Climate Change

Chemical firms will coalesce around more ambitious climate goals

by Craig Bettenhausen

It’s already unusual for a chemical company not to have specific, public targets for reducing its greenhouse gas (GHG) emissions. In 2021, expect more firms to change their goals to net-zero GHG emissions by 2050, in line with the urging of the 2018 Intergovernmental Panel on Climate Change (IPCC) report.

Takeaways

• Chemical companies’ climate goals are getting more ambitious.

• Standards are emerging on carbon-counting practices and goal setting.

• The industry is focused on energy efficiency and renewable power now, but it will likely need carbon capture at some point.

• Big players are leading the way to net-zero greenhouse gas emissions by 2050.

The report suggests that humanity can limit global warming to 1.5 °C above preindustrial levels if by 2030 we cut carbon dioxide emissions by 45% from 2010 levels and reach net zero by 2050. In addition to a clear goal to rally around, the report provides standardized methods for auditing GHG emissions.

C&EN looked at the targets set by 25 firms and found that they fall into three basic categories.

The smallest group has the most modest goal: keep GHG emissions flat. In part, that goal reflects aggressive growth targets, because increasing chemical output without releasing more carbon requires new, top-of-the-line equipment and upgrades to existing facilities. The next and largest group is looking on average to cut GHG emissions by 35% from 2010 levels, usually by about 2030. Beyond that, a number of companies—including some of the biggest—aim to be carbon neutral by 2050, meeting the IPCC recommendation. As chemical firms update their goals in 2021, more will likely join this most ambitious cohort, as Eastman Chemical did in December.

Efficiency and renewable power are the most popular strategies for reducing GHG emissions. “The first chunk of it is just simple business sense—be as efficient as possible, and that’s going to help your bottom line,” says Charlie Quann, carbon services lead at the consulting firm Antea Group.

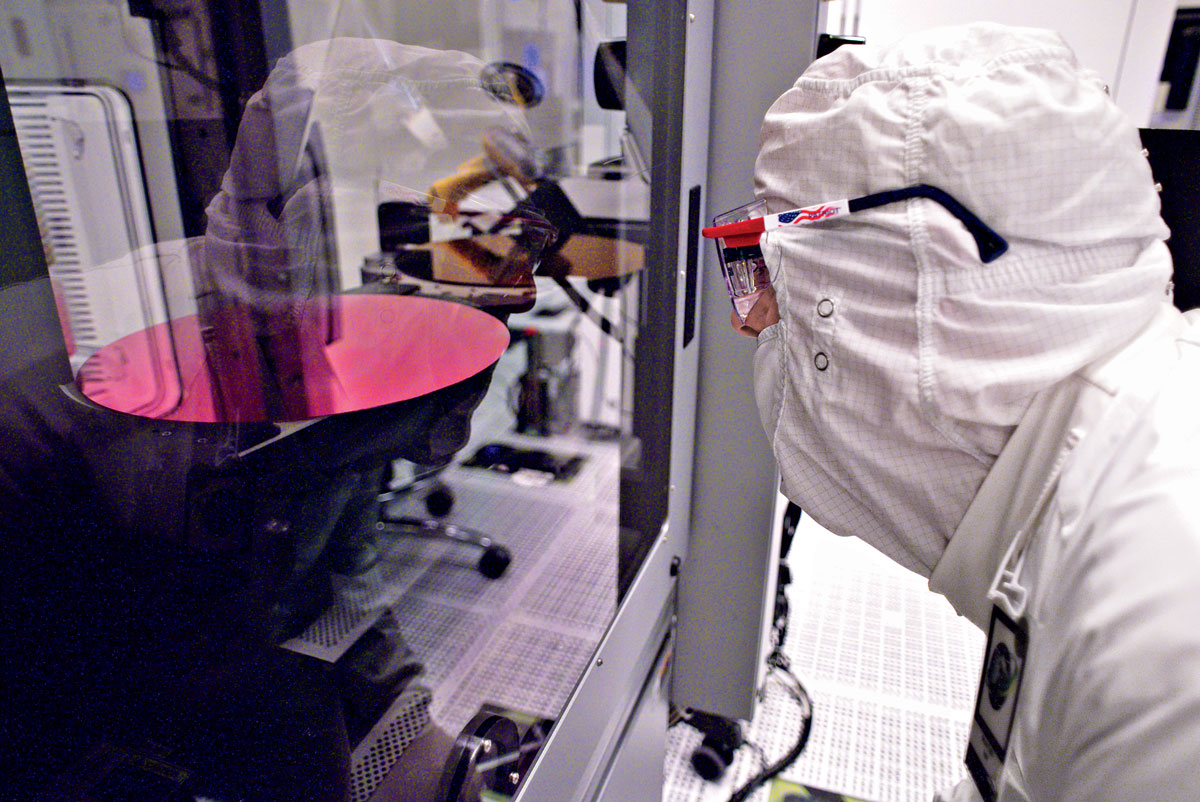

To get all the way to net zero, Quann says, the chemical industry will need to capture the GHGs it produces rather than release them to the air. Companies that have carbon capture at the center of their plans now are mostly the chemical divisions of oil companies such as ExxonMobil and PetroChina, but the rest of the industry is watching the technology closely, he says.

Firms that have led the industry in climate change response have already picked a lot of their low-hanging fruit, in some cases leading to current goals that look relatively tame. BASF, for example, emphasizes in its sustainability reports that it has already reduced its GHG emissions by 49% from 1990 levels, and it hopes to resume reducing emissions in 2030.

Consensus is also emerging on how to quantify and report climate change’s risk to businesses, with a standardized approach known as the TCFD framework proposed by the international Task Force on Climate-related Financial Disclosures. The framework allows shareholders to get their heads around the numbers, Quann says, and they are using those numbers to make specific, actionable, and consistent demands on executives. “Everybody is starting to realize that climate risk is financial risk,” he says.

Carbon-reduction targets for 25 chemical companies fall into three categories.

| Company | Target | Target date |

| Modest: Carbon-neutral growth | ||

| BASF | Maintain 2018 levels | n/a |

| ExxonMobil Chemical | Maintain 2020 levels | n/a |

| LG Chem | Maintain 2019 levels | n/a |

| Moderate: Near-term carbon reduction | ||

| Air Liquide | 30% reduction versus 2015 | 2025 |

| Braskem | 58% reduction versus 2008 | 2030 |

| Covestro | 50% reduction versus 2005 | 2025 |

| Evonik Industries | 50% reduction versus 2008 | 2025 |

| Linde | 35% reduction versus 2018 | 2028 |

| Lotte Chemical | 26% reduction versus 2013 | 2028 |

| LyondellBasell Industries | 15% reduction versus 2015 | 2030 |

| Mitsui Chemicals | 25% reduction versus 2005 | 2030 |

| Sabic | 25% reduction versus 2010 | 2025 |

| Shin-Etsu Chemical | 55% reduction versus 1990 | 2025 |

| Solvay | 26% reduction versus 2018 | 2030 |

| Sumitomo Chemicalᵃ | 57% reduction versus 2013 | 2050 |

| Toray Industries | 30% reduction versus 2013 | 2030 |

| Ambitious: Net zero by 2050 | ||

| Chemours | Carbon negative | 2050 |

| Dow | Carbon neutral | 2050 |

| DuPont | Carbon neutral | 2050 |

| Eastman Chemical | Carbon neutral | 2050 |

| Mitsubishi Chemical | Carbon neutral | 2050 |

| PetroChina | Near carbon neutral | 2050 |

| Reliance Industries | Carbon neutral | 2035 |

| Sinopec | Carbon neutral | 2030 |

| Yara | Carbon neutral | 2050 |

Modest: Carbon-neutral growth

Company: BASF

Target: Maintain 2018 levels

Target date: n/a

Company: ExxonMobil Chemical

Target: Maintain 2020 levels

Target date: n/a

Company: LG Chem

Target: Maintain 2019 levels

Target date: n/a

Moderate: Near-term carbon reduction

Company: Air Liquide

Target: 30% reduction versus 2015

Target date: 2025

Company: Braskem

Target: 58% reduction versus 2008

Target date: 2030

Company: Covestro

Target: 50% reduction versus 2005

Target date: 2025

Company: Evonik Industries

Target: 50% reduction versus 2008

Target date: 2025

Company: Linde

Target: 35% reduction versus 2018

Target date: 2028

Company: Lotte Chemical

Target: 26% reduction versus 2013

Target date: 2028

Company: LyondellBasell Industries

Target: 15% reduction versus 2015

Target date: 2030

Company: Mitsui Chemicals

Target: 25% reduction versus 2005

Target date: 2030

Company: Sabic

Target: 25% reduction versus 2010

Target date: 2025

Company: Shin-Etsu Chemical

Target: 55% reduction versus 1990

Target date: 2025

Company: Solvay

Target: 26% reduction versus 2018

Target date: 2030

Company: Sumitomo Chemicalᵃ

Target: 57% reduction versus 2013

Target date: 2050

Company: Toray Industries

Target: 30% reduction versus 2013

Target date: 2030

Ambitious: Net zero by 2050

Company: Chemours

Target: Carbon negative

Target date: 2050

Company: Dow

Target: Carbon neutral

Target date: 2050

Company: DuPont

Target: Carbon neutral

Target date: 2050

Company: Eastman Chemical

Target: Carbon neutral

Target date: 2050

Company: Mitsubishi Chemical

Target: Carbon neutral

Target date: 2050

Company: PetroChina

Target: Near carbon neutral

Target date: 2050

Company: Reliance Industries

Target: Carbon neutral

Target date: 2035

Company: Sinopec

Target: Carbon neutral

Target date: 2030

Company: Yara

Target: Carbon neutral

Target date: 2050

Sources: Companies, as of December 2020.

Note: n/a means not applicable.

a Sumitomo is also targeting a decrease of 30% by 2030.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter