Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Asia: Slowdown In China, Although Mild, Is Cause For Concern

by Jean-François Tremblay

January 14, 2013

| A version of this story appeared in

Volume 91, Issue 2

Most economists predict that Asia will experience faster economic growth in 2013 than it did in 2012. Still, after last year’s sluggishness, chemical executives remain wary of what 2013 will bring.

Nan Ya Plastics, a member of Formosa Plastics Group that produces a wide range of chemicals, fibers, and industrial parts, is a good representative of industry sentiment. “We are conservative in our outlook for 2013,” says Tsou Ming-ping, Nan Ya’s spokesman. “Final consumer demand remains weak, and this affects demand for our materials.”

China, where Nan Ya sells most of its products, is of particular concern, Tsou says. In recent years, China has been the world’s largest importer of chemicals. When the country’s economic growth slows from the 9–10% achieved in 2010–11 to the 7.5% posted last year, it’s almost a crisis for chemical companies.

Growth in China last year was the lowest in a decade due to a slowdown engineered by the government to prevent inflation. The measure was successful, and the government has already started to adopt a looser macroeconomic policy. The Asian Development Bank expects China’s economy to expand by 8.1% in 2013.

The outlook for India, Asia’s second-largest emerging economy, is also brighter. The Indian economy is gathering speed because of a loose monetary policy and a recovery in the agricultural sector, according to the Organisation for Economic Cooperation & Development. Confident about the future, India’s biggest chemical producer, Reliance Industries, is moving forward with a major expansion of its Jamnagar complex.

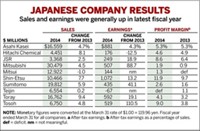

In contrast, the outlook for Japan is not bright, and the Asian Development Bank predicts lower economic growth this year than in 2012. But Japan’s chemical companies may actually have a decent 2013. In a research note, Yoshihiro Azuma, a stock analyst at the brokerage firm Jefferies & Co., wrote that aggressive spending by Japan’s new prime minister, Shinzo Abe, will boost demand for petrochemicals. Asahi Kasei, a chemical company that produces construction materials and residential homes, will also benefit, he wrote.

On the whole, 2013 will not be a bumper year for chemical companies exposed to Asia, but it is likely to be better than 2012 was.

MORE ON THIS STORY

- - World Chemical Outlook

- - Pharmaceuticals: Companies Will Focus On External Partnerships To Improve Productivity

- - U.S.: Domestic Manufacturing Slowdown Will Be Offset By Shale Gas Upside

- - Construction: The Action, Once Again, Is In Developing Countries

- - Europe: Economy And Chemical Industry Are Expected To Stagnate

- - Fine Chemicals: Optimism Prevails Over Uncertainty

- - Asia: Slowdown In China, Although Mild, Is Cause For Concern

- - Petrochemicals: The U.S. Will See A Boom As Europe And Asia Struggle

- - Cleantech: New Funding Will Be Scarce, But Scale-Up Plans Continue

- - Specialties: Growth To Be Fueled By Autos, Electronics

- - Canada: After A So-So 2012, Chemical Firms Prepare For A Brighter Future

- - Instrumentation: Firms Plan For The Long Term Amid Short-Term Uncertainties

- - Middle East: After Years Of Growth, A Profits Squeeze Lies Ahead

- - Advanced Materials: Carbon Fiber, 3-D Printing, Graphene To Make Inroads

- - Latin America: Policymakers, Industry Seek To Boost Competition

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter