Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Polymers

How membranes are upending chemical separations

Developers of membrane technologies see enormous environmental benefits in potentially replacing distillation and improving electrolysis

by Alexander H. Tullo

September 13, 2020

| A version of this story appeared in

Volume 98, Issue 35

In July, a team of scientists from ExxonMobil, the Georgia Institute of Technology, Imperial College London, and Queen Mary University of London published breakthrough membrane research in the journal Science.

Using an N-aryl-linked spirocyclic polymer membrane that it created, the team was able to separate hydrocarbons with 12 or fewer carbons—such as gasoline and jet fuel—from light crude oil (DOI: 10.1126/science.aba9806).

“For the membranes and separations community, the big impact of the paper was the demonstration that you can, in fact, separate incredibly complex mixtures like crude oil with membranes,” says Ryan Lively, a professor of chemical engineering at Georgia Tech and one of the paper’s authors.

Lively’s vision is of a series of pressurized membranes, the porosity of each customized to extract different hydrocarbon fractions, that augment the century-old oil-boiling process of refinery distillation. The paper points out that petroleum distillation alone consumes about 1% of the world’s energy. “The payoff is pretty tremendous in terms of the energy and carbon saved,” he says.

The opportunity presented by the refinery membranes isn’t unique. In an influential 2016 Nature comment titled “Seven Chemical Separations to Change the World,” Lively and another Georgia Tech chemical engineer, David S. Sholl, write that “most industrial chemists spend their days separating the components of large quantities of chemical mixtures into pure or purer forms” (DOI: 10.1038/532435a). In total, they note, such processes consume 10–15% of the world’s energy.

Membranes are nothing new. They have been desalinating and purifying water, making chlorine and caustic soda, cleaning up natural gas, and doing other important work for decades.

But membranes are poised to go deeper, thanks to materials science advances that are making them more robust and sophisticated. Soon they might do some of the work of petrochemical distillation towers, ease the energy intensity of industries like pulp and paper, and even enable a future hydrogen economy. “It’s a superactive field right now,” Lively says.

Membranes are up to the task, proponents say. Massive scale is second nature to them. Lively points out that Israel’s Ashkelon desalination plant, which can process 118 million m3 of water per year, has nearly twice the fluid throughput of the world’s largest oil refinery, in Jamnagar, India.

But membrane technology still needs to be proven, application by application. This requires forward-thinking companies to see enough potential in membranes to try them. And the membranes themselves have to demonstrate high performance and durability.

On these fronts, membrane technology is “gaining traction,” Lively says. “Once people are convinced that membranes can withstand real-life conditions, that will be a watershed moment.”

Sifting alkenes from alkanes

Hannah Murnen, chief technology officer of Newport, Delaware–based Compact Membrane Systems (CMS), agrees that membranes are at a crossroads. “There’s a bunch of technologies that are coming to fruition now, driven by the fact that industry is a little more open and excited about some of these things,” she says.

CMS was spun off from DuPont in 1993. It makes fluoropolymer membranes for applications such as dehydrating organic solvents.

The company is now developing a membrane for separating olefins such as propylene and butenes from paraffins like propane and butane. The application is one of the seven listed in the Nature article, which notes that such separations, normally done in distillation towers, consume about 0.3% of the world’s energy. “The olefin-paraffin application is bigger than anything we’ve addressed in our company’s history,” Murnen says.

CMS’s membrane has a silver moiety designed for “facilitated transport” of olefins through the membrane, Murnen says. The silver forms a complex with the double bonds of alkenes but not the single bonds of alkanes. The fluoropolymer backbone lends stability. In many previous attempts to do the separation with less-robust materials, she says, “the membranes died in hours.”

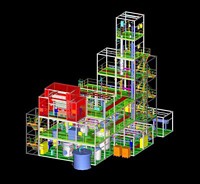

The company has been rolling out commercial demonstration units. One extracted propane from a propane-propylene stream at the Delaware City refinery, owned by PBF Energy. Early next year, CMS will install trial systems at Dow’s Freeport, Texas, plant and at a Braskem facility in North America, both to extract propylene from propane.

The Braskem unit will process gas from the purge stream of a polypropylene reactor. The propane buildup in such vessels has to be intermittently purged, and some unreacted propylene comes along for the ride. Normally, the mixture is recycled in a splitter, which fractionates propylene and propane, or even flared. The other unit will recover propylene from the mixed C3 hydrocarbon output of a steam cracker.

CMS will also soon roll out demonstrations of its membranes for separating butenes from mixed C4 streams.

Early adopters of the membranes will likely use them in scenarios like the reactor purge streams, Murnen says. The membranes might also be employed to expand plants where revamping or replacing a distillation unit might not be worthwhile.

The Ontario-based start-up Imtex Membranes is also targeting olefin-paraffin separations. The company’s membranes, made of chitosan derived from crustacean shells, were developed 20 years ago at the University of Waterloo, according to CEO Karlis Vasarais. In its membrane system, silver nitrate provides the interaction with the olefin double bonds.

In the beginning, the membranes worked, but not for very long. The chitosan would dry up. Eventually Imtex scientists hit on the idea of continuously hydrating the chitosan with the solution containing silver nitrate.

Like CMS, Imtex is targeting separations of butenes from streams of C4 hydrocarbons, called raffinate, produced in ethylene crackers as well as propylene from various sources. The firm’s emphasis is on the former. Vasarais says raffinate is often shipped great distances to be processed at centralized plants. Imtex’s technology might allow petrochemical makers to handle it on-site.

For propylene, Vasarais sees Imtex’s technology as complementary to distillation. Engineers could use a distillation unit to get the propylene up to 93% purity and then deploy Imtex’s membranes as a polishing step to achieve 99%. “It’s that last-mile problem of getting to polymer-grade purity that costs a hell of a lot of energy,” he says.

Imtex has piloted the membranes since 2015 and is ready to take the next step. The petrochemical giant Sabic invested in the company as part of a $20 million financing round earlier this year. Under their collaboration, Imtex will build a pilot plant in Saudi Arabia.

Imtex is also working on a pilot plant in Sarnia, Ontario, that will process about 500 kg of C4 hydrocarbons per hour. When the plant’s run is completed, Imtex intends to move it to Alberta to process both C4 and C3 hydrocarbons.

Greener paper and chemicals

Via Separations, a membrane start-up from Somerville, Massachusetts, is targeting an industry that, from an energy perspective, can be an even bigger hog than refining: pulp and paper.

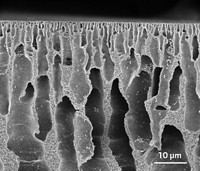

Via’s membranes are based on nanoscale fragments of graphene oxide, which Via tethers together into sheets. CEO Shreya Dave says the spacing between the fragments of graphene oxide likely determines the porosity and selectivity of the membrane.

The company’s initial target application is black liquor, the highly alkaline broth of lignin, inorganic chemicals, and other residues left over from wood pulping. According to the National Science Foundation, papermakers boil the black liquor to boost its solids concentration from 10% to 70%. This one process accounts for 2.5% of US energy consumption.

“As we think about decarbonization and we think about energy efficiency, this is a really impactful sector that doesn’t get the same sort of attention that steel, aluminum, and cement do,” Dave says.

A normal water treatment membrane “won’t last 10 minutes” treating the high-temperature, caustic liquor, Dave claims. Via’s membranes can last more than a year and potentially save customers $7 million to $10 million per annual deployment, she says.

Georgia Tech’s Lively says such performance would be encouraging. “Any progress you can make on a black-liquor separation membrane is fantastic,” he says.

Via conducted a trial at a customer this past summer and is planning a pilot unit next year. Dave hopes for the first commercial installations by 2022.

The Moss Landing, California–based start-up Chemetry is looking to upend two mainstay chemical processes that involve chlorine: making the polyvinyl chloride precursor ethylene dichloride (EDC) and producing propylene oxide via the chlorohydrin process.

At the heart of Chemetry’s processes is a new membrane that modifies the electrolysis of brine into chlorine and caustic soda. Traditionally, a single membrane or diaphragm allows sodium ions to pass through to the cathode to form caustic soda, while the chloride ions left behind form chlorine gas, which reacts with ethylene to form EDC.

Chemetry introduces an additional compartment separated by an anode membrane. The membrane allows chloride ions to pass through to react with copper(I) chloride to form copper(II) chloride. The copper(II) chloride reacts with ethylene to make EDC, and the resulting copper(I) chloride is recycled. Preventing the formation of chlorine gas reduces energy use by about 25%.

Ryan Gilliam, Chemetry’s CEO, says the process’s great enabler was finding the right membrane. “We needed a membrane that would allow chlorides—or any other halogen—to cross over the membrane into the anode compartment without allowing copper to go the opposite way,” he says. The membrane also had to stand up to the relatively high temperature of 100 °C. Working with Fumatech BWT in Germany, the company came up with a functionalized hydrocarbon membrane.

The chlorohydrin process that Chemetry wants to replace is more complex than the traditional EDC process. In it, propylene reacts with hypochlorous acid, derived from chlorine, to make propylene chlorohydrin, which is saponified—with caustic soda or lime—to make propylene oxide.

Chemetry’s process harnesses its copper-based electrolysis, which brings a few advantages downstream. One is that it eliminates the water used in the saponification step. The normal chlorohydrin process, Gilliam says, produces 45 metric tons (t) of wastewater for every metric ton of propylene oxide. The salt generated in the process exits the plant with the wastewater.

The salt in Chemetry’s process is concentrated enough to be recycled, so the firm can use the more expensive—but more efficient and reactive—sodium bromide, rather than running the process on sodium chloride. In all, Chemetry says, the process uses 60% less energy than the chlorohydrin process.

Chemetry’s chemistry has generated a lot of interest. In 2018, the firm won a Green Chemistry Challenge Award. It is working with TechnipFMC to market the propylene oxide process. And it is building a demonstration unit for its EDC technology at a Braskem site in Brazil.

Better electrolysis for H2

In the most lofty scenario for membranes, they will contribute to a more sustainable chemical industry and even a world powered by carbon-free energy. That could happen if hydrogen is made by renewable energy–powered water electrolysis instead of the traditional steam reforming of natural gas.

In the past few months, chemical companies have demonstrated their willingness to jump into renewable hydrogen. In July, Air Products and Chemicals announced a $5 billion plan for a complex in Saudi Arabia that will use wind and solar power to run a hydrogen electrolysis plant. The hydrogen will be reacted with nitrogen to make 1.2 million t of ammonia per year.

A slew of similar projects is on the drawing board. The fertilizer maker Yara is conducting a $1 million study of converting some of its ammonia operations in Australia from natural gas-based to electrolysis-based hydrogen. Other companies, such as BASF and Ineos, are investigating hydrogen electrolysis to make methanol.

But for electrolysis to establish itself in industry, the cost of renewable power must continue to decline. Better processes to split water into hydrogen and oxygen will also be a big help, and that’s where membrane technology shows promise.

“You cannot have ammonia without hydrogen,” says Gabriel G. Rodríguez-Calero, CEO of the Ithaca, New York–based membrane start-up Ecolectro. “You cannot have reduction of CO2 and convert that into fuels or chemicals without hydrogen. If we are to have any hopes of decarbonizing a lot of these industries, renewable hydrogen has to be cheap.”

Advertisement

Ecolectro and the German firm Evonik Industries are both developing a water-cracking method—anion-exchange membrane (AEM) electrolysis—that they hope will enable big-time adoption of renewable hydrogen.

Currently, electrolysis accounts for less than 5% of the hydrogen generated in the world, and that sliver is shared by two technologies: the traditional alkaline diaphragm and the newer proton-exchange membrane (PEM) process.

Alkaline electrolysis of water is conducted in a potassium hydroxide solution. Hydrogen ions form diatomic hydrogen, which bubbles up at the cathode. Negatively charged hydroxyl ions migrate to the anode through a porous diaphragm to form oxygen and water. In PEM electrolysis, the positively charged hydrogen ions move through a membrane toward the cathode.

The alkaline electrolysis cell is reliable but has limited charge density and must operate at low pressure. PEM cells solve these problems, but they require expensive platinum-group catalysts and other costly components, like machined titanium parts.

AEM works like alkaline electrolysis but with a robust membrane instead of a diaphragm, and it doesn’t require precious-metal catalysts, as PEM does. “AEM electrolysis tries to combine the best attributes of both worlds,” says Oliver Conradi, director of advanced membrane materials at Evonik’s Creavis technology development unit.

The challenge for AEM is finding a membrane that will conduct hydroxyl ions while remaining stable under the severe alkaline conditions of the cell, according to Goetz Baumgarten, director of business management for membranes at Evonik.

Baumgarten says Evonik is tapping into its core competencies to find candidates. Evonik has long sold membranes for gas processing. For example, it offers membranes that separate methane from carbon dioxide and ones that extract helium from natural gas. Another big business for Evonik is the high-performance polymer polyether ether ketone (PEEK). Combining these two areas of expertise, the company came up with functionalized PEEK membranes for AEM.

In June, the company announced it is working with a consortium to further develop the membranes. Partners include the oil company Shell, which is keen on renewable hydrogen, and the Italian electrolyzer developer Enapter. The consortium will receive a $2.4 million grant from the European Union’s Horizon 2020 research program. It hopes to have a demonstration unit running by 2022.

For a commercially viable AEM, Evonik is targeting an installed cost of $600–$700 per kilowatt of power produced. This, it says, would handily beat the $1,200 for PEM and even the roughly $950 for diaphragm-based alkaline electrolysis.

Conradi says some of the technical goals for the consortium include perfecting a roll-to-roll coating process to manufacture the membranes at large scale. The team must also demonstrate high current densities and the ability to split water molecules at relatively low voltage.

Ecolectro is further developing technology that originated at the Energy Materials Center at Cornell University, an interdisciplinary collaboration of the school’s scientists and engineers. A team led by chemistry professor Geoffrey W. Coates was tasked with applying its polymer expertise to make an AEM.

Kristina Hugar, now the company’s chief science officer, took over the project around 2010. She developed an aliphatic hydrocarbon membrane with cations tethered to it. In 2015, she and Rodríguez-Calero founded Ecolectro. “We thought there was real commercial potential,” she says.

In 2018, Ecolectro secured $1.7 million in funding from the US Department of Energy’s Advanced Research Projects Agency–Energy to develop its membranes for electrolysis and fuel cells. The company is working with Proton OnSite, which makes small PEM-based hydrogen generators, as well as the US National Renewable Energy Laboratory.

“Within the next 12 months or so, we’ll probably have membranes in pilot production, which means we can collaborate more broadly with industry,” Rodríguez-Calero says.

It might take some time, but membrane technology boosters believe they will indeed one day make an impact. Via Separations’ Dave compares membranes to past great advances in technology, like the development of lithium-ion batteries, which offer several times the energy density of lead-acid batteries. Membranes, she says, will be “just as important of a step change.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter