Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Europe

Chemical industry rides the crest of the business cycle but readies for possible slowdown

by Patricia L. Short

January 14, 2008

| A version of this story appeared in

Volume 86, Issue 2

AS 2008 BEGINS, the soothsayer's task seems more challenging than usual. Optimism still abounds, but it is increasingly tempered by caution as company executives acknowledge worrisome world economic conditions.

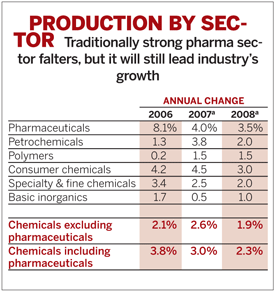

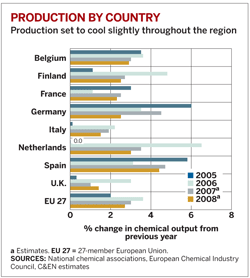

The European Chemical Industry Council (CEFIC) predicts a slowdown this year, following what its economists describe as the "good year of 2007." CEFIC forecasts that the European chemical industry's output—excluding pharmaceuticals—will expand by about 1.9% in 2008. That will be down from 2.6% in 2007 and the 2.1% growth rate experienced in 2006. Growth in 2007, CEFIC's economists say, was above the average of the past five years due in part to recovery from technical problems at several petrochemical complexes in 2006.

During the first seven months of 2007, points out CEFIC Chief Economist Moncef Hadhri, chemical industry output was strong and the chemical business confidence index remained high, supported by important chemical users such as automobile and machinery makers. All chemical sectors benefited from a relatively good macroeconomic environment in the European Union, he adds. Moreover, exports continued to grow despite the weakening of the U.S. dollar.

For the whole of 2007, all segments are expected to have grown, paced by strong performance in the consumer chemicals sector, Hadhri says. Among other key segments, petrochemicals recovered in 2007 after a modest 2006; polymers bounced back from low growth in 2006, despite rising imports; and basic inorganics were up moderately, even though energy prices were high.

Pharmaceuticals, traditionally the star performer in the European chemical industry, are projected to have slowed significantly from what CEFIC calls an "extraordinary 2006," although the sector is still expected to be among the growth leaders in 2007 and into 2008.

By the final quarter of 2007, however, CEFIC was able to discern a loss of momentum in the industry. For example, the association says specialty chemicals experienced slightly slower growth because of cooling demand from manufacturing industry customers in Europe.

CEFIC expects an output growth of 2.3% in 2008 for the EU chemical industry as a whole, including the pharmaceuticals sector, down from 3.0% in 2007. The decline in 2008 will materialize only with some months' delay, tracking what Hadhri and his team see as a general cooling of the world economy.

Concerns about general economic conditions are widely shared in the financial community. For example, the Zurich-based bank Credit Suisse worries about inflation in the 2008 market outlook it issued last month. According to Nannette Hechler-Fayd'herbe, head of global fixed income and credit research at the firm, threats are posed by increases in the prices of raw materials, as well as prices for oil and other energy supplies.

Economists are particularly concerned that the general economic climate in Europe and the rest of the world deteriorated in the fourth quarter of 2007.

The European Commission's Business & Consumer Survey, published in November 2007, reported that perception of the economic situation in the EU worsened considerably, although its "economic sentiment indicator" remained above the long-term average. The deteriorating sentiment, the commission said, results mainly from a significant drop in confidence in the services sector and a slightly lower confidence in the construction sector.

CEFIC points out that the latest World Economic Climate index produced by Munich-based economic consultants CESifo worsened in the last quarter of 2007 in all major world regions and especially in the U.S. Asia shows the smallest deterioration, CEFIC says. Expectations for this year are slipping. The current situation is more negative than it was one quarter ago, the index indicates, although the assessment is still rather positive.

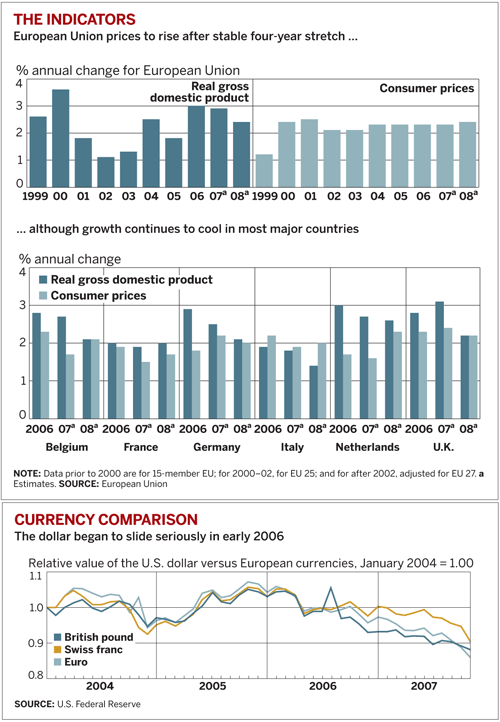

ECONOMIC GROWTH in the EU is expected to decelerate from 2.9% in 2007 to 2.4% in both 2008 and 2009, notes EU economists in their autumn forecast, published in November.

Credit analysts at Standard & Poor's are also tempering their forecasts. The European chemical industry is riding a strong cycle into 2008, but there is a slowdown ahead, according to credit analyst Tobias Mock in S&P's Frankfurt offices.

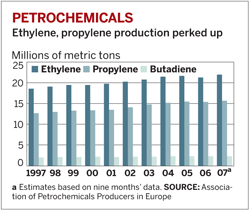

Still-sound economic growth around the globe and a prolonged commodity chemical cycle helped petrochemical producers in particular to achieve strong results in 2007, S&P says.

Overall strong global demand and tight capacities have resulted in healthy chemical plant operating rates, Mock points out. Moreover, many petrochemical companies enjoy strong pricing power, enabling them to pass on higher raw material costs to their customers. European specialty chemicals producers, on the other hand, often had to swallow raw material price increases. Still, on average, operating profit margins and cash flow generation across the sector improved in 2007.

European and Middle Eastern chemical companies look set for another year of strong operating conditions in 2008, Mock and his colleagues note in the company's industry "report card," published in December. Credit profiles are expected to stabilize as firms adopt more conservative financial policies in preparation for an expected 2009 downturn in the industry's economic cycle.

According to Mock and his colleagues, producers of ethylene and other commodity chemicals should remain the main beneficiaries of the strong petrochemical cycle as they revel in high capacity utilization resulting from strong economic growth over the past few years and an underinvestment in production plants in the past. "We expect companies to increase ethylene prices in the first quarter of 2008 and therefore improve their margins," Mock says. Producers in the Middle East and Russia, in particular, will benefit from this situation, as their feedstock costs have remained largely stable.

Specialty chemical companies will continue to be hard hit by high raw material costs and competition, Mock and his colleagues predict. They point out that the financial performance of European specialty chemicals players has been mixed. Some have clearly benefited from strong global economic activity; others are struggling to cope with significant competition and have not been able to pass on higher raw material costs.

Mock's forecast: "We expect specialty chemicals producers to remain tested by the inflation of raw material costs in 2008. They will also be more sensitive to the depreciation of the dollar than petrochemical companies, as they have a large proportion of exports. However, overall good economic activity in 2008, internal cost restructuring programs, and an expected easing of petrochemical prices in 2009 should provide a good basis for business operations for this segment in the coming years."

Consistent with S&P's forecast is the resolutely optimistic outlook of BASF. The portfolio of the chemicals giant spans all businesses that S&P assesses, from oil, gas, and commodity chemicals to specialty and fine chemicals.

BASF Chairman Jürgen Hambrecht is eagerly looking ahead to this year. "Everything that we can see today points to an optimistic outlook for 2008," he told a group of German journalists during a press conference in December 2007 to discuss the company's recently announced reorganization.

Hambrecht conceded that BASF's performance in the last quarter of 2007 was weaker than some securities analysts expected. He blamed fluctuating oil prices and the delayed start-up of some chemical plants that had been shut down for maintenance. However, he also said that the company's financial aims for 2007 would be attained.

Moreover, Hambrecht indicated that the German giant would not be resting in 2008. He noted that "we can support any acquisition when we want to and when it suits us." At the same time, the company will not hesitate to sell off businesses that no longer meet its operational and financial requirements, such as its styrenic plastics operation, now on the block.

Economic analyses by pan-European organizations such as BASF or CEFIC necessarily offer a panorama of the industry's performance. For individual country associations, however, the outlook for 2008 varies slightly.

For example, according to Jan Zuidam, chairman of the Association of the Dutch Chemical Industry, the Netherlands' chemical industry "has once again exhibited an excellent performance in 2007," with a sales increase of nearly 6.5%. The growth incorporates a 3.5% increase in production output-above the overall European average-and a 3.0% increase in selling prices.

Dutch industry growth is expected to continue into 2008, although at a slightly lower rate, reflecting high end-of-the-year producer confidence and well-filled order books. Also supporting the industry is record-level capital spending-up 7% from 2006, according to Zuidam.

Zuidam's counterpart in Germany, Ulrich Lehner, president of the German Chemical Industry Association, also sees slower growth for 2008. Speaking in December at the organization's annual economic outlook press conference, Lehner said the association expects German chemical sales to rise 4.5% over 2007 and production to increase 2.5%. However, that must be compared with sales growth of 7.5% in 2007 and a 4.5% increase in production.

Lehner, who is also chief executive officer of chemicals and consumer goods producer Henkel, cited a number of dampening influences as the reason for the predicted slowing. These include the strong euro compared with the U.S. dollar, the high price of oil, and financial market turbulence that still must run its course.

In defiance of those dampening influences, however, he pointed out that capital investments are increasing in the German chemical industry. For 2007, he said, the industry spent more than $9 billion, up 30% over 2006.

And this year, Lehner predicted, spending should continue to increase. In previous years, he explained, companies were primarily spending to replace old plants. Now, companies are expanding existing plants. Not only is that good for the industry's production capabilities, he noted, it is also good for employment in Germany. For the first time since 1991, he said, the number of employees in the German chemical industry grew-by 0.2%, to 436,900. Another increase is expected in 2008.

OPTIMISM CARRIES, even more emphatically, into the chemical industries in the new EU countries. Iván Budai, director general of the Hungarian Chemical Industry Association, expects 2008 will be an even better year than 2007, contrary to CEFIC's outlook for the European industry as a whole.

Budai explains that his optimism rests on expectations of a growth in gross domestic product for Hungary. The country's GDP increased by 1.7% in 2007, he notes, "one of our lowest" increases in the past few years. Current forecasts are for 2008 GDP growth of about 2.8%, a rate that gives Budai "some ground for optimism. Our exports market will grow as strongly as last year, and the internal market will improve and be better than last year."

In 2007, he says, Hungarian chemical production expanded by 4-5%. This year, he predicts,"it could be higher. Plastics raw materials, industrial gases, consumer chemicals, and fertilizers all have good chances for 2008 to increase production and sales volumes."

EU economists acknowledge strong economic growth in the 10 countries that joined the EU in 2004, including most of the countries formerly in the East bloc, as well as in the two—Romania and Bulgaria—that joined at the beginning of 2007. Nonetheless, they are worried about the coming year throughout the EU.

"Clouds have clearly gathered on the horizon with this summer's turbulence in the financial markets, the U.S. slowdown, and the ever-rising oil prices. As a result, economic growth is becoming more moderate and the downside risks have clearly increased," observes JoaquÍn Almunia, the EU's economic and monetary affairs commissioner. "But thanks to strong world growth and solid economic fundamentals, the negative impact should be limited."

The commission's forecast assumes that the distress currently convulsing the international financial community will peter out. In the meantime, the report added, the distress has tightened financing conditions. But private consumption has picked up and has become the main driver of growth within the EU, the forecast notes. Indeed, private consumption is expected to grow at a healthy pace, underpinned by relatively sustained employment growth. The EU economists expect that the final data for 2007 will show that capital investment has proven dynamic thus far. But they cautioned that, at this stage of the cycle, capital spending will probably start to moderate, not least given the sharp slowdown of construction investment in some EU countries.

For the chemical industry, it all means that there are some "serious downside risks," CEFIC warns. Among them: The continuing weakness of the U.S. dollar against the euro, an imbalance that weighs heavily on the export performance of European industry; high oil prices, which are leading to higher production costs and lower consumer and business confidence; and a stronger than expected impact on the world economy by the financial crisis in the U.S. All of which should make 2008 a challenging year for the European chemical industry.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter