| Editorial lead: | Michael McCoy |

| Project manager: | Arminda Downey-Mavromatis |

| Writers: | Craig Bettenhausen, Matt Blois, Shi En Kim, Jessica Marshall, Michael McCoy, Rick Mullin, Alex Scott, Alex Tullo, Gina Vitale, and Vanessa Zainzinger |

| Editors: | Michael McCoy and Matt Blois |

| Creative director: | Robert Bryson |

| Art director: | William A. Ludwig |

| UI/UX director: | Kay Youn |

| Web producers: | Luis A. Carrillo, Ty A. Finocchiaro, and Jennifer Muller |

| Illustrations & icons: | Christian Gralingen |

| Production editors: | Brianna Barbu, Jonathan Forney, Raadhia Patwary, Sydney Smith, and Marsha-Ann Watson |

| Copyeditor: | Sabrina J. Ashwell |

| Engagement editors: | Arminda Downey-Mavromatis and Dorea I. Reeser |

One of the amazing things about chemistry is the diversity of problems to which it can be applied. They don’t call chemistry the central science for nothing. It’s been a harder year for young companies trying to raise venture capital. The value of the deals made through the first three quarters of 2022 is down almost 25% from the year-ago period, according to a recent survey by PitchBook and the National Venture Capital Association.

But even with the funding decline, chemistry-centric companies seem to launch weekly by entrepreneurs from across the globe. And as can be seen from the firms we’ve chosen for C&EN’s 10 Start-Ups to Watch for 2022, these entrepreneurs are applying chemistry to a refreshingly diverse set of markets.

In agriculture, Micropep Technologies is harnessing micropeptides to kill weeds without harming crops or the environment. In the food industry, Phytolon is developing fermented natural colors that could make serious inroads in the artificial-color market. In the energy field, Air Company is making sustainable jet fuel from just carbon dioxide, hydrogen, and green electricity. And in human health, Exo Therapeutics is creating small molecules that inhibit enzymes by latching on to them at a place called an exosite.

Although these companies serve quite different markets, they are united by a desire to improve the health of the planet or the people on it. And along the way, they hope to make some money.

How did we choose these companies? Readers from around the world submitted nominations via our website. We also tracked the new firms that C&EN reports on week in and week out. After considering more than 200 companies, we selected 10 for their science and the range of problems they are working to solve.

Most start-ups fail, and some of the firms we’ve profiled in years past have failed as well. But plenty of them are thriving, even to the point of getting acquired or launching products that improve our lives.

Know about an interesting chemistry start-up? Nominate it for our 2023 feature at cenm.ag/startupnom.

At a glance

Publicly launched: 2019

Headquarters: New York City

Focus: Production of chemicals and fuels from carbon dioxide

Technology: Catalytic CO2 hydrogenation

Founders: Stafford Sheehan and Gregory Constantine

Funding or notable partners: $40 million from investors and partners including Toyota, Carbon Direct, JetBlue, Virgin Atlantic, Boom Supersonic, and the US Air Force

One winning strategy for a chemistry start-up is to first bring a high-value, low-volume specialty chemical to market and then use the resulting cash flow to build a capacity and technology portfolio en route to higher-volume business lines. The carbon dioxide-to-chemical start-up Air Company is doing exactly that.

Its rollout started in 2020 with vodka and perfume base containing ethanol made from CO2. Air Company’s vodka is a classically correct spirit with no odor or aftertaste, moderate astringency, and a slight warmth going down. The $75 bottle is consistently sold out in the liquor stores that carry it—something new facilities that are in the planning stages will fix, according to the company’s spirit brand manager.

The new plants will indeed make ethanol, but the alcohol will be a side product to the company’s main aspiration: converting captured CO2 into jet fuel. “Today is where our entire strategy comes to fruition,” CEO and cofounder Gregory Constantine told the crowd at the firm’s sustainable aviation fuel (SAF) launch party in September.

Air Company’s chemical technology is conceptually simple. “We do CO2 hydrogenation,” cofounder and Chief Technology Officer Stafford Sheehan says. “That’s pretty much it: a heterogeneous catalyst in a fixed-bed flow reactor.”

Air Vodka—the company’s CO2-based vodka—flowed freely at the event which was held in an industrial-chic events venue in Brooklyn, New York. After a cocktail and networking hour, guests were ushered into a dance hall complete with bumping music, artificial fog, laser lights, and a raised stage. Though the vibe was as much from the liquor and airline industries as it was from cleantech, Sheehan’s entrance got the most raucous ovation of the night, with the SAF reveal a close second, which suggests the crowd had a scientific bent.

Across the street from the venue, the firm’s recently installed CO2 hydrogenation pilot plant sits in a hangar-style warehouse. Tours of that facility started with a 140 kW electrolytic hydrogen generator purchased from Nel, a specialist in proton-exchange membrane electrolyzers. Next in line is a large tank filled with pressurized CO2, which Sheehan says is sourced from regional ethanol producers. Both H2 and CO2 then flow into the reactor, a thermally insulated cylinder about the height of a shipping container and half a meter in diameter.

The catalyst inside is a patent-pending, “confidential mixture of earth-abundant metals supported on alumina,” according to a paper the firm recently published in ACS Energy Letters (2022, DOI: 10.1021/acsenergylett.2c00214). “Our company is built around scaling these catalysts,” Sheehan says.

In addition to the CO2-to-chemical system, Air Company has intellectual property covering its distillation-based separation and purification rig, which is installed at the back of the hangar in Brooklyn.

The pilot system yields about 7,000 L of methanol, 19,000 L of ethanol, and 21,000 L of jet-range paraffins per year. As long as the electrolyzer is powered by low-carbon electricity from renewable or nuclear sources, the jet fuel qualifies as SAF, which the aviation industry is clamoring for as the main way to meet its decarbonization goals. Air Company currently gets 91% wind and 9% solar electricity through the Brooklyn grid via renewable energy credits.

The plant’s product distribution suggests that the chemical mechanism on the surface of the firm’s catalyst is different from what happens on related catalysts used by the chemical industry for Fischer-Tropsch conversion, Sheehan says. Several other companies looking to make SAF at scale plan to do it by gasifying biomass into syngas and converting it to fuel with Fischer-Tropsch chemistry.

“As we scale our technology, we want to understand the chemistry better. Obviously, we’re a business, so it’s our goal to scale the technology, not to do fundamental studies,” Sheehan says. “But once we have this technology in true commercial scale, then I think we’ll be able to be more open about our catalysts, which will in turn help the mechanistic studies.”

Air Company says the next plant it builds will have a total methanol, ethanol, and SAF output of more than 7.5 million L per year; Sheehan says that facility is about 2 years away. After that will be a commercial-scale plant optimized for SAF.

Sheehan and Constantine founded Air Company in stealth mode in 2017. Through March of that year, Constantine was an executive at the liquor maker Diageo, and Sheehan was CEO of another company he cofounded, Catalytic Innovations. Air Company launched publicly in 2019.

Sheehan previously worked on the direct electroreduction of CO2—including when he was part of C&EN’s 2017 Talented 12 class—and Air Company has some intellectual property around that route to chemicals. But in 2018, he says, he realized that CO2 hydrogenation is easier to scale up. Other than Air Company’s in-house catalyst, the equipment needed is available more or less off the shelf from chemical engineering and construction firms.

“If you’re trying to build big things, water electrolysis has 40 years of development,” Sheehan says. “I’d rather deploy an electrolyzer that’s been derisked over the course of decades and decades.” Fixed-bed flow reactors are, likewise, a mature technology. “We have a lot more degrees of freedom. We can explore and safely scale the way that we are doing our technology now.”

CORRECTION:

Air Company's "At a glance" box was updated on Nov. 8, 2022, to correct the description of the $40 million in funding. The US Air Force is a partner, not an investor.

by Gina Vitale

by Gina Vitale

At a glance

Publicly launched: 2021

Headquarters: Cambridge, Massachusetts

Focus: Treatment of genetically driven disease

Technology: Transfer RNA engineered to overcome genetic mutations

Founders: Noubar Afeyan, Lovisa Afzelius, Theonie Anastassiadis, David Berry, and Ewen Cameron

Funding or notable partners: $50 million from Flagship Pioneering

Within our cells, in a sort of microscopic assembly line, strands of messenger RNA (mRNA) are translated into proteins. Ribosomes move along the mRNA strands like monorails on a track, reading units of genetic code, or codons, that indicate what amino acid should be added to a growing polypeptide chain that will become a protein.

But it’s another type of molecule—shaped like a lumpy, upside-down L—that’s ferrying the amino acids to the ribosome. This molecule is a transfer RNA, or tRNA, and it works by binding to a specific codon on the mRNA and bringing the appropriate amino acid to add to the polypeptide chain. Another tRNA comes and adds the next amino acid, and so on, until the protein is complete. It’s this underappreciated molecule that Alltrna plans to engineer to treat genetic disease.

“I realized that actually tRNAs are very often overlooked and just this worker bee that helps with that transition but not a star molecule,” says Theonie Anastassiadis, Alltrna’s scientific cofounder. “I started asking myself, ‘Well, what could you do with that molecule if it actually was the star of the show?’ ”

Anastassiadis, a cell and molecular biologist who started as a fellow at the venture capital firm Flagship Pioneering in 2017, was exploring a different area of translation when she stumbled across the molecules. As she learned more about tRNA and its central role in translation, her focus shifted. She joined Flagship full-time in 2018 and continued her dive into tRNA’s potential, laying the foundation for Alltrna. The start-up received $50 million in funding from Flagship in March 2020 and emerged from stealth in November 2021.

Alltrna’s first focus, its leaders say, is to engineer tRNA to overcome certain genetic mutations. Sometimes, a codon calling for an amino acid can be mutated into a “stop” codon, one that signals to end protein construction. This is called a nonsense mutation. With a premature stop codon, the ribosome disconnects from the mRNA and releases the protein being built even though it isn’t complete, and the truncated protein can then cause disease. Alltrna’s engineered tRNA will bind to the stop codon and still attach the correct amino acid, allowing the protein building to proceed as normal—effectively reading through the premature stop codon.

Nonsense mutations cause thousands of conditions. A tRNA designed to insert a specific amino acid when it reads a premature stop codon can be applied to any disease involving that particular error.

“We actually believe that there’s a possible world in which we can reclassify patients not by those diseases but into a few groups of shared genetic alterations,” says Alltrna’s CEO, Michelle C. Werner. “So instead of treating a disease, you can treat this cluster of patients with multiple different diseases that are all unified by that shared genetic alteration. And that’s something that hasn’t been done before.”

The start-up employs its own assays and machine learning to identify patterns and test what modifications to tRNAs bring about desired features. While it isn’t disclosing any particular disease targets, Werner says the company is exploring therapeutic areas including rare genetic diseases and oncology.

Alltrna dubs itself the first tRNA platform company, but it’s not alone in the tRNA space. Start-ups Tevard Biosciences, Shape Therapeutics, and ReCode Therapeutics are all aiming to use the transfer molecules to overcome genetic code errors.

There are also small-molecule drugs on the market that force a read through at a premature stop codon, but those drugs don’t necessarily cause the right amino acid to be added to the polypeptide chain. They can therefore allow a nonfunctioning protein to be made, Anastassiadis says. Werner notes that over 5,000 rare diseases and over half of cancers have a genetic component. Though some treatment options exist, Werner says significant unmet need remains.

“The reality is that none of these medicines actually correct these mutations,” Werner says. “And this is precisely the premise that we’re looking to address.”

by Shi En Kim

by Shi En Kim

At a glance

Publicly launched: 2019

Headquarters: Boston

Focus: Psychedelic-inspired drug discovery

Technology: Psychoactive compounds engineered to be nonhallucinogenic

Founders: Nick Haft and David E. Olson

Funding or notable partners: $100 million from investors including Artis Ventures, OMX Ventures, and RA Capital Management

The hallucinogenic anesthetic ketamine was all the rage in psychiatry research when David E. Olson was a postdoctoral researcher at the Broad Institute of MIT and Harvard in the early 2010s. Though the drug was tightly regulated, scientists recognized its potential for transforming the treatment of cognitive and behavioral disorders by repairing the brain’s neural circuitry. During meetings, “all of the psychiatrists from Massachusetts General and McLean Hospital would come in and rave about ketamine,” Olson says.

But the research community was realistic about ketamine gaining traction as an everyday prescription drug. Far from being a miracle molecule, ketamine could cause side effects such as unconsciousness, high blood pressure, and organ damage among frequent users.

So when Olson started his own lab at the University of California, Davis, in 2015, his long-term goal was to “identify a better version of ketamine,” he says.

Olson also aimed to use chemical modification to eliminate the hallucinogenic effect that gives psychedelics their stigma as party drugs. In 2019, he cofounded Delix Therapeutics to create a portfolio of small molecules for mental health treatment that can rewire the brain without incurring any undesirable side effects.

People with neuropsychiatric disorders often have atrophied brain cells and dwindling neural connections. One class of therapeutics is what Olson calls psychoplastogens: small molecules that can reverse this cellular damage in the brain after a single administration.

In recent years, psychedelics, which are one type of psychoplastogen, have gained popularity as a mental health treatment for their rapid and long-lasting effects on behavior and the mind. There are 50–100 drug companies involved in psychedelics, but Delix says it stands out for its pursuit of strictly nonhallucinogenic designer psychoplastogens that are inspired by common psychedelics such as LSD and psilocybin, the active substance in magic mushrooms.

Removing the hallucinogenic effects will increase the accessibility and prescription of this class of cognitive treatments, Delix contends. Only trained health-care professionals can administer psychedelics, usually in hours-long, in-person sessions. Trip-free drugs could save patients a trip to the clinic and allow them to self-administer the medication at home.

Some experts are skeptical about whether psychedelics can provide neuropsychiatric benefits if they don’t incur a mystical experience. At least in rodents, the Olson lab has demonstrated a nonhallucinatory ibogaine analog that can reduce alcohol- or heroin-seeking behavior and produce antidepressant effects. Delix hopes its compounds will similarly treat people who prefer to skip the trip.

While some patients might want a hallucinatory experience for their treatment, “we believe there’s a much wider group that could also and, I should hope, will benefit from approaches such as Delix’s,” says Mark Rus, the company’s CEO. He calls the need for different psychoplastogen offerings an “and” situation rather than an “either-or” story. “The world needs more brain health companies, not fewer. We’re rooting on all of the other companies in this space.”

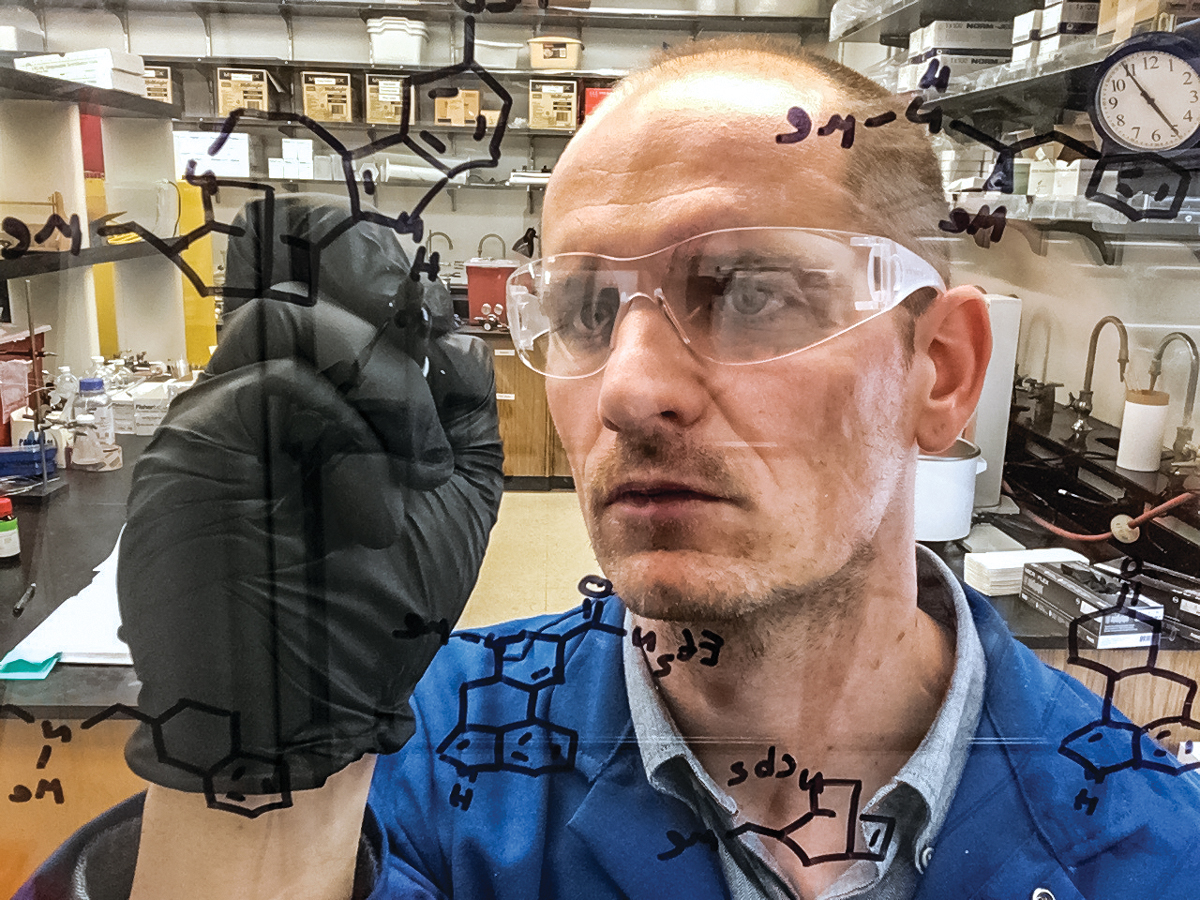

To eliminate the hallucinogenic effect, Delix uses chemistry to remove or append chemical groups in psychedelic molecules.

“Structure begets function,” Olson says. That’s the design principle behind Delix’s synthetic approach. The company’s discovery platform is based on analyzing an existing psychedelic and mapping its chemical substructures to the physiological effects they induce. Knowing what structural elements to keep, kick, or add will allow the researchers to engineer completely novel molecules, Olson says. According to Delix, the chemical modifications range from shifting a single nitrogen atom to larger structural switch-ups. The key is to hit the right receptors in the brain that are involved in synaptic rewiring and not hallucinogenic activity. “Our knowledge of the structure-activity relationships has evolved to the point where we’re moving into completely new space, with chemical entities that don’t look anything like psychedelic compounds,” Olson says.

One challenge in drugging the brain is that these molecules need to be small enough to cross the blood-brain barrier. Researchers have to watch a drug’s molecular weight and can’t simply add chemical groups willy-nilly. So far, Delix’s talented medicinal chemists have been able to work within this intrinsic weight limit, Olson says. The company is advancing a portfolio of over 1,400 compounds and expects to move 2 lead assets into the clinic early next year.

The company isn’t fazed by the cultural baggage associated with psychedelics. Moreover, Delix’s nonhallucinogenic variants will probably face less resistance from policy makers than traditional psychedelics, Rus says. “I think it’ll be a nonexistent issue 5 to 10 years from now.”

by Rick Mullin

by Rick Mullin

At a glance

Publicly launched: 2014

Headquarters: Boulder, Colorado

Focus: Bioprocessing

Technology: Dynamic metabolic control

Founders: Matthew Lipscomb and Michael D. Lynch

Funding or notable partners: About $53 million

When Cargill acquired Colorado-based OPX Biotechnologies in 2015, Michael D. Lynch, OPX’s cofounder and chief science officer, and Matthew Lipscomb, project leader at the company, had given a lot of thought to what they’d been doing since 2007—developing fermentation-based chemical manufacturing processes—and how they could do it better.

The two were tired of dealing with the vagaries of cells and the resulting unpredictability of biomanufacturing. Typically, rounds of trial-and-error experimentation and serial process optimization are required to accommodate changes in temperature, pH, and other environmental elements—which is to say nothing about the challenges of scaling up a process for commercial production.

“We lived all these things firsthand,” Lipscomb recalls. One of OPX’s main accomplishments was the development of the pilot-scale production of 3-hydroxypropionic acid, a precursor to acrylic acid, from sugars via fermentation. “It was maddeningly frustrating,” Lipscomb says.

He and Lynch began funneling that frustration toward a hoped-for breakthrough bioprocessing method, one that would operate more like the traditional chemical processes that biomanufacturing aims to supplant.

The technique they devised, dynamic metabolic control, is a two-stage process intended to decouple the growth of cells from their function as chemical producers. Gene silencing and targeted proteolysis are also applied. Overall, this approach limits the ability of microbes to respond to their environment and focuses them on creating enzymes that efficiently carry out biotransformations.

The two launched DMC Biotechnologies in 2014 to commercialize the approach. Lipscomb, the firm’s CEO, says the technique enables a standard processing environment at lab through commercial scale, regardless of the intended product.

“The general concept of DMC’s technology is to make cells act like traditional catalysts,” says Lynch, now an assistant professor in the Biomedical Engineering and Chemistry Departments at Duke University. “How do you do that? You don’t have them make the product; you have them make more of themselves. Rather than adding catalysts to a reactor, we are basically growing catalysts.”

There is a balancing act in traditional bioprocessing between managing what “makes the cell happy” and what you want it to do, Lynch says. But once the cells’ activity has been curtailed in the first step of DMC’s process, “they are kind of just a bag of enzymes that act more like traditional catalysts.”

The partners succeeded in securing grants totaling $2.5 million from the US National Science Foundation, Department of Energy, and Department of Agriculture and established their first laboratory, in Boulder, Colorado, in 2016. DMC went on to secure three rounds of financing, most recently closing a $39 million series B in January that brought total funding up to about $53 million.

The company opened a laboratory at Duke’s BRiDGE incubator in 2018 and then in 2020 moved to Research Triangle Park, North Carolina, where it does most of its process development work. Lynch, who was acting chief technology officer until 2020, now works full-time at the university, supporting DMC in a consulting role. He remains on the company’s board of directors.

Last year, DMC announced the successful commercial-scale production of the amino acid L-alanine. It also announced a deal under which the Boston-based metabolic engineering company Conagen will produce the chemical. The partners aren’t saying where, but local reports say Conagen acquired and is upgrading a fermentation plant in Kaba, Hungary.

DMC has other products in development: xylitol, a low-calorie sweetener; and branched-chain amino acids including valine, isoleucine, and leucine, which are used in animal feed and human nutrition applications.

Among DMC’s most recent announcements is the hiring of a chief operating officer, chief financial officer, and a vice president of R&D, Kelly Smith, who works in North Carolina.

Beyond the benefits that dynamic metabolic control promises compared with traditional bioprocess manufacturing—lower cost and shorter time to market—Smith says she is motivated by the environmental benefit of replacing standard chemistry with a highly efficient technology.

“A lot of start-ups say, ‘Oh, you are going to come to work for a small company, and you’ll have a big influence on how the company develops,’ ” she says. “That is true, and we are also going to have a big influence on better, more sustainable products in a really big way that will really move the needle on a lot of industries.”

At a glance

Publicly launched: 2020

Headquarters: Cambridge, Massachusetts

Focus: Small-molecule drug discovery

Technology: Inhibitors of enzyme exosites

Founders: David R. Liu, Juan Pablo Maianti, and Alan Saghatelian

Funding or notable partners: $103 million from investors including Newpath Partners, Nextech Invest, BVF Partners, and Novartis Venture Fund

The result of Juan Pablo Maianti’s inhibitor screen was a puzzle. The then graduate student was looking for compounds that block the activity of the enzyme that degrades insulin, known as insulin-degrading enzyme (IDE). But one of the candidates looked unlike any other known IDE inhibitor. Maianti and his advisers, David R. Liu of the Broad Institute of MIT and Harvard and Alan Saghatelian at the Salk Institute for Biological Studies, probed further and discovered that the inhibitor had a surprising property: it did not bind to IDE’s active site, the primary spot where IDE’s substrates bind and where the IDE-catalyzed reactions take place.

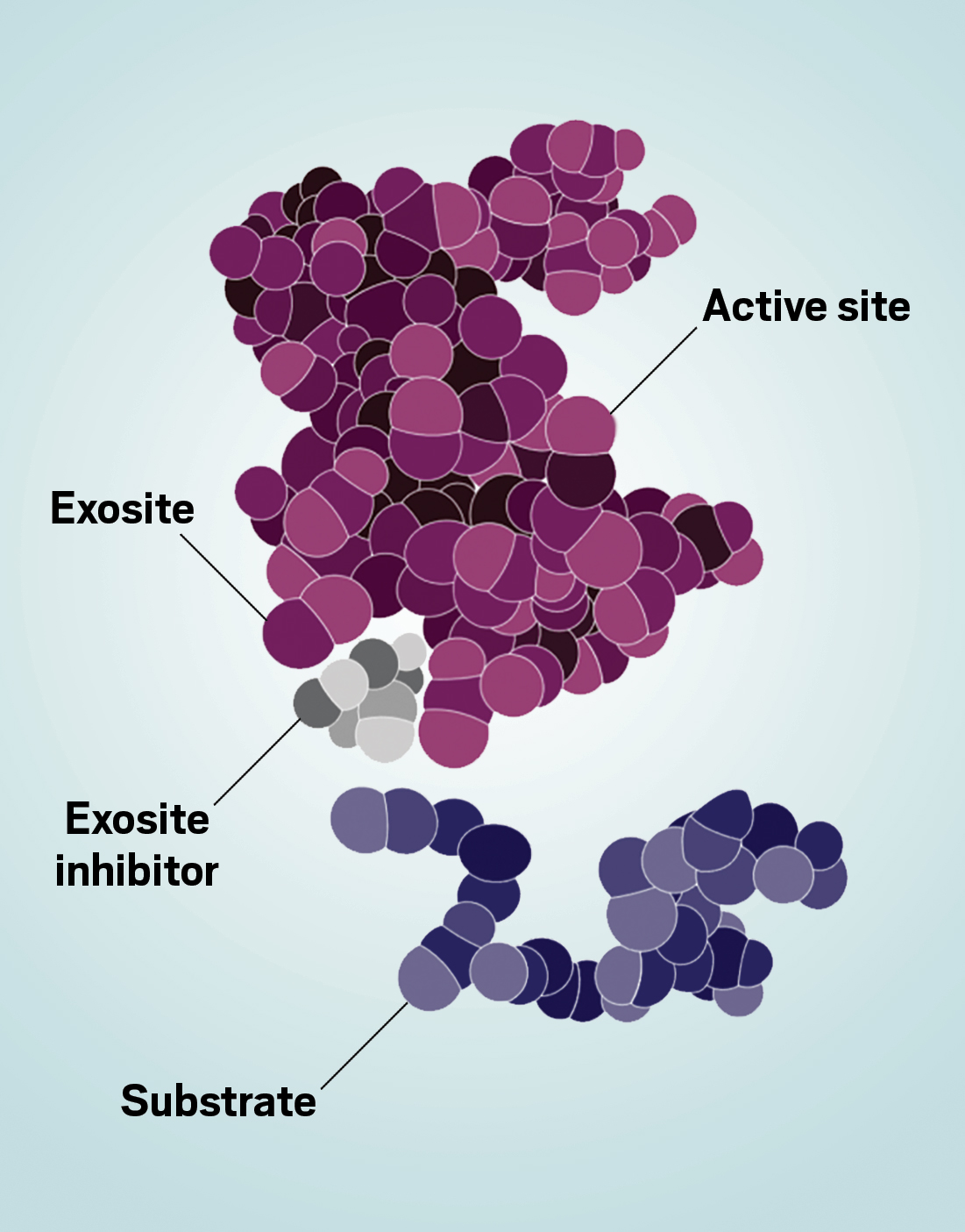

In fact, the inhibitor acted on an exosite—a secondary site on an enzyme where a substrate binds in addition to the active site. The team quickly realized that inhibiting exosites had enormous potential for solving some problems in drug discovery. This realization set the three scientists on the path to launching Exo Therapeutics, which announced its series A funding in December 2020 and series B in late 2021. Exosite inhibitors “have the opportunity of being much more target specific than active-site inhibitors,” Liu says. This could mean fewer side effects from an exosite-targeting drug.

Many enzymes belong to larger enzyme families that catalyze related reactions thanks to highly similar active sites. Drug candidates that bind to the active site of a given enzyme have a decent chance of binding to the active sites of other enzymes in the same family and inhibiting them, potentially causing side effects.

Exosites, on the other hand, interact uniquely with substrates. What Maianti and others realized as they studied and refined their IDE inhibitors is that IDE degrades more than just insulin; it also degrades glucagon, which has the opposite effect of insulin on blood sugar—causing it to rise instead of fall.

Insulin and glucagon both bind to the active site of IDE, but they have very different sizes and shapes. Maianti and team engineered an inhibitor molecule to target the exosite on IDE where insulin binds, a move that allowed them to inhibit insulin-degrading activity without interfering with glucagon degradation.

This finding led the team to start thinking about other examples of enzymes that do multiple things in the body. Could exosite inhibitors be useful in other diseases?

Maianti, now an assistant professor at Albert Einstein College of Medicine, “put together a fairly large list, certainly enough for any company to take decades” to investigate, Liu says.

“A less sophisticated drug would just turn off the active site,” Liu says. “We want the active site of the protein to maintain its ability to do whatever it was doing. We just want it to no longer interact with the substrate or the binding partner that is involved in the disease process.”

One reason scientists may not have taken notice of exosites before is that many small-molecule drug-screening assays look for compounds that interfere with the target’s active site. But DNA-encoded libraries, which the Exo team uses for screening, tend to identify compounds that bind to the target anywhere, not only on the active site, Liu says.

Technological advances have coincided to make the moment right for identifying exosite binders, the team says. For one thing, DNA-encoded library screens are now easily outsourced, making agnostic screens for inhibitors easier than ever. Meanwhile, recent advances in protein structure determination—experimentally via cryo-electron microscopy and computationally via the AlphaFold platform—have positioned the company well to rapidly discover and develop exosite-based therapies, Liu says.

Some of the targets that Exo has identified as worth pursuing “include some of the most important classes of protein targets that are known for therapeutics,” Liu says. The company won’t say specifically what’s in its sights. But Saghatelian says its targets include autoimmune indications and cancer. “With more and more [protein] structures coming out, the list continues to grow. So the opportunity continues to grow as well,” Saghatelian says.

by Matt Blois

by Matt Blois

The French start-up Micropep Technologies is aiming for agriculture’s holy grail: a biological herbicide that selectively kills the most problematic weeds for row crops.

Micropep is developing herbicides based on natural micropeptides that control gene expression in weeds. In July, the company raised $8.6 million to move its products toward commercialization. It hopes its first customers will be farmers in the US.

At a glance

Publicly launched: 2016

Headquarters: Toulouse, France

Focus: Bioherbicides for row crops

Technology: Micropeptides that silence key genes to stop weeds’ growth

Founders: Jean-Philippe Combier, Thomas Laurent, and Dominique Lauressergues

Funding or notable partners: $24 million from FMC Ventures, Sofinnova Partners, and others

Micropeptides are short molecules of 10–20 amino acids that stimulate the production of small snippets of RNA called microRNAs. The microRNAs search for corresponding messenger RNAs, which are the molecules containing instructions for linking amino acids into proteins. The microRNAs bind with complementary messenger RNAs, reducing—or silencing—the production of the proteins they make.

Plants use micropeptides and microRNAs to decrease the production of certain proteins in response to changing environmental conditions. For example, during droughts, some plants appear to slow their own growth with microRNAs, freeing up physiological resources to deal with water stress. Micropep’s cofounder and CEO, Thomas Laurent, says he thinks about this response like a piece of music. “We have lots of instruments playing a nice symphony,” he says. “You need to have an instrument shut down so that you can hear other instruments better.”

Micropep hopes to turn this natural process around by inundating weeds with micropeptides and stopping the weeds’ growth completely. To use the music analogy, the weeds’ score calls for a certain section to be played pianissimo, or very softly. Instead, Micropep wants to replace that section with a rest, resulting in total silence.

When microRNAs are created in a cell, they contain a tail of extra base pairs that is eventually snipped off. Laurent says most people thought the extra base pairs were junk, but Micropep’s other cofounders, Jean-Philippe Combier and Dominique Lauressergues, found evidence to the contrary while working at the French National Center for Scientific Research’s Plant Science Research Laboratory. They discovered that the RNA tail contains instructions for making micropeptides that stimulate the production of specific microRNAs.

Laurent was working with a separate organization helping Combier and Lauressergues turn their discoveries into a potential product, but rather than license the technology, they decided to create their own company. The discovery was innovative enough that Laurent quit his job to become CEO.

The first step of Micropep’s discovery process is identifying the weed proteins to target. From there, its scientists work backward, using artificial intelligence to identify the microRNAs that control those proteins’ expression.

Micropep’s approach has several advantages. It would be a new mode of action, potentially allowing farmers to kill weeds that have evolved to tolerate popular synthetic herbicides like glyphosate and dicamba. Since the 1980s, crop companies have introduced only one new mode of action, and farmers are eager for more.

And it’s possible that regulators would consider Micropep’s product a biopesticide. That means the registration process would be faster and cheaper. The company claims that micropeptides break down quickly in the environment and don’t harm human health.

GreenLight Biosciences is working on a similar technology that uses artificial RNA sequences to kill insects by silencing genes. Laurent says that for herbicides, micropeptides are more suitable because they’re smaller than RNA strands. “It’s easier to get inside the leaves,” he says. The challenge is to find a micropeptide that can penetrate leaves quickly without breaking down in the unforgiving conditions of an agricultural field, Laurent says.

While some pharmaceutical companies use chemical synthesis to make peptides, Micropep is using a cheaper bioproduction process. The company is currently running fermenters at the scale of a few thousand liters, but it’s trying to scale up. The goal is to reach a cost of 50 cents per gram, which would make micropeptides cheap enough for row crops like corn and soybeans.

Making them cheap will be a challenge, according to Mark Trimmer, managing partner with the biopesticide market research firm DunhamTrimmer. A lot of research shows that peptides can be effective, but there are very few commercial products, he says. “The Achilles’ heel for peptides has always been the cost of production,” Trimmer says.

That also means the space is wide open. If Micropep can solve the cost problem, Trimmer says, it could have a blockbuster on its hands.

At a glance

Publicly launched: 2018

Headquarters: Yoqne’am ’Illit, Israel

Focus: Natural colors

Technology: Yeast fermentation of betalain pigments

Founders: Halim Jubran, Tal Zeltzer, and Guy Polturak

Funding or notable partners: $14.5 million in series A funding from DSM, Ginkgo Bioworks, the Trendlines Agrifood Fund, and other firms

In 2016, the food giant Mars vowed to remove artificial colors from all its confections, foods, and drinks within the next 5 years. But it’s now 2022, and the company’s M&M candies are still bright thanks to blue 1 lake, yellow 6, red 40, and seven other artificial colors.

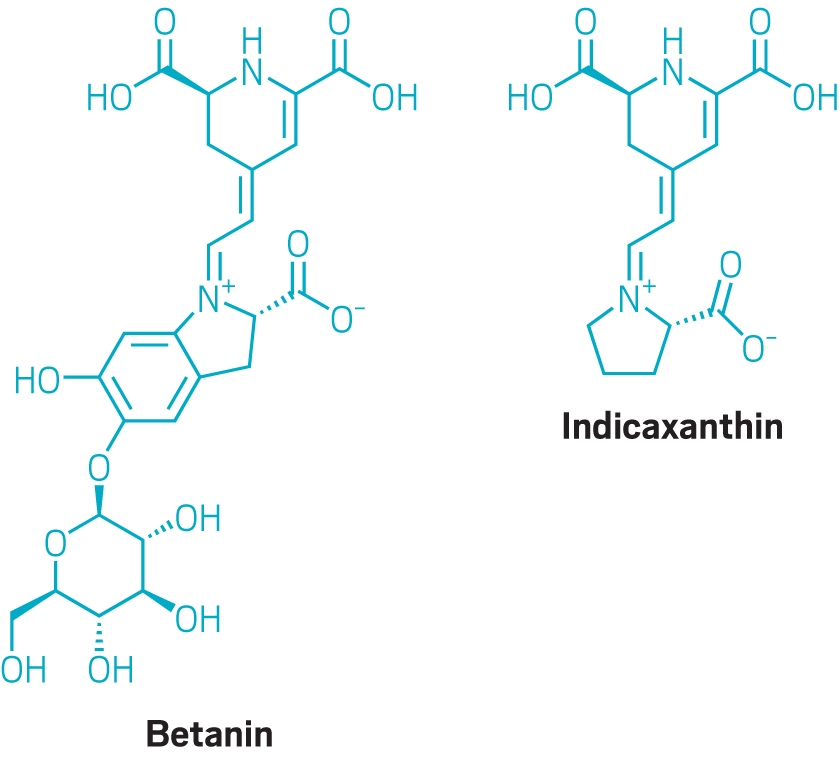

Phytolon sees a business opportunity here. The 4-year-old Israeli start-up is developing fermentation-derived betalain pigments that its founders say can offer food makers the hues they want with the processability they need and at prices they are willing to pay.

Phytolon has its roots in the research of Asaph Aharoni, a professor in the Department of Plant and Environmental Sciences at the Weizmann Institute of Science. Aharoni and his team identified key genes in the metabolic pathway to betalains, pigments that are found abundantly in fruits and vegetables such as beets, swiss chard, and cactus fruit.

As part of their research, the scientists introduced the relevant genes into baker’s yeast to see how well the pigments would be expressed. They were surprised to find that yeast cells not only expressed betalains well but also spontaneously expelled them into the fermentation broth, making them easy to recover. “This is when they recognized the potential of the technology,” says Halim Jubran, Phytolon’s CEO.

Trendlines Group, a venture capital firm that had worked with the institute before, brought on Jubran, who was a postdoctoral fellow at Weizmann in a lab near Aharoni’s and was working for another start-up, and Tal Zeltzer, a PhD graduate from Technion—Israel Institute of Technology who is now Phytolon’s chief technology officer. Guy Polturak, a Weizmann scientist at the time, is another cofounder.

Phytolon is developing two yeast strains, one expressing the yellow pigment indicaxanthin and the other expressing the purple pigment betanin. By mixing the two pigments in various ratios, Jubran says, the company can create 75% of the colors demanded by food manufacturers, including purples, yellows, pinks, oranges, and reds.

Food companies can also create many of the colors they want from plant extracts, but not without difficulty, according to Jubran. Many plant extracts are insoluble and must be made soluble to work in industrial-scale food production. “It’s a pretty complicated and expensive process,” he says. Other issues with plant extracts, he adds, include deterioration or fading, off-tastes, and texture changes.

And to achieve the colors they desire, food manufacturers often must combine two or three plant materials—say, paprika, curcumin, and beetroot extract—that don’t easily combine. “These pigments, they chemically don’t really mix,” Jubran says. “You have to force them to mix.” The water-soluble betalains don’t present such problems, he says.

Phytolon isn’t the only start-up using fermentation to create natural colors. For example, another Israeli company, Lycored, uses the fungus Blakeslea trispora to express carotenoid pigments. The US firm Spira derives a blue pigment from the cyanobacterium Arthrospira platensis. And Argentina-based Michroma is isolating red pigments expressed by fungi.

But Jubran says it’s telling that the food ingredient giant DSM led Phytolon’s recent series A funding round, in which it raised $14.5 million. “I think in our space we are the first start-up that offers fermentation that has obtained a serious contract with a serious entity,” he says.

Another participant in the funding round was Ginkgo Bioworks, a synthetic biology specialist that is contributing fermentation services rather than cash. The Boston-based company is helping Phytolon maximize the efficiency of the two yeast strains, according to Jubran. Phytolon is tackling fermentation and purification improvement on its own.

But even without improvements, Phytolon is ready to go, Jubran maintains. The firm, which has about 25 employees, is demonstrating the production of its pigments at a European contract manufacturing firm in 15 m3 reactors, a size that he says is very close to commercial scale. It is focused on penetrating the dairy, confectionary, bakery, and plant-based meat markets and hopes to win US and European regulatory clearances in 2023.

Jubran knows that natural colors still don’t always offer the vibrancy of synthetics, and they are more expensive. “We are getting there,” he says. “We have closed some gaps that current natural colors cannot close.” That’s news that the M&M team at Mars should be happy to hear.

At a glance

Publicly launched: 2015

Headquarters: Emeryville, California

Focus: Long-range and low-cost electric vehicles

Technology: Nanoporous polymeric membrane and liquid electrolyte to stabilize lithium-metal batteries

Founders: Pete Frischmann and Brett Helms

Funding or notable partners: $16 million in series A funding led by Fine Structure Ventures and other investors, including Solvay

The transition to electric vehicles is not happening fast enough for Pete Frischmann, cofounder and CEO of the California-based start-up Sepion Technologies.

“The shift from combustion engine vehicles to electric vehicles is arguably the largest change in how raw materials, especially metals, move around the globe in the past century,” he says. “I don’t think people fully appreciate how massive the shift is and how important establishing new mines and supply chains is for combating climate change.”

The cost of lithium-ion batteries is a key hurdle to making electric vehicles more affordable and hence more ubiquitous. The battery pack accounts for up to a third of the cost of an electric vehicle, according to Frischmann.

Sepion reckons it can change the game by helping manufacturers switch from incumbent lithium-ion batteries to the firm’s lithium-metal battery approach. The start-up is promising automakers that its technology will cut cost per kilowatt-hour by 15% and unlock a 40% increase in electric vehicle range.

The lithium-metal battery has an anode made of pure lithium and promises to more than double the energy storage capacity of today’s graphite-anode batteries. Commercialization of lithium-metal batteries has been elusive, however, because they can easily catch fire and typically last only a few hundred recharge cycles.

Sepion’s batteries incorporate a nanoporous polymer separator membrane that helps overcome problems with dendrites—spiky metallic microstructures that can form on the anode, poke through the separator membrane, and contribute to fires.

A typical battery separator has pores 20–200 nm in diameter. Sepion says its membrane has a coating with 0.5–4.0 nm pores, creating a more uniform current density across the anode and giving rise to flatter plating of lithium rather than the unwanted spikes.

The start-up says the membrane also helps avoid the chemical reaction between electrolyte and lithium that can occur in lithium-metal batteries. “Our membranes are different in that they are not solid-ion conductors. They are a material that interacts with the electrolyte; the pores of the membrane swell to some degree with the electrolyte,” Frischmann says. “This is in essence a new phase of matter sitting right at the lithium-metal surface.”

A chemist and former project scientist at Lawrence Berkeley National Laboratory, Frischmann had the idea for the membranes while working on materials to improve lithium-sulfur batteries and flow batteries. “Both of those technologies stand to benefit greatly from better membranes,” he says.

While at the lab, Frischmann took part in the US National Science Foundation’s Innovation Corps program. “I did the course to improve my independent research proposal, but what actually came out of it was me thinking, ‘Maybe there is some interest in using the materials we are developing commercially,’ ” he recalls.

Frischmann and Brett Helms founded Sepion in 2015. They initially planned to commercialize Sepion’s membranes for a variety of applications, including lithium-sulfur and flow batteries. But 2 years ago, Frischmann decided to shut down all the company’s application development and focus exclusively on lithium-metal batteries for electric vehicles, where he believes the start-up can have the biggest impact in combating climate change.

The venture capital community took notice, and in November 2021, Sepion raised $16 million in funding. Today it has about 25 employees.

Sepion’s battery technology is designed to be easily adopted by the automotive industry. The firm plans to sell a coated separator and then license the electrolyte and lithium-metal cell design to car battery manufacturers, which can switch their current lithium-ion battery production from graphite to lithium-metal anodes at minimal cost.

Proving that notoriously fiery lithium-metal batteries are a safe option for vehicles of the future is a challenge that remains for the start-up, Frischmann acknowledges. “There is the perception that lithium-metal batteries are less safe than lithium ion. I don’t think that’s true, but regardless, we need to combat that head-on,” he says, adding that Sepion is planning a series of safety tests next year.

Sepion has a backlog of sample requests from more than a dozen battery manufacturers, according to Frischmann. The company has plans to scale up production to 10,000 m2 of separator next year. If everything goes according to plan, Frischmann says, he will be driving an electric car powered by Sepion in 5 years’ time.

by Alex Scott

by Alex Scott

It was a conversation with a mining company in California about the twin challenges of sulfate mine waste and the high cost of sulfuric acid that led Laura Lammers, then assistant professor of environmental geochemistry at the University of California, Berkeley, to create a process that could solve both problems simultaneously. Yet another benefit to Lammers’s process is that it captures carbon dioxide. A year and a half later—in January 2022—Lammers had tested her idea at lab scale and taken a risk to exit academia, becoming founder and CEO of the start-up company Travertine Technologies.

Lammers’s idea, now Travertine’s core technology, involves turning sulfate waste—often generated by metal-mining companies that use sulfuric acid to leach metals from an ore—back into sulfuric acid using electrochemistry.

At a glance

Publicly launched: 2022

Headquarters: Boulder, Colorado

Focus: Conversion of mining waste and carbon dioxide into sulfuric acid, construction material, hydrogen, and oxygen

Technology: Electrochemistry featuring water electrolysis

Founder: Laura Lammers

Funding or notable partners: $3 million from investors including the Clean Energy Ventures and Jeremy and Hannelore Grantham Environmental Trust

The process not only recycles mine waste but also consumes CO2. Travertine does so by combining sulfate-rich mining waste—including material containing phosphogypsum, calcium, or magnesium —with hydroxyl ions produced by water electrolysis. This reaction absorbs CO2 from the air or from point sources to form a calcium or magnesium carbonate material that can be sold to the construction industry for making cement and heat- resistant bricks. The reaction is a fast version of the natural geological weathering process known as the Urey cycle.

The commercially interesting by-products don’t stop there: the electrolysis also generates hydrogen and oxygen. “We have a lot of products that are commercially viable coming out of the process simultaneously,” Lammers says.

The biggest cost in the process is electricity, and to be truly sustainable, Travertine will need to use renewable electricity. “Electricity from a coal plant would eliminate any net carbon dioxide removal,” Lammers says.

She says her lab tests showed good results from the get-go, and she has filed two provisional patents for the process. “We found that it was very efficient—on par with the industrial chlor-alkali process,” she says.

Travertine’s commercial progress has been equally efficient. “We started fundraising right off the bat,” Lammers says. Under her leadership, the company quickly raised $3 million in seed funding.

Additionally, Travertine raised $500,000 by preselling carbon-sequestration credits to Frontier, a $1 billion fund. The payment-processing company Stripe created the fund to support companies with early- stage carbon-removal technologies. More presales are in the cards if Travertine can deliver the first tranche of CO2 removal. Securing income from the scheme “solidified the idea” that the Travertine process could be economically viable, Lammers says.

The funds that the company has already raised should be enough to allow it to test its process at 1 kg per day of CO2 sequestration and 2.2 kg of sulfuric acid production at its demonstration plant in Boulder, Colorado. The funding will also enable Travertine to design a facility that would sequester 1 metric ton per day of CO2 at a partner company’s mine.

The company has grown to seven employees, including an electrochemist and a mining engineer. The company’s Boulder base allows them to tap into a pool of mining experts—the Colorado School of Mines is nearby—as well as the region’s high concentration of experts in environmental technology, Lammers says.

The technology Travertine is developing could meet the growing need of some mining companies to show they are improving their environmental performance. “Travertine is not just about economically removing and sequestering carbon dioxide but also promoting environmentally friendly mining practices,” Lammers says. She is well aware that lithium miners, who are ultimately selling their material for its environmental performance, could find Travertine’s technology to be a perfect fit.

by Alex Tullo

by Alex Tullo

At a glance

Publicly launched: 2018

Headquarters: Woburn, Massachusetts

Focus: Wastewater treatment

Technology: Zwitterionic filtration membranes

Founders: Christopher Drover, Alex Rappaport, and Chris Roy

Funding or notable partners: $45 million

ZwitterCo was founded in 2018 with a problem in mind. Many conventional water-filtering membranes—made from materials such as polysulfones, polyacrylonitrile, and polyamides—tend to get fouled with fats, oils, and other hydrophobic molecules. If such contaminants are present in the water at concentrations of just a few parts per million, the membranes can be ruined in a matter of days or even hours.

“One of the Achilles’ heels that has always limited their practicality or how well membranes can be applied is how they clog,” says Alex Rappaport, cofounder and CEO of the Boston-area firm. “If you could reduce fouling, if you could eliminate this failure mode, you could use filtration much more broadly.”

As its name suggests, ZwitterCo’s approach to the problem relies on zwitterions, molecules that have both positively and negatively charged groups in proximity. To make its membranes, the company copolymerizes these zwitterions to create its active filtration layer.

“Zwitterionic polymers are some of if not the most hydrophilic class of high-performance polymers that are out there, ”Rappaport says. “Ours that we work with are so hydrophilic, they are hygroscopic. They will wick moisture out of the air. You have to work with them in a humidity-free environment as you are going through the different stages of synthesis.”

The zwitterions in the firm’s membranes act as conduits for water, but they reject hydrophobic fats and oils. The impact of the chemistry is dramatic. ZwitterCo says its membranes can tolerate 10,000 ppm or even 100,000 ppm of oil and grease. And some of the firm’s filtration elements have been operating in the field for more than a year with periodic cleaning but without the need to be replaced.

Rappaport says the company’s technology is a good option for treating wastewater with a high concentration of organic molecules. Because other filtration tools aren’t available today, such water is now treated with chemicals such as flocculants, which aggregate organics and turn them into sludge.

For example, one of ZwitterCo’s markets is wastewater from anaerobic digesters, which are often colocated on large dairy farms and capture methane from decomposing manure to produce electricity. The ZwitterCo filtration elements concentrate the solids in the spent manure mixture, or digestate, as it is known in the field, into an organic fertilizer, while the water is recirculated into the process.

Similarly, the company is working with wastewater from the meat, poultry, and dairy industries. Using filtration might allow a food processor to recover proteins, oils, or other nutrients that can be added to pet food or animal feed. With chemical treatment, such potentially useful materials are hauled away as waste. The water can go through further processing steps such as reverse osmosis and be reused as fresh water.

ZwitterCo’s technology originated in the lab of Tufts University chemical and biological engineering professor Ayse Asatekin, who had previous experience commercializing water membranes. In 2011, she cofounded Clean Membranes, which was based on polyacrylonitrile membranes she developed as part of her PhD work at the Massachusetts Institute of Technology.

At Tufts, Asatekin conducted the foundational research on the zwitterionic materials and carried out lab tests to generate preliminary performance data. This work was to be the nucleus of ZwitterCo.

Upon launch in 2018, ZwitterCo was one of the winners of the Tufts Gordon Institute’s $100k New Ventures Competition for a pitch that Rappaport delivered on cleaning up wastewater from oil and gas drilling.

ZwitterCo attracted investment soon thereafter. The firm as well as Asatekin’s lab received $225,000 from the US National Science Foundation, and the US Department of Energy awarded the firm $1.25 million to explore purifying wastewater from oil and gas extraction. Wastewater from oil and gas exploration is a big problem in the US, where the production of a barrel of oil generates up to 10 barrels of wastewater. The water is normally injected into disposal wells.

In 2021, the company got $5.9 million in seed funding in an investment round led by the filtration specialist Mann+Hummel and the venture capital firm R-Cubed Capital Partners. Two months ago, ZwitterCo completed a $33 million series A financing round led by the venture capital firm DCVC, which also backed the synthetic biology company Zymergen, later purchased by Ginkgo Bioworks.

Since taking over the technology from Asatekin, ZwitterCo has mostly worked on packaging it as a commercial product, identifying the best applications for its use, and scaling it up so the membranes can be manufactured efficiently.

To date, ZwitterCo has raised $45 million. The firm now has 45 employees and since 2021 has signed up 16 commercial projects. Its installed base of modules will be able to purify nearly 4 million L of water per day by the end of the year.

There are too many interesting start-ups to fit on one list. These early-stage companies are also on our radar.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter