Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Canada

Despite mixed results, the industry is optimistic about the future

by Alexander H. Tullo

January 14, 2008

| A version of this story appeared in

Volume 86, Issue 2

AN ASSESSMENT of the strength of Canada's chemical sector depends on where you look. For petrochemical makers in the natural-gas-rich west, business has been booming. Chemical companies in the east, on the other hand, have been suffering from rising oil prices, a strong Canadian dollar, and the country's manufacturing slump.

Against this backdrop, industry watchers expect that 2008 will again be a decent year for petrochemicals in Canada. Most other sectors will likely lag, though experts are optimistic overall about the Canadian chemical industry's long-term future.

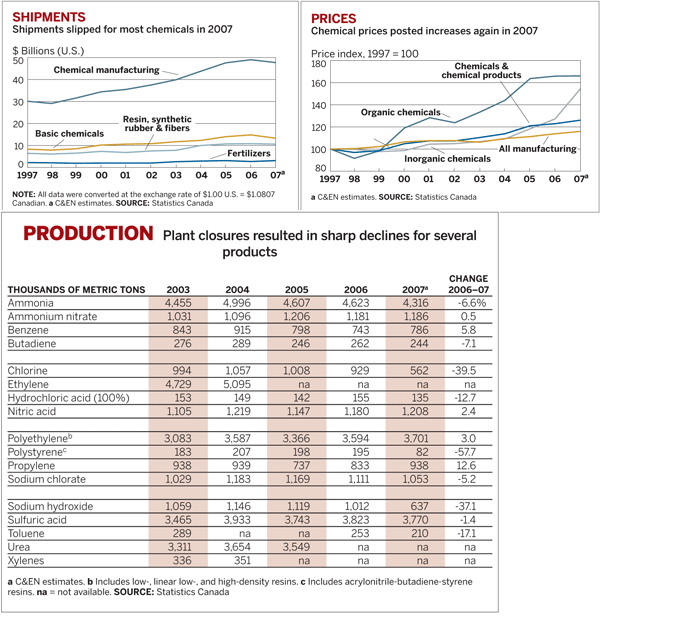

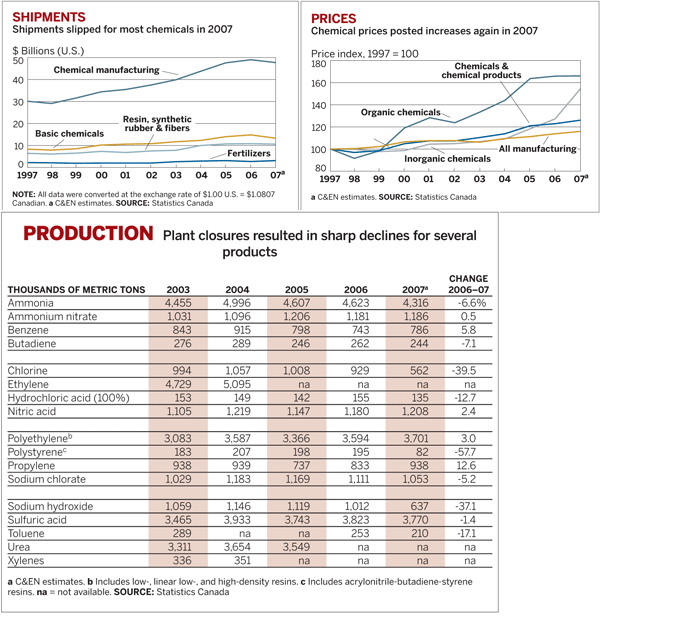

Canadian chemical shipments declined by 2.7% in 2007, hitting $47.7 billion, according to C&EN projections based on figures from Statistics Canada, the country's national statistical agency.

Data from the Canadian Chemical Producers' Association show a 7% decline in 2007 shipments to $23.1 billion. CCPA's figures cover the basic chemicals and plastics produced in the country and don't include other segments such as pharmaceuticals.

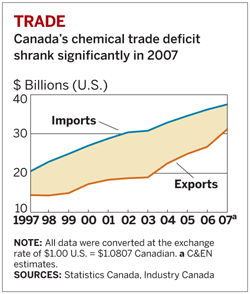

The most dramatic trend in Canada, according to CCPA, is a 48% drop in sales to Canadian customers from $8.3 billion in 2006, based on preliminary figures. The plummet in in-country sales means that Canada exported 81% of its chemical production in 2007, up from 66.5% in 2006. Indeed, Canadian chemical exports climbed 16.4% in 2007 to $31.1 billion, according to C&EN projections of the Statistics Canada data. With a modest increase in imports, the Canadian chemical trade deficit shrank from $9.5 billion in 2006 to $6.4 billion in 2007.

CCPA's data for basic chemicals and resins show a 13% increase in 2007 exports to $18.8 billion. Exports to the U.S. were down by 3%, meaning that Canadian sales outside of North America increased by about 66%. David Podruzny, vice president of business and economics at CCPA, says the low sales to Canadian customers may reflect the shuttering of chemical-consuming manufacturers in Ontario and Quebec because of the strong Canadian dollar and competition from overseas companies, particularly ones from China. "It looks like there is a trend here in which some chemical industry customers may be moving to offshore locations," he says.

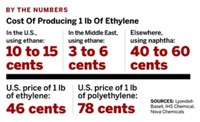

Still, the year was profitable for Canadian chemical producers. According to CCPA, chemical operating profits increased 18% in 2007. Podruzny says the increased profits were driven by producers of ethylene and its derivatives in western Canada; these firms are paying much less for ethane, a natural-gas-based feedstock, than overseas competitors are paying for naphtha, an oil-based feedstock. When the ratio between Canadian natural gas prices, in millions of Btu, and world oil prices, in barrels, is about 1 to 7, the competitiveness of the feedstocks is balanced. With oil flirting with the $100 mark and gas relatively stable, the ratio has opened up to roughly 1 to 10.

Nova Chemicals' results bear out the huge profits being made in western Canada's petrochemical sector. The company posted profits before taxes of $667 million in its Canadian olefins business, which includes its complex in Ontario, on sales of $3.2 billion, a profit margin of about 20%. Its Joffre, Alberta, olefins operations alone generated profits of $400 million on sales of $1.3 billion, a profit margin of more than 30%.

ACCORDING TO NOVA, the so-called Alberta Advantage—the difference in cost between making ethylene in Alberta versus the U.S. Gulf Coast—was 21 cents per lb in the third quarter of 2007, a gaping difference from the historic norm of about 7 cents.

"The Alberta Advantage has increased significantly over the past couple of years as we have seen oil prices increase dramatically," says Grant Thompson, senior vice president of olefins and feedstocks at Nova. He adds that the advantage is opening up even over U.S. ethylene makers that use ethane, because ethane prices on the Gulf Coast have been usually high.

But a lot of Canadian chemical producers haven't been so fortunate. The rising Canadian dollar, says David J. Shearing, an economist with CCPA, has been tough on the Canadian specialty chemical sector, which is centered in Ontario and Quebec. The U.S. dollar lost about 18% of its value versus the Canadian dollar in 2007 and for a while was weaker than its Canadian counterpart for the first time since the late 1970s. That hurts Canadian profitability, Shearing explains, because sales to the U.S. are conducted in U.S. dollars, while manufacturing costs like labor are in Canadian dollars. "This has put a crunch on specialty chemical operations," he says.

Even petrochemical producers outside Alberta have felt the squeeze. "Feedstock costs, with crude the way it increased, have had an impact," says J. S. (Steve) Griffiths, vice president and general manager for ExxonMobil's Canadian affiliate, Imperial Oil. Imperial's operations, centered in Ontario, are based mostly on petroleum. The firm posted a 31% decline in net income for the first nine months of 2007 to about $70 million.

But results for 2007 were still decent, coming as they did off a peak year for petrochemicals, Griffiths says. And industry operating rates are still reasonably high. "Overall, it was a pretty good year," he says.

Observers expect business this year to be down somewhat versus 2007. CCPA's outlook, based on a poll of its member companies, forecasts a dip in the Canadian chemical sector in 2008. Shipments are expected to fall by 1%, exports are anticipated to be flat, and profits are predicted to fall by 9%. "The general feeling is that there is a slowdown ahead of us," Podruzny says.

But the Canadian petrochemical sector should benefit from a global industry that is still at the top of its business cycle. Podruzny says cost overruns and construction delays in the Middle East mean that multiple petrochemical projects won't all start up at the same time, as was once feared. "It is quite possible that capacity utilization won't take as big a hit as we anticipated worldwide," he says.

Imperial's Griffiths agrees. "If you were standing a year or two back and looked out at what today's environment would be like, you would probably have predicted a little weaker performance in the chemical industry than we actually had," he says. He says 2008 should be another good year for petrochemicals, though not quite as strong as 2007. He says 2009 and 2010 are when the industry may start to see a downturn.

THE CANADIAN chemical industry is still reeling from a few noteworthy plant closures. Dow Chemical closed its Fort Saskatchewan, Alberta, chlorine unit and its Sarnia, Ontario, polystyrene unit at the end of 2006. Dow is planning to shut down all other plants at the Sarnia facility, including acrylic latex, and propylene oxide derivatives as a result of the suspension of ethylene shipments from western Canada on BP's Cochin pipeline.

Dow isn't the only company closing Canadian plants. Basell plans to shut down two polypropylene plants—one in Sarnia and another in Varennes, Quebec—later this year. The newly formed Ineos Nova polystyrene joint venture is closing its Montreal polystyrene plant.

Amid closures in eastern Canada, the profitable petrochemical makers in Alberta are trying to find ways to expand. To date, though, expansion has been stymied by limited ethane availability. To address the shortfall, the government of Alberta put in place incentive programs a year ago to help encourage the development of new sources of ethane.

Since then, Nova has inked two agreements aimed at tapping additional feedstocks. Along with Williams Cos., it is evaluating the capture of ethane and ethylene that is produced during the processing of bitumen from Alberta's oil sands.

Nova's Thompson says the sands have the potential to yield some 160,000 bbl per day of ethane if all of the gas is extracted from all the present and slated oil sands projects. Currently, companies in the province extract about 250,000 bbl per day of ethane from natural gas, which supports Alberta's 8.6 billion lb of annual ethylene capacity.

Nova is also working with Williams' Aux Sable Canada affiliate to build an extraction plant in Fort Saskatchewan that would extract 40,000 bbl per day of additional ethane from conventional natural gas sources.

With these new feedstocks, Nova says it could expand its ethylene and polyethylene capacity in Joffre. In fact, Thompson notes, Alberta is the only place in North America where new feedstock sources can be tapped. "When we look across North America, we think there is only one place that makes sense to grow, and that is here in Alberta," he says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter