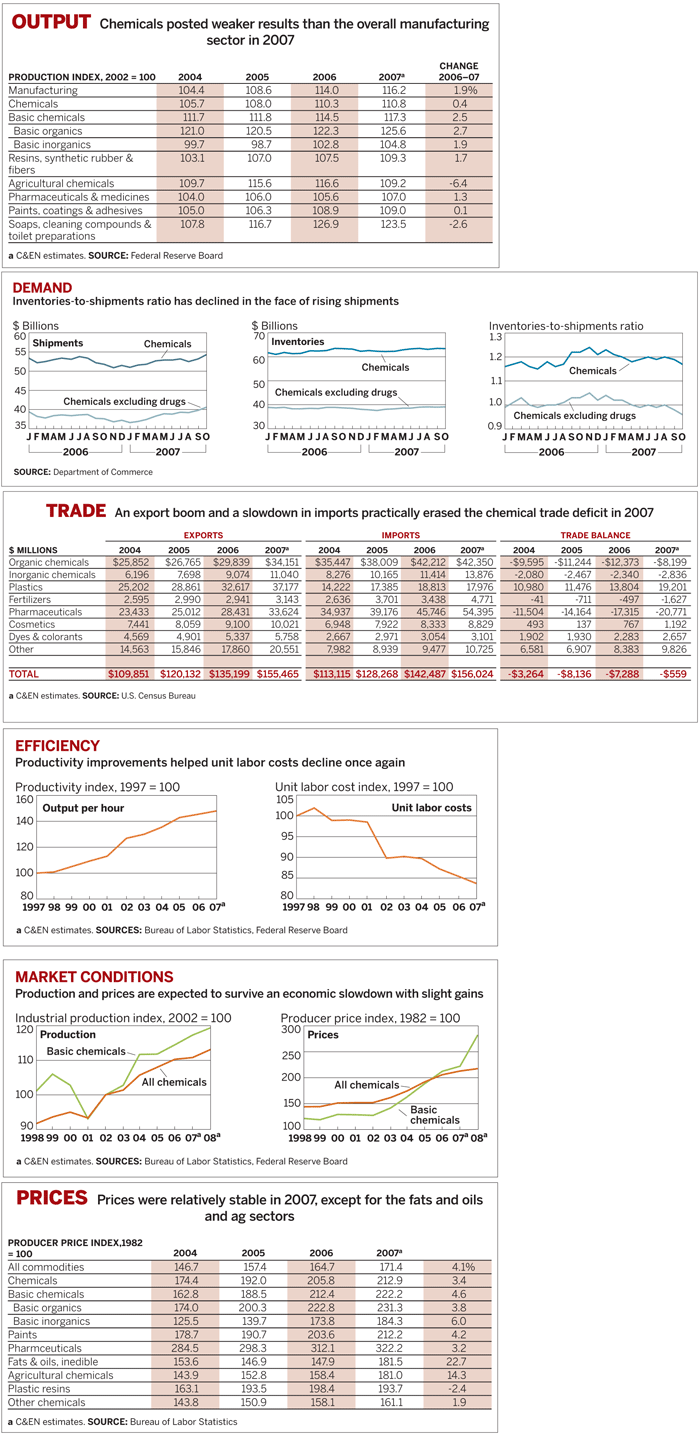

Although company results showed strength, government data reveal some weakness. Chemical production crept up by a mere 0.4% versus 1.9% for the overall manufacturing sector in 2007, according to C&EN projections based on 11 months of data from the Federal Reserve Board. Basic chemicals posted stronger results than chemicals as a whole, showing a production gain of 2.5%. The biggest drag on the chemical sector was agricultural chemicals, which suffered a 6.4% decline.

"The industry got off to a rocky start in the year," said T. Kevin Swift, chief economist with the American Chemistry Council (ACC), at a meeting last month in New York City. He blamed an inventory correction at the beginning of 2007 in which companies that make goods using chemical raw materials sold from their own stocks instead of making more products for sale. He added, however, that the chemical sector soon rebounded from that correction and was stronger toward year's end.

U.S. chemical shipments declined 0.5% during the first 10 months of the year to $526.1 billion. Excluding pharmaceuticals, shipments increased 0.6% to $385.8 million.

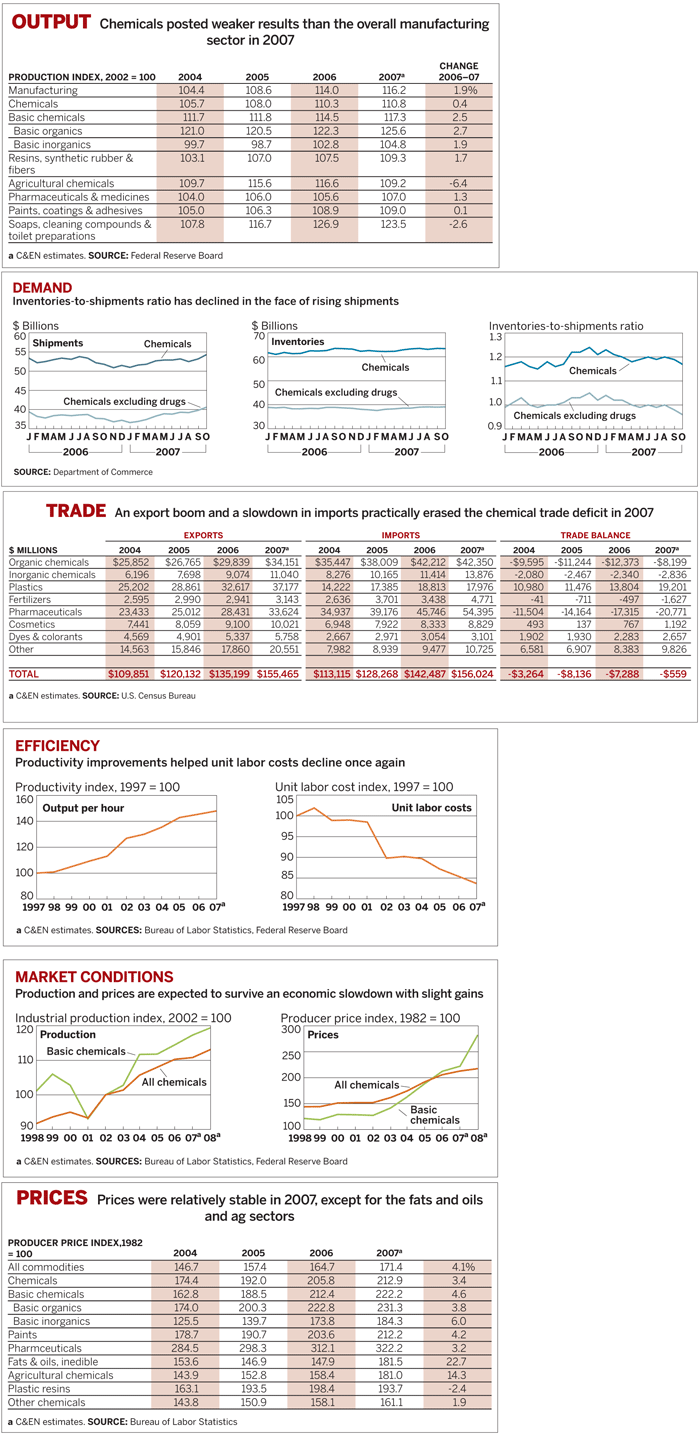

Chemical prices posted moderate gains. Department of Labor statistics show an increase of 3.4% for the first 10 months of 2007 versus the same period in 2006. The only chemical sector that saw declining prices was plastic resins, which posted a 2.4% decrease in average selling prices. But chemical prices failed to keep pace with commodity goods as a whole, which saw prices increase by 4.1% during the year.

The brightest spot in 2007 was trade. The U.S. chemical trade deficit shrank to a mere $559 million from $7.3 billion in 2006, according to C&EN projections based on the first 10 months of the year. Because much of the strength in exports occurred toward the end of the year, November and December may turn out to be stronger than expected, and the U.S. could end up with a trade surplus when final numbers come in from the Census Bureau.

"The news story of the year is that probably we'll have a surplus, which we haven't seen since 2001," Swift said. "The low value of the dollar and strong growth overseas contributed to that."

The dollar slid throughout 2007. A euro that fetched $1.32 at the beginning of the year cost $1.46 by Dec. 31, 2007. The dollar showed a similar decline in 2006. But the drop isn't necessarily bad news for U.S. chemical makers because it makes U.S. products cheaper for foreign buyers. This phenomenon is expected to propel strong chemical exports in 2008.

On the downside, the U.S. economy is contending with rising energy costs, which could dampen economic growth and also squeeze chemical profit margins. The price for the benchmark U.S. crude oil, West Texas Intermediate, began the year at about $58 per barrel and climbed throughout the year, flirting with a high of $100 toward the end of the year. Meanwhile, natural gas began the year at about $6.30 per million Btu, climbing to a high of roughly $8.60 in early November.

The U.S. Energy Information Administration expects that rising consumption and slow output growth will push oil prices up, on average, another 17.7% in 2008. EIA expects natural gas prices to climb a more modest 4.1% during the same period.

The silver lining for the U.S. chemical industry may be boosted international cost competitiveness because prices for natural gas are a bargain compared with those of oil. Given that a barrel of oil contains about 5.8 million Btu of energy, an equivalent amount of gas cost only about $50 at its peak last year. The U.S. ethylene industry relies heavily on ethane—a natural gas derivative—as a feedstock, whereas in Europe and Asia, ethylene makers depend on petroleum derivatives.

Randal Biang, a bond analyst with Fitch Ratings, expects the currency and energy effects to create a healthy competitive climate for U.S. petrochemical makers in 2008. "Exports are likely to keep pace with 2007 levels as the weaker U.S. dollar and ethylene economics based on ethane provide for greater opportunities in light of higher crude oil prices," he says.

IN ADDITION to escalating energy prices, the economy was hit by a subprime mortgage crisis in 2007, the full effects of which have yet to play out. Interest payments on adjustable-rate mortgages increased beyond what many new home buyers could afford, resulting in foreclosures and financial ruin for many Americans. The pain spread to financial institutions holding securities backed by these bad loans, choking the ability of banks to lend money.

The crisis has already had a devastating effect on the construction sector. The National Association of Home Builders projects that new housing starts will have finished 2007 at 1.35 million units, a 25.4% decline from 2006. The association expects a further 20% tumble in 2008.

In a recent economic outlook report, Wachovia Bank says the effects of the housing troubles will linger as the U.S. works through oversupply. "Housing will continue to decline into the new year, and we do not expect any meaningful recovery on a national basis before the end of the decade," the bank says. The consequences of a weak construction sector on the chemical sector will be painful. According to ACC, every new house is made with about $17,000 worth of chemicals.

Some economists fear that housing and car manufacturing won't be the only sectors that take a tumble in 2008. They worry about an overall economic recession. Most notably, at a forum in Lisbon, Portugal, last year, former Federal Reserve Board chairman Alan Greenspan put the probability of a U.S. recession at between one-third and one-half.

In November, the National Association for Business Economics (NABE) released its survey of 50 professional forecasters, a group that includes Swift and Robert Fry, DuPont's senior associate economist. The panel has its pessimists. About one-fifth of them put the odds of recession at more than 50%. The majority of the economists, however, put the chances of a recession at less than one-third.

Overall, the panel predicts the U.S. economy will expand by 2.6% in 2008, down from its September forecast of 2.8%. Still, the figure is better than the 2.4% increase expected when the numbers come in for 2007 and the anemic 1.5% annualized growth for the fourth quarter.

"While the U.S. economy faces a higher risk of recession from credit markets, housing, and energy prices, NABE's panelists still do not see recession as the most likely outcome," said Ellen Hughes-Cromwick, chief economist of Ford Motor Co. and NABE's president, when NABE released its outlook.

The Livingston Survey, a poll of 36 economists conducted by the Federal Reserve Bank of Philadelphia, is forecasting 1.9% growth in the first half of 2008 followed by a rebound to 2.8% growth in the second half of the year, for a net full-year growth of 2.4%.

Economists see a few bright spots, such as strong consumer spending outside of the automotive and housing sectors. "The consumer is still engaged in two-thirds of the economy," Swift said. Indeed, according to the Department of Commerce, retail sales for the first 11 months of the year, excluding motor vehicles, increased 4.7% versus 2006.

In its outlook for next year, ACC predicts healthy growth for the worldwide chemical industry of 4.3%, versus 4.1% in 2007. It predicts that U.S. chemical production will increase 2.1% in 2008 and that chemical shipments will jump by 2.3% to $654 billion. "For the business of chemistry in the U.S., resilient overseas economic growth and a low dollar will aid export demand, resulting in a trade surplus and new highs for production volumes," the report states.

Eric P. Vogelsberg, senior vice president of the consulting group Kline & Co., says specialty chemicals that depend largely on the construction market, such as coatings, concrete additives, adhesives, and sealants, will be impacted by a U.S. economic slowdown. But he also sees offsetting factors such as overseas strength for specialty chemical firms as well as a potential increase in remodeling activity. "Although people may not afford a new house, they might upgrade what they are living in," he says.

MEANWHILE, observers say the petrochemical industry will not have to contend with a cyclical downturn in 2008 because of a surplus of capacity due to come onstream in the Middle East, particularly in Iran.

Paul Bjacek, who leads global chemicals and natural resources strategic research at Accenture, a consulting firm, is optimistic about petrochemicals. He notes that operating rates are still high and chemical inventories continue to be low. "The chemical industry will continue to be on the up cycle for the next 12 to 18 months, maybe even two years, based on supply-and-demand fundamentals," he says.

Observers also expect brisk merger and acquisition activity in chemicals, which last year saw blockbuster deals like Saudi Basic Industries Corp.'s purchase of GE Plastics, Basell's acquisition of Lyondell Chemical, Akzo Nobel's ICI takeover, and Hexion Specialty Chemicals' bid for Huntsman Corp. Dow Chemical, which is putting its basic chemicals business into a joint venture with Kuwait Petroleum, is already on the hunt for specialty chemical acquisitions.

Bjacek expects chemical companies to use some of their currently high cash flow to expand through acquisitions. Aiding them is the fact that private equity firms, the source of a lot of dealmaking in recent years, are finding it difficult to line up financing because of the subprime crisis. "It might be better now for chemical companies because they might get better value for the acquisitions since they are not competing with the private equity firms," he says.

On balance, experts believe that the U.S. chemical industry will absorb the economic blows and deliver—thanks to a strongly growing world economy—not such a bad year in 2008.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter