Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Biologics

New day for antibody-drug conjugates

The drug services sector jolts as ADC approvals ramp up and a slew of candidates enter the clinic

by Rick Mullin

May 15, 2022

| A version of this story appeared in

Volume 100, Issue 17

You may have heard of the consulting firm Gartner’s technology hype cycle—the technology trigger, the peak of inflated expectations, the trough of disillusionment, the slope of enlightenment, and the plateau of productivity.

Consider the antibody-drug conjugate.

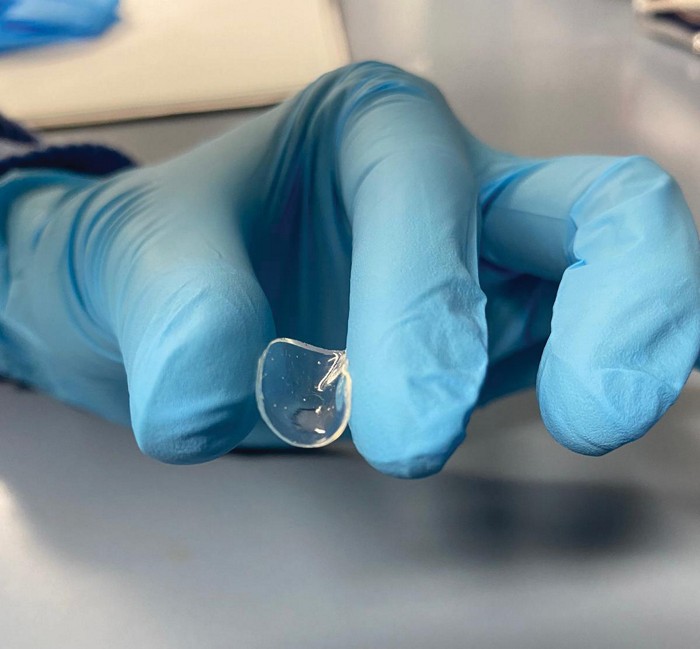

ADCs emerged more than 20 years ago with the promise of improving cancer treatment. The basic idea is to chemically link highly potent small-molecule payloads to antibodies that connect with proteins on the surface of tumor cells, creating a kind of guided-missile approach to drug delivery far less toxic than chemotherapy.

It intrigued the world of cancer research, where highly potent compounds and biologics had been making halting progress on their own. Large drug companies rushed in and lined up for their first shots on goal.

AbbVie took a $6 billion shot with Rova-T (rovalpituzumab tesirine), a treatment for advanced small-cell lung cancer, that it got in 2016 with the acquisition of Stemcentrx. Its failure in 2019 was a shock; many in the sector stopped talking about ADCs. Some, perceiving that the promise of ADCs would not be realized, stopped working on them.

But other drug developers kept busy, and the approvals came. The US Food and Drug Administration approved three ADCs in 2019. By the end of last year, 12 in all had been approved, and 145 ADC candidates were active in the clinic, according to Beacon Targeted Therapies, the drug development intelligence arm of the consulting firm Hanson Wade. The most recent to be approved was Tivdak, an ADC from Genmab and Seagen for recurrent or metastatic cervical cancer.

In addition to being an emerging therapeutic class, ADCs are a ripe opportunity for contract development and manufacturing organizations (CDMOs). An ADC is complicated, requiring an antibody, a payload, a linker molecule to join the two, and conjugation to bring all the parts together. CDMOs have been supplying these services for well over a decade. They are now stepping up with a round of new investments to serve drug firms that are bringing forward the next generation of candidates, including site-specific ADCs engineered to set payload molecules at precise locations on antibodies.

ADC dynamics

a All approvals are by the US Food and Drug Administration except for one by China's National Medical Products Administration in 2021.

Jake Morris, a senior account manager at Beacon, says recent approvals reflect a high level of steady development. “The approved ones were in development during the recent slump,” he says. “It’s not as if something changed in everyone’s strategy.”

Approaches to designing ADCs have evolved, Morris says, but the more evolved candidates are still working their way through the R&D system. “It’s quite interesting that all the approved drugs for ADCs are non-site-specific, all using the first-generation approach,” he says. But the new generation is coming up fast. “In 2020, every ADC that entered the clinic was site specific,” he says.

Large drug companies, their confidence restored by recent approvals, are active in developing ADCs, Morris notes, but most players are small biotech firms that lack manufacturing facilities, creating a lot of work for service providers.

“We see a very strong CDMO business for ADCs,” says Matthias Bucerius, head of actives and formulation for MilliporeSigma, the CDMO arm of Germany’s Merck KGaA.

The company is well positioned for business going forward, Bucerius says. Over the past several years, it has filled out its ADC services with the acquisition of Sigma-Aldrich; added services for linkers and highly potent payloads at Sigma-Aldrich’s plant in Madison, Wisconsin; and introduced conjugation services at Sigma-Aldrich’s home base in Saint Louis. Merck KGaA has been manufacturing monoclonal antibodies in Martillac, France, for more than 20 years.

MilliporeSigma is currently investing $65 million to expand ADC-related capacity in Madison. The project will add six high-containment laboratories, according to Bucerius. The company recently expanded its conjugation and clinical-scale manufacturing facility in Saint Louis.

The growth in the number of ADC candidates entering the clinic in recent years is driven by innovative research, Bucerius says. He estimates that 30% of the ADC projects his company is working on are novel-format conjugates, a term coined by Beacon for conjugates that use oligomers, immunostimulants, and chelators for radioconjugates as substitutes for antibodies.

MilliporeSigma has been innovating as well. It introduced a research technology service addressing hydrophobicity, or poor aqueous solubility, the cause of more than 20% of terminations during clinical trials, Bucerius says. Overall, the firm currently provides services for more than half the approved ADCs, he says.

Lonza, one of the world’s largest CDMOs, makes monoclonal antibodies and highly potent active pharmaceutical ingredients and provides ADC conjugation services, all at the company’s complex in Visp, Switzerland, according to Stefan Egli, head of bioconjugation. Antibodies for ADC work can also be supplied from Lonza’s plants in Portsmouth, New Hampshire, and Singapore, where it has larger-scale production.

“There is definitely a moment for excitement in the ADC world,” Egli says, pointing to the arrival of new technologies, including ADCs with stabler linkages and improved toxicity profiles.

In response, Lonza is adding capacity for ADC conjugation. This year the company is opening an additional 1,500 m2 of capacity for conjugation in Visp. Egli says space is also available for ADC customers at Lonza’s Ibex facility in Visp, a general manufacturing campus at which customers can set up operations.

Piramal Pharma Solutions, an India-based CDMO, put its ADC business together via acquisition. One of its first steps was to launch conjugation services at a facility in Grangemouth, Scotland, that it acquired from Avecia in 2005. Its 2016 purchase of Ash Stevens added payload and linker services. The company performs fill-and-finish work at a plant that it bought from the University of Kentucky in 2015. And last year Piramal acquired a minority stake in Yapan Bio, an Indian producer of monoclonal antibodies.

Stuart Needleman, Piramal’s chief commercial officer, says the investment in Yapan is the first step in adding antibody production to the ADC services the company already offers in the US and Scotland.

Meanwhile, Piramal plans to spend $68 million to expand its facility in Grangemouth. The project will begin with the addition of two conjugation suites next year and room to build two more. The firm announced a $32 million expansion of its Riverview, Michigan, site in 2020. Needleman stresses that Piramal has been servicing the ADC market since the early days and provides services to Seagen for Adcetris, the second ADC therapy to be approved. “It’s a growing space,” Needleman says. “But it’s down to track record.”

Novasep, a French CDMO that recently merged with PharmaZell, also claims a track record. It made its first ADC payload in 2006 at a plant in Le Mans, France, that manufactured small volumes of generic cytotoxic molecules such as docetaxel and paclitaxel, according to Kevin Daley, marketing director for pharmaceuticals. “We just had the perfect fit,” he says. “Small-volume cytotoxics and high-performance liquid chromatography, which are absolutely vital for purifying these ADC payloads.”

The company produced its first conjugation batch in 2010 and began scaling up its operation, bringing an $11 million bioconjugation unit on line in Le Mans in 2017. The company is providing services for “at least three” commercialized ADCs, Daley says.

It’s arguable whether being able to provide a full range of services, including antibody production, presents an advantage over more focused experience with payload and conjugation services, Daley says. Novasep sold its viral vector business, which manufactured antibodies, to Thermo Fisher Scientific last year, and it is emphasizing its strength in highly potent small molecules and conjugation.

“The CDMO business is all about relationships with customers and confidence in technical teams and management,” Daley says. “From Novasep’s perspective, having the payload and conjugation on one site presents advantages for our customers.”

The company is expanding capacity in Le Mans with a $6 million project to add a manufacturing suite for highly potent active pharmaceutical ingredients. The company invested $4 million at the site in 2021. “Our next step forward will be to carry out quality-control analysis,” Daley says.

Carbogen Amcis got a head start in ADCs with expertise in highly potent small molecules that dates back to 2005 at its facility in Bubendorf, Switzerland, says Scott Miller, senior scientific adviser at the company. “Early on we were asked to produce a drug linker for an early ADC,” Miller says. The company added conjugation services as demand grew.

“The conjugation side really kicked off in 2013 and 2014,” Miller says. Carbogen invested in a clean-room lab in Bubendorf and in formulation and fill-and-finish services at its plant in Riom, France. The firm is currently expanding drug linker capacity in Bubendorf and plans to open a new fill-and-finish site in Riom next year.

“Our conjugation services are presently 100% with biotech companies, and most of our proposal requests come from this sector of the industry,” Miller says. On the other hand, he says, 75% of Carbogen’s business in linkers for highly potent drugs is with larger pharmaceutical companies that do not require conjugation services.

Sterling Pharma Solutions, a UK-based services firm with expertise in highly potent molecules, moved into conjugation in a partnership with ADC Biotechnology, another British CDMO, in 2020. Sterling purchased ADC Biotechnology the following year and recently announced it will spend $1.3 million to expand R&D at ADC Biotechnology’s site in Deeside, Wales.

“We saw opportunity in the market,” says Colin McKee, head of technical services in Deeside. McKee says that for 8 years, the Deeside plant has been making conjugates in quantities of up to tens of grams to support preclinical research on ADCs. The company is investing an additional $1.3 million for clinical and commercial supply.

“Colin and team have done a great job expanding process development and the clinical development aspect of the site over the last year, close to doubling the number of people on the site, from 30 to 55,” says Stewart Mitchell, site head at the Deeside plant.

It is hard to predict whether productivity in ADC development will plateau, in keeping with the Gartner hype cycle. But any disillusionment the sector may have experienced is in the rearview mirror. And service companies are enthusiastic about the challenges ahead—challenges that even the most experienced among them need to be alert to, Lonza’s Egli says.

“It always sounds like the chemical part is easy, but this is supercomplex to synthesize,” Egli says. And bioconjugation requires experience in the handling of radioisotopes, biopolymers, and oligonucleotides.

MilliporeSigma’s Bucerius says the action in the ADC market is encouraging. “I really like that we are talking about ADCs again,” he says. “For the past 24 months, all the focus has been on other technologies,” he says, primarily messenger RNA–based vaccines. “Therefore, it is great that we are bringing technologies like ADCs to the forefront again, because there is so much going on in that space.”

CORRECTION:

This story was updated on May 24, 2022, to correctly describe Adcetris. It was the second antibody-drug conjugate to be approved, not the first. Mylotarg was the first.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter