Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

C&EN’s Global Top 50 chemical firms for 2024

Mounting challenges pushed the industry into a downturn

by Alexander H. Tullo

July 19, 2024

| A version of this story appeared in

Volume 102, Issue 22

Credit: Yang H. Ku/C&EN/Shutterstock

Global Top 50 interactive dashboard

Global Top 50 Interactive Dashboard

Click through an interactive look at the Global Top 50 with complete data going back to 2007. Be sure to also check out our US Top 50 information presented in the same interactive format.

Downloads

PDF of C&EN’s Global Top 50 chemical firms for 2023

Previous Coverage

C&EN’s Top 50 US chemical producers of 2024

C &EN’s Global Top 50 ranking has always been a snapshot of the world’s largest and most influential chemical makers. It captures the rise of some firms relative to others based on ambitious expansions, acquisitions, and the fortunes of the sectors they serve.

And because most of the largest chemical companies operate globally, the Global Top 50 is also a good check on the health of the industry. For 2023, the fiscal year on which the survey is based, the diagnosis is that the world’s chemical sector experienced a downturn.

The combined chemical sales of the top 50 firms declined by 10.7% during 2023, to $1,036 billion. The year before, the Global Top 50 posted a 17% increase in sales. But the COVID-19 rebound that buoyed the 2022 increase waned last year, and an inventory correction that undermined sales volumes, and overcapacity caught up to the industry.

Combined profits for the 38 firms reporting such figures tumbled by 44.1% from 2022, to $54.4 billion. Twenty-nine of the firms posted declines in their bottom lines; 7 lost money.

It was a bad year. It was particularly bad for European firms, which have been suffering from a lack of competitiveness due to high energy costs and an aging fleet of assets. Europe’s severing of ties with Russia after the invasion of Ukraine cut the industry off from an abundant supply of natural gas and exacerbated the sector’s weakness. European companies like BASF, Ineos, Covestro, Arkema, and Evonik Industries posted sharp declines in chemical sales. Many firms operating in the region are cutting costs or shutting inefficient capacity.

The petrochemical sector is facing its own downturn, primarily driven by new capacity in China and the US. Declines in chemical sales and profits at Dow, ExxonMobil, LyondellBasell Industries, Indorama Ventures, and Braskem reflect that. Fertilizer prices have come down from their highs in 2022, causing results to tumble at firms like Mosaic, Nutrien, and Yara.

The industry is in a state of flux. The biggest structural change by far to the sector in recent years is the rise of several Chinese petrochemical producers. Rongsheng Petrochemical, Hengli Petrochemical, and Wanhua Chemical Group rose in the ranking because of additional revenues garnered from big recent plant expansions.

And two Chinese petrochemical makers joined the list for the first time. Jiangsu Eastern Shenghong debuts at a lofty number 22 after the start-up of a massive complex in China and a 79% increase in chemical sales. Xinfengming Group, a polyester fiber producer, makes the cut at number 48. Hengyi Petrochemical and Tongkun Holding Group, which both fell off the ranking in 2023, join again this year.

Other newcomers include DSM-Firmenich, which appears at number 36 after the merger of DSM and the flavor and fragrance maker Firmenich. Albemarle debuts at 43 because of the strength of its battery material business. Celanese joins the ranking because of its purchase of DuPont’s engineering polymer business. Hanwha Solutions got a lift from solar power materials to reenter at 47. SK Innovation rejoins the ranking after a multiyear absence.

A number of previous top 50 companies failed to make the ranking. The petrochemical makers Westlake, PTT Global Chemical, and Borealis saw lower results and fell below the cutoff. The same holds true for the polyester maker Alpek, the inorganics firms SQM and ICL Group, and the fertilizer maker CF Industries Holdings.

Solvay didn’t make the ranking because it split into two firms. Neither the new Solvay, a maker of commodity chemicals, or Syensqo, a new specialty chemical supplier, are big enough. OCI slipped from the list because of the sale of its Fertiglobe joint venture stake to Abu Dhabi National Oil Company.

1

BASF

2023 chemical sales: $74.5 billion

With so many of its assets sitting in Germany, a country with some of the highest chemical production costs in the world, BASF weathered a difficult year in 2023. The world’s largest chemical maker saw sales decline by 21% and earnings plummet 44%. In February, the company unveiled a $1.1 billion cost-cutting program for its headquarters site in Ludwigshafen, Germany. The move follows two earlier rounds of belt-tightening at BASF—one in 2022 meant to save more than $500 million and another in 2023 intended to reap $200 million. That latter program led to production cuts in Ludwigshafen and 700 layoffs. BASF is also conducting a long-term review of how the site is positioned in the market. Overseeing this study will be Markus Kamieth, who took over as CEO from Martin Brudermüller in April. Kamieth has a PhD in organic chemistry from the University of Essen.

2

Sinopec

2023 chemical sales: $58.1 billion

Sinopec, China’s largest chemical maker, continues to deepen its relationship with the British firm Ineos. Last August, Ineos completed the purchase of a 50% stake in a new Sinopec ethylene cracker complex in Tianjin, China. The firms are also building an acrylonitrile-butadiene-styrene polymer plant there. Sinopec has a number of Chinese projects of its own in the works. It is starting up a purified terephthalic acid plant with 3 million metric tons (t) of capacity this year in Yizheng. In Zhenhai, the company plans to complete a refinery and propane dehydrogenation plant by the end of this year. Also in Zhenhai, Sinopec is building an ethylene cracker complex with 1.5 million t per year of capacity by 2025. It plans a 1 million t ethylene expansion for Maoming the year after that.

3

Dow

2023 chemical sales: $44.6 billion

Dow’s optimism sets it apart from most chemical makers today. At an Investor Day event in May, CEO Jim Fitterling said he thought that the worst of the chemical industry’s downturn was behind it and that the sector was showing signs of recovery, even in Europe. At the event, the company laid out a road map for growing earnings by more than $3 billion per year. Some $2 billion will come from projects it has completed or will complete in the near term. These modest investments include expansions of alkoxylation and specialty amine capacity. Another $1 billion will come from just one project: a $6.5 billion ethylene complex in Fort Saskatchewan, Alberta. Dow will use hydrogen instead of hydrocarbons to run the furnaces at the facility. The hydrogen will be made from hydrocarbons, and the resulting carbon dioxide emissions will be captured and stored underground. Recycled plastics will be another large business for Dow, responsible for $500 million in additional earnings, Fitterling said. By 2030, the company plans to be selling 3 million metric tons per year of recycled and renewable plastics.

4

LG Chem

2023 chemical sales: $42.3 billion

The South Korean firm is plunging into biobased chemicals. LG Chem is planning a biorefinery at its complex in Daesan, South Korea. Using Eni’s Ecofining technology, it will transform 400,000 metric tons per year of biomass into products such as feedstock for petrochemicals. LG Chem and another South Korean firm, GS Caltex, are building a plant in Yosu, South Korea, that will demonstrate a process to make biobased 3-hydroxypropionic acid, a potential precursor to acrylic acid. And LG Chem is forming a joint venture with the fermentation firm CJ CheilJedang to make pentamethylenediamine, a raw material for nylon 5,10. LG Chem continues to expand its battery material business. Late last year it started construction on a $3 billion cathode material plant in Tennessee. It also inked a battery material supply agreement with General Motors worth almost $19 billion.

5

PetroChina

2023 chemical sales: $40.9 billion

The state-owned Chinese refining and petrochemical giant turned the corner in 2023 as the local economy recovered from the COVID-19 pandemic. PetroChina’s chemical sales were up 3.4%, and the business regained modest profitability after posting a loss in 2022. Like many Chinese chemical firms, PetroChina has an ambitious expansion program. Capital spending in its chemical and refining business will be about $4 billion this year. Last year, it started construction on a 1.2 million-metric-ton-per-year ethylene cracker at its Dushanzi Petrochemical subsidiary in western China. The company also has big expansions underway at its Jilin Petrochemical and Guangxi Petrochemical subsidiaries.

6

ExxonMobil

2023 chemical sales: $40.7 billion

Advertisement

At a chemical conference in Houston in March, Karen McKee, who heads ExxonMobil’s Product Solutions unit, stressed the need for a better European industrial policy. She thinks Europe should look to the US, which is providing hefty incentives for carbon capture and storage, leading to a boom in low-carbon hydrogen and ammonia projects. Such an approach might reverse the dire situation the European chemical industry faces as high costs close chemical plants. “We need action in order to avoid the fundamental deindustrialization of Europe,” she said. McKee’s company is feeling these effects directly. By the end of this year, ExxonMobil will close an ethylene cracker complex in Port-Jérôme-sur-Seine, France. Since 2018, the complex has lost more than $530 million in total, the firm says. As ExxonMobil pulls back in Europe, it continues to invest in the US. In May, the company said it would expand its pyrolysis-based plastics recycling plant in Baytown, Texas.

7

Sabic

2023 chemical sales: $37.7 billion

With its low-cost feedstocks at home, the Saudi Arabia–based chemical maker doesn’t close plants very often, but the bad economics of producing petrochemicals in Europe has forced its hand there. Sabic is permanently shutting down the Olefins 3 cracker at its site in Geleen, the Netherlands. It will continue to run its Olefins 4 cracker in Geleen, a unit of 1970s vintage recently modernized with a $150 million investment. Sabic, a subsidiary of Saudi Aramco since 2020, is also parting with a business it has run for more than 40 years. It agreed to sell its Saudi Arabian steel operations to that country’s Public Investment Fund for $3.3 billion. The business had sales of about $4 billion in 2022, nearly 8% of Sabic’s total sales. Sabic will be focused entirely on chemicals. True to its nature, the company has been making bold investments. It is moving forward with a $6.4 billion petrochemical joint venture in Fujian Province, China, with a local partner.

8

LyondellBasell Industries

2023 chemical sales: $31.9 billion

LyondellBasell Industries was formed in 2007 when Basell, a major European petrochemical maker, bought Houston-based Lyondell Chemical. As a result, LyondellBasell today has an enormous footprint in Europe. It is the region’s largest polyolefin maker, with an 18% market share. Europe is at a severe disadvantage in petrochemicals because of the region’s high energy and feedstock costs, so LyondellBasell’s big business there has become a liability. In May, the company launched a review of its assets that may result in the sale or closure of some facilities. LyondellBasell might also modernize some sites. The firm does see a future in Europe in sustainable polymers. It has chosen Knapsack, Germany, as the location of a planned plastics recycling hub.

9

Formosa Plastics

2023 chemical sales: $31.1 billion

Because of local opposition, Formosa Plastics has had difficulty getting a $9.4 billion petrochemical project in Louisiana off the ground. Construction was blocked in 2021 after the US Army Corps of Engineers ordered an environmental review. One smidgen of positive news for the Taiwanese enterprise came in January when the Louisiana Court of Appeal, First Circuit, reinstated air permits. Meanwhile, Formosa’s affiliate Formosa Plastics Corporation, USA, completed a polypropylene plant in Point Comfort, Texas, in May. It has about 250,000 metric tons per year of capacity and will ramp up production later this year.

10

Linde

2023 chemical sales: $30.7 billion

Decarbonization has become a core business for Linde. In May, the industrial gas maker signed an agreement to build a $150 million air separation plant that will supply industrial gases to H2 Green Steel, which is building a steel plant in Boden, Sweden. That plant, H2 Green Steel claims, will have only 5% of the carbon dioxide emissions of conventional steel plants. Linde’s engineering arm is providing H2 Green Steel with a pressure swing adsorption unit to capture hydrogen from the plant’s direct reduction iron furnace. Linde is helping the chemical industry decarbonize too. Earlier this year, it started supplying clean hydrogen and captured CO2 to Celanese for making methanol in Clear Lake, Texas. Linde has also been collaborating with OCI on a low-carbon ammonia plant in Beaumont, Texas. Earlier this year, Linde, Sabic, and BASF completed an electric ethylene cracker demonstration plant in Ludwigshafen, Germany.

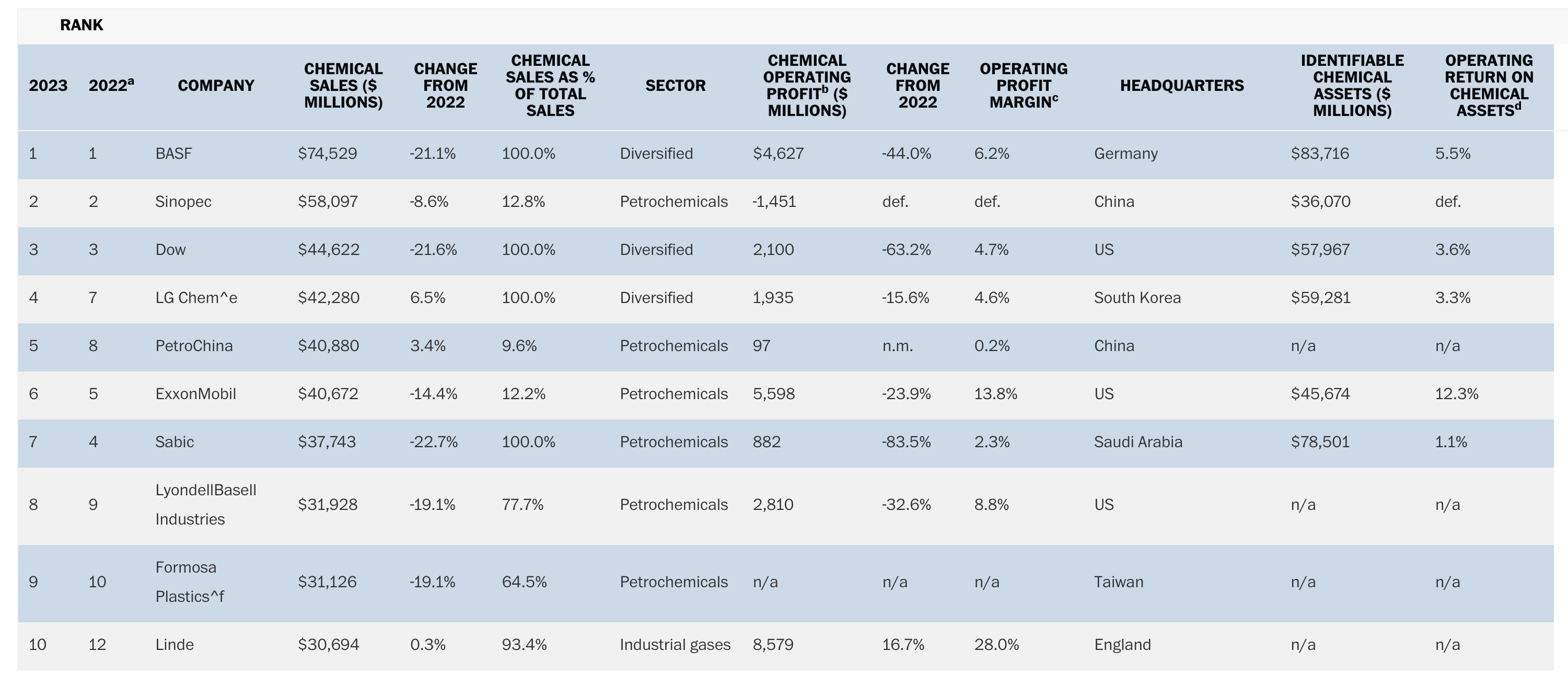

Global Top 50

Global Top 50

Most major chemical companies posted declines in sales in 2023, reflecting an ongoing industry downturn.

| RANK | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023 | 2022a | COMPANY | CHEMICAL SALES ($ MILLIONS) | CHANGE FROM 2022 | CHEMICAL SALES AS % OF TOTAL SALES | SECTOR | CHEMICAL OPERATING PROFITb ($ MILLIONS) | CHANGE FROM 2022 | OPERATING PROFIT MARGINc | HEADQUARTERS | IDENTIFIABLE CHEMICAL ASSETS ($ MILLIONS) | OPERATING RETURN ON CHEMICAL ASSETSd | |

| 1 | 1 | BASF | $74,529 | -21.1% | 100.0% | Diversified | $4,627 | -44.0% | 6.2% | Germany | $83,716 | 5.5% | |

| 2 | 2 | Sinopec | $58,097 | -8.6% | 12.8% | Petrochemicals | -1,451 | def. | def. | China | $36,070 | def. | |

| 3 | 3 | Dow | $44,622 | -21.6% | 100.0% | Diversified | 2,100 | -63.2% | 4.7% | US | $57,967 | 3.6% | |

| 4 | 7 | LG Chem^e | $42,280 | 6.5% | 100.0% | Diversified | 1,935 | -15.6% | 4.6% | South Korea | $59,281 | 3.3% | |

| 5 | 8 | PetroChina | $40,880 | 3.4% | 9.6% | Petrochemicals | 97 | n.m. | 0.2% | China | n/a | n/a | |

| 6 | 5 | ExxonMobil | $40,672 | -14.4% | 12.2% | Petrochemicals | 5,598 | -23.9% | 13.8% | US | $45,674 | 12.3% | |

| 7 | 4 | Sabic | $37,743 | -22.7% | 100.0% | Petrochemicals | 882 | -83.5% | 2.3% | Saudi Arabia | $78,501 | 1.1% | |

| 8 | 9 | LyondellBasell Industries | $31,928 | -19.1% | 77.7% | Petrochemicals | 2,810 | -32.6% | 8.8% | US | n/a | n/a | |

| 9 | 10 | Formosa Plastics^f | $31,126 | -19.1% | 64.5% | Petrochemicals | n/a | n/a | n/a | Taiwan | n/a | n/a | |

| 10 | 12 | Linde | $30,694 | 0.3% | 93.4% | Industrial gases | 8,579 | 16.7% | 28.0% | England | n/a | n/a | |

| 11 | 6 | Ineos | $29,563 | -30.1% | 100.0% | Diversified | 761 | -80.6% | 2.6% | England | $37,080 | 2.1% | |

| 12 | 11 | Air Liquide | $29,441 | -7.6% | 98.6% | Industrial gases | 3,253 | 8.3% | 11.0% | France | $48,630 | 6.7% | |

| 13 | 13 | Syngenta Group | $26,800 | -6.0% | 83.2% | Agricultural chemicals | n/a | n/a | n/a | Switzerland | n/a | n/a | |

| 14 | 15 | Rongsheng Petrochemical | $26,788 | 5.9% | 58.3% | Petrochemicals | n/a | n/a | n/a | China | n/a | n/a | |

| 15 | 14 | Mitsubishi Chemical Group | $26,405 | -3.4% | 84.6% | Diversified | 1,066 | -17.0% | 4.0% | Japan | $37,642 | 2.8% | |

| 16 | 18 | Wanhua Chemical Group | $24,765 | 5.9% | 100.0% | Diversified | 3,044 | -0.5% | 12.3% | China | $35,736 | 8.5% | |

| 17 | 16 | Reliance Industries^f | $22,799 | -5.0% | 18.8% | Petrochemicals | n/a | n/a | n/a | India | n/a | n/a | |

| 18 | 26 | Hengli Petrochemical^f | $21,849 | 14.4% | 65.9% | Petrochemicals | n/a | n/a | n/a | China | n/a | n/a | |

| 19 | 19 | Shell^f | $17,342 | -17.7% | 5.5% | Petrochemicals | n/a | n/a | n/a | England | n/a | n/a | |

| 20 | 21 | Shin-Etsu Chemical^e | $17,188 | -14.0% | 100.0% | Diversified | 4,990 | -29.8% | 29.0% | Japan | $36,640 | 13.6% | |

| 21 | 20 | Evonik Industries | $16,514 | -17.4% | 100.0% | Specialty chemicals | -72 | def. | def. | Germany | $21,568 | def. | |

| 22 | — | Jiangsu Eastern Shenghong | $15,733 | 79.2% | 79.3% | Petrochemicals | n/a | n/a | n/a | China | n/a | n/a | |

| 23 | 24 | Indorama Ventures | $15,713 | -17.9% | 100.0% | Petrochemicals | 16 | -98.8% | 0.1% | Thailand | $16,966 | 0.1% | |

| 24 | 22 | Covestro | $15,551 | -20.0% | 100.0% | Diversified | 90 | -66.3% | 0.6% | Germany | $14,751 | 0.6% | |

| 25 | 17 | Yara | $15,431 | -35.4% | 100.0% | Fertilizers | 312 | -91.8% | 2.0% | Norway | $16,027 | 1.9% | |

| 26 | 31 | Toray Industries | $15,312 | -1.8% | 87.3% | Diversified | 745 | 7.2% | 4.9% | Japan | n/a | n/a | |

| 27 | 29 | Lotte Chemical | $15,264 | -10.5% | 100.0% | Diversified | -266 | def. | def. | South Korea | $25,618 | def. | |

| 28 | 30 | Sumitomo Chemical | $14,479 | -8.6% | 83.1% | Diversified | -57 | def. | def. | Japan | $18,268 | def. | |

| 29 | 23 | Braskem | $14,129 | -26.9% | 100.0% | Petrochemicals | -350 | def. | def. | Brazil | $18,368 | def. | |

| 30 | 25 | Mosaic | $13,696 | -28.4% | 100.0% | Fertilizers | 1,710 | -67.5% | 12.5% | US | $23,033 | 7.4% | |

| 31 | 37 | Air Products and Chemicals | $12,600 | -0.8% | 100.0% | Industrial gases | 2,704 | 14.8% | 21.5% | US | $32,003 | 8.5% | |

| 32 | 35 | Mitsui Chemicals | 12,454 | -6.9 | 100.0 | Diversified | 627 | -9.0 | 5.0 | Japan | 15,771 | 4.0 | |

| 33 | 36 | DuPont | 12,068 | -7.3 | 100.0 | Diversified | 1,717 | -15.1 | 14.2 | US | 38,552 | 4.5 | |

| 34 | 32 | Bayer | 11,862 | -23.4 | 23.0 | Agricultural chemicals | n/a | n/a | n/a | Germany | n/a | n/a | |

| 35 | 33 | Chevron Phillips Chemical | 11,560 | -18.5 | 100.0 | Petrochemicals | n/a | n/a | n/a | US | 19,709 | n/a | |

| 36 | — | DSM-Firmenich^e | 11,495 | 26.7 | 100.0 | Specialty chemicals | -614 | def. | def. | Netherlands/Switzerland | 37,069 | def. | |

| 37 | — | Tongkun Holding Group | 11,320 | 33.0 | 100.0 | Petrochemicals | n/a | n/a | n/a | China | n/a | n/a | |

| 38 | 27 | Nutrien | 11,164 | -40.8 | 38.4 | Fertilizers | 3,885 | -61.9 | 34.8 | Canada | 27,475 | 14.1 | |

| 39 | 48 | Celanese | 10,940 | 13.1 | 100.0 | Diversified | 1,218 | -11.9 | 11.1 | US | 26,597 | 4.6 | |

| 40 | — | Hengyi Petrochemical | 10,858 | 20.0 | 56.5 | Petrochemicals | n/a | n/a | n/a | China | n/a | n/a | |

| 41 | 34 | Umicore | 10,297 | -24.0 | 52.1 | Specialty chemicals | 534 | -1.9 | 5.2 | Belgium | 7,856 | 6.8 | |

| 42 | 38 | Arkema | 10,291 | -17.6 | 100.0 | Specialty chemicals | 877 | -43.8 | 8.5 | France | 15,703 | 5.6 | |

| 43 | — | Albemarle | 9,617 | 31.4 | 100.0 | Specialty chemicals | 181 | -92.7 | 1.9 | US | 18,271 | 1.0 | |

| 44 | 42 | Eastman Chemical | 9,210 | -12.9 | 100.0 | Diversified | 1,095 | -4.5 | 11.9 | US | 14,633 | 7.5 | |

| 45 | 45 | Resonac Holdings^e | 9,173 | -7.5 | 100.0 | Diversified | -27 | def. | def. | Japan | 14,462 | def. | |

| 46 | 50 | Asahi Kasei | 8,980 | -4.2 | 45.3 | Specialty chemicals | 303 | 3.8 | 3.4 | Japan | 12,526 | 2.4 | |

| 47 | — | Hanwha Solutions | 8,964 | 2.1 | 88.1 | Diversified | 205 | -78.3 | 2.3 | South Korea | 21,032 | 1.0 | |

| 48 | — | Xinfengming Group | 8,681 | 21.0 | 100.0 | Petrochemicals | n/a | n/a | n/a | China | n/a | n/a | |

| 49 | — | Sasol | 8,662 | -0.4 | 55.2 | Diversified | 864 | -51.1 | 10.0 | South Africa | n/a | n/a | |

| 50 | — | SK Innovation | 8,370 | -2.9 | 14.2 | Diversified | 404 | 558.7 | 4.8 | South Korea | n/a | n/a | |

Sources: Company documents, C&EN analysis.

Note: Some figures were converted at 2023 average exchange rates of US$1.00 = 4.9946 Brazilian reais, 7.0809 Chinese yuan, 0.9245 euros, 82.5708 Indian rupees, 140.5001 Japanese yen, 31.1525 New Taiwan dollars, 3.75 Saudi riyals, 18.4535 South African rand, 1,306.764 South Korean won, and 34.7841 Thai baht. def. means deficit, n/a means not available, and n.m. means not meaningful.

a Prior-year rankings have been revised from the July 24, 2023, issue of C&EN to reflect restated prior-year results and changes in exchange rates. Comparisons with prior years also use revised numbers.

b Chemical sales less administrative expenses and cost of sales.

c Chemical operating profit as a percentage of chemical sales.

d Chemical operating profit as a percentage of identifiable chemical assets.

e Chemical sales include a significant number of nonchemical products.

f C&EN estimates.

11

Ineos

2023 chemical sales: $29.6 billion

While other European chemical makers are cutting back on production, Ineos is adding more. The company resumed work on an ethylene cracker in Antwerp, Belgium, after it was granted permits. Ineos will run the cracker on US-made ethane, which is far cheaper than naphtha, the primary feedstock for most European petrochemical makers. In December, Ineos opened a cumene plant in Marl, Germany. The facility is the largest of its kind in Europe and will have a greenhouse gas footprint 50% lower than that of other cumene plants, Ineos says. In the US, Ineos recently unveiled plans to build a low-carbon ammonia plant with Hanwha Corporation. The plant will have 1 million metric tons per year of capacity, some of which Ineos plans to use to make acrylonitrile. True to its habit of buying businesses from its chemical peers, Ineos made a pair of small acquisitions over the past year. In May, it bought an ethylene oxide and derivatives plant in Bayport, Texas, from LyondellBasell Industries. In December, it bought Eastman Chemical’s acetic acid site in Texas City, Texas.

12

Air Liquide

2023 chemical sales: $29.4 billion

Like many industrial gas makers, Air Liquide has sharpened its focus on sustainability in recent years. The company plans to spend $850 million to build four air separation units to supply oxygen and nitrogen to a low-carbon hydrogen and ammonia facility that ExxonMobil is building in Baytown, Texas. The French industrial gas maker says the air separation units will also be low carbon because of renewable energy purchases and innovative design. Separately, Air Liquide plans to build plants in Holland Township, Michigan, and Center Township, Pennsylvania, that will make biomethane from manure in anaerobic digesters. Air Liquide already runs 26 biomethane plants around the world. The firm is also getting in on the US push to set up more domestic semiconductor manufacturing. It will build a $250 million plant for ultrapure nitrogen and other gases that will serve a memory chip plant that Micron Technology is constructing in Idaho.

13

Syngenta Group

2023 chemical sales: $26.8 billion

Advertisement

In recent years, Syngenta Group, the crop protection arm of Sinochem Holdings, has emphasized collaboration with outside firms, such as start-ups, to develop crop protection chemicals and seed traits. In June, Syngenta said it would use an InstaDeep-created artificial intelligence model. InstaDeep has trained its model on trillions of nucleotides of crop species to understand their genetic codes. Syngenta also began working with the Israeli firm Lavie Bio to develop biological insecticides. Such collaborations can bear fruit. In January, Syngenta announced that it and Enko created new molecules for controlling fungal diseases in crops.

14

Rongsheng Petrochemical

2023 chemical sales: $26.8 billion

Rongsheng Petrochemical has been one of the key players in transforming China’s chemical industry with megaprojects that integrate large refineries and big-scale petrochemical production. Its subsidiary Zhejiang Petroleum and Chemical on Dayushan Island, with 40 million metric tons per year of total capacity, is the landmark project along these lines. Keen to place bets on this trend, Saudi Aramco bought a 10% stake in Rongsheng last year for $3.4 billion. The deal came with a crude oil supply agreement. Deepening their relationship, Rongsheng agreed to acquire a 50% stake in the Saudi Aramco Jubail Refinery in Saudi Arabia. Aramco, in turn, will buy a 50% interest in Ningbo Zhongjin Petrochemical, a Rongsheng affiliate. Separately, Rongsheng plans to spend $9.5 billion on a complex in Jintang, China, that will make polymers such as polytrimethylene terephthalate and polybutylene terephthalate as well as chemicals like phenol, acetone, bisphenol A, and propanediol.

15

Mitsubishi Chemical Group

2023 chemical sales: $26.4 billion

Mitsubishi Chemical Group replaced its CEO, Jean-Marc Gilson, after only 3 years. Gilson was the company’s first non-Japanese leader and a Mitsubishi outsider, with experience at Dow Corning and Roquette. Taking over is Manabu Chikumoto, a Mitsubishi hand for 35 years. Mitsubishi’s board may have had discomfort over Gilson’s direction because with the announcement of his replacement came word that the company is reversing his signature initiative: spinning off its petrochemical unit. The business had been struggling because of high costs and stiff competition, and Mitsubishi plans to take measures to restructure the business. It is closing methyl methacrylate and acrylonitrile plants in Hiroshima, Japan, that use an older process involving hydrogen cyanide.

16

Wanhua Chemical Group

2023 chemical sales: $24.8 billion

Wanhua Chemical Group has been undertaking projects to shore up its core polyurethane business and to diversify into other lines. The Chinese company completed a project at its affiliate BorsodChem in Hungary to back integrate methylene diisocyanate production with the raw materials nitrobenzene and aniline. In Fujian, China, it completed plants for toluene diisocyanate, aniline, and polyvinyl chloride. Wanhua has a cracker complex under construction in Yantai that includes low-density polyethylene and polyolefin elastomer facilities.

17

Reliance Industries

2023 chemical sales: $22.8 billion

The Indian conglomerate operates what it calls the world’s largest single-site refinery, in Jamnagar, India. Like many refining and petrochemical companies, Reliance Industries sees a brighter outlook for chemicals than it does for transportation fuels. As a result, it is trying to maximize chemical yields. It is developing a multizone catalytic cracking technology, which will convert 70% of the catalytic cracker unit’s input into chemicals such as ethylene and propylene. Looking to make its operations more sustainable, Reliance also plans to use pyrolysis oil made from recycled plastics as a petrochemical feedstock. The company’s goal is to process 500 metric tons of plastic waste per day by 2025.

18

Hengli Petrochemical

2023 chemical sales: $21.8 billion

Hengli Petrochemical may soon get a big foreign backer. Saudi Aramco is in negotiations to buy a 10% stake in the private Chinese chemical maker. Looking to establish itself in China while also upgrading its oil into petrochemicals, Aramco has pursued deals with similar firms, such as its purchase of a 10% stake in Rongsheng Petrochemical, number 14 in this ranking, last year for $3.4 billion. Aramco will get a stake in a high-growth company if the talks with Hengli yield a deal. Last year, Hengli commissioned a purified terephthalic acid plant with 5 million metric tons (t) of capacity. This year, it intends to start up a complex with 1.6 million t of annual output for specialty materials including bisphenol A, polycarbonate, dimethyl carbonate, ethanolamines, ethyleneamines, polyoxymethylene resins, and acetic acid.

19

Shell

2023 chemical sales: $17.3 billion

Advertisement

The energy transition has forced major oil companies to rethink their businesses. Some are plunging into alternative energy or lithium for batteries. Others are diverting more of their oil production into chemicals. Shell is reassessing its manufacturing footprint. In May, after a strategic review, Shell announced that it was selling its Singapore chemical and refining operations to Indonesia’s Chandra Asri Group and the miner Glencore. The complex has an ethylene cracker with 1.1 million metric tons of capacity as well as downstream ethylene oxide, ethoxylates, propylene oxide, and styrene plants. It is Shell’s largest petrochemical complex in the Asia-Pacific region. Shell is also converting a hydrocracker in Wesseling, Germany, to produce base oils, used as lubricants, instead of fuels.

20

Shin-Etsu Chemical

2023 chemical sales: $17.2 billion

Seeing growth in markets like electric vehicles and renewable energy, Shin-Etsu Chemical is expanding its silicone business. Last August, the Japanese firm announced an investment of about $700 million to add capacity in the US, Hungary, Thailand, Japan, and other parts of Asia. And in May, the company said it would build a silicone plant in Zhejiang, China. The plant will be twice the size of one the company currently operates in the area, which it will replace with the new facility when it opens in 2026. Separately, Shin-Etsu will build a $540 million plant in Isesaki, Japan, that will make materials for semiconductor lithography. The company already operates three lithographic material facilities.

21

Evonik Industries

2023 chemical sales: $16.5 billion

Evonik Industries tied a loose end recently when it inked a deal to sell its superabsorbent polymer business to International Chemical Investors Group. The business, which Evonik had been trying to sell since 2020, had nearly $1 billion in 2023 sales of the polymers, used in diapers. The same private equity buyer bought Evonik’s sites in Lülsdorf and Wesseling, Germany, last year. Evonik’s C4 chemical business is still for sale after the company earmarked it for disposal in 2022. Like other German chemical makers, Evonik has struggled, generating a small loss in 2023. In response, the company launched a program to cut 2,000 jobs, mostly in Germany, to save about $435 million annually. But the firm hasn’t stopped investing. It is expanding silica production in Charleston, South Carolina, by 50% to meet high demand from the tire industry. It also began production of rhamnolipids, a class of biosurfactants, in Slovakia earlier this year.

22

Jiangsu Eastern Shenghong

2023 chemical sales: $15.7 billion

Recent years have seen large, integrated petrochemical makers in China appear seemingly out of nowhere on C&EN’s ranking among more familiar names. After posting a 79% increase in revenues in 2023, Jiangsu Eastern Shenghong debuts on the list at a lofty number 22. The company started up a massive refinery and petrochemical complex in Lianyungang, China, in December 2022. The facility has 16 million metric tons of overall capacity to make products including ethylene and p-xylene. Eastern Shengdong also runs a methanol-to-olefin complex and is a significant producer of polyester. Saudi Aramco has been negotiating to buy a 10% stake in its subsidiary Jiangsu Shenghong Petrochemical Industry Group.

23

Indorama Ventures

2023 chemical sales: $15.7 billion

Facing overcapacity in its core polyester business, largely because of new capacity in China, Indorama Ventures is retrenching. In March, the Thai firm said it would cut chemical and polymer capacity by 10%. So far, the company has idled a purified terephthalic acid (PTA) plant in Portugal. It also initiated a consultation process with employees over the possible shutdown of a PTA and polyethylene terephthalate complex in Rotterdam. In June, the company said it would shutter an ethylene oxide and derivatives facility in Australia. Further, Indorama plans an initial public offering of its surfactant business, which had $3.6 billion in sales last year. The company constructed that business by buying a Huntsman business and the Brazilian firm Oxiteno.

24

Covestro

2023 chemical sales: $15.6 billion

Covestro may soon be acquired. It has been in negotiations with Abu Dhabi National Oil Company (ADNOC) since last September. And in June, the firms announced that they were close to a deal that values the German polyurethane maker at $12.5 billion. ADNOC has been looking to make chemical purchases. It recently agreed to buy out OCI’s interest in the fertilizer maker Fertiglobe and had been talks, which broke up, for a controlling interest in Braskem. Like other German chemical makers, Covestro had a rough year in 2023, posting a 20% decline in sales and a 66% tumble in profits. The firm is reacting by cutting more than $400 million in costs. Despite the difficulties, Covestro is making a few sustainability-minded investments. It opened a pilot plant to test a process for making aniline from sugar. The company is also spending $50 million on a reactor at its toluene diisocyanate plant in Dormagen, Germany, that will make the facility 80% more energy efficient than rival plants.

Spending

Most companies increased capital and R&D spending budgets in 2023.

| Chemical Capital Spending | Chemical R&D Spending | |||||

|---|---|---|---|---|---|---|

| 2023 ($ MILLIONS) | CHANGE FROM 2022 | % OF CHEMICAL SALES | 2023 ($ MILLIONS) | CHANGE FROM 2022 | % OF CHEMICAL SALES | |

| Air Liquide | $3,598 | 4.6% | 12.2% | $334 | 0.3% | 1.1% |

| Air Products and Chemicals | 4,626 | 58.1 | 36.7 | 106 | 2.6 | 0.8 |

| Albemarle | 2,149 | 70.4 | 22.3 | 86 | 19.0 | 0.9 |

| Arkema | 686 | -10.3 | 6.7 | 297 | 1.9 | 2.9 |

| Asahi Kasei | 793 | 4.7 | 8.8 | 312 | 4.8 | 3.5 |

| BASF | 5,836 | 23.3 | 7.8 | 2,304 | -7.3 | 3.1 |

| Braskem | 907 | -6.6 | 6.4 | 77 | 2.3 | 0.5 |

| Celanese | 568 | 4.6 | 5.2 | 146 | 30.4 | 1.3 |

| Covestro | 827 | -8.1 | 5.3 | 405 | 3.6 | 2.6 |

| Dow | 2,356 | 29.2 | 5.3 | 829 | -2.6 | 1.9 |

| DSM-Firmenich | 600 | 9.7 | 5.2 | 705 | 121.0 | 6.1 |

| DuPont | 619 | -16.7 | 5.1 | 508 | -5.2 | 4.2 |

| Eastman Chemical | 828 | 35.5 | 9.0 | 239 | -9.5 | 2.6 |

| Evonik Industries | 858 | -8.3 | 5.2 | 479 | -3.7 | 2.9 |

| ExxonMobil | 2,826 | -4.4 | 6.9 | n/a | n/a | n/a |

| Hanwha Solutions | 1,681 | 190.4 | 18.8 | 47 | -22.3 | 0.5 |

| Hengli Petrochemical | n/a | n/a | n/a | 194 | 15.7 | 0.9 |

| Indorama Ventures | 690 | -6.3 | 4.4 | 38 | -10.4 | 0.2 |

| Ineos | 2,153 | 4.5 | 7.3 | 75 | -6.8 | 0.3 |

| LG Chem | 9,918 | 61.1 | 23.5 | 1,556 | 15.2 | 3.7 |

| Linde | 4,716 | 44.9 | 15.4 | n/a | n/a | n/a |

| Lotte Chemical | 2,786 | 40.4 | 18.2 | 92 | 17.5 | 0.6 |

| LyondellBasell Industries | 1,487 | -18.7 | 4.7 | 130 | 4.8 | 0.4 |

| Mitsubishi Chemical Group | 1,931 | 11.0 | 7.3 | n/a | n/a | n/a |

| Mitsui Chemicals | 1,025 | 8.9 | 8.2 | 318 | 4.0 | 2.6 |

| Mosaic | 1,402 | 12.4 | 10.2 | n/a | n/a | n/a |

| Resonac Holdings | 620 | -0.9 | 6.8 | 304 | -9.3 | 3.3 |

| Rongsheng Petrochemical | n/a | n/a | n/a | 926 | 50.1 | 3.5 |

| Sabic | 2,789 | 3.4 | 7.4 | 505 | 2.0 | 1.3 |

| Shin-Etsu Chemical | 2,665 | 26.7 | 15.5 | 468 | -2.2 | 2.7 |

| Sinopec | 7,773 | -6.1 | 13.4 | n/a | n/a | n/a |

| Sumitomo Chemical | 887 | 9.4 | 6.1 | n/a | n/a | n/a |

| Umicore | 780 | 98.7 | 7.6 | 229 | -14.0 | 2.2 |

| Wanhua Chemical Group | n/a | n/a | n/a | 576 | 19.3 | 2.3 |

| Yara | 1,139 | 23.0 | 7.4 | 113 | 18.9 | 0.7 |

Sources: Company documents, C&EN analysis.

Note: Figures are for companies on the top 50 list reporting capital or R&D expenditures or both. n/a means not available. Some figures were converted at 2023 average exchange rates listed with the Top 50 list. Comparisons with prior years are based on revised numbers that reflect restated prior-year results and changes in exchange rates.

Spending

Most companies increased capital and R&D spending budgets in 2023.

| CHEMICAL CAPITAL SPENDING | CHEMICAL R&D SPENDING | |||||

|---|---|---|---|---|---|---|

| 2023 ($ MILLIONS) | CHANGE FROM 2022 | % OF CHEMICAL SALES | 2023 ($ MILLIONS) | CHANGE FROM 2022 | % OF CHEMICAL SALES | |

| Air Liquide | $3,598 | 4.6% | 12.2% | $334 | 0.3% | 1.1% |

| Air Products and Chemicals | 4,626 | 58.1 | 36.7 | 106 | 2.6 | 0.8 |

| Albemarle | 2,149 | 70.4 | 22.3 | 86 | 19.0 | 0.9 |

| Arkema | 686 | -10.3 | 6.7 | 297 | 1.9 | 2.9 |

| Asahi Kasei | 793 | 4.7 | 8.8 | 312 | 4.8 | 3.5 |

| BASF | 5,836 | 23.3 | 7.8 | 2,304 | -7.3 | 3.1 |

| Braskem | 907 | -6.6 | 6.4 | 77 | 2.3 | 0.5 |

| Celanese | 568 | 4.6 | 5.2 | 146 | 30.4 | 1.3 |

| Covestro | 827 | -8.1 | 5.3 | 405 | 3.6 | 2.6 |

| Dow | 2,356 | 29.2 | 5.3 | 829 | -2.6 | 1.9 |

| DSM-Firmenich | 600 | 9.7 | 5.2 | 705 | 121.0 | 6.1 |

| DuPont | 619 | -16.7 | 5.1 | 508 | -5.2 | 4.2 |

| Eastman Chemical | 828 | 35.5 | 9.0 | 239 | -9.5 | 2.6 |

| Evonik Industries | 858 | -8.3 | 5.2 | 479 | -3.7 | 2.9 |

| ExxonMobil | 2,826 | -4.4 | 6.9 | n/a | n/a | n/a |

| Hanwha Solutions | 1,681 | 190.4 | 18.8 | 47 | -22.3 | 0.5 |

| Hengli Petrochemical | n/a | n/a | n/a | 194 | 15.7 | 0.9 |

| Indorama Ventures | 690 | -6.3 | 4.4 | 38 | -10.4 | 0.2 |

| Ineos | 2,153 | 4.5 | 7.3 | 75 | -6.8 | 0.3 |

| LG Chem | 9,918 | 61.1 | 23.5 | 1,556 | 15.2 | 3.7 |

| Linde | 4,716 | 44.9 | 15.4 | n/a | n/a | n/a |

| Lotte Chemical | 2,786 | 40.4 | 18.2 | 92 | 17.5 | 0.6 |

| LyondellBasell Industries | 1,487 | -18.7 | 4.7 | 130 | 4.8 | 0.4 |

| Mitsubishi Chemical Group | 1,931 | 11.0 | 7.3 | n/a | n/a | n/a |

| Mitsui Chemicals | 1,025 | 8.9 | 8.2 | 318 | 4.0 | 2.6 |

| Mosaic | 1,402 | 12.4 | 10.2 | n/a | n/a | n/a |

| Resonac Holdings | 620 | -0.9 | 6.8 | 304 | -9.3 | 3.3 |

| Rongsheng Petrochemical | n/a | n/a | n/a | 926 | 50.1 | 3.5 |

| Sabic | 2,789 | 3.4 | 7.4 | 505 | 2.0 | 1.3 |

| Shin-Etsu Chemical | 2,665 | 26.7 | 15.5 | 468 | -2.2 | 2.7 |

| Sinopec | 7,773 | -6.1 | 13.4 | n/a | n/a | n/a |

| Sumitomo Chemical | 887 | 9.4 | 6.1 | n/a | n/a | n/a |

| Umicore | 780 | 98.7 | 7.6 | 229 | -14.0 | 2.2 |

| Wanhua Chemical Group | n/a | n/a | n/a | 576 | 19.3 | 2.3 |

| Yara | 1,139 | 23.0 | 7.4 | 113 | 18.9 | 0.7 |

Sources: Company documents, C&EN analysis.

Note:Figures are for companies on the top 50 list reporting capital or R&D expenditures or both. n/a means not available. Some figures were converted at 2023 average exchange rates listed with the Top 50 list. Comparisons with prior years are based on revised numbers that reflect restated prior-year results and changes in exchange rates.

25

Yara

2023 chemical sales: $15.4 billion

In a breakthrough for clean ammonia production, Yara started up a green ammonia demonstration plant in Porsgrunn, Norway. Yara says the unit is Europe’s largest electrolysis plant, with 24 MW of capacity. Using renewable electricity, it will make enough hydrogen from water to produce 20,000 metric tons (t) of ammonia annually. At its plant in Sluiskil, the Netherlands, Yara is working with the firm Northern Lights to transport and store carbon dioxide emissions from natural gas–based ammonia production. The project, which should reduce carbon dioxide emissions by 800,000 t per year, is expected to start up in 2026. In an entirely different route to sustainable fertilizers, Yara agreed in December to buy Agribios Italiana, which makes 60,000 t of organic fertilizers annually.

26

Toray Industries

2023 chemical sales: $15.3 billion

Advertisement

Toray Industries managed to climb C&EN’s ranking by having only a slight decline in 2023 sales, about 2%, while peers posted more extensive drops during a difficult year. Seeing vibrant 17% annual demand increases for carbon fiber due to emerging use in hydrogen and natural gas storage, Toray has projects underway to expand capacity in South Carolina, South Korea, and France by 2025. Toray’s laboratories have also been active. Earlier this year, the Japanese company launched a mold-release film for semiconductor manufacturing that’s free from per- and polyfluoroalkyl substances. The company also developed an ultra-high-molecular-weight polyethylene film that it claims is nearly as strong as steel. Toray sees it as an alternative to fluoropolymers.

27

Lotte Chemical

2023 chemical sales: $15.3 billion

The South Korean chemical maker has a couple of big US clean ammonia investments on its plate. It is planning a complex with Mitsubishi Corporation and RWE in Corpus Christi, Texas, and is considering a joint venture with CF Industries in Louisiana. Lotte Chemical has been making more modest investments in its home country. In December, it completed a hydroxyethyl cellulose plant in Yosu. Made from cellulose and ethylene oxide, the material is used to alter viscosity in products like paints and personal care goods. The company also broke ground on a $220 million engineering polymer compounding facility in Jeollanam-do.

28

Sumitomo Chemical

2023 chemical sales: $14.5 billion

Japanese commodity chemical makers have been struggling in recent years because of high costs and competition from large new complexes in China. Sumitomo Chemical, which posted a loss in 2023, is no exception. The company is enacting what it calls “emergency measures” meant to reap $3.3 billion for its bottom line. It will reduce about 4,000 jobs, about 10% of its total, over the next year. It plans on streamlining its petrochemical business. And it will not increase its involvement in Petro Rabigh, its refining and petrochemical joint venture with Saudi Aramco. Not all developments have been dour for Sumitomo. In Chiba, Japan, the company is building a plant to make propylene directly from ethanol.

29

Braskem

2023 chemical sales: $14.1 billion

Braskem’s ownership is up in the air. The Brazilian conglomerate Novonor, which has been trying to sell its controlling interest in the petrochemical maker for years, has entertained offers from Abu Dhabi National Oil Company (ADNOC) and others. ADNOC walked away in May, but other suitors are in the wings. Amid the potential upheaval, Braskem seems receptive to new technical ideas, particularly related to sustainability. For example, it formed a partnership with Northwestern University to explore making chemicals from carbon dioxide using coelectrolysis. It has been working with New Iridium to make chemicals from CO2 using photocatalysis. And Braskem will study using Lummus Technology’s electric short-residence-time cracking technology at a site in Brazil. Last July, Braskem completed a 30% expansion of its ethanol-to-ethylene plant in Triunfo, Brazil, bringing capacity to 260,000 metric tons per year.

30

Mosaic

2023 chemical sales: $13.7 billion

Mosaic got a new CEO at the beginning of the year when Bruce Bodine, the company’s senior vice president for North America, took over from Joc O’Rourke, who retired after leading Mosaic for 8 years. Bodine presides over an expanding firm. In 2022, Mosaic completed Esterhazy K3, a potash mine in Saskatchewan. The $3 billion project brought the Canadian site’s production up to 7.8 million metric tons, making it the largest potash mine in the world. Mosaic also spent $35 million to expand capacity for its MicroEssentials line of specialty fertilizers, which blend phosphorus with zinc and other nutrients. The company says the line boosts plant uptake of phosphorus by 28% versus commodity fertilizers such as diammonium phosphate.

31

Air Products and Chemicals

2023 chemical sales: $12.6 billion

Air Products and Chemicals’ charismatic CEO Seifi Ghasemi prides himself on leading a company that is doing more than just talk about green hydrogen production. During a recent Air Products earnings call, he gave an update on the company’s $6.7 billion green hydrogen and ammonia complex in Neom, Saudi Arabia. “I can show you the picture of the wind turbines installed,” he said. But a $4 billion US green hydrogen project, a joint venture with the energy firm AES, has stalled. Ghasemi said on the same call that the company would delay a final investment decision until the rules for US Inflation Reduction Act incentives become clearer. In any case, Air Products is planning for a future in which it will produce a lot of green hydrogen. It recently signed a contract with TotalEnergies to supply 70,000 metric tons per year of such H2 to the French energy company’s oil refineries.

32

Mitsui Chemicals

2023 chemical sales: $12.5 billion

Like other Japanese chemical makers, Mitsui Chemicals is downsizing domestically. The firm is closing a polyethylene terephthalate (PET) plant in Yamaguchi, citing foreign competition. The plant’s capacity is 145,000 metric tons per year, a fraction of the size of the integrated PET complexes cropping up in China. Similarly, Mitsui and Idemitsu Kosan are consolidating ethylene production. Idemitsu will close its cracker in Chiba, Japan, and Mitsui’s nearby unit will make ethylene for both companies. Mitsui is taking safe harbor in technology. With Microwave Chemical and Chiyoda, the firm is working on an electric ethylene cracking process that will use microwave radiation to convert naphtha into olefins. It is also using carbon nanotubes to make pellicles that cover semiconductor wafers during the photolithographic etching of circuit lines.

33

DuPont

2023 chemical sales: $12.1 billion

DuPont will likely disappear from C&EN’s ranking in another year or two. The company is splitting itself into three new firms. The plan will result in a new DuPont, which will make familiar materials like Kevlar, Nomex, and Tyvek. But at $6.6 billion in annual sales, that firm is unlikely to make the cut for this survey. The second new firm will be an electronic materials company with $4.0 billion in sales of products like chemical-mechanical planarization pads and lithography chemicals. And a $1.5 billion water treatment company will supply ion-exchange resins and reverse osmosis membranes. The moves come as no surprise for those following the career of CEO Ed Breen, who earlier broke up the conglomerate Tyco. At DuPont, Breen presided over the brief merger with Dow, which ultimately resulted in the formation of Corteva Agriscience. He also divested DuPont’s engineering polymer and nutrition and health businesses. Now Breen has hung up his hat as CEO. Former chief financial officer Lori Koch took over that role on June 1.

34

Bayer

2023 chemical sales: $11.9 billion

Bayer was once a diversified chemical and pharmaceutical company. That changed when it spun off its Lanxess chemical business and its Covestro polymer business into stand-alone firms in 2005 and 2015, respectively. In March, Bayer CEO Bill Anderson raised the specter of another eventual breakup that would create separate pharmaceutical and crop protection companies. “Not now—and this shouldn’t be misunderstood as never,” Anderson said in a statement in March. The firm has high debt and faces liabilities related to its glyphosate herbicide Roundup. For now, Bayer plans to cut annual costs by $2.2 billion. Another struggle for Bayer has been trying to get the herbicide dicamba back on the US market after a court decision in February that overturned the Environmental Protection Agency’s earlier approval.

35

Chevron Phillips Chemical

2023 chemical sales: $11.6 billion

Chevron Phillips Chemical CEO Bruce Chinn has retired after running the joint venture for 3 years. Replacing him is Steve Prusak, former head of corporate planning and technology. Prusak might preside over a structural change at Chevron Phillips Chemical (CPChem). Trinseo, its partner in the styrene and polystyrene joint venture Americas Styrenics, is looking to sell its 50% stake. In March, CPChem and QatarEnergy started construction on a $6 billion ethylene cracker complex in Ra’s Lafān, Qatar. The companies are planning a similar plant in Texas.

36

DSM-Firmenich

2023 chemical sales: $11.5 billion

After a year absence, DSM returns to C&EN’s ranking as DSM-Firmenich. DSM and the flavor and fragrance maker Firmenich completed their merger in May 2023. DSM-Firmenich is a far cry from the diversified chemical company DSM was a decade ago, before it sold off traditional businesses like engineering plastics. The company makes natural and synthetic fragrances, food and nutritional ingredients, and animal health products such as vitamins. And DSM-Firmenich itself is already trimming assets. In February, it announced that it would separate its animal nutrition business, which generated sales of $3.4 billion last year, in preparation for an eventual sale.

37

Tongkun Holding Group

2023 chemical sales: $11.3 billion

Tongkun Holding Group debuted on C&EN’s ranking in 2022 but didn’t make the cut last year. Now, after a 33% surge in 2023 sales, the company reappears in the ranking at a healthy number 37. The Chinese company is among the largest polyester filament companies in the world. It also makes polyethylene terephthalate and its major raw material, purified terephthalic acid. The company is considering a $5.9 billion investment in a massive complex in Indonesia that would have 10 million metric tons of refining and petrochemical capacity.

38

Nutrien

2023 chemical sales: $11.2 billion

In a development that might prove to be a bad portent for the clean ammonia boom, Nutrien decided against pursuing a project in Geismar, Louisiana. The decision came as many industrial gas and fertilizer makers, eager to tap into generous government incentives, are aggressively pursuing US hydrogen and ammonia projects. Nutrien says the expected cost of building the plant exceeds the $2 billion it estimated when announcing the project in 2022. The company is also skeptical that demand for ammonia as a fuel will ramp up quickly. In another move, Nutrien is evaluating strategic options for its 50% stake in Profertil, a large urea joint venture in Bahía Blanca, Argentina.

39

Celanese

2023 chemical sales: $10.9 billion

The US chemical maker debuts on the ranking this year after narrowly missing the cut a year ago. Celanese experienced a 13% jump in 2023 sales mostly because of its $11 billion purchase of DuPont’s engineering polymer business in November 2022. The business gave Celanese about $3 billion in additional sales from materials such as nylon 6,6 and polybutylene terephthalate. These materials complement existing Celanese businesses, like polyacetal and polyphenylene sulfide. Separately, Celanese recently started production of methanol from carbon dioxide at its Fairway Methanol joint venture with Mitsui & Co. Celanese will use the methanol to make acetic acid.

40

Hengyi Petrochemical

2023 chemical sales: $10.9 billion

Hengyi Petrochemical entered the C&EN top 50 ranking in 2022 but dropped off in 2023. After a 20% surge in sales, Hengyi makes the cut again this year. The company started up an integrated refining and petrochemical complex in Brunei in 2019. The complex processes about 8 million metric tons of oil per year and boasts what Hengyi says is the world’s largest single-series aromatics plant. The plant supplies raw materials for Hengyi’s production in China of aromatic derivatives such as purified terephthalic acid. Hengyi is constructing a major addition to the Brunei site.

41

Umicore

2023 chemical sales: $10.3 billion

Umicore may have buyer’s remorse. In recent years, the catalyst firm has been betting heavily on battery materials for electric vehicles. For instance, in 2022, it unveiled a plan to build a $1.2 billion battery material plant in Ontario. But under new CEO Bart Sap, the Belgian company is reassessing this strategy. In June, Umicore said the battery business’s volumes might shrink this year. “Customers are scaling back their electrification ramp-up plans,” it said in the announcement. Umicore pledged to phase in its production increases to match actual growth in the market.

42

Arkema

2023 chemical sales: $10.3 billion

Arkema is on a mini buying spree. In May, the French specialty chemical maker agreed to purchase Dow’s business in laminated adhesives for flexible packaging. The enterprise has annual sales of about $250 million. In April, it agreed to buy a 78% interest in Proionic, an Austrian supplier of ionic liquids for emerging industrial applications. Proionic had $2.7 million in sales last year. Arkema is also growing organically. For example, it is spending $135 million to expand production of dimethyl disulfide, an additive used in renewable aviation fuels.

43

Albemarle

2023 chemical sales: $9.6 billion

Record sales at the US lithium producer propelled it to a strong debut in C&EN’s Global Top 50 ranking. Albemarle’s sales soared 31% in 2023. Most of that increase was due to higher sales volumes and high lithium prices, which tumbled during the year. In response to the decline, the company is cutting capital spending. Albemarle also withdrew a $4.3 billion bid to acquire the Australian lithium miner Liontown Resources, in part because a rival was accumulating a stake in the firm.

44

Eastman Chemical

2023 chemical sales: $9.2 billion

In Kingsport, Tennessee, Eastman Chemical has started up what might be the world’s most ambitious plastics recycling project. The new plant there will use methanolysis to break apart more than 100,000 metric tons per year of polyethylene terephthalate (PET) carpet, film, and other polyester items into dimethyl terephthalate and ethylene glycol. The company will use this recycled feedstock to make high-end specialty polyester resins. Eastman is building similar recycling plants in France and Longview, Texas. In addition to the recycling unit, these new facilities will likely have polymerization lines to make PET and specialty polyesters.

45

Resonac Holdings

2023 chemical sales: $9.2 billion

Resonac Holdings, formed last year, is already taking a major restructuring step. The Japanese company plans to spin off its petrochemical unit as a separate firm in which it will retain a 20% stake. The business generates about $2.1 billion in revenue annually and has its major complex in Oita, Japan. Another Japanese firm, Mitsubishi Chemical Group, considered a similar move but has walked back the plan. In the meantime, Resonac is partnering with Neste and the Japanese trading company Marubeni to introduce renewable feedstocks, made by Neste, at the Oita chemical complex.

46

Asahi Kasei

2023 chemical sales: $9.0 billion

Asahi Kasei is placing bets on lithium-ion batteries. The Japanese company plans to spend $1.1 billion to build a plant in Port Colborne, Ontario, that will make separator films critical to the batteries. It intends to work with Honda Motor Co., which is spending $11 billion on batteries and components in the province. In another battery development, Asahi Kasei announced in June that it had successfully tested ionic conductive electrolytes that are based on acetonitrile. The firm says they allow for batteries with high power output at low temperatures. Another emerging area for Asahi Kasei is electrolysis modules that split water into hydrogen and oxygen. The company hopes they will generate $600 million in annual sales by 2030. In May, it started to test its electrolyzer technology in Kawasaki, Japan.

47

Hanwha Solutions

2023 chemical sales: $9.0 billion

Hanwha Solutions returned to C&EN’s ranking after a 1-year absence. Part of the reason is the company’s growth in the solar power field. The South Korean firm’s subsidiary Qcells plans to spend $2.5 billion to build an integrated photovoltaic cell plant in Georgia that will make silicon ingots, wafers, cells, and panels. The firm says incentives from the US Inflation Reduction Act partly spurred the investment. To feed the new plant, Hanwha plans to buy up all the polysilicon from REC Silicon’s facility in Moses Lake, Washington. Hanwha is REC’s largest shareholder.

48

Xinfengming Group

2023 chemical sales: $8.7 billion

Xinfengming Group is another Chinese petrochemical maker debuting in the Global Top 50 this year. Xinfengming was founded in 2000. It makes 8.6 million metric tons (t) of polyester filament and 5 million t of purified terephthalic acid per year. It also plans to be a minority partner in Tongkun Group’s Indonesian petrochemical complex.

49

Sasol

2023 chemical sales: $8.7 billion

Sasol got its start in the 1950s making liquid fuels and chemicals from gasified coal using the Fischer-Tropsch process. The name itself is an acronym of South Africa Synthetic Oil Limited. Now the company is interested in deriving more of its sales from biobased raw materials. In October, Sasol began a collaboration with Solugen, which uses enzymes and catalysts to make chemicals from sugar, to develop chelating agents for home and personal care products. Around the same time, it launched a range of biosurfactants that it developed in partnership with Holiferm.

50

SK Innovation

2023 chemical sales: $8.4 billion

After a 3-year absence, SK Innovation just squeezes into this year’s Global Top 50. In recent years, its chemical business SK Geo Centric has placed a lot of emphasis on plastics recycling, partnering with firms outside South Korea with access to recycling technology to build plants in its home base of South Korea. For instance, SK has signed pyrolysis agreements with Brightmark and Plastic Energy. And it owns a stake in PureCycle, which is commercializing a technology for purifying polypropylene using solvents. It is working with Loop Industries on polyethylene terephthalate (PET) depolymerization.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter