Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

C&EN’s top 50 US chemical producers for 2023

Companies increased sales but saw profits slip in a challenging year

by Alexander H. Tullo

May 7, 2023

| A version of this story appeared in

Volume 101, Issue 15

Credit: Chevron Phillips | Chevron Phillips gave the go-ahead for a new ethylene cracker in Texas.

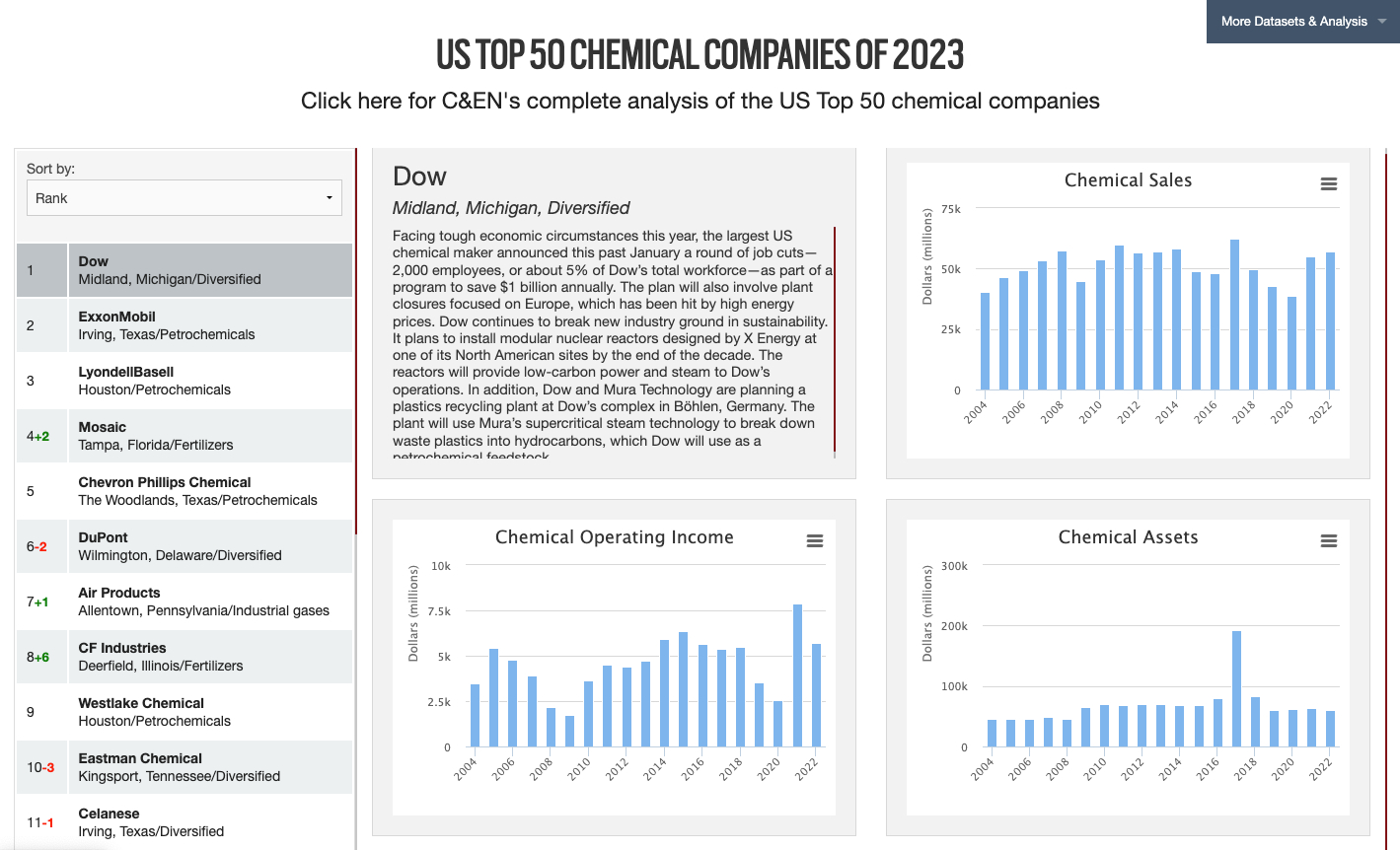

US TOP 50 INTERACTIVE TABLE

US top 50 interactive table

Click through an interactive look at the US Top 50 going back to 2004. Be sure to also check out our Global Top 50 information presented in the same interactive format.

Downloads

JPG of C&EN’s US Top 50 chemical companies for 2023

Previous coverage

C&EN’s Global Top 50 chemical firms for 2022

Despite headwinds like the war in Europe, high inflation, and the lingering effects of the COVID-19 pandemic, the US chemical industry made it out of 2022 in relatively good shape. That is one interpretation of the results of C&EN’s new survey of the top 50 US chemical producers, which is based on these firms’ financial results for 2022.

These 50 chemical makers posted combined sales of $376.7 billion, an 11.4% increase from a year ago and a new record for the annual survey. Only six firms posted a sales decline.

But for the 43 firms that disclose profit figures, combined chemical operating profits fell 4.8%, to $55.2 billion. Sixteen firms posted an earnings decline. One company, Trinseo, posted a loss.

Many of those that reported reduced profits—Dow, ExxonMobil, LyondellBasell Industries, and Westlake—are large petrochemical makers. The petrochemical industry built a lot of capacity in recent years, and the sector is in a cyclical downturn. In addition, energy prices rose sharply in 2022 because of the war in Ukraine. Oil prices spiked by 33% in the first half before settling down.

In contrast, fertilizer makers had a tremendous year. Sales at Mosaic, which makes phosphate fertilizers, rose 54.8%, lifting the firm to number 4 in the US top 50. Sales at the nitrogen fertilizer maker CF Industries skyrocketed 71.1%, propelling it to number 8.

But even those gains are modest compared with the jump at Albemarle, a major supplier of lithium for electric car batteries. Its sales more than doubled, launching it from 24 in last year’s ranking to 15 this year.

Spending on the future was mixed at chemical firms. The 42 companies that disclose capital spending figures reported a combined rise of 22.2%, to $20.1 billion. Some 26 firms report R&D spending. Their combined total was $3.2 billion, a 1.0% decline.

Many firms departed this year’s US top 50. Kraton was acquired in March 2022 by South Korea’s DL Chemical for $2.5 billion. The polymer and pine chemical firm was number 34 in last year’s survey. The electronic materials maker CMC Materials, number 42 last year, was acquired in July 2022 by Entegris—ranked 41 this year—for $5.7 billion.

In April 2022, the industrial conglomerate Prince International, backed by the private equity firm American Securities, bought Ferro, number 43 in last year’s ranking, for $2.1 billion. Prince and Ferro then merged with Chromaflo Technologies to form Vibrantz Technologies. As a private company, Vibrantz does not publicly report financial results.

Minerals Technologies and Goodyear Tire & Rubber, last year’s numbers 49 and 50, respectively, didn’t have enough revenues to make the cut this year.

Debuting in the ranking at a hefty number 26 is Ascend Performance Materials. The nylon 6,6 business, once part of Solutia, is owned by the private equity firm SK Capital and is now disclosing its annual sales.

Other newcomers are firms riding a wave of high commodity prices. LSB Industries and CVR Partners, numbers 45 and 46, respectively, are both nitrogen fertilizer producers. Livent, the lithium business that spun out of FMC in 2019, nearly doubled sales in a single year and comes in at number 48. Sisecam Resources, wrapping up the list at number 50, makes soda ash.

The C&EN ranking includes only companies that publicly report sales from chemicals. Some large companies would likely make the list if they disclosed these figures. For example, Invista, a polymer and fiber business owned by the privately held Koch Industries, would easily be on the list, possibly near the top. SI Group and TPC Group, two other private firms, would also probably make the survey. In addition, some diversified public firms don’t break out chemical sales—for example, Procter & Gamble with its oleochemical business.

Top 50 US chemical firms

Top 50 US chemical firms

Though some firms saw profits decline, 2022 was overall a strong year for chemical makers.

| RANK | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2022 | 2021a | COMPANY | CHEMICAL SALES ($ MILLIONS) | CHANGE FROM 2021 | CHEMICAL SALES AS % OF TOTAL SALES | SECTOR | CHEMICAL OPERATING PROFITb ($ MILLIONS) | CHANGE FROM 2021 | OPERATING PROFIT MARGINc | HEADQUARTERS | IDENTIFIABLE CHEMICAL ASSETS ($ MILLIONS) | OPERATING RETURN ON CHEMICAL ASSETSd | |

| 1 | 1 | Dow | $56,902 | 3.5% | 100.0% | Diversified | $5,702 | -27.7% | 10.0% | Midland, Michigan | $60,603 | 9.4% | |

| 2 | 2 | ExxonMobil | 47,498 | 12.7 | 11.9 | Petrochemicals | 7,356 | -43.2 | 15.5 | Irving, Texas | 44,372 | 16.6 | |

| 3 | 3 | LyondellBasell Industries | 39,476 | 1.2 | 78.2 | Petrochemicals | 4,168 | -48.0 | 10.6 | Houston | n/a | n/a | |

| 4 | 6 | Mosaic | 19,125 | 54.8 | 100.0 | Fertilizers | 5,258 | 89.8 | 27.5 | Tampa, Florida | 23,386 | 22.5 | |

| 5 | 5 | Chevron Phillips Chemical | 14,180 | 0.5 | 100.0 | Petrochemicals | n/a | n/a | n/a | The Woodlands, Texas | 18,656 | n/a | |

| 6 | 4 | DuPont | 13,017 | -21.8 | 100.0 | Diversified | 2,022 | -23.8 | 15.5 | Wilmington, Delaware | 41,355 | 4.9 | |

| 7 | 8 | Air Productsf | 12,699 | 23.0 | 100.0 | Industrial gases | 2,357 | 6.4 | 18.6 | Allentown, Pennsylvania | 27,193 | 8.7 | |

| 8 | 14 | CF Industries | 11,186 | 71.1 | 100.0 | Fertilizers | 5,571 | 157.4 | 49.8 | Deerfield, Illinois | 13,313 | 41.8 | |

| 9 | 9 | Westlake | 11,008 | 27.0 | 69.7 | Petrochemicals | 2,416 | -5.2 | 21.9 | Houston | 13,978 | 17.3 | |

| 10 | 7 | Eastman Chemical | 10,580 | 1.0 | 100.0 | Diversified | 1,147 | -21.0 | 10.8 | Kingsport, Tennessee | 14,667 | 7.8 | |

| 11 | 10 | Celanese | 9,673 | 13.3 | 100.0 | Diversified | 1,382 | -28.7 | 14.3 | Irving, Texas | 26,272 | 5.3 | |

| 12 | 13 | Corteva Agriscience | 8,476 | 16.9 | 48.6 | Agrochemicals | 1,300 | 57.6 | 15.3 | Indianapolis | 14,097 | 9.2 | |

| 13 | 11 | Huntsman | 7,797 | -5.6 | 100.0 | Diversified | 710 | -8.3 | 9.1 | The Woodlands, Texas | 8,220 | 8.6 | |

| 14 | 12 | Olin | 7,776 | 6.1 | 82.9 | Chlorine chemistry | 1,570 | -2.8 | 20.2 | Clayton, Missouri | 6,984 | 22.5 | |

| 15 | 24 | Albemarle | 7,320 | 120.0 | 100.0 | Specialties | 2,479 | 393.2 | 33.9 | Charlotte, North Carolina | 15,457 | 16.0 | |

| 16 | 17 | Ecolabe | 6,944 | 10.1 | 48.9 | Process services | 977 | -5.2 | 14.1 | St. Paul, Minnesota | n/a | n/a | |

| 17 | 16 | Chemours | 6,794 | 7.1 | 100.0 | Diversified | 788 | 15.5 | 11.6 | Wilmington, Delaware | 7,640 | 10.3 | |

| 18 | 19 | Occidental Petroleum | 6,757 | 28.8 | 18.4 | Petrochemicals | 2,508 | 62.4 | 37.1 | Houston | 4,558 | 55.0 | |

| 19 | 15 | Lubrizol | 6,700 | 3.1 | 100.0 | Specialties | n/a | n/a | n/a | Wickliffe, Ohio | n/a | n/a | |

| 20 | 18 | Honeywell International | 5,996 | 11.0 | 16.9 | Fluorochemicals | n/a | n/a | n/a | Charlotte, North Carolina | n/a | n/a | |

| 21 | 20 | FMC | 5,802 | 15.0 | 100.0 | Agrochemicals | 1,237 | 7.3 | 21.3 | Philadelphia | 11,171 | 11.1 | |

| 22 | 21 | Trinseo | 4,966 | 2.9 | 100.0 | Polymers | -127 | def | def | Wayne, Pennsylvania | 3,760 | def | |

| 23 | 23 | Cabotf | 4,321 | 26.8 | 100.0 | Specialties | 572 | 26.0 | 13.2 | Boston | 3,525 | 16.2 | |

| 24 | 25 | H.B. Fullere,g | 3,749 | 14.4 | 100.0 | Specialties | 323 | 27.8 | 8.6 | St Paul, Minnesota | 4,464 | 7.2 | |

| 25 | 22 | Tronox | 3,454 | -3.3 | 100.0 | Pigments | 543 | -5.9 | 15.7 | Stamford, Connecticut | 6,306 | 8.6 | |

| 26 | -- | Ascend Performance Materials | 3,000 | -6.3 | 100.0 | Polymers | n/a | n/a | n/a | Houston | n/a | n/a | |

| 27 | 27 | Avantor | 2,898 | 13.7 | 38.6 | Laboratory chemicals | n/a | n/a | n/a | Radnor, Pennsylvania | n/a | n/a | |

| 28 | 30 | Stepan | 2,773 | 18.2 | 100.0 | Detergents | 199 | 10.1 | 7.2 | Northbrook, Illinois | 2,433 | 8.2 | |

| 29 | 29 | NewMarket | 2,765 | 17.3 | 100.0 | Fuel additives | 355 | 37.7 | 12.8 | Richmond, Virginia | 2,407 | 14.8 | |

| 30 | 33 | ChampionXe | 2,493 | 25.7 | 65.5 | Oil field chemicals | 150 | -23.5 | 6.0 | The Woodlands, Texas | n/a | n/a | |

| 31 | 32 | Ashlandf | 2,391 | 13.3 | 100.0 | Specialties | 288 | 67.4 | 12.0 | Wilmington, Delaware | 6,213 | 4.6 | |

| 32 | 28 | Avient | 2,355 | -1.6 | 69.3 | Pigments | 301 | -0.7 | 12.8 | Avon Lake, Ohio | 2,703 | 11.1 | |

| 33 | 31 | International Flavors & Fragrances | 2,339 | 0.4 | 18.8 | Food additives | 271 | -0.4 | 11.6 | New York City | 10,877 | 2.5 | |

| 34 | 37 | Americas Styrenics | 2,060 | 13.0 | 100.0 | Polymers | 212 | 3.6 | 10.3 | The Woodlands, Texas | 677 | 31.4 | |

| 35 | 39 | Orion Engineered Carbons | 2,031 | 31.3 | 100.0 | Inorganics | 200 | 29.7 | 9.8 | Spring, Texas | 1,889 | 10.6 | |

| 36 | 36 | Hexion | 2,000 | 5.3 | 100.0 | Specialties | n/a | n/a | n/a | Columbus, Ohio | n/a | n/a | |

| 37 | 40 | Innospec | 1,964 | 32.4 | 100.0 | Fuel additives | 187 | 43.7 | 9.5 | Englewood, Colorado | 1,604 | 11.7 | |

| 38 | 38 | AdvanSix | 1,946 | 15.5 | 100.0 | Polymers | 227 | 18.6 | 11.7 | Parsippany, New Jersey | 1,495 | 15.2 | |

| 39 | 35 | Kronos Worldwide | 1,930 | -0.5 | 100.0 | Pigments | 160 | -19.0 | 8.3 | Dallas | 1,934 | 8.3 | |

| 40 | 41 | Ingevity | 1,668 | 19.9 | 100.0 | Pine chemicals | 341 | 11.0 | 20.4 | North Charleston, South Carolina | 2,737 | 12.5 | |

| 41 | 47 | Entegrise | 1,380 | 94.0 | 42.1 | Electronic materials | 219 | 30.6 | 15.9 | Billerica, Massachusetts | 7,536 | 2.9 | |

| 42 | 45 | Genesis Energy | 1,258 | 29.3 | 45.1 | Inorganics | 307 | 83.9 | 24.4 | Houston | 2,358 | 13.0 | |

| 43 | 42 | 3M | 1,205 | 0.4 | 3.5 | Fluorochemicals | n/a | n/a | n/a | St. Paul, Minnesota | n/a | n/a | |

| 44 | 46 | Koppers | 1,192 | 25.7 | 60.2 | Coal tar chemicals | 141 | -1.4 | 11.8 | Pittsburgh | 1,017 | 13.8 | |

| 45 | -- | LSB Industries | 902 | 62.1 | 100.0 | Fertilizers | 308 | 205.3 | 34.2 | Oklahoma City | 1,440 | 21.4 | |

| 46 | -- | CVR Partners | 836 | 56.9 | 100.0 | Fertilizers | 320 | 137.8 | 38.3 | Sugar Land, Texas | 1,100 | 29.1 | |

| 47 | 49 | Ecovyst | 820 | 34.2 | 100.0 | Inorganics | 139 | 76.6 | 17.0 | Malvern, Pennsylvania | 1,885 | 7.4 | |

| 48 | -- | Livent | 813 | 93.4 | 100.0 | Specialties | 337 | 848.2 | 41.4 | Philadelphia | 2,074 | 16.2 | |

| 49 | 48 | Balchem | 789 | 17.9 | 83.8 | Nutritional ingredients | 118 | 15.7 | 15.0 | Montvale, New Jersey | 1,346 | 8.8 | |

| 50 | -- | Sisecam Resources | 720 | 33.3 | 100.0 | Inorganics | 134 | 137.0 | 18.6 | Atlanta | 672 | 19.9 | |

Sources: Company documents, C&EN analysis.

Note: n/a means not available; def means operating profits were a deficit.

a Prior-year results have been restated to accommodate changes in the reporting of chemical sales at ExxonMobil and Hexion.

b Chemical sales less administrative expenses and cost of sales.

c Chemical operating profit as a percentage of chemical sales.

d Chemical operating profit as a percentage of identifiable chemical assets.

e Chemical sales include a significant amount of nonchemical products.

f Fiscal year ended Sept. 30, 2022.

g Fiscal year ended Dec. 3, 2022.

1

Dow

2022 chemical sales: $56.9 billion

Facing tough economic circumstances this year, the largest US chemical maker announced this past January a round of job cuts—2,000 employees, or about 5% of Dow’s total workforce—as part of a program to save $1 billion annually. The plan will also involve plant closures focused on Europe, which has been hit by high energy prices. Dow continues to break new industry ground in sustainability. It plans to install modular nuclear reactors designed by X Energy at one of its North American sites by the end of the decade. The reactors will provide low-carbon power and steam to Dow’s operations. In addition, Dow and Mura Technology are planning a plastics recycling plant at Dow’s complex in Böhlen, Germany. The plant will use Mura’s supercritical steam technology to break down waste plastics into hydrocarbons, which Dow will use as a petrochemical feedstock.

2

ExxonMobil

2022 chemical sales: $47.5 billion

In December, ExxonMobil started up a plastics pyrolysis plant that is integrated with its Baytown, Texas, petrochemical complex. The plant, which can process 30,000 metric tons (t) of waste per year, is one of the largest of its kind in the US. Another big environmental initiative from the energy and chemical major is advancing. Early this year, ExxonMobil awarded Technip Energies the engineering and design contract for a low-carbon hydrogen plant to be built at Baytown. The plant will capture 7 million t per year of carbon dioxide for storage, thus reducing emissions there by 30%. The company plans to use the hydrogen to make ammonia and to run existing operations at the site.

3

LyondellBasell Industries

2022 chemical sales: $39.5 billion

LyondellBasell Industries is trimming its business portfolio. The company plans to sell its ethylene oxide and derivatives unit, which generates about 1% of its pretax earnings. And LyondellBasell plans to close its 100-year-old refinery in Houston, which generates about 22% of its sales, by year-end. Although the firm will no longer operate the refinery, it hopes to hold on to the property and reuse some of the equipment for plastics sustainability projects. The firm may establish a recycling complex that would combine mechanical and chemical recycling methods and would be similar to the one it plans in Cologne, Germany.

4

Mosaic

2022 chemical sales: $19.1 billion

Riding the wave of high fertilizer prices, Mosaic had a remarkable year. The phosphate fertilizer producer saw its sales increase by 55%—advancing the firm to number 4 in the US top 50, from 6 last year—while its earnings nearly doubled. Early this year, Mosaic made some news you don’t see every day from a chemical producer: It sold Streamsong Resort, a golf resort in Bowling Green, Florida, to KemperSports for $160 million. The resort sits on 2,800 hectares of land that Mosaic redeveloped in 2012 after long using it for phosphate mining.

5

Chevron Phillips Chemical

2022 chemical sales: $14.2 billion

Following a surge in US petrochemical projects in the 2010s, building activity on the Gulf Coast has eased. Chevron Phillips is one of the few companies undertaking a big new project. It and QatarEnergy announced in November that they are proceeding with an $8.5 billion ethylene cracker and polyethylene complex in Orange, Texas. In January, the two firms green-lighted a similar project in Las Raffan, Qatar. That complex will come with a $6 billion price tag.

6

DuPont

2022 chemical sales: $13.0 billion

DuPont’s plan to plunge deeper into electronic materials suffered a setback late last year when it called off its $5.2 billion purchase of Rogers, which makes laminates for circuit boards and other electronic materials. The companies agreed to the deal in November 2021 but were unable to attain “timely clearance” from the Chinese government. DuPont bought the electronic shielding specialist Laird Performance Materials in 2021. DuPont has a strong balance sheet for pursuing other deals. In November 2022, it sold its engineering polymer business to Celanese for $11 billion. The firm also plans to sell its Delrin polyacetal business.

7

Air Products

2022 chemical sales: $12.7 billion

In March of this year, Air Products disclosed that it would walk away from a $2 billion coal-to-methanol project it had been planning in Indonesia. Since it announced the project in 2020, the firm has changed direction dramatically toward low-carbon hydrogen production. In December 2022, Air Products announced that it was building a $4 billion plant in Texas that will use wind and solar power to make hydrogen via water electrolysis. It is planning other green hydrogen facilities in Saudi Arabia, Oman, and New York. And it is planning blue hydrogen plants, which produce hydrogen from natural gas while capturing and storing by-product carbon dioxide, in Louisiana and Canada.

Spending

Capital spending saw healthy increases in 2022, while R&D outlays slipped modestly.

| CHEMICAL CAPITAL SPENDING | CHEMICAL R&D SPENDING | |||||

|---|---|---|---|---|---|---|

| 2022 ($ MILLIONS) | CHANGE FROM 2021 | % OF CHEMICAL SALES | 2022 ($ MILLIONS) | CHANGE FROM 2021 | % OF CHEMICAL SALES | |

| AdvanSix | $89 | 57.4% | 4.6% | $13 | -10.7% | 0.6% |

| Air Products | 2,927 | 18.8 | 23.0 | 103 | 10.1 | 0.8 |

| Albemarle | 1,262 | 32.3 | 17.2 | 72 | 33.3 | 1.0 |

| Americas Styrenics | 34 | 76.0 | 1.6 | 2 | -19.0 | 0.1 |

| Ashland | 113 | 7.6 | 4.7 | 55 | 10.0 | 2.3 |

| Avient | 41 | 2.0 | 1.8 | n/a | n/a | n/a |

| Balchem | 45 | 39.9 | 5.6 | 12 | -9.6 | 1.5 |

| Cabot | 211 | 8.2 | 4.9 | 55 | -1.8 | 1.3 |

| Celanese | 543 | 16.3 | 5.6 | 112 | 30.2 | 1.2 |

| CF Industries | 453 | -11.9 | 4.0 | n/a | n/a | n/a |

| ChampionX | 42 | 7.5 | 1.7 | n/a | n/a | n/a |

| Chemours | 307 | 10.8 | 4.5 | 118 | 10.3 | 1.7 |

| Corteva Agriscience | 380 | 13.1 | 4.5 | n/a | n/a | n/a |

| CVR Partners | 45 | 117.0 | 5.3 | n/a | n/a | n/a |

| Dow | 1,823 | 21.5 | 3.2 | 851 | -0.7 | 1.5 |

| DuPont | 743 | -16.6 | 5.7 | 536 | -13.3 | 4.1 |

| Eastman Chemical | 611 | 10.1 | 5.8 | 264 | 3.9 | 2.5 |

| Ecovyst | 59 | -1.8 | 7.2 | 7 | -4.0 | 0.9 |

| Entegris | 151 | 103.4 | 11.0 | n/a | n/a | n/a |

| ExxonMobil | 2,955 | 109.0 | 6.2 | n/a | n/a | n/a |

| FMC | 142 | 42.2 | 2.5 | 314 | 3.1 | 5.4 |

| Genesis Energy | 175 | -23.2 | 13.9 | n/a | n/a | n/a |

| H.B. Fuller | 130 | 35.3 | 3.5 | 45 | 14.2 | 1.2 |

| Huntsman | 272 | -20.5 | 3.5 | 125 | -16.7 | 1.6 |

| Ingevity | 143 | 37.3 | 8.5 | 30 | 15.2 | 1.8 |

| Innospec | 40 | 1.3 | 2.0 | 39 | 3.5 | 2.0 |

| International Flavors & Fragrances | 160 | 15.1 | 6.8 | n/a | n/a | n/a |

| Koppers | 56 | -7.1 | 4.7 | n/a | n/a | n/a |

| Kronos Worldwide | 63 | 7.8 | 3.3 | 15 | -11.8 | 0.8 |

| Livent | 337 | 155.4 | 41.4 | 4 | 30.0 | 0.5 |

| LSB Industries | 46 | 30.5 | 5.1 | n/a | n/a | n/a |

| LyondellBasell Industries | 1,830 | -1.4 | 4.6 | 124 | 0.0 | 0.3 |

| Mosaic | 1,247 | -3.2 | 6.5 | n/a | n/a | n/a |

| NewMarket | 56 | -28.8 | 2.0 | 140 | -2.6 | 5.1 |

| Occidental Petroleum | 331 | 4.7 | 4.9 | n/a | n/a | n/a |

| Olin | 179 | 10.8 | 2.3 | n/a | n/a | n/a |

| Orion Engineered Carbons | 233 | 8.4 | 11.5 | 22 | -1.4 | 1.1 |

| Sisecam Resources | 28 | 10.1 | 3.9 | n/a | n/a | n/a |

| Stepan | 302 | 55.1 | 10.9 | 67 | 6.2 | 2.4 |

| Trinseo | 148 | 25.9 | 3.0 | 51 | -19.6 | 1.0 |

| Tronox | 428 | 57.4 | 12.4 | 12 | -7.7 | 0.3 |

| Westlake | 913 | 61.0 | 8.3 | n/a | n/a | n/a |

Sources: Company documents, C&EN analysis.

Note: Figures are for companies on the top 50 list reporting capital and/or R&D expenditures. n/a means not available.

Top 50 US chemical firms

Though some firms saw profits decline, 2022 was overall a strong year for chemical makers.

| CHEMICAL CAPITAL SPENDING | CHEMICAL R&D SPENDING | |||||

|---|---|---|---|---|---|---|

| 2022 ($ MILLIONS) | CHANGE FROM 2021 | % OF CHEMICAL SALES | 2022 ($ MILLIONS) | CHANGE FROM 2021 | % OF CHEMICAL SALES | |

| AdvanSix | $89 | 57.4 | 4.6 | $13 | -10.7 | 0.6 |

| Air Products | 2,927 | 18.8 | 23.0 | 103 | 10.1 | 0.8 |

| Albemarle | 1,262 | 32.3 | 17.2 | 72 | 33.3 | 1.0 |

| Americas Styrenics | 34 | 76.0 | 1.6 | 2 | -19.0 | 0.1 |

| Ashland | 113 | 7.6 | 4.7 | 55 | 10.0 | 2.3 |

| Avient | 41 | 2.0 | 1.8 | n/a | n/a | n/a |

| Balchem | 45 | 39.9 | 5.6 | 12 | -9.6 | 1.5 |

| Cabot | 211 | 8.2 | 4.9 | 55 | -1.8 | 1.3 |

| Celanese | 543 | 16.3 | 5.6 | 112 | 30.2 | 1.2 |

| CF Industries | 453 | -11.9 | 4.0 | n/a | n/a | n/a |

| ChampionX | 42 | 7.5 | 1.7 | n/a | n/a | n/a |

| Chemours | 307 | 10.8 | 4.5 | 118 | 10.3 | 1.7 |

| Corteva Agriscience | 380 | 13.1 | 4.5 | n/a | n/a | n/a |

| CVR Partners | 45 | 117.0 | 5.3 | n/a | n/a | n/a |

| Dow | 1,823 | 21.5 | 3.2 | 851 | -0.7 | 1.5 |

| DuPont | 743 | -16.6 | 5.7 | 536 | -13.3 | 4.1 |

| Eastman Chemical | 611 | 10.1 | 5.8 | 264 | 3.9 | 2.5 |

| Ecovyst | 59 | -1.8 | 7.2 | 7 | -4.0 | 0.9 |

| Entegris | 151 | 103.4 | 11.0 | n/a | n/a | n/a |

| ExxonMobil | 2,955 | 109.0 | 6.2 | n/a | n/a | n/a |

| FMC | 142 | 42.2 | 2.5 | 314 | 3.1 | 5.4 |

| Genesis Energy | 175 | -23.2 | 13.9 | n/a | n/a | n/a |

| H.B. Fuller | 130 | 35.3 | 3.5 | 45 | 14.2 | 1.2 |

| Huntsman | 272 | -20.5 | 3.5 | 125 | -16.7 | 1.6 |

| Ingevity | 143 | 37.3 | 8.5 | 30 | 15.2 | 1.8 |

| Innospec | 40 | 1.3 | 2.0 | 39 | 3.5 | 2.0 |

| International Flavors & Fragrances | 160 | 15.1 | 6.8 | n/a | n/a | n/a |

| Koppers | 56 | -7.1 | 4.7 | n/a | n/a | n/a |

| Kronos Worldwide | 63 | 7.8 | 3.3 | 15 | -11.8 | 0.8 |

| Livent | 337 | 155.4 | 41.4 | 4 | 30.0 | 0.5 |

| LSB Industries | 46 | 30.5 | 5.1 | n/a | n/a | n/a |

| LyondellBasell Industries | 1,830 | -1.4 | 4.6 | 124 | 0.0 | 0.3 |

| Mosaic | 1,247 | -3.2 | 6.5 | n/a | n/a | n/a |

| NewMarket | 56 | -28.8 | 2.0 | 140 | -2.6 | 5.1 |

| Occidental Petroleum | 331 | 4.7 | 4.9 | n/a | n/a | n/a |

| Olin | 179 | 10.8 | 2.3 | n/a | n/a | n/a |

| Orion Engineered Carbons | 233 | 8.4 | 11.5 | 22 | -1.4 | 1.1 |

| Sisecam Resources | 28 | 10.1 | 3.9 | n/a | n/a | n/a |

| Stepan | 302 | 55.1 | 10.9 | 67 | 6.2 | 2.4 |

| Trinseo | 148 | 25.9 | 3.0 | 51 | -19.6 | 1.0 |

| Tronox | 428 | 57.4 | 12.4 | 12 | -7.7 | 0.3 |

| Westlake | 913 | 61.0 | 8.3 | n/a | n/a | n/a |

Sources: Company documents, C&EN analysis.

Note: Figures are for companies on the top 50 list reporting capital and/or R&D expenditures. n/a means not available.

8

CF Industries

2022 chemical sales: $11.2 billion

CF Industries is making a massive push into clean ammonia. Along with Mitsui & Co., the fertilizer maker is studying a project in Louisiana that would produce ammonia from natural gas and capture and store the by-product carbon dioxide. The plant would be built at CF’s newly acquired Blue Point complex on the Gulf Coast and serve overseas customers, some of which plan to use ammonia as a power plant fuel. It is studying a similar project with the South Korean conglomerate SK Group. CF is also a candidate for a big supply agreement with the Japanese power company Jera that could result in another clean ammonia project. In March, CF agreed to buy an ammonia plant in Louisiana from the Australian firm Incitec Pivot for nearly $1.7 billion; CF is considering installing carbon capture and storage facilities at the plant, which was built in 2016. And in green ammonia, where hydrogen is produced via water electrolysis, CF is installing capacity in Donaldsonville, Louisiana. Just last month, the company unveiled a plan with NextEra Energy Resources to establish green ammonia production at its plant in Verdigris, Oklahoma.

9

Westlake

2022 chemical sales: $11.0 billion

Westlake is about as low key as a major chemical maker can get, but the petrochemical and chlorovinyl maker has seen rapid growth in recent years. The company’s chemical sales rose 27% last year, though its spot in the US top 50 remains the same. Some of the sales gain was due to high chemical prices, while some was attributable to the firm’s purchase last year of Hexion’s epoxy resins unit. Westlake is seeing a big change in upper management: Chief Operating Officer Roger Kearns is leaving to become CEO of Canada’s Nova Chemicals.

10

Eastman Chemical

2022 chemical sales: $10.6 billion

Eastman Chemical wants plastics recycling to be a major new business, one that will generate $450 million in pretax earnings annually by 2027. It plans to spend a total of over $2 billion on three plants that will use a methanolysis process to break down polyethylene terephthalate waste into the raw materials dimethyl terephthalate and ethylene glycol. The first unit, in Kingsport, Tennessee, is expected to start up by this fall. The company is building a second one in Normandy, France. And last October, Eastman signed a supply agreement with Pepsi that will allow it to build the third plant, in the US. The beverage maker will buy a large part of that plant’s output to make bottles with recycled content.

11

Celanese

2022 chemical sales: $9.7 billion

Late last year, Celanese completed its $11 billion purchase of DuPont’s engineering polymer business. The deal added nylon 6,6 and polybutylene terephthalate polymers, among other materials, to Celanese’s lineup, which includes liquid crystal polymers, polyacetal, polyphenylene sulfide, and ultra-high-molecular-weight polyethylene. To satisfy the concerns of European antitrust regulators, Celanese sold its thermoplastic copolyester business to the Italian engineering polymer supplier Taro Plast.

12

Corteva Agriscience

2022 chemical sales: $8.5 billion

Corteva expanded its biological crop-growth business significantly with the completion in March of its purchases of Stoller Group and Symborg. Stoller, which Corteva bought for $1.2 billion, supplies plant hormones, high-tech nutrients, and microorganisms that help plants absorb nutrients and make them more resilient. It has annual sales of about $400 million. Symborg, which Corteva acquired for an undisclosed amount, makes biostimulants and biofertilizers. Corteva expects biologicals to represent 25% of the crop protection market by 2035.

13

Huntsman

2022 chemical sales: $7.8 billion

Huntsman completed a round of portfolio trimming in February with the sale of its textile effects business to Archroma for $593 million. Huntsman had once intended to make the business part of its 2017 spin-off of Venator Materials, a titanium dioxide maker, but elected to sell it separately. The textile effects business, which Huntsman purchased from Ciba Specialty Chemicals in 2006, has annual sales of about $770 million. In 2020, Huntsman sold its chemical intermediates and surfactants business to Indorama for $2 billion.

14

Olin

2022 chemical sales: $7.8 billion

The chlor-alkali and epoxy resin maker is getting into the low-carbon hydrogen business. Olin has long made hydrogen as a by-product of generating chlorine and caustic soda from salt in electrochemical cells. It customarily burned the hydrogen or even vented it into the atmosphere. Last year, the company signed an agreement to capture 15 metric tons of hydrogen per day for sale to Plug Power, which operates fuel cell systems and fueling stations. The deal accounts for only 6% of Olin’s hydrogen production, so the chlorine producer has much untapped potential. Olin has been cutting back other operations: it will end methylene chloride and chloroform production in Germany this year, and it is shutting a cumene plant in the Netherlands and solid epoxy resin units in South Korea and Brazil.

15

Albemarle

2022 chemical sales: $7.3 billion

As more people buy electric cars, demand and prices for lithium have skyrocketed. Albemarle, a leading supplier of the scarce mineral, has been a big beneficiary. Its sales more than doubled and its earnings nearly quintupled in 2022, which sent it to number 15 in the US top 50 from 24 last year. With a lot of cash in the bank and a strong outlook for its business, Albemarle is looking to expand. In March, it made a $3.7 billion offer to buy the Australian lithium miner Liontown Resources, which rejected the price as too low. Albemarle is also planning a $1.3 billion plant in South Carolina that will make lithium hydroxide.

16

Ecolab

2022 chemical sales: $6.9 billion

Ecolab, a water treatment specialist, is extending a collaboration with Microsoft to help clients manage water consumption data. The companies say they can help customers reduce water consumption, integrate water and sustainability data, and identify energy-saving opportunities. Purolite, which Ecolab acquired in December 2021, recently opened a plant in King of Prussia, Pennsylvania, that will make ion-exchange membranes and active pharmaceutical ingredients.

17

Chemours

2022 chemical sales: $6.8 billion

Energy transition is a growing business for Chemours. The company plans to spend $200 million to expand output of its Nafion ion-exchange fluoropolymer materials in Villers-Saint-Paul, France. Nafion membranes are used in hydrogen fuel cells and in water electrolyzers for the production of green hydrogen. And this April, Chemours and TC Energy announced a plan to install electrolysis capacity to make hydrogen in West Virginia. The hydrogen would be used as fuel at two Chemours plants, and the electrolysis units would use the firm’s proton-exchange membranes.

18

Occidental Petroleum

2022 chemical sales: $6.8 billion

In 2022, petrochemical makers unveiled a rash of big projects—most of them very preliminary and vaguely defined—in applications for local property tax breaks in Texas. One of these came from Occidental Chemical, which promised a chlor-alkali expansion at its complex in Deer Park, Texas. The application specifies more chlorine and caustic soda production and notes that the new equipment the company planned to install would lower the carbon intensity of chlor-alkali manufacture. Such has been the theme for OxyChem’s parent, Occidental Petroleum, which is developing a carbon capture and sequestration project in Louisiana.

19

Lubrizol

2022 chemical sales: $6.7 billion

Lubrizol, the specialty chemical company owned by Berkshire Hathaway, has gone through several CEOs over the past few years, but last September it may have found a permanent hire, tapping Rebecca Liebert for the job. Liebert had been in charge of PPG Industries’ automotive coatings business; before that, she led the process technology firm Honeywell UOP. In an interesting technological twist, Lubrizol is establishing a lab in India to study calcium sulfonate as an alternative to lithium soaps in industrial greases. Its use in automotive batteries means lithium is becoming an expensive ingredient.

20

Honeywell International

2022 chemical sales: $6.0 billion

Honeywell’s performance materials and technologies segment, which houses the company’s UOP process technology arm and its chemical unit, tapped Lucian Boldea as CEO late last year. He replaces Vimal Kapur, who was promoted to president and chief operating officer of all of Honeywell. Boldea came to Honeywell from Eastman Chemical, where he led its additives and functional products and chemical intermediates businesses. UOP has recently been emphasizing its sustainability offerings. For example, its technology for hydrotreating esters and fatty acids will be used by World Energy in a sustainable aviation fuel plant planned for Houston. And in December, Honeywell announced that its plastics pyrolysis process will be used in a recycling plant in Egypt.

21

FMC

2022 chemical sales: $5.8 billion

A new acquisition may help FMC bring insect pheromones to large-scale agriculture. Pheromones are used on specialty crops such as fruit to disrupt the reproduction of pest insects. But the synthetic chemistry used to make the pheromones can be expensive. FMC acquired BioPhero for $200 million last year. The Danish firm has a fermentation technology that reduces the cost of production and thus could allow pheromones to be applied to commodity crops like corn and soybeans. Separately, FMC is collaborating with Micropep, which is developing biological pesticides that can control weeds that are resistant to conventional herbicides.

22

Trinseo

2022 chemical sales: $5.0 billion

Trinseo’s intention to shift its portfolio to the specialty end of the polymer market was dealt a blow in the middle of last year, when deteriorating economic conditions in Europe caused it to halt the planned sale of its polystyrene business. The company then decided to close its styrene plant in Böhlen, Germany, which had been losing money. Trinseo also said it would close a polycarbonate plant in Stade, Germany. In another headache for the firm, its Bristol, Pennsylvania, plant spilled more than 30,000 L of acrylic latex polymer into a Delaware River tributary in March. The incident prompted water authorities in Philadelphia to issue warnings to local residents.

23

Cabot

2022 chemical sales: $4.3 billion

The carbon black maker is looking for opportunities in the growing electric vehicle battery market. Cabot plans to spend about $200 million on conductive carbon additives in the US. A major part of this program will be a project at its facility in Pampa, Texas, that alone could cost $90 million. The company also plans to boost capacity for nanotube powders and dispersions. Separately, Cabot is investing $50 million to expand output of aqueous pigment dispersions for inkjet printers at its plant in Haverhill, Massachusetts.

24

H.B. Fuller

2022 chemical sales: $3.7 billion

The adhesive company got a change in top management last December when Celeste Mastin took over as CEO, succeeding the retiring Jim Owens. She had been chief operating officer. H.B. Fuller is increasingly emphasizing sustainable products. It is collaborating with HSMG on polymer-free coatings for paper beverage cups. And last November, the company announced that it was working with the German chemical supplier Covestro and the Chinese furniture maker Sunon on sustainable adhesives for furniture.

25

Tronox

2022 chemical sales: $3.5 billion

Sales and earnings at the titanium dioxide maker fell slightly in 2022, but co-CEO Jean-François Turgeon says he is happy the results were as strong as they were. “The year ended very different from where it began,” he commented in a recent earnings report. The year began strongly, but by the second half, business was starting to falter. The downturn came first in China, which saw stringent COVID-19 lockdowns, then in the rest of Asia, in Europe, and finally, in the Americas, according to the white pigment producer.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter