As more organizations commit to achieving net-zero greenhouse gas (GHG) emissions by 2050, they are increasingly considering the scope of the emissions included in that goal. In 2022, that scope will widen significantly for chemical companies in response to shareholder and customer pressure.

Takeaways

• The chemical industry’s customers are demanding carbon reduction up and down the value chain.

• Most chemical companies report upstream and downstream emissions; few detail reduction plans.

• Changing feedstocks is one powerful way chemical firms can reduce upstream emissions.

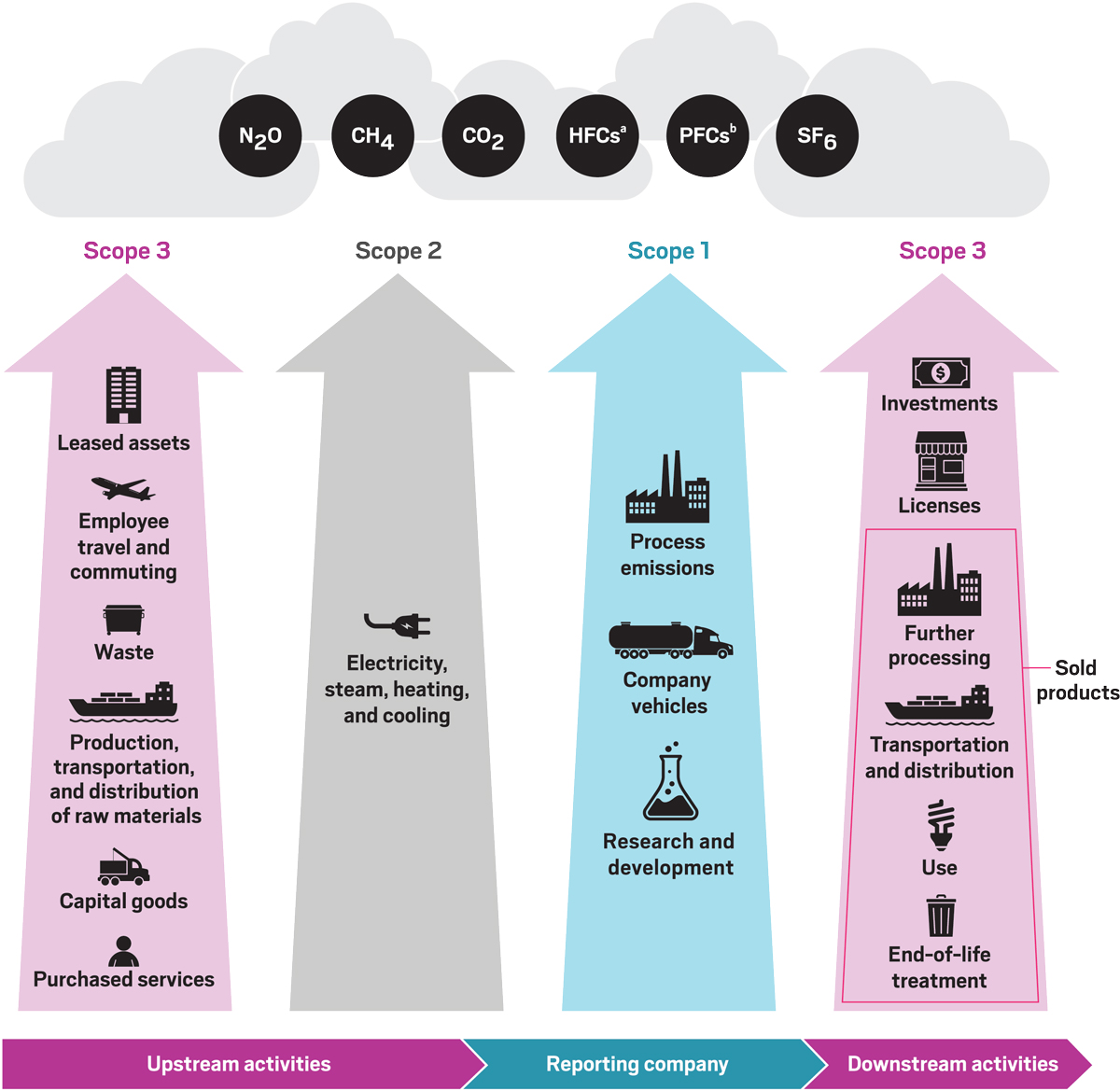

Almost all chemical companies have specific and public targets for reducing what are known as scope 1 and 2 emissions: the carbon emitted from their manufacturing processes and from generating the energy to run their overall operations, respectively.

Information about scope 3 emissions—the upstream carbon footprint of raw materials and the downstream emissions associated with the use and disposal of products—is harder to find in sustainability reports and other corporate documents. And most companies don’t include scope 3 emissions in their publicized emission reduction goals.

In 2022, the norm in the chemical industry will start moving from measuring and reporting scope 3 emissions toward making plans and setting public goals to reduce them. The push to do this will come largely from the industry’s customers, which are demanding that suppliers rapidly cut all types of emissions.

Source: GHG Protocol. a Hydrofluorocarbons. b Perfluorocarbons.

David Yankovitz, who leads the chemical group at the consulting firm Deloitte, says scope 3 emissions are on the minds of the industry’s sustainability executives, but few firms have detailed plans to reduce them. Because chemical firms are often far removed from their products’ final uses, he says, it can be hard to calculate scope 3 emissions.

The industrial gas company Linde offers one of the more robust treatments of scope 3 emissions among the firms C&EN analyzed, but even it doesn’t try to make a complete accounting of them. “Linde is at the beginning of numerous value chains and provides many intermediate products with many downstream applications, each of which has a very different GHG profile,” the firm says in its Sustainable Development Report 2020. “Linde does not estimate the downstream emissions associated with the various end uses of all its products.” That sentiment echoes throughout the chemical industry.

Chemical companies have more control over their upstream scope 3 emissions. They can score big cuts by switching from fossil-derived raw materials to biobased and recycled feedstocks, says Robert Kumpf, a chemical and materials specialist at Deloitte. Chemical recycling of plastic is developing quickly, Kumpf says, and approaching commercial scale. “That’s an innovation from the chemical industry that’s being implemented right now and is a way to lower the amount of pure virgin feedstock.”

Even if chemical companies are slow to embrace scope 3 accounting, their consumer-facing customers are barreling ahead. According to the consulting firm McKinsey, $1.5 trillion of the chemical industry’s sales are under scope 3 scrutiny by customers, and 50% of brand owners are promising low-carbon products to consumers.

To get there, brands need their suppliers to cut emissions, Kumpf says. “There’s a broad understanding of the ecosystem aspect. If everyone takes care of their own business, emissions will reduce in scope 1 and scope 2, and that will reduce scope 3. We’re all in this together.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter