Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pesticides

Chemical Outlook 2016 By Region

January 11, 2016

| A version of this story appeared in

Volume 94, Issue 2

Jump to Topics:

- U.S.: Amid Growth, Big Companies Clear The Decks For The Future

- Europe: Cheap Feedstock Will Offset The Region’s Soft Markets

- Asia: Signs That Bottom Is In Place For The Region’s Chemical Industry

- Canada: Sales Ebb, But Country’s Sector To Remain Profitable

- Latin America: Brazilian Chaos May Lead To ‘Depression’ In The Region

- Middle East: Less Competitive, But Still Adding Massive Capacity

The U.S. chemical industry faced plenty of economic headwinds in 2015. A strong dollar hampered exports. Trade partners Brazil, Japan, and Russia flirted with recession while growth in China slowed. Yet output increased by a healthy 3.8% last year, thanks in large part to consumers, according to the American Chemistry Council (ACC).

This year, output will continue to expand, though the growth pace will slow a bit to 3.1%, ACC forecasts. “Consumer spending remains strong as further improvements in the labor market and rising confidence support growth,” says T. Kevin Swift, ACC’s chief economist.

Such continued recovery from the 2008 recession will boost demand for autos, construction materials, and business equipment, Swift says. Sales of light vehicles are expected to edge up with hiring and better availability of credit. Basic chemicals, synthetic rubber, and specialties will top the list of growth segments.

Chemical companies will likely see prices continue to slide in some product areas, but “even with the fall in oil prices, the U.S. industry still has a favorable competitive position with regard to feedstock costs as natural gas prices have fallen as well,” Swift suggests. Low prices for agricultural commodities as well as oil and gas have dampened demand for chemicals used in those industries, though ACC anticipates crop prices may rebound later this year.

But whereas this year’s economic drivers will be similar to those of 2015, the U.S. chemical industry will certainly feel different for those who work in it. The once-unimaginable merger of Dow Chemical and DuPont will be under way, and businesses—particularly in agriculture—will need to be cast off to satisfy antitrust regulations.

Last month, DuPont said it will cut 10% of its global workforce, or about 5,300 positions. That and other streamlining moves could negate earlier expectations of a slight increase in U.S. chemical employment, ACC says.

DowDuPont will break into three businesses for materials, specialty chemicals, and agriculture, kicking off a flurry of spin-offs, snap-ups, and portfolio reworkings. The only firms looking to get bigger, though, are likely to be agriculture rivals girding to compete with the new giant, according to investment bank Grace Matthews.—Melody Bomgardner

European chemical firms can look forward to another year of low oil prices, a key benefit for a region that relies on oil-derived naphtha as its main raw material. The fly in the ointment is that the slowing of growth in the Chinese economy is set to impact Europe’s major chemical firms, including DSM, Lanxess, and BASF, which now generate much of their income from China.

The current sub-$50-per-barrel cost of oil is the “new normal,” and the cost of running naphtha-based ethylene crackers will continue to be relatively low in 2016, suggests Paul Hodges, chairman of the London-based consulting firm International eChem. If he is correct, it will be a welcome scenario for many of Europe’s petrochemical producers because 40 of the region’s 44 crackers are designed to use oil-derived naphtha feedstock.

As a result of the tepid macroeconomic conditions, the European Chemical Industry Council, or CEFIC, Europe’s largest chemical industry association, is forecasting 1.0% growth in European chemical production in 2016. That is up from 0.5% growth in 2015 because of an expected increase in demand for chemicals in industries such as food and beverages and construction, CEFIC says.

The association warns, though, that the longer-term outlook is poor. “Although we are forecasting a slight uptick compared to the previous year, the conditions under which this modest growth took place, such as low oil prices and a favorable euro-to-dollar exchange rate, cannot be expected to last indefinitely,” says Director General Hubert Mandery.

Stephanus le Roux, head of economics for the U.K.’s Chemical Industries Association, also expects a modest uptick this year. “In 2016 we see many of the fundamentals that supported growth remaining in place,” he says.

But growth is also likely to be sector-specific. “The risk posed by the slowdown in emerging economies like China and Brazil may reduce the growth in key chemical customer sectors like agriculture and personal care,” le Roux says.

VCI, Germany’s largest chemical industry association, is predicting a 1.5% increase in the country’s chemical production this year, up from 1.0% growth in 2015. Much of the growth will come from foreign customers. It will be “a somewhat brisker chemical business with customers at home and abroad,” says Bayer Chairman and VCI President Marijn Dekkers.—Alex Scott

Few people have a better sense of where the chemical industry is headed in Asia than Sanjeev Gandhi, BASF’s top manager for the region. The giant chemical company runs manufacturing and R&D centers in China, India, Japan, South Korea, and Southeast Asia. From his well-informed position, Gandhi expects business conditions will start to improve in 2016.

Companies across nearly all business sectors in Asia have been affected over the past two years by a slowdown in China, the region’s largest market. Whereas, for the past few decades, the Chinese economy expanded by at least 8% annually—and much more in some years—the Asian Development Bank expects that China managed less than 7% growth in 2015 and will not do any better this year.

But Gandhi is confident the worst is over for the chemical sector in Asia. “We see steady improvement in demand—nothing too exciting—across all of our businesses in the region,” Gandhi says. Producers of commodity chemicals will go through a particularly slow recovery, he expects. “It will take up to seven quarters for commodity prices to recover.”

For years now, Chinese chemical producers have struggled with overcapacity. But the outlook is improving, Gandhi says, especially for specialties. In particular, the construction sector, where China’s slowdown had been particularly sharp, is showing signs of life. This could stimulate demand for the myriad building materials supplied by chemical companies such as BASF.

Gandhi’s guardedly optimistic outlook is in tune with much of the economic news coming from Asia. In Japan, the December “Tankan” business confidence survey conducted by the Bank of Japan revealed a mood of cautious optimism. During the first half of the fiscal year that will end on March 31, Japanese chemical companies delivered solid profits .

Meanwhile, India, Asia’s third-largest economy, is roaring, and its economic growth is expected to pass that of China in 2016. The country’s biggest chemical producer, Reliance Industries, achieved its most profitable six months during the first half of the fiscal year that will end on March 31.

Gandhi expects 2016 will be an even better year than 2015 for India’s economy. One reason is that the sales tax system will be reformed to lower and simplify the cost of transactions. In addition, the monsoon in 2016 will likely be better than last year’s because India rarely experiences two bad monsoons in a row. The rains matter to the economy in a country where two-thirds of the population is rural and dependent on agriculture.—Jean-François Tremblay

The Canadian chemical industry should stabilize this year after a volatile 2015.

Chemical sales in Canada were crushed in 2015. They fell 10.3% to $20.3 billion, according to the Chemistry Industry Association of Canada (CIAC), their lowest level since 2012.

Blame prices for oil- and gas-related raw materials, which saw their second straight year of declines.

Volumes sold actually rose 1.9%, meaning most of the sales decline was price-related. And profits decreased a mere 2.7%, to $3.1 billion, making 2015 still one of the strongest years on record. “That means a lot of our input costs also went down,” says David Podruzny, CIAC’s vice president of business and economics.

Overall, CIAC members expect 2016 to look a lot like 2015 for the Canadian chemical business, with a 1.9% decline in sales but a 1.0% increase in volumes. Profits will ebb by 5.5%, they anticipate, but that would still make 2016 a lucrative year for the sector.

Capital expenditure numbers indicate caution about the future among Canadian executives. In 2015, spending dropped to $835 million, a 58% decline in just a year and its lowest level since 2010. CIAC expects a further 1.9% erosion for 2016. “We can only say that it must be a reflection of a weakness in investor confidence,” says John Margeson, CIAC’s director of business and economics.

Some of the caution stems from low oil prices and a weaker economic outlook. Government policies, such as higher corporate and greenhouse gas taxes in several provinces, might also be forcing investors to recalculate their investment decisions, Margeson says.

A few big Canadian chemical projects are still awaiting imprimaturs that may come in 2016. Nova Chemicals has yet to decide whether it will build a polyethylene plant in Ontario. It will complete a new plant for the plastic in Alberta later this year.

Williams Cos. has been kicking around plans for a propane dehydrogenation plant in Alberta. It recently signed on North American Polypropylene as a partner that would build a downstream polypropylene plant. Williams will make a final decision in 2016.

John Floren, chief executive officer of Methanex, is on the fence about a project to expand his company’s methanol plant in Alberta. “In the current environment, it’s very difficult to make significant investments, but we are continuing to pursue that project,” he noted in a recent conference call with analysts.—Alex Tullo

Brazil is a mess. A corruption scandal has engulfed the Brazilian government and its state-run oil company, Petrobras. President Dilma Rousseff may even face impeachment in 2016. After booming for the better part of the past decade, the country’s economy, by far Latin America’s largest, has hit a wall.

Brazil’s chemical industry has been pulled down by the turmoil, though its 2016 prospects are modestly better.

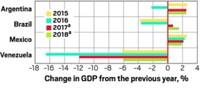

According to the International Monetary Fund, Brazil’s gross domestic product shrank 3.0% in 2015. IMF expects the country’s economy to slip another 1.0% this year. It blames deteriorating political conditions, declining investment, and fiscal tightening.

Alberto Ramos, chief Latin American economist at Goldman Sachs, paints an even bleaker picture for Brazil. “What started as a recession driven by the adjustment needs of an economy that accumulated large macro imbalances is now mutating into an outright economic depression,” he wrote last month.

Ramos expects an economic decline of 3.6% in 2015 followed by another 2.3% decrease this year. He pointed out that investment spending has dropped 21% since the second quarter of 2013. Other troubling issues for the country include high inflation, a weak labor market, high household indebtedness, and soft commodity prices.

Brazilian chemical production, meanwhile, declined 4.4% during 2015, according to the American Chemistry Council (ACC).

Plastic resin demand in Brazil was particularly hammered, according to Rina Quijada, senior director for Latin America at the consulting firm IHS Chemical. In 2015, demand for polyethylene, used in consumer packaging, dropped 4.5%. Demand for polypropylene, used in durable goods such as cars, declined 8.0%. And demand for polyvinyl chloride (PVC), used heavily in construction, plummeted 14%.

It isn’t all bad news for Brazilian chemical makers. A 30% devaluation of the Brazilian currency, the real, against the dollar, has made the country’s imports more expensive and exports cheaper. Also, low oil prices have made the country’s petrochemical sector, which runs mostly on oil-derived naphtha instead of natural gas, more competitive globally. “Imports have dropped considerably,” Quijada says.

And this year should be better. ACC predicts 0.8% growth in Brazil’s chemical industry. Quijada expects the polyethylene industry will show modest growth, although she expects to see demand drops of 10% for PVC and 3% for polypropylene.—Alex Tullo

Some 70% of the Middle East’s petrochemical industry uses natural gas as its raw material. That means the low price of oil and the rising price of gas will continue to have a dampening effect on the region’s chemical industry.

Despite the raw material challenges, companies in the Middle East are still on track to commission a series of huge petrochemical complexes in 2016. But in light of their diminishing feedstock advantage, they are taking steps to diversify their product lines beyond basic gas-based chemicals, says Mohit Sood, principal analyst for IHS Chemical.

Advertisement

The biggest example of this diversification—and the biggest-ever chemical complex to be built in a single phase—is Sadara, a $20 billion petrochemical facility in Jubail, Saudi Arabia, being constructed by Saudi Aramco and Dow Chemical. A number of Sadara’s 26 plants, which will make a combined 2.7 million metric tons of product annually, including ethylene, elastomers, and polyols, are due to start up in 2016.

Sadara will be the first complex in Saudi Arabia to use naphtha as its feedstock, thus sidestepping gas price hikes. “We have the hydrocarbon resources; we have the capital; we have the operational know-how. Now, it’s just a matter of getting after it,” said Warren W. Wilder, vice president of chemicals for Saudi Aramco, speaking at a recent Sadara briefing.

A hike in capacity is also in the cards for Iran. In March, international trade sanctions on Iran are set to be lifted, enabling the country, its government contends, to increase its annual petrochemical output by 25% to about 56 million metric tons within one year.

Iran’s chemical industry, which can draw on large national reserves of gas, could continue to grow after 2016 if the country can secure the $70 billion needed to complete the construction of 67 projects that sit partly built as a result of years of sanctions.

If the funding is secured, petrochemical production could rise to 120 million metric tons within five years and 180 million metric tons over 10 years, according to the Iranian consulting firm ICG Group. German firms, including BASF and Linde, have already indicated they may invest in Iran’s chemical industry.—Alex Scott

↑ Top

Jump to Topics:

- U.S.: Amid Growth, Big Companies Clear The Decks For The Future

- Europe: Cheap Feedstock Will Offset The Region’s Soft Markets

- Asia: Signs That Bottom Is In Place For The Region’s Chemical Industry

- Canada: Sales Ebb, But Country’s Sector To Remain Profitable

- Latin America: Brazilian Chaos May Lead To ‘Depression’ In The Region

- Middle East: Less Competitive, But Still Adding Massive Capacity

MORE ON THIS STORY

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter